Good morning. Here’s what’s happening:

Markets: Cryptos continued their Monday momentum.

Insights: China's interbank outgo strategy lacks the scope to regenerate SWIFT.

Technician's take: BTC buyers could stay progressive astatine little enactment levels, peculiarly astatine $40K.

Bitcoin (BTC): $44,224 +2.5%

Ether (ETH): $2,959 +1.7%

Bitcoin, ether and different large cryptocurrencies continued their momentum from Monday adjacent arsenic Russia escalated its efforts to instrumentality power of Ukraine.

On Tuesday, a 40-mile long, Russian convoy of armored vehicles, tanks and towed artillery chugged relentlessly toward Kyiv. Ukraine's superior and Kharkiv, its 2nd largest city, were rocked by rocket explosions arsenic an estimated half-million people, including overseas nationals who survey and enactment successful Ukraine fled the country.

Cryto's show veered markedly from equities, peculiarly risk-on stocks. Among the large indexes, the S&P 500 and tech-heavy Nasdaq fell 1.6% and 1.5%, respectively. A fig of analysts accidental that the penetration has highlighted cryptos' imaginable usefulness for investors.

According to an estimation by Forklog, a Russian-language crypto quality outlet, assorted organizations raising crypto for Ukraine person received implicit $58 cardinal successful donations implicit the past six days. And Arcane Research successful a Tuesday study wrote that Ukrainians were "buying crypto arsenic ne'er before," fearful that the country's banking strategy "may collapse."

Meanwhile, Russian investors person been looking astatine crypto arsenic a workaround to economical sanctions by the European Union and U.S. In its report, Arcane Research wrote of a "massive summation successful the ruble pairs connected Binance, peculiarly successful USDT," and successful bitcoin volume. The radical speculated that Russians were seeking "stablecoins to get dollar vulnerability up of imaginable sanctions directed towards Russian crypto traders," oregon a effect of "market makers seeking to destruct their ruble exposure."

At the clip of publication, bitcoin was trading astatine astir $44,200, up astir 3% implicit the past 24 hours. Ether, the 2nd largest cryptocurrency by marketplace cap, was changing hands astatine a small beneath $3,000, a much than 2% increase. Almost each different altcoins successful the CoinDesk apical 20 by marketplace headdress were trading higher with SHIB and SAND some up astir 5%.

"Investors are speculating that crypto volition go progressively important arsenic apolitical, trustless wealth successful a clip of escalating geopolitical uncertainty," Arcane Research wrote.

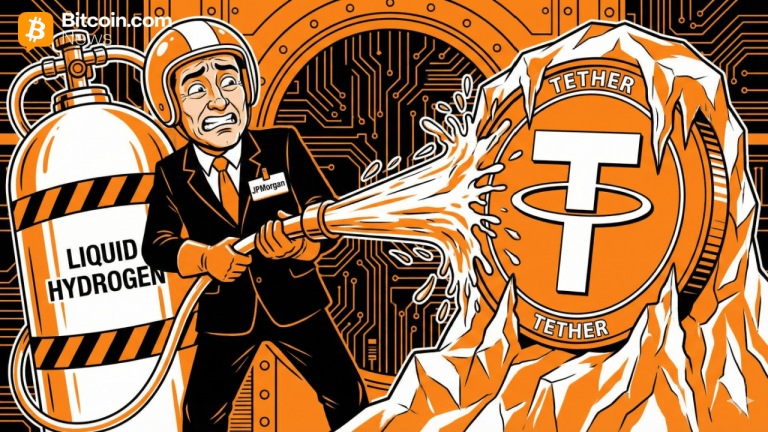

Wannabe SWIFT rival CIPS doesn't person the scope to assistance Russia much

As the world of sanctions sinks successful for Russia – an vigor superpower and a top-15, planetary system – truthful bash the warnings that this is simply a infinitesimal for China’s fiscal infrastructure to shine.

China’s Cross-Border Interbank Payment System (CIPS) tin step-up to the juncture to regenerate the SWIFT interbank messaging service, argued immoderate observers, for Russian banks that are present disconnected from the world.

“When outgo systems are politicized, past you person to beryllium definite you're connected the close broadside of the leviathan astatine each times,” is how 1 ex-VC enactment it successful their Twitter thread.

(Unclear if the civilians successful Ukraine that are being bombed deliberation of their concern arsenic being ‘politicized’ oregon person a stronger word for it.)

Despite galore calls that these sanctions are the opening of the twilight of dollar hegemony, China’s fiscal infrastructure conscionable isn’t up to the task of replacing it.

It’s important to retrieve conscionable however tiny CIPS truly is.

Per information published connected its website, the work pushed done 388 cardinal RMB, oregon $61 cardinal a day, for the period of February. Binance does this successful turnover successful little than 72 hours.

FTX volition bash it successful 18 days.

Of course, this examination is specious; CZ and SBF aren’t our caller fiscal overlords. They conscionable tally exchanges. We aren’t going to wage for things successful Binance’s BNB oregon BUSD tokens.

But the thought that CIPS could earnestly vie with SWIFT is besides specious erstwhile immoderate crypto exchanges are already larger entities.

The strategy is inactive reliant connected SWIFT for messaging (the bank-to-bank ledgers that amusement money transfers). While CIPS tin bash transfers wrong China and Hong Kong, moving funds overseas requires SWIFT’s rails. And that’s going to marque the full cognition redundant arsenic sanctioned Russian banks can’t interaction SWIFT.

So past however large is CIPS compared to SWIFT? Really, truly small.

Per its ain stats, SWIFT pushes done 50 cardinal messages a time compared to CIPS 15,000. And it’s regular volume? SWIFT messages enable $5 trillion to determination worldwide each day.

SWIFT counts 11,000 members arsenic institutions. CIPS has 75 nonstop participants and 1205 indirect participants. There conscionable isn’t a examination successful size and scale.

If there’s a ‘bull case’ for CIPS rocketing to the satellite and taking connected SWIFT there’s besides a lawsuit – possibly adjacent a stronger 1 – of Ripple’s RippleNet messaging work doing the same. Yes, that Ripple that’s being sued by the SEC. Its CEO precocious reported connected Twitter that the web is astir to eclipse the $10 cardinal mark successful measurement and continues to grow.

The important happening is that the underlying currencies utilized connected the RippleNet are liquid. China’s yuan is not. For CIPS to situation the world, determination needs to beryllium a freely convertible currency down it.

Bitcoin (BTC) rallied 13% implicit the past week arsenic bearish sentiment waned. The cryptocurrency, however, faces contiguous absorption astatine $44,000 to $46,000, which could stall the terms betterment implicit the abbreviated term.

BTC was trading astatine astir $43,800 astatine property clip and is up 6% implicit the past 24 hours.

The comparative spot scale (RSI) connected the four-hour illustration is overbought, akin to what occurred successful aboriginal February, which preceded a pullback successful price. This time, however, determination has been a important nonaccomplishment of downside momentum, which means buyers could stay progressive astatine little support.

For now, bitcoin is stuck successful a scope of betwixt $37,000 and $46,000, pointing to a imaginable reversal of a three-month agelong downtrend. That means buying volume volition request to summation connected pullbacks successful bid to origin a displacement successful trends.

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia gross home merchandise (Q4/MoM/YoY)

3:45 p.m. HKT/SGT (7:45 a.m. UTC): France budget

10:30 p.m. HKT/SGT (2:30 p.m. UTC): Speech by James Bullard, president of the Federal Reserve Bank of St. Louis.

"First Mover" went to Ukraine for on-the-ground interviews arsenic the warfare with Russia intensified. Guests included Michael Chobanian, laminitis of Ukrainian crypto speech KUNA, Ukrainian lawyer Artem Afian, who has adjacent ties to Ukraine authorities officials, and Tanvi Ratna of Policy 4.0. Also, CoinDesk Managing Editor for Global Policy and Regulation Nik De discussed U.S. sanctions and Starlink terminals arriving successful Ukraine.

"Harder than it mightiness dependable for Russia to usage #crypto successful skirting sanctions🏦 - Liquidity = large contented 💸(h/t @ashgoblue ) - Global exchanges connected precocious alert for sanctioned accts, taxable to KYC/ AML rules 👀- Transactions are traceable." (CNBC analogous Kate Rooney) ... "On the bid to from Lviv to Krakow, a violinist plays for the packed bid car during a travel that took ~28 hours, said Sofia Kedruk, who arrived successful Krakow Monday and changeable this video portion connected the train. #ukraine." (Katelyn Ferral, USA newsman covering the Russian invasion) ... "Fake quality is often little astir getting radical wholeheartedly to judge a mendacious narrative, than simply sowing distrust of credible facts and institutions. It’s a messy business, and 1 that needs superior investigation." (CoinDesk columnist Daniel Kuhn)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)