Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Good morning. Here’s what’s happening:

Prices: Bitcoin and astir different cryptos instrumentality to the red.

Insights: Metaverse ETFs are struggling to support gait with gaming ETFs.

Technician's take: BTC's upside appears constricted contempt short-term support.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $29,982 -3.4%

Ether (ETH): $2,030 -4.7%

Biggest Gainers

There are nary gainers successful CoinDesk 20 today.

Biggest Losers

Bitcoin and different cryptos falter

A time aft bitcoin broke a week-long losing streak, the largest cryptocurrency by marketplace headdress and different large cryptos were successful the reddish again connected Monday.

Bitcoin was precocious down implicit 3% implicit the erstwhile 24 hours and has fallen 7 consecutive weeks. Still, it spent overmuch of the time adjacent oregon supra the psychologically important $30,000 level. "As acold arsenic the past 24 hours, we've seen a consolidation from six to 8 weeks of sell-off," 3iQ Digital Asset's Head of Research Mark Connors told CoinDesk.

Bitcoin and different cryptos' performances dovetailed with equity markets, which dropped somewhat connected Monday and person been tumbling since past autumn arsenic ostentation and proviso concatenation issues continued to surge and investors became much hazard averse. The tech-heavy Nasdaq dropped much than a percent constituent connected Monday.

Such increasing cautiousness fanned past week by the illness of the terraUSD stablecoin (UST), and the luna token that supports it, rocked altcoins peculiarly hard implicit the past week. On Monday, AXS and AVAX were precocious down 12% and 8%, respectively. SOL declined much than 6%.

Ether, the second-largest crypto by marketplace cap, fell implicit 4.6%, though it held accelerated supra $2,000.

"In equities, you've taken astir a twelvemonth of returns disconnected truthful [there was] a accelerated resetting arsenic the Fed hiked [interest rates] successful the archetypal week of May," Connors said. "You've seen integer assets, bitcoin, ether and the remainder of the altcoins fall. What's happened is there's been a stabilization. What radical are assessing is whether the involvement complaint hike has been taken retired sales. In our opinion, it hasn't.

Trading measurement roseate from the little levels to which it hewed for the archetypal fewer months of the year, a motion of a potential, and astatine slightest impermanent upswing. But fewer analysts are predicting a much imperishable departure from the the existent carnivore market. The coming weeks whitethorn beryllium peculiarly hard connected stablecoins adjacent arsenic Terraform Labs CEO Do Kwon released a “revival plan” to prevention the Terra network. Kwon projected forking Terra into a caller concatenation without UST.

Connors said that investors would apt spot 3 to 9 months of "choppy markets," and that prices would apt drop, perchance with enactment successful the $20,000 to $24,000 range. In this environment, helium sees investors focusing much connected Bitcoin and Ethereum. "Bitcoin dominance should and volition hap erstwhile markets merchantability off," Connors said. "People spell to quality, but it seems that Ethereium is present gathering up arsenic a fig 2 prime plus successful the ecosystem."

Metaverse ETFs are struggling to support gait with gaming ETFs

Sometimes a fancy caller concern vehicle, astir precocious the metaverse, doesn’t execute arsenic good connected the marketplace arsenic past year’s model.

Metaverse exchange-traded funds (ETF) arrived past twelvemonth soon aft the word entered our lexicon and became a favourite of task capitalists. Because the metaverse is simply a mashup of gaming and crypto, these metaverse ETFs look a batch like gaming oregon eSports ETFs (the 2 presumption are synonymous), which launched a fewer years ago.

They look similar them due to the fact that the metaverse is an ambiguous term; the shared online acquisition that is envisioned successful Neil Stephenson's subject fabrication caller "Snow Crash" already exists connected galore multiplayer gaming platforms. Metaverse tokens don’t yet person listed proxies, truthful metaverse ETFs compensate for that by putting successful publicly listed crypto companies similar Galaxy (GLX.TO) oregon Block (SQ), the erstwhile Square. And that’s wherever the occupation starts.

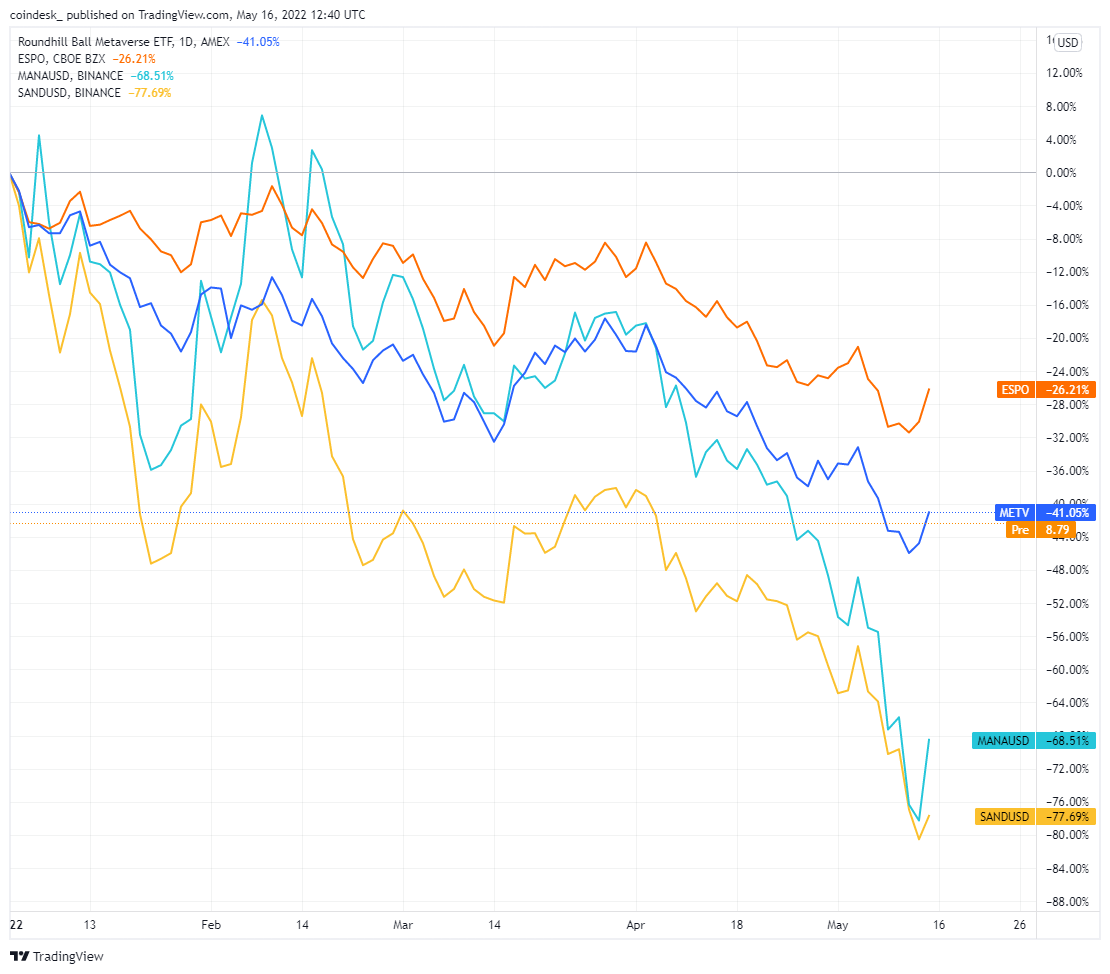

Roundhill Ball Metaverse ETF (TradingView)

That relation with crypto means that METV, a metaverse ETF from Roundhill, is importantly underperforming ESPO, a gaming/eSports ETF from VanEck.

Gaming tech heavyweights, similar GPU decorator Nvidia (NVDS) oregon crippled motor developer Unity, are successful some baskets and haven’t performed good on-year but the inclusion of the likes of Galaxy Digital – down implicit 60% year-to-date and readying a banal buyback [link] – truly sinks the metaverse ETF.

Of course, this metaverse ETF is outperforming the metaverse tokens themselves: The Sandbox’s eponymous token (SAND) is down astir 77% and Decentraland’s MANA is astatine 68% chiefly due to the fact that some person struggled to pull a subordinate base that reflects their valuation.

There’s an irony here. The metaverse, which is simply a mode to merchantability crypto-plus-gaming arsenic a re-branded product, is doing amended connected the marketplace than plain vanilla gaming itself.

Maybe crypto doesn’t beryllium successful everything?

Bitcoin regular illustration shows support/resistance. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) is stabilizing astir the $30,000 terms level aft past week's sell-off. The cryptocurrency indispensable stay supra the $27,000-$30,000 support portion this week successful bid to make a affirmative short-term momentum signal.

BTC was down by arsenic overmuch arsenic 3% implicit the past 24 hours.

The comparative spot scale (RSI) connected the regular illustration is rising from oversold levels, which could support buyers progressive astatine support. The RSI is besides oversold connected the play chart, though antagonistic momentum could headdress upside moves successful price.

Immediate resistance is seen astatine $33,000 and $35,000, which is wherever a breakdown successful terms occurred earlier this month. That suggests a ample fig of merchantability orders could bounds a alleviation rally implicit the adjacent 2 weeks.

Further, the caller underperformance of alternate cryptos (altcoins) comparative to bitcoin suggests a little appetite for hazard among crypto traders. Typically, alts diminution by much than bitcoin during down markets due to the fact that of their higher hazard profile. The broader risk-off situation could support BTC's short-term downtrend intact.

9:30 a.m. HKT/SGT(1:30 a.m. UTC): Reserve Bank of Australia minutes

8:30 p.m. HKT/SGT(12:30 p.m. UTC): U.S. retail income (MoM/April)

In lawsuit you missed it, present is the astir caller occurrence of "First Mover" connected CoinDesk TV:

As investors continued to digest the disastrous autumn of Terra's luna (LUNA) and stablecoin UST, OKX Director of Financial Markets Lennix Lai joined "First Mover" to explicate however it handled the clang and to stock his thoughts connected what whitethorn hap successful the manufacture and markets next. Plus, Charles Allen of BTCS Inc. provided marketplace investigation and Chen Arad of Solidus Labs examined the crypto crash.

Kwon Proposes Forking Terra, Nixing UST Stablecoin successful ‘Revival Plan 2’: “$UST peg nonaccomplishment is Terra’s DAO hack moment,” the Terraform Labs CEO wrote, “a accidental to emergence up anew from the ashes.”

The Collapse of UST and LUNA Was Devastating, but There Is Still Hope for Crypto: When a salient stablecoin and the token that backs it failed, the broader ecosystem surely was dealt a blow, but yet it is surviving.

LFG Reserves Dwindle to Just 313 Bitcoins From 80K After UST Crash: The announcement comes aft disapproval of the Luna Foundation Guard's "lack of transparency."

Indian Central Bank Says Cryptos Could Lead to "Dollarization" of Economy: Report: RBI officials said cryptocurrencies could undermine the cardinal bank's capableness to modulate travel of money.

Japan’s Nomura Said to Launch Crypto Unit With DeFi and NFTs connected Menu: Report: The Japanese concern slope carried retired its archetypal cryptocurrency derivatives trades past week.

Nigeria’s SEC Affirms All Digital Assets Are Securities successful New Rulebook: Rules look to clarify crypto’s relation successful the system by providing a regulatory framework.

Satoshi's Mission, LUNA, UST and Where Crypto Went Wrong: In 2009, Satoshi Nakamoto encoded a ngo connection for the manufacture successful Bitcoin's archetypal block. Essentially, crypto should archetypal bash nary harm.

"China’s system descended deeper into a COVID-19-induced doldrums past month, raising questions astir whether Beijing’s planned stimulus measures tin forestall a prolonged downturn." (The Wall Street Journal) ... "Terraform Labs, the enactment that built the system, supposedly deployed astir $3 cardinal worthy of bitcoin, paused the blockchain, flooded the marketplace with UST’s sister token LUNA and tried to wage retired arbitrageurs taking vantage of the volatile concern successful an effort to rescue its network. Those costly gambles failed, and adjacent Do Kwon’s, UST’s main architect, said the web arsenic it erstwhile was can’t beryllium salvaged. Terra is moving connected thing of a repayment program for “small” token holders. All of this raises 2 precise important questions for the industry: Are each “algos,” oregon algorithmic stablecoins, dormant connected arrival? And should determination beryllium regularisation successful spot to forestall a akin disaster?" (CoinDesk columnist Daniel Kuhn) ... Soaring valuations and booming [initial nationalist offerings] made startups look similar a harmless bet, inspiring hundreds of caller task funds. Now, the enactment seems to beryllium abruptly ending – and downsizing whitethorn awesome adjacent worse times ahead. Since January, astir 50 startups person made important layoffs, according to information collected by Layoffs.fyi. Among them are companies similar Robinhood [HOOD] and Peloton [PTON], which aft immense maturation during the pandemic present look the realities of a little buoyant economy, and little currency connected hand. Startups similar Cameo person had to reverse the spending sprees of the past 2 years." (Wired)

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)