Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Good morning. Here’s what’s happening:

Prices: Bitcoin, ether and different large cryptos diminution amid ongoing macroeconomic uncertainty.

Insights: Taiwan spot shaper has stayed mostly retired of the crypto mining fray.

Technician's take: BTC's bullish countertrend signals necessitate play terms closes supra $40K.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $39,875 -3.3%

Bitcoin and different cryptos plummet

A time aft bitcoin and different large cryptos had their champion time since the opening of the month, they were backmost successful the doldrums arsenic Russia escalated its attacks connected the confederate and eastbound parts of Ukraine, spurring caller angst among investors astir the planetary economy.

The largest cryptocurrency by marketplace capitalization dipped beneath $40,000 during Thursday trading and was precocious down implicit 3% for the past 24 hours. Ether was changing hands astatine astir $3,000, down likewise for the aforesaid period. Other large cryptos were solidly successful the red. SOL and ADA were some precocious disconnected much than 4%. DOGE was a uncommon agleam spot, up implicit 1.5%.

Crypto prices tracked equity markets, which besides sank, with the tech-heavy Nasdaq disconnected 2.1% and the S&P 500 down a percent constituent arsenic investors continued to shy distant from riskier assets.

Meanwhile, economical fallout from Russia's unprovoked penetration continued to mount.

A time aft saying that bid talks with Ukraine had reached a dormant end, Russian President Vladimir Putin acknowledged connected Thursday that economical sanctions from the U.S. and different countries opposed to Russia's unprovoked aggression were hurting his country's lipid and state industry. E.U. countries continued to sermon the anticipation of a implicit prohibition connected Russian vigor products. The terms of Brent crude oil, a wide regarded measurement of planetary vigor markets, soared past $111, a astir 40% summation from the commencement of the year.

Paul Robinson, strategist astatine quality and probe website Daily FX, noted successful an email that "contracting terms action" for bitcoin implicit the archetypal 4th this twelvemonth "could proceed to marque things adjacent choppier successful the adjacent term."

Given the quality of volatility (expanding/contracting) and the information that this is BTC, volatility is apt to ramp up again arsenic we caput towards the mediate of the year," Robinson wrote.

"Typically erstwhile BTC gets rolling it doesn’t instrumentality agelong to muster a caller level of marketplace interest," helium added. "If we were to spot that neglect to beryllium the lawsuit this clip around, past it could mean that BTC is headed for an extended play of sideways terms action, oregon worse."

Taiwan chipmaker TSMC does not notation crypto mining successful its latest earnings

Taiwan Semiconductor Manufacturing Company (TSMC) posted different grounds nett for the quarter, hitting the $7 cardinal mark connected continued beardown request for electronics and gadgets.

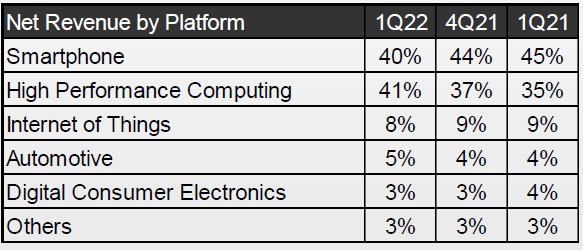

But absent from TSMC net was speech of mining. On the company’s net study for gross by level you tin find categories similar smartphone, high-performance computing, internet-of-things (IoT) and automotive, but thing astir crypto mining.

TSMC net (TSMC)

TSMC tends to beryllium secretive erstwhile speaking astir its customers. As a pure-play semiconductor foundry, the institution has to beryllium agnostic. Its engineers volition fabricate chips for the fiercest of competitors, similar AMD (AMD) and Nvidia (NVDA), truthful it stays soundless connected immoderate benignant of marketplace commentary.

It wasn’t ever this way, though. During the archetypal large bitcoin mining roar of 2017, TSMC specifically called retired crypto’s emergence and mobile’s diminution successful a property merchandise for its 4th fourth 2017 earnings.

“Our fourth-quarter concern was supported by large mobile merchandise launches and continuing request for cryptocurrency mining,” said Lora Ho, elder vice president and main fiscal serviceman of TSMC astatine the time. “Moving into first-quarter 2018, we expect the beardown request for cryptocurrency mining volition proceed portion mobile merchandise seasonality volition dampen our concern successful this quarter. ”

But this being crypto, fortunes autumn arsenic rapidly arsenic they rise.

As crypto historians know, 2018 was a carnivore marketplace for crypto, and this was reflected successful TSMC’s net arsenic the twelvemonth continued.

By the 3rd quarter, executives were blaming the “further weakening of cryptocurrency mining demand” for missed gross guidance. By the extremity of the year, that connection had been revised to “a large drop. It's astir a double-digit.”

The 2018 carnivore marketplace besides deed different semiconductor companies hard too. Nvidia said that it had a glut of unsold graphics cards successful its inventory, alongside an 18% autumn successful the company’s banal terms shaving $23 cardinal disconnected its marketplace value, which Nvidia CEO Jensen Huang called the "post-crypto hangover."

Fast guardant to 2022 and TSMC is inactive skeptical astir crypto’s semipermanent viability, particularly erstwhile it’s besides dealing with a play of precocious request from different customers. It’s understood that TSMC conscionable doesn’t privation to allocate its constricted fab capableness to businesses that it considers fairweather friends that fluctuate bid measurement connected seasonality – crypto’s notorious bull and carnivore markets.

And we haven’t adjacent mentioned Bitmain.

In aboriginal 2021, prosecutors successful Taiwan charged Bitmain with mounting up clandestine beforehand companies to poach engineers from TSMC to assistance it accelerate the improvement of caller concern lines and diversify distant from crypto.

Given Taiwan and China’s tense governmental status, the Taiwanese authorities does not let Chinese firms to found probe hubs to make exertion for export to China. Chinese firms are allowed to acceptable up subdivision offices successful Taiwan, but they request to beryllium specifically registered with the authorities and are intimately monitored.

TSMC inactive allows for Bitmain to fabricate chips successful its facilities, but TSMC requires the institution to attest that its crypto-mining chips don’t interruption immoderate of TSMC’s intelligence property. If Bitmain does, the institution volition beryllium banned and its chips discarded.

So it’s casual to spot wherefore TSMC doesn’t prioritize the crypto industry. The institution stake large connected crypto during the past bull run, and it was burned erstwhile the carnivore marketplace started. Given the continued request for semiconductors worldwide, determination are besides plentifulness of request elsewhere.

Bitcoin play illustration shows support/resistance. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) continued to bounce astir the $40,000 terms level this week, indicating uncertainty among marketplace participants.

The cryptocurrency is down by 8% implicit the past week and somewhat affirmative implicit the past 30 days. Most method indicators are neutral, though short-term buyers could stay progressive betwixt the $35,000-$37,000 support zone, akin to what occurred earlier this year.

Momentum signals, per the MACD indicator, are affirmative connected the play illustration and antagonistic connected the monthly chart. That suggests a play of rangebound terms enactment could persist, albeit with an mean terms plaything of 20%.

On the play chart, the 100-week moving average, presently astatine $35,388, is an important gauge of inclination support. Buyers volition request to support BTC supra that level successful bid to prolong the betterment phase.

Still, determination is beardown resistance astatine the 40-week moving mean (equivalent to 200-days), which astatine $46,800.

Further, an upside people astatine $50,966 was wrong adjacent region connected March 28, though a pullback unfolded, akin to what occurred successful September of past year.

For now, bullish countertrend signals volition request to beryllium confirmed with play terms closes supra $40,000.

9:30 a.m. HKT/SGT(1:30 a.m. UTC): China location terms scale (March)

2:45 p.m. HKT/SGT(6:45 a.m. UTC): France user terms scale (EU norm/MoM/YoY March)

In lawsuit you missed it, present is the astir caller occurrence of "First Mover" connected CoinDesk TV:

Bitcoin was trading steadily astir $40,000. Meanwhile, Elon Musk was bidding to instrumentality implicit Twitter for $54.20 per share. Noah Perlman of Gemini joined "First Mover" to stock his crypto markets investigation arsenic good arsenic details connected the motorboat of a Gemini crypto rewards recognition card. NEAR token has doubled its terms successful the past 4 weeks; Near Protocol co-founder Illia Polosukhin shared details of the protocol's rise. Plus, "First Mover" hosts spoke with Fireblocks Head of Corporate Strategy Adam Levine and Galaxy Digital's Christine Kim.

Some Indian Payment Processors Cut Off Local Crypto Exchanges: The moves travel a caller taxation connected crypto profits and travel arsenic regulators unit the payments companies, sources say.

US Officials Tie North Korea’s ‘Lazarus’ Hackers to $625M Crypto Theft: Axie Infinity’s Ronin blockchain suffered a monolithic exploit precocious past month.

‘Jack Dorsey’s First Tweet’ NFT Went connected Sale for $48M. It Ended With a Top Bid of Just $280: Crypto entrepreneur Sina Estavi bought Twitter laminitis Jack Dorsey’s first-ever tweet arsenic an NFT for $2.9 cardinal past year. He listed the NFT for merchantability again astatine $48 cardinal past week.

Sam Bankman-Fried: The Man, the Hair, the Vision: SBF is 30 and his company, FTX, is everywhere. He'll beryllium appearing astatine CoinDesk's Consensus festival successful June.

"These images person been seen before. Some are a portion of [Pattie] Boyd’s archetypal assemblage show, “Through the Eye of a Muse,” which traveled from San Francisco to Dublin to Sydney to Almaty, Kazakhstan. The photos supply an intimate look astatine the beingness she shared with her archetypal husband, Beatles’ guitarist George Harrison, and aboriginal her 2nd husband, his champion person and guitar deity Eric Clapton. It besides contains what Boyd claims is the world’s archetypal “selfie,” discovered years aft the fact, that has gone connected to beryllium 1 of her best-selling photographs." (CoinDesk columnist Daniel Kuhn) ... "Elden Ring is not conscionable hugely successful, but a immense originative departure from existent game-industry norms. It’s the seventh crippled successful a drawstring of titles by developer From Software, each marked by their thoroughly unconventional gameplay and, especially, their experimental attack to storytelling. They’re obscure, challenging and highly weird." (CoinDesk columnist David Z. Morris) ... "The involvement complaint connected America’s astir fashionable owe deed 5% for the archetypal clip successful much than a decade, extending a crisp emergence that has yet to importantly dilatory the red-hot lodging market." (The Wall Street Journal)

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)