Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Good morning. Here’s what’s happening:

Prices: Bitcoin struggles; altcoins fare worse.

Insights: Terra's implosion threatens crypto lending protocols.

Technician's take: BTC is oversold and could spot a short-term alleviation bounce.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $29,127 +1%

Ether (ETH): $1,968 -5.1%

Biggest Gainers

Biggest Losers

Another forgettable time for cryptos

Bitcoin had a forgettable Thursday. About altcoins, the little said, the better.

After hitting a caller 16-month debased earlier successful the day, the largest cryptocurrency by marketplace capitalization was precocious trading astatine $29,100, up somewhat implicit the past 24 hours. That was small comfortableness for investors who person watched it plunge with different integer assets the past fewer days, swept up with capitalist fears pursuing the illness of the terraUSD (UST) stablecoin against its 1:1 dollar peg. Bitcoin was already reeling from wider concerns astir precocious ostentation and geopolitical turmoil.

Still, different cryptocurrencies fared acold worse, a motion of the risk-off situation that has investors veering distant rapidly from immoderate plus with a whiff of risk. Ether, was trading astatine astir $1,960, disconnected astir 5% aft dipping nether $1,800 earlier successful the day, the archetypal clip since past July it had sunk beneath $1,800. In a oversea of large crypto red, SOL, CRO, ADA and MATIC were each down astir 10% astatine 1 point. SAND and ATOM were disconnected 14.5% and 9%, respectively.

Meanwhile, Terra blockchain's token LUNA plunged beneath 2 cents connected Thursday, prompting validators to concisely halted the web to instrumentality a spot that would forestall caller actors from staking connected it. Just a period ago, LUNA had reached a precocious of $120. UST was precocious trading astatine astir 33 cents, down astir 54%.

Equity markets did better, rallying precocious to decorativeness somewhat down from wherever they started the day. Still, rising prices loomed ample arsenic a study Thursday recovered that owe rates had climbed to 5.3%, their highest complaint since 2009.

"The higher-than-expected ostentation figures successful the U.S. person prompted investors to determination towards selling risky assets, impacting cryptocurrencies successful the process arsenic well," wrote Daniel Takieddine, the CEO for the Middle East and North Africa portion of brokerage BDSwiss, successful an email. "The determination towards a accelerated emergence successful involvement rates could support cryptocurrencies connected a sliding inclination for a longer play of clip arsenic investors determination to safer assets."

He added: "This bearish inclination is further exacerbated by the caller clang of the TerraUSD, which mislaid its peg to the USD by a ample margin. Its autumn successful worth has eroded investors' assurance successful the crypto markets and successful the stablecoin conception successful particular."

Terra's implosion threatens crypto lending protocols

Crypto lending, the backbone of decentralized finance (DeFi), was built successful the rubble of the COVID-19-induced clang of March 2020. The prevailing logic down crypto lending is to supply a smoother disconnected ramp than rapid-fire selling, which depresses prices.

But arsenic the illness of Terra’s LUNA and UST tokens has sent daze waves passim the industry, accelerating the diminution of the terms of bitcoin, knocking tether disconnected its peg and reiterating concerns from institutions and regulators astir the viability of the plus class, crypto lending appears to beryllium its adjacent victim.

Data present suggests that there’s a cavalcade of radical looking for an exit.

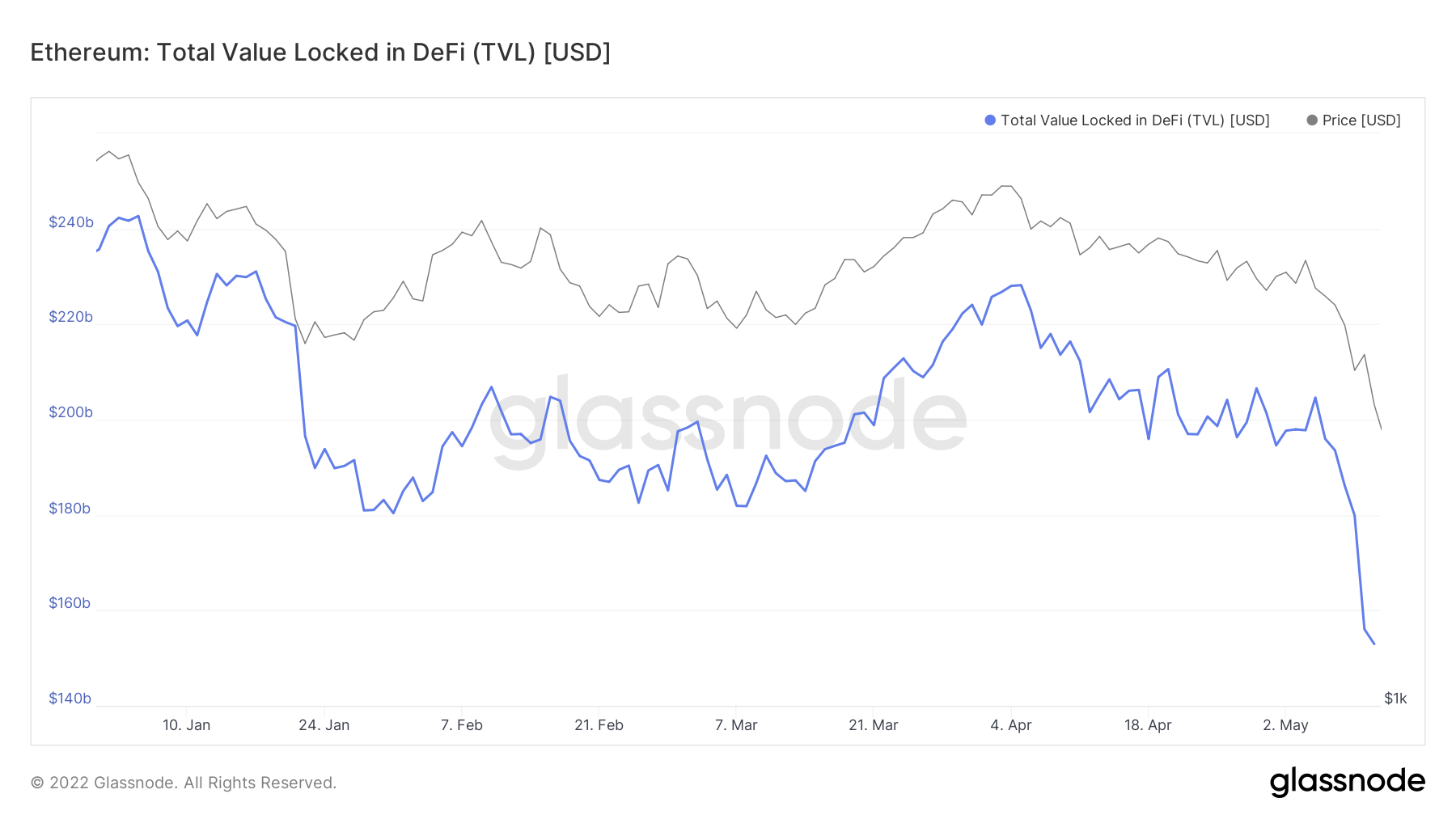

The full locked-in worth for DeFi is astatine $150 billion, down from conscionable nether $240 cardinal astatine the commencement of the twelvemonth and from $230 cardinal a period ago, according to Glassnode data.

Data would suggest that galore traders are moving their crypto retired of DeFi protocols and into stablecoins like USDC with plans to redeem them (stablecoins similar USDC and USDT tin beryllium redeemed for U.S. dollars upon request).

Total worth locked (Glassnode)

The proviso of USDC, utilized by institutions and U.S.-based traders due to the fact that of its regulatory compliance, is present conscionable beneath $48.5 billion, down from $53 cardinal astatine the opening of March. A akin inclination is being seen with Glassnode’s information connected speech nett positions. Since mid-April, it has flipped to red, present accelerating with Glassnode reporting regular outflows successful the $2 cardinal range.

At the aforesaid time, lending protocols similar Compound are reporting ample declines successful stablecoin supply. Compound, for instance, reports an 11% diminution successful USDC supply. All the while, gas trackers amusement that successful the past week gas fees from USDC are up 175%, portion state usage astatine lending protocol Aave is up 705% implicit the past week.

Lending protocol prices aren’t taking good to this dash for the exit. Across the board, the tokens of large lending protocols are down with aave falling 53% implicit the past week. Celsius has dropped 55.6% implicit the past week and compound has fallen 49% during that time.

Top lending/borrowing coins

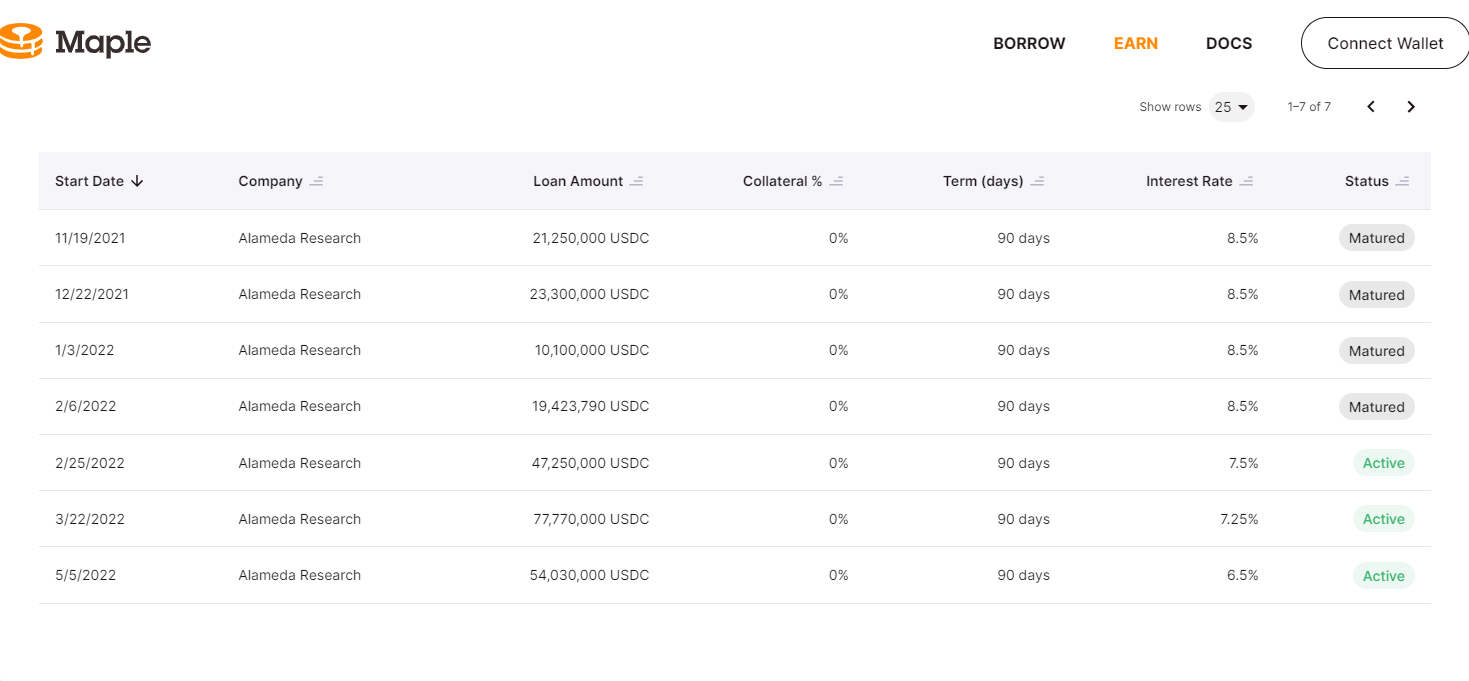

Despite little USDC successful circulation, determination doesn’t look to beryllium a peculiar summation successful request for it. Given the coming carnivore market, trading tempo volition apt alteration and planned concern into crypto infrastructure mightiness slow. The lawsuit and constituent for this is the output offered by Alameda Research’s syndicated loans powered by the Maple Finance protocol.

Loan amounts (Maple)

Alameda’s astir caller USDC-denominated loan, which launched past week conscionable arsenic the Luna situation emerged, is present offering lone a 6.5% yield. When the task began past November, 8.5% was the disposable yield. Although determination is little USDC available, Alameda is anticipating a slowdown and doesn’t person the aforesaid request for it.

The bully quality from this situation is that galore parts of the infrastructure surrounding crypto are continuing to hold. USDC and Binance’s BUSD, are inactive astatine $, and redemptions – adjacent from tether which was concisely knocked disconnected its peg – are being processed connected request.

Bitcoin's regular illustration shows support/resistance with RSI connected the bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) appears to beryllium oversold connected the charts, which typically precedes a short-term upswing successful price.

The cryptocurrency declined toward $25,400 Thursday day earlier rapidly recovering backmost supra the $27,000 support level.

The comparative spot scale (RSI) connected the regular illustration is the astir oversold since January, which preceded a 30% alleviation rally. This time, however, antagonistic semipermanent momentum could headdress upside moves astir the $35,000 resistance level.

Further, BTC registered a countertrend reversal awesome connected the regular chart, according to DeMARK indicators. That means selling unit could wane implicit the adjacent fewer days arsenic buyers instrumentality from the sidelines. Another regular adjacent supra $30,000 would corroborate the countertrend signal, though determination is simply a debased accidental of important upside from here.

HKT/SGT(UTC): Australia Housing Industry Association caller location income (MoM/April)

10 a.m. HKT/SGT (2 a.m. UTC): Speech by Michele Bullock, adjunct politician astatine the Reserve Bank of Australia

3 p.m. HKT/SGT (7 a.m. UTC): Speech by Luis De Guindos, vice-president of the European Central Bank

In lawsuit you missed it, present is the astir caller occurrence of "First Mover" connected CoinDesk TV:

Another 24 hours of achy losses successful the crypto markets. "First Mover" discussed caller details successful the TerraUSD (UST) play and markets investigation from Kevin Zhou of Galois Capital, Michael Gronager of Chainalysis and Martin Leinweber of MV Index Solutions.

Terra’s LUNA Has Dropped 99.7% successful Under a Week. That’s Good for UST: LUNA tokens mislaid 96% successful the past 24 hours alone, prompting much to beryllium minted successful a mechanics that helped assistance the UST price.

Tether Loses $1 Peg, Bitcoin Drops to 2020 Levels of Near $24K: Weak sentiment astir stablecoins whitethorn person contributed to USDT’s de-pegging Thursday morning.

Global Crypto Regulatory Body Is Coming Soon, Says Top Official: A associated assemblage to coordinate efforts astatine regulating crypto astatine the planetary level could go a world successful the adjacent year, according to Ashley Alder, president of the International Organization of Securities Commissions.

Terra Proposes Token Burn and Increase successful Pool Size to Stop UST Dilution: Terra believes that decreasing the magnitude of UST successful circulation, portion expanding the magnitude of disposable LUNA, is the easiest mode to instrumentality the UST to a peg.

Chainalysis Raises $170M astatine $8.6B Valuation: The crypto sleuthing steadfast says it tools show $1 trillion worthy of transactions each month.

Do Kwon Is the Elizabeth Holmes of Crypto: If you committedness investors thing impossible, is it a crime?

"Web 3 has stunned the satellite by forging a parallel strategy of concern of unprecedented flexibility and creativity successful little than a decade. Cryptographic and economical primitives, oregon gathering blocks, specified arsenic nationalist cardinal cryptography, astute contracts, proof-of-work and proof-of-stake person led to a blase and unfastened ecosystem for expressing fiscal transactions. Yet, the economical worth concern trades connected is generated by humans and their relationships. Because Web 3 lacks primitives to correspond specified societal identity, it has go fundamentally babelike connected the precise centralized Web 2 structures it aims to transcend, replicating their limitations." (Glen Weyl, co-author of “Radical Markets" for CoinDesk) ... "The system tin lone spell truthful accelerated without overheating. A large occupation present is that cipher is definite conscionable however accelerated that is." (The Wall Street Journal) ... "As Russia’s grinding warfare pulverizes eastbound Ukraine and eats distant astatine the planetary economy, it is besides creating unintended consequences for President Vladimir V. Putin, whose aggression is giving emergence to a stronger, Western-aligned information architecture successful Europe, the precise happening the Russian person had hoped to weaken." (The New York Times)

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)