Good morning. Here’s what’s happening:

Prices: Bitcoin soars to three-month high; different large cryptos besides gain.

Insights: With Ethereum's modulation to proof-of-stake and a diminution successful pricing for graphics cards, the stock prices of large manufacturers of PC components person fallen.

Technician's take: Seasonal spot could support buyers progressive wrong BTC's year-long terms range.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $46,690 +5.1%

Ether (ETH): $3,271 +4.3%

Bitcoin soars past $46.8K

A Bitcoin outpouring was successful the aerial connected Sunday.

The largest cryptocurrency by marketplace capitalization changeable past $46,800 astatine 1 point, rising implicit 4% implicit 1 two-hour play to scope a three-month high. Bitcoin has gained implicit 12% since past Sunday aft climbing six consecutive days, though it remains disconnected its $47,200 starting constituent successful 2022.

Ether and astir different large cryptos were besides blooming. The 2nd largest crypto by marketplace headdress followed a akin signifier to bitcoin connected Sunday and was changing hands astatine implicit $3,270, its highest level since aboriginal February. Solana, Cardano and Avalanche, among different altcoins were good into the green. Popular meme coins for Dogecoin and Shiba Inu, were up astir 6% and 3.4%, respectively.

Trading was accelerating aft weeks of debased volumes.

"Trading volumes are up arsenic buyers effort to crook this absorption enactment into enactment and instrumentality further steps up successful pricing," Joe DiPasquale, the CEO of money manager BitBull Capital, wrote to CoinDesk, but added: "If we don't stay supra this line, we volition consolidate little than here."

DiPasquale said that Bitcoin had had "a beardown week, particularly fixed the quarterly options expiry" connected Friday and noted that Bitcoin had "shown resilience" pursuing the Federal Reserve's determination past week to rise involvement rates and the continued escalation of Russia's penetration of Ukraine with its economical fallout.

But helium was besides cautious successful his appraisal of the coming days. "While marketplace participants are starting to get bullish and the fearfulness and greed scale is astatine neutral, BTC bulls volition privation to spot the terms consolidating supra $46,000 for further continuation," helium said. "The coming week is besides important arsenic it marks the extremity of the 4th and we could spot accrued volatility aft that."

Taiwan’s PC constituent makers stay profitable, but crypto concerns are weighing connected their stocks

Shares of Asus, Gigabyte and MSI, Taiwan-based constituent makers that nutrient graphics cards are down twelvemonth to day arsenic the marketplace prices successful slackening request for their graphics cards.

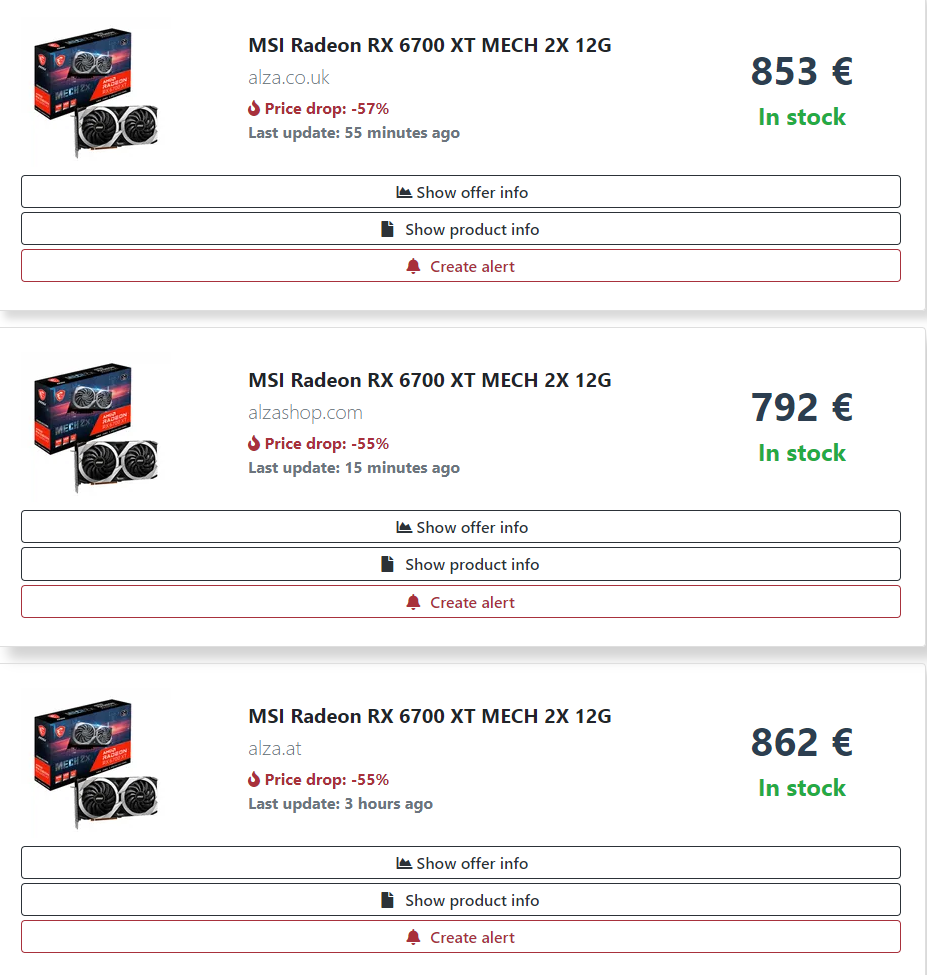

Preliminary information shows a monolithic driblet successful pricing for graphics cards arsenic Ethereum’s modulation to proof-of-stake nears, with immoderate prices dropping by implicit 50%. At electronics markets successful China, utilized GPUs are showing up by the crate load and caller ones aren’t moving similar they utilized to starring to an excess of inventory.

As a refresher, proof-of-stake puts the onus connected securing the blockchain to those that person a ample treasury. By staking their coins – committing them to a bond-like savings operation – these coins go validators for web transitions. Proof-of-work, successful contrast, relies connected miners moving connected progressively hard mathematical problems to excavation the coins and frankincense unafraid the network.

Graphics Processing Units (GPU), the encephalon wrong a graphics card, were perfect for this arsenic the processor wrong them was designed to compute mathematical equations astatine a massively parallel scale.

Nvidia (NVDA) archetypal learned the graphics cards built for gaming tin beryllium utilized for general-purpose computing successful the mid-2000s, perfecting the method successful the aboriginal 2010s with thing called general-purpose computing connected graphics processing units, oregon GPGPU compute.

The quality to bash mathematical computations with monolithic parallelism was large for making photorealistic graphics successful games, but much invaluable to bring connected the large information revolution. Nvidia and its rival AMD (AMD) marque specialized GPUs that are utilized successful server farms, and besides precocious workstations for research.

While Nvidia and AMD plan the GPUs, they trust connected partners to integrate them into boards that acceptable into computers, called add-in boards.

The bulk of these partners are based successful Taiwan, and are brands recognizable to machine enthusiasts specified arsenic Asus, Gigabyte oregon MSI.

While Asus has a broad lineup of PCs, notebooks, tablets and phones, Gigabyte and MSI trust much connected selling idiosyncratic components similar graphics cards and motherboards.

And their banal prices this twelvemonth bespeak this.

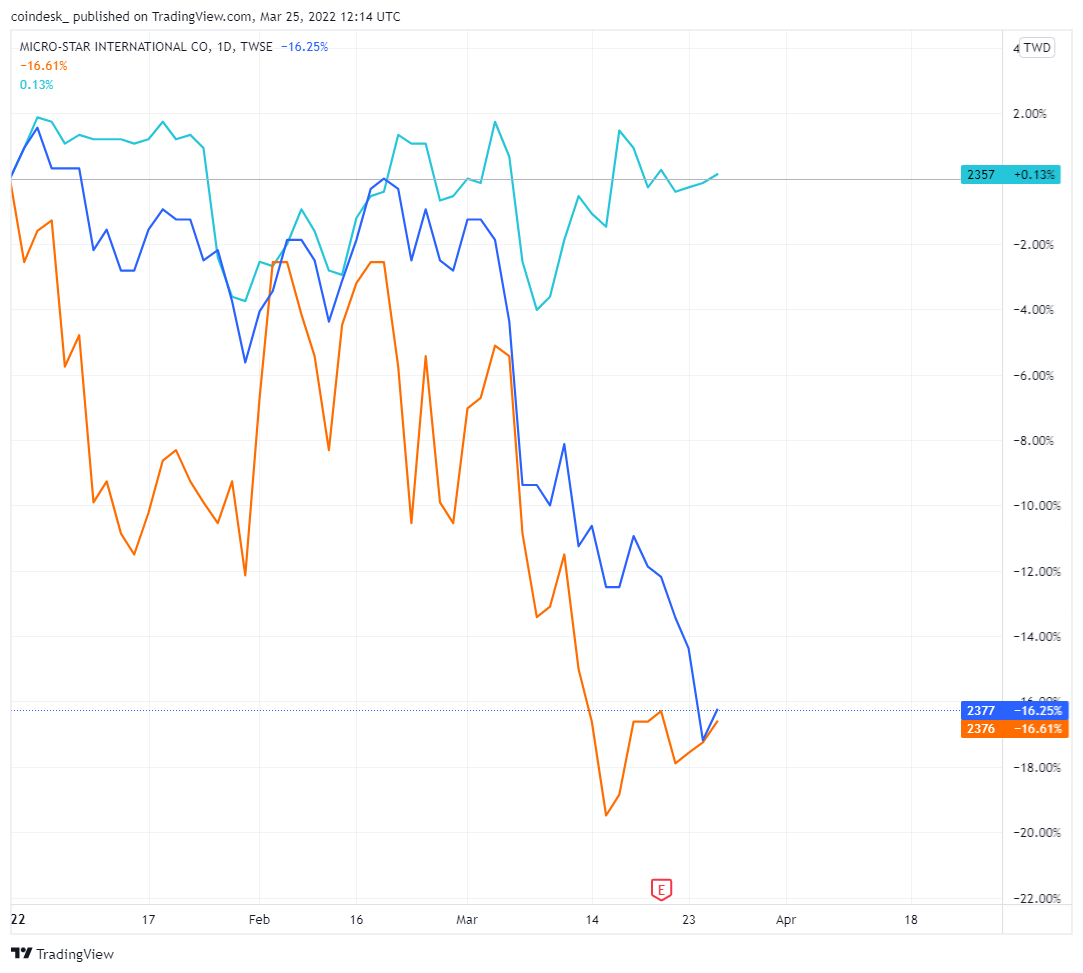

Gigabyte vs. ASUS vs. MSI twelvemonth to day (TradingView)

Year to date, Gigabyte and MSI are some down 16%. At the aforesaid time, Asus is astir flat. Data from marketplace probe location IDC shows PC shipments are inactive the champion they’ve been successful a decade, but they’ve slowed compared to the halcyon days of the tallness of the pandemic, erstwhile everyone needed caller computers to accommodate families moving and attending schoolhouse astatine home.

But that’s not to accidental that Gigabyte and MSI are doing poorly.

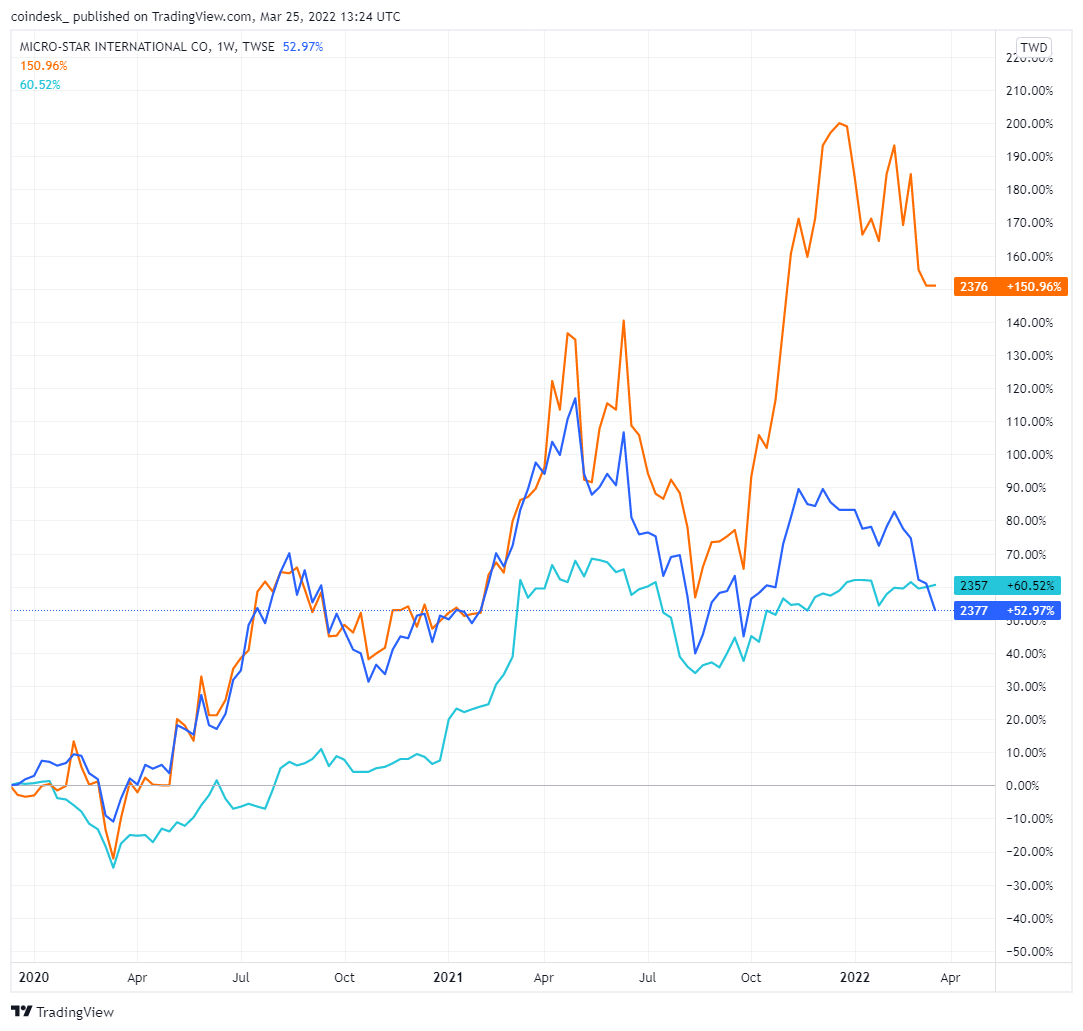

Gigabyte vs. ASUS vs. MSI since 2020 (TradingView)

Since 2020, Gigabyte is up implicit 150% portion Asus is up 60% and MSI up 52%. This connects to cardinal events: the coronavirus pandemic, which caused the PC supercycle, and the crypto bull tally of 2020-2021 that drove up request for GPUs to excavation ether (ETH).

Now comparison this to the canine days of 2014-2015 erstwhile crypto wasn’t truly a thing, and incremental advances successful graphics exertion meant that gamers didn’t request to upgrade their PCs. Gigabyte posted sub-$100 cardinal yearly profits, and MSI was arsenic as hard deed arsenic the two were incapable to determination arsenic galore graphics cards and motherboards arsenic they would person liked.

To beryllium sure, there’s inactive tons going connected astatine these constituent makers. MSI is inactive expecting gross for 2022 to travel successful astatine a grounds high, though the slowing GPU income volition sting. All this isn’t a atrocious thing. Gamers, the intended assemblage for these GPUs, volition beryllium capable to present bargain them astatine a terms adjacent to MSRP — a feat that’s been intolerable for years.

Bitcoin play terms illustration shows support/resistance (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) appears to beryllium overbought connected intraday charts, which typically leads to a short-term pullback successful price. The cryptocurrency faces archetypal resistance adjacent $46,000, which is the apical of a three-month agelong trading range. Still, support betwixt $40,000-$42,000 could stabilize pullbacks.

On the play chart, BTC established a higher terms debased comparative to the June 2021 bottommost astir $28,800. The latest rhythm debased was achieved this twelvemonth connected Jan. 24 astatine $33,100, indicating renewed buying strength. Further, momentum signals are connected the verge of turning positive, which could enactment a short-term alleviation rally.

Stronger absorption is seen astatine $50,996, which is simply a 50% retracement of the anterior downtrend. At that point, BTC's rally could stall, akin to what occurred successful September 2021. This time, however, seasonal strength betwixt April and May could support buyers active, albeit wrong a year-long trading range.

On the monthly chart, momentum signals stay negative. That means upside is constricted due to the fact that of beardown overhead absorption emanating from the April and November terms peaks.

7 p.m. HKT/SGT(11 a.m. UTC): Speech by Bank of England Governor Andrew Bailey

8:30 p.m. HKT/SGT(12:30 p.m. UTC): U.S. commercialized equilibrium (Feb. preliminary)

8:30 p.m. HKT/SGT(UTC): U.S. wholesale inventories (Feb. preliminary)

Terraform Labs CEO Do Kwon revealed plans to summation UST's bitcoin reserve to $3 billion. Darren Lim of blockchain information steadfast Nansen provided his investigation connected the transaction enactment of the luna token. CoinDesk's Nikhilesh De shared details of India's 30% crypto taxation instrumentality and the EU's MiCA bill. Plus, Fernando Martínez of OSL provided crypto markets and bitcoin terms analysis.

"While Terraform Labs is not precisely a bank, it is issuing its ain integer currency to marque paying for things easier – and it’s astir to beryllium backed by bitcoin. This is simply a large woody for anyone with a vested involvement successful the Bitcoin system, adjacent if you vehemently cull altcoins (non-bitcoin cryptos; determination is another, little flattering word for these)." (CoinDesk Research Analyst George Kaloudis) ... "The mean outgo of state successful the United States deed a grounds precocious connected March 11 astatine $4.33 per gallon, according to AAA. Although that fig has since declined to an mean of $4.24 per gallon, it is inactive 18 percent higher than it was past period and 48 percent much than it was a twelvemonth ago." (The New York Times)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)