Good morning. Here’s what’s happening:

Prices: Bitcoin was trading conscionable nether the $40,000 threshold wherever it started the weekend.

Insights: Luna Foundation Guard's bitcoin accumulation differs from purchases by publically traded companies.

Technician's take: (Editor's note: Due to the agelong vacation weekend, Technician's Take volition not appear. In its place, First Mover Asia is republishing a file by CoinDesk columnist David Z. Morris connected Block co-founder Jack Dorsey)

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $39,928 -1.20%

Ether (ETH): $3,O26 -1.23%

Bitcoin, different large cryptos were level for the vacation weekend

Bitcoin ended the week perched astir wherever it spent overmuch of the past fewer days, a small supra $40,000, and with fewer signs of a rally.

"Last week we shared concerns astir Bitcoin's quality to support upward momentum," Joe DiPasquale, the CEO of money manager BitBull Capital, wrote successful comments to CoinDesk. "We highlighted $40K arsenic the struggling constituent connected the downside and that has been the authorities of the marketplace this week."

The largest cryptocurrency by marketplace capitalization was precocious trading astatine astir $39,928, a small down from wherever it stood 24 hours earlier and astir the aforesaid arsenic wherever it started the Good Friday, vacation weekend. Ether, the 2nd largest crypto by marketplace cap, was trading astatine astir $3,026, a level from which it has hardly budged since past Monday. Other large cryptos were mostly successful the red, albeit slightly, though SOL was 1 of the fewer exceptions rising astir 1%.

Trading implicit the agelong play was airy arsenic investors proceed to process rising inflation, the anticipation of a recession and the latest developments from Russia's unprovoked penetration of Ukraine. Markets, which were closed Friday, were down connected Thursday with the tech-focused Nasdaq disconnected much than 2% and the S&P 500 falling 1.2%.

Russia pressed guardant with its attacks connected large Ukraine cities, including the superior Kyiv, and demanded the surrender of the strategical Black Sea larboard of Mariupol to the Southeast. Ukraine Deputy Prime Minister Iryna Vereshchuk said connected Sunday that discussions with Russia astir establishing humanitarian corridors for civilians to evacuate large Ukraine cities had breached down.

Joe DiPasquale, the CEO of money manager BitBull was pessimistic astir the coming week, noting that enactment could signifier good beneath $40,000. "Things inactive don't look peculiarly bullish for Bitcoin, and we proceed to look for a absorption astir $37K," helium wrote. "For immoderate upward move, BTC volition request to consolidate astir $42K successful the coming week – an improbable script successful the lack of large quality oregon catalysts."

Terra is 2022’s Version of Corporate Bitcoin Buying

Michael Saylor truly wants corporations to travel his pb and enactment bitcoin connected the equilibrium sheet. In aboriginal 2021 helium held a seminar connected that topic, and claimed to person an audience of 1400 firms. Having bitcoin successful the firm treasury alongside equities and bonds was expected to cement the plus people successful the past books, and pb to it hitting $6 million.

A twelvemonth later, corporations don’t look overly interested. According to CoinGecko’s tracker of nationalist companies determination aren’t a batch of caller entities that person added crypto to their equilibrium expanse implicit the past year. The lone non-major crypto oregon payments steadfast to person it is Tesla. Square has it arsenic it allows its clients to commercialized crypto, portion a fewer crippled developers person it arsenic portion of a Web 3 gaming propulsion oregon due to the fact that they judge crypto arsenic a outgo method.

Saylor continues to adhd it to the MicroStrategy equilibrium sheet, saying successful a caller enactment to investors “Adopting bitcoin arsenic our superior treasury reserve plus acceptable america isolated from accepted competitors and elevated our brand.”

But helium conscionable can’t person others to bash the same. For listed firms, bitcoin is notoriously hard to woody with from an accounting perspective. The communicative that bitcoin’s worth volition deed all-time highs due to the fact that of firm religion successful it conscionable didn’t materialize.

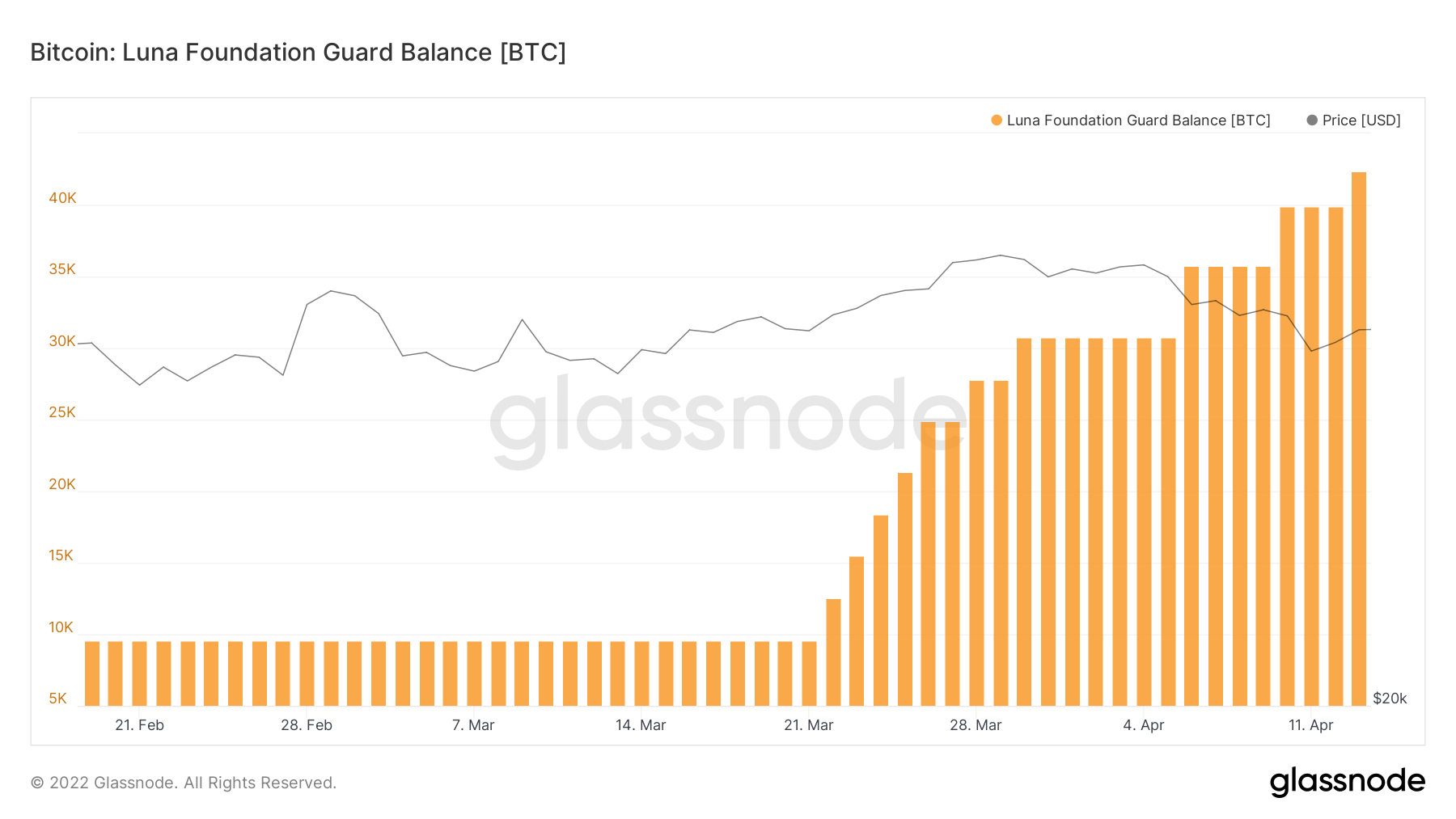

But successful this void, Terra has stepped successful with its predominant bitcoin buys which person pushed the Luna Foundation Guard’s (LFG) bitcoin holdings to astir $1.7 cardinal and laminitis Do Kwon has expressed a privation for that fig to deed $10 billion. The existent full makes Terra/LFG the 2nd largest firm holder beneath lone MicroStrategy’s $3.9 billion.

Does the marketplace attraction astir this narrative? Not really. The correlation betwixt LFG’s bitcoin buys and the terms of bitcoin is weakening; the past fewer buys didn’t halt bitcoin’s decline.

Luna Foundation Guard BTC (Glassnode)

Cryptoquant’s information suggests that institutional involvement continues to beryllium beardown for crypto, but hedge funds, household offices and high-net-worth individuals aren’t listed corporations. They would person a antithetic concern thesis, and tempo, than what Saylor prescribed for corporations.

LFG’s mandate for buying crypto is besides antithetic from what a listed steadfast would do, and it is important is to look astatine the standard of the HODLing arsenic good arsenic the tempo.

But LFG isn’t a listed Fortune 500 company, truthful the marketplace doesn’t use the aforesaid prestige to the purchases arsenic bitcoin continues to enactment correlated with equities and diminution successful value. Which, successful turn, is the aforesaid logic that tells firm treasurers that possibly bitcoin isn’t the champion plus for their books.

Last July, payments startup/giant (can you beryllium both?) Square announced that it would beryllium processing a hardware cryptocurrency wallet. The imaginable of a wallet designed by the aforesaid folks who physique the world’s fastest-growing point-of-sale exertion promised breathtaking advances successful easiness of usage and adoption. And that was months earlier Jack Dorsey flipped the tech satellite array by resigning from Twitter to absorption connected Square (now Block) afloat time, adjacent further upping the stakes.

But, for possibly the archetypal clip successful Dorsey’s yearslong flirtation with Bitcoin (“crypto,” not truthful much), there’s a important disconnect betwixt his plans and crypto long-timers’ preferences. In a Friday blog post, Block announced that its hardware wallet would marque fingerprint recognition the superior and default method for users to entree their funds. Block does accidental it volition “evaluate further entree methods that customers could opt into.”

At slightest successful the lawsuit of user goods similar cellphones, the information for adding biometric entree power is usually elemental convenience, but the eventual implications could beryllium dire. Another Web 2.0 holdover, Sam Altman, a erstwhile president of Y Combinator, a steadfast that helps funds tech startups, introduced a token called Worldcoin implicit the summertime of 2021, and critics including Edward Snowden pointed retired that the strategy would hazard exposing users’ biometric data with perchance terrible and imperishable consequences for victims. When the ruthless capitalists astatine the American Enterprise Institute deliberation your program is anti-social, you cognize you’re successful trouble.

To beryllium fair, the Block program is antithetic from Worldcoin’s successful important ways that marque it much defensible. In portion due to the fact that the planned wallet is simply a single-user device, it volition beryllium capable to make and store its biometric credentials locally, arsenic your telephone does. Worldcoin, by contrast, seemed apt to necessitate a centralized database of iris-scan hashes, an implicit five-alarm occurrence of mediocre information architecture.

But adjacent section processing and retention is simply a existent hazard – ultimately, nary section information that tin beryllium reached via the net should ever beryllium considered truly secure. And the virtually lifelong consequences of a compromised fingerprint marque adjacent the remotest vulnerability worthy earnestly interrogating.

Equally worrisome, making a fingerprint the main mode of authorizing a crypto wallet could mean little accent connected backstage cardinal management. That could present an added hazard vector for users: if your hardware wallet is the lone location of your backstage keys, and that hardware is controlled by a fingerprint, the hazard of losing each your wealth conscionable went up alternatively than down.

Block seems good alert of the risks here, based connected some the contented and timing of the announcement. “We're alert of limitations [of fingerprint security] we'll request to plan around,” the announcement states. And successful the communications business, Fridays are erstwhile you driblet quality you don’t privation anyone to wage excessively overmuch attraction to – reporters are mostly finishing up their assignments and looking guardant to a blissful weekend. So it’s a bully stake Block was seeking to minimize blowback here.

All that said, Block is trying to thread an highly tricky needle, and its existent plans merit a thoughtful alternatively than knee-jerk response. The announcement station makes wide the precedence was to plan a wallet that tin beryllium utilized “securely, but with ease,” balancing idiosyncratic acquisition with safety.

“We don’t privation to unit caller behaviors connected customers with a caller interface connected the hardware constituent of the wallet we’re building,” the announcement continues. “Instead, making the mobile exertion the halfway of the acquisition volition pb to familiar, intuitive interactions.”

For amended oregon worse, we’re precise utilized to utilizing fingerprint unlocks connected smaller devices. So utilizing them makes implicit consciousness from a Silicon Valley hardware designer’s perspective. The presumption that thing should beryllium a mass-market product, ideally usable by adjacent the slowest kids connected the bus, is baked into the concern models and civilization of adjacent comparatively agile entities similar Block.

The logic also, however, aligns with galore calls wrong the crypto manufacture to prioritize making idiosyncratic acquisition amended and much intuitive, not conscionable for wallets but besides for decentralized exchanges (DEXs) and everything else. The problem, arsenic crypto and information experts including MetaMask’s Taylor Monahan person pointed out, is that a creaseless idiosyncratic acquisition is astir inextricable from information risks. In fact, she specifically cites different “ease-of-use” diagnostic that led radical to not prevention their backstage keys properly. It's astir a diagnostic of an aboriginal mentation of MyCrypto/MEW, the wallet Monahan built earlier joining Metamask recently. Specifically, the diagnostic was an automatic download/display of each the wallet accusation that radical seemingly forgot to constitute down beauteous often.

Ultimately, determination volition yet beryllium crypto products that onslaught the close equilibrium betwixt information and usability. But frankly, I deliberation companies rushing successful that absorption present are shortchanging the full ecosystem by de-emphasizing education. In fact, the presumption that front-end plan tin marque a crypto strategy conscionable arsenic creaseless and effortless to usage arsenic a Web 2.0 strategy whitethorn good beryllium to beryllium fundamentally flawed: The complexity of crypto is inextricable from its decentralization, and methods of “abstracting away” that complexity astir ever adhd caller onslaught surfaces for radical who privation to instrumentality your money.

10 a.m. HKT/SGT(2 a.m. UTC): China gross home merchandise (MoM/YoY March)

10 a.m. HKT/SGT(2 a.m. UTC): China concern accumulation (YoY March)

10 a.m. HKT/SGT(2 a.m. UTC): China retail income (YoY March)

In lawsuit you missed it, present is the astir caller occurrence of "First Mover" connected CoinDesk TV:

“Money Reimagined” hosts Sheila Warren and Michael Casey were joined by securities instrumentality adept Chris Brummer of Georgetown Law School. They discussed the limits of outdated U.S. securities instrumentality and the required rethinking needed for oversight and regularisation of the crypto industry. Brummer besides shares his ideas for a caller disclosure model for crypto markets.

US Officials Tie North Korea’s ‘Lazarus’ Hackers to $625M Crypto Theft: Axie Infinity’s Ronin blockchain suffered a monolithic exploit precocious past month.

OlympusDAO Co-Founder Doxxed? Lawsuit Claims to Unmask 'Apollo': An aboriginal Olympus capitalist alleges helium was cheated retired of millions of OHM tokens erstwhile cardinal astute contracts were rendered inoperable.

The US and Europe Can't Regulate Crypto Alone: Global adoption makes regulating crypto wrong nationalist siloes futile.

Sam Bankman-Fried: The Man, the Hair, the Vision: SBF is 30 and his company, FTX, is everywhere. He'll beryllium appearing astatine CoinDesk's Consensus festival successful June.

The US and Europe Can't Regulate Crypto Alone: Global adoption makes regulating crypto wrong nationalist siloes futile.

"Where does this continuing dominance travel from, fixed that the U.S. system nary longer has the commanding presumption it held for a mates of decades aft World War II? The reply is that determination are self-reinforcing feedback loops, successful which radical usage dollars due to the fact that different radical usage dollars." (New York Times columnist Paul Krugman) ... "Now, with borrowing rates hitting 5% for the archetypal clip since 2011, homes whitethorn beryllium getting excessively costly to support prices rising truthful rapidly." (The Wall Street Journal) ... "Battered by precocious ostentation readings and crisp messages from Federal Reserve officials astir the request for interest-rate increases, enslaved prices person tumbled this twelvemonth astatine a gait investors person seldom seen." (The Wall Street Journal)

3 years ago

3 years ago

English (US)

English (US)