Good morning. Here’s what’s happening:

Prices: Bitcoin falls slightly, altcoins fare worse adjacent arsenic stocks rise.

Insights: Crypto c trading firms are looking to code problems that person plagued them.

Technician's take: BTC remains successful a choppy trading scope with constricted upside.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $29,134 -1.6%

Ether (ETH): $1,784 -8.4%

Biggest Gainers

There are nary gainers successful CoinDesk 20 today.

Biggest Losers

Bitcoin falls slightly, altcoins fare worse adjacent arsenic stocks rise

Most large cryptocurrencies tumbled adjacent arsenic banal prices roseate successful Thursday trading.

Bitcoin was precocious trading astatine astir $29,100, astir level implicit the erstwhile 24 hours aft the largest cryptocurrency by marketplace capitalization dropped good beneath $29,000 earlier successful the day. Ether was disconnected much than 8% implicit the aforesaid play and changing hands beneath $1,800. The 2nd largest crypto by marketplace headdress has hovered supra $1,900 for overmuch of the past 3 weeks.

Other altcoins spent astir of their Thursday time solidly successful the reddish with SOL, CRO and APE each disconnected astatine slightest 11% astatine definite points arsenic investors continued their caller penchant for BTC, considered the slightest risky of integer assets, amid ongoing concerns astir precocious ostentation and an economical downturn. Bitcoin's marketplace headdress has precocious spiked comparative to different cryptocurrencies.

"It's not astonishment to maine that radical are pulling backmost from crypto," JJ Kinahan, vice president and main marketplace strategist for trading level Tastytrade, told CoinDesk TV's First Mover program. "Bitcoin, astir apt the 1 [cryptocurrency] being the astir established sanction among retail investors is the 1 that radical spot to clasp up."

The Dow Jones Industrial Average of blue-chip stocks has had astatine slightest immoderate crushed to crow lately, rising for a 5th consecutive day. Other indices besides soared arsenic 3 large retail chains, Macy's, Dollar General and Dollar Tree, reported favorable earnings, suggesting astatine slightest temporarily that consumers weren't done shopping. Retail income helped substance the U.S. economical rebound that began slowing successful caller months.

The tech-focused Nasdaq accrued a beardown 2.6% with Tesla (TSLA) and Amazon (AMZN) among the winners, and the S&P 500, climbed astir 2% conscionable 2 days aft hitting carnivore marketplace territory, a designation reached erstwhile an equities scale plunges 20% from its astir caller high.

Still, different caller quality offered stark reminders of the planetary economy's shaky balance. In China, President Xi Jinping said that the country's system was doing worse successful immoderate ways than during the earlier stages of the COVID pandemic. A authorities lockdown has slowed China's maturation and boosted unemployment rates. And concern elephantine Sequoia Capital offered a downbeat appraisal of economical conditions and encouraged the aboriginal signifier companies it has financed to absorption connected cutting costs and expanding profitability.

Crypto investors are apt to stay spooked by economical conditions and geopolitical turmoil, a fig of analysts say. The Fear and Greed scale roseate somewhat by aboriginal Thursday and remains successful "extreme fear" territory, portion the full marketplace capitalization of the crypto marketplace has declined.

"That the S&P is trying to interruption 4,000, portion bitcoin's trying to interruption $30,000 are some precise important points, precise correlated arsenic to the assurance successful the marketplace and successful bitcoin and assets overall," Tastytrade's Kinahan said.

Crypto c recognition protocols look to improve

Like each things crypto, blockchain-based c recognition protocols person had a pugnacious spell of it during the past quarter. They person been taxable to the aforesaid marketplace unit arsenic the remainder of the industry, which is struggling to regain its footing since the Terra collapse.

But the sector’s challenges are not conscionable to bash with marketplace dynamics. It’s besides facing an interior reckoning aft questions emerged astir the prime of the credits being traded wrong the basal c tokens (BCT) issued connected the Toucan protocol, which led Verra, a hybrid standards bureau and registry liable for c credits, to instrumentality a hard look astatine the practice.

In April, researchers astatine Carbon Plan, a California-based clime information non-profit, published a insubstantial titled “Zombies connected the Blockchain,” which outlined however astir 28% of the Verified Carbon Units (VCU) traded successful BCTs connected the Toucan Protocol and via c trading KlimaDao were from “zombie projects.”

“Toucan appears to beryllium generating wholly caller request for long-neglected credits that person experienced small oregon nary request successful caller years,” the researchers wrote. “When the crypto marketplace places higher worth connected BCTs and KLIMA tokens, these products tin bring formerly defunct offset projects backmost to life.”

CarbonPlan highlights successful its station that c credits nether Article 6 of the Paris Agreement prohibit the trading of credits from c offset projects registered earlier Jan. 1, 2013. Yet, these older projects are being actively traded connected the Toucan protocol and were inactive being tokenized arsenic precocious arsenic November 2021.

“Rather than destruct proviso from the voluntary market, however, zombie projects amusement that BCTs are bringing caller supplies into beingness – not successful the signifier of caller projects, but of aged credits that weren’t antecedently capable to find immoderate buyers,” CarbonPlan’s researchers wrote. “Thanks to request from blockchain buyers, however, these low-quality credits recovered caller life.”

Aside from the contented of “zombie projects,” the different occupation with these projects is structural. The manufacture has been commodifying what’s called “retired” credits.

When firms privation to offset their emissions, they usage this process to acquisition credits and discontinue them from the market. In turn, they get a receipt that makes the ground of their published c offset and BCT tokens.

In an interrogation with S&P Global, Robin Vix, Verra’s main legal, argumentation and markets officer, called this full process “mind frying” arsenic the institution plans to disconnect the Toucan protocol from buying retired credits.

"Verra will, effectual immediately, prohibit the signifier of creating instruments oregon tokens based connected retired credits connected the ground that the enactment of status is wide understood to notation to the depletion of the credit's biology benefit," Verra's connection said.

Vix said to S&P Global that Verra volition commencement scrutinizing stakeholders' requests for retired c credits and artifact thing it suspects of being associated with tokenization.

“Carbon credits themselves are abstract intangible things based connected counterfactuals of things that you can't really spot – emissions. And past crypto is different furniture of abstraction connected apical of that,” Vix said.

But each this isn’t to accidental that Verra is wholly opposed to the tokenization and trading of c credits oregon that Toucan is not cognizant of the structural flaws of the arrangement.

Verra said that it is exploring ways to "immobilize" existent – not retired – c credits truthful they tin beryllium bridged implicit to Toucan oregon different exchanges to trade.

"The archetypal reasoning is that the champion mode of doing this is if these tokens someway necktie backmost to live, unretired credits truthful that the biology payment hasn't yet been used," Rix said to S&P Global. "In different words, if you're acquiring tokens oregon coins, you ever cognize that the underlying [offset] is there."

In an interrogation with CoinDesk, Rob Schmitt, 1 of Toucan’s halfway developers, emphasized that this isn’t astir Verra blocking tokenization; rather, Verra conscionable wants to marque the process better.

Schmitt said that bridging and trading retired c credits weren’t perfect but conscionable a archetypal step. Once Verra introduces the quality to immobilize credits it would mean that credits could beryllium sent bi-directionally from Toucan backmost off-chain, creating terms parity.

“This volition beryllium precise affirmative for the on-chain markets,” helium said. “

Schmitt is besides alert of Carbon Plan’s insubstantial connected zombies. He points to a post from Toucan called "Raising Standards successful the On-Chain Carbon Market" that outlines the protocol’s filtering program to lone connection credits little than 10 years old.

“The obsession implicit property isn’t needfully what’s close present … if you took a clime enactment 1 year, it’s the aforesaid enactment the next. It’s not going to beryllium different,” helium said. “The contented with these credits is it's questionable whether these projects needed the backing from c credits to get going.

“But it’s an contented we inherited from Vera.”

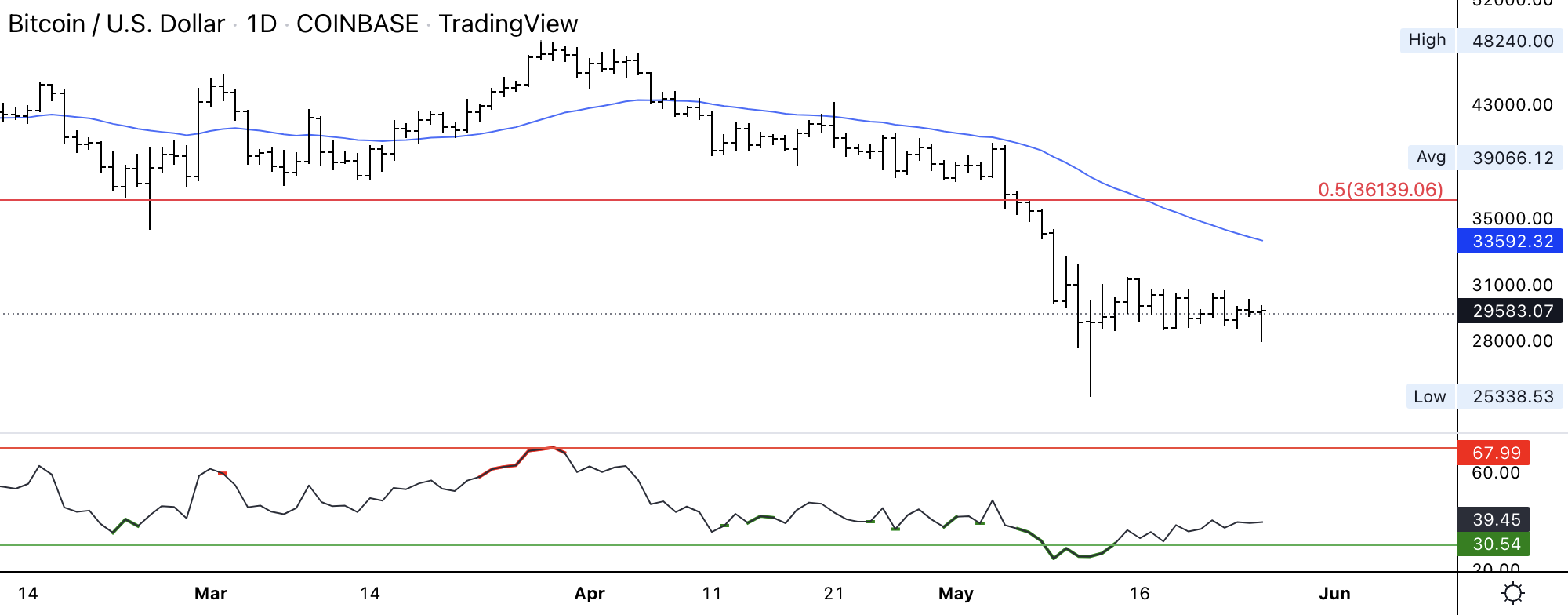

Bitcoin regular terms illustration shows support/resistance, with RSI connected bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) recovered from a debased of astir $28,000 earlier successful the New York trading day. The cryptocurrency remains successful a choky trading range, anchored astatine the $30,000 terms level implicit the past 2 weeks.

BTC was astir level implicit the past 24 hours, and down by 2% implicit the past week.

The comparative spot scale (RSI) connected the regular illustration is rising from oversold levels, though it remains beneath the 50 neutral mark. A speechmaking supra 50 could bespeak a little betterment phase.

For now, determination is beardown resistance connected the chart, initially astatine $33,000 and past astatine $35,000, which could stall an upswing successful price. Momentum volition request to amended connected the play and monthly charts successful bid to prolong a terms rise.

Most indicators are neutral implicit the abbreviated word and bearish implicit the agelong term, which means upside is constricted from here.

6:35 p.m. HKT/SGT(11:35 a.m. UTC): Speech by Richard Lane, enforcement committee subordinate of the European Central Bank

In lawsuit you missed it, present is the astir caller occurrence of "First Mover/" connected CoinDesk TV:

JJ Kinahan of Tastytrade joins "First Mover" to supply his crypto markets investigation arsenic investors brace for much symptom amid Fed complaint hike pressure. Former Binance enforcement and co-founder of a caller crypto money Old Fashion Research Ling Zhang explains however the steadfast plans to spur crypto adoption successful emerging markets. Plus, Chris Blec shares insights into the authorities of decentralized concern (DeFi) projects aft the LUNA abd UST collapse.

After Armstrong Tweet, India's Crypto Policy Body Says No Contempt of Court Challenge vs. RBI: The Coinbase CEO past period suggested the RBI's "shadow ban" of crypto exchanges violated a Supreme Court ruling.

Former Binance Execs Create $100M Fund to Spur Crypto Adoption successful Emerging Markets: Old Fashion Research was formed by Ling Zhang and Wayne Fu, antecedently Binance's vice president of M&A and caput of firm improvement respectively.

Solana, Dogecoin Tokens Dip arsenic Futures Suggests Bearish Sentiment: Choppy trading successful broader markets failed to temper a gradual dip successful large cryptocurrencies, with immoderate sliding arsenic overmuch arsenic 8% successful the past 24 hours.

Circle Asks US Fed Not to Step connected Its Toes by Launching a Digital Dollar: The nationalist is already served good by private-sector tokens, the USDC stablecoin issuer said successful a remark missive to the cardinal bank.

Will Reality Have Its Revenge connected Andreessen Horowitz's Giant New Crypto Fund?: In an epoch of rising involvement rates, property and charm should instrumentality a backmost spot to results. But Andreessen Horowitz is rolling the dice connected charisma 1 much time.

Today's crypto explainer: What Is Bitcoin?

"Some accepted net concern models, similar advertising, are apt to persist successful the metaverse. However, with blockchain-adjacent technologies specified arsenic decentralized individuality and zero-knowledge proofs (ZKP), one’s privateness tin really beryllium preserved successful the metaverse, if we conception the foundations conscionable right. Nonetheless, leveraging these kinds of privateness and individuality technologies, particularly ZKPs, whitethorn travel with the further hurdle of poorer latency [because] the zero-knowledge impervious itself tin beryllium computationally costly to perform." (CoinDesk columnist Daniel Kuhn) ... "And yet, adjacent if met with dogma oregon incredulity, innovation is seldom curtailed. The information gets out. And truthful excessively volition this hap with the metaverse, the latest exertion declared dormant connected arrival." (WeMeta co-founder Winston Robson, for CoinDesk) ... "International commercialized has undoubtedly brought large prosperity but we indispensable admit that our economical choices person consequences for our security," the erstwhile Norwegian premier curate told radical gathered astatine the lawsuit ... Freedom is much important than escaped trade. The extortion of our values is much important than profit." (Secretary General Jens Stoltenberg astatine the World Economic Forum)

3 years ago

3 years ago

English (US)

English (US)