Galaxy Digital, a starring subordinate successful the integer assets sphere, has issued a bullish prediction for Bitcoin’s trajectory pursuing the motorboat of the much-anticipated US-regulated spot Bitcoin ETF. According to a caller survey published by the steadfast connected October 24, the instauration of the ETF is acceptable to considerably bolster Bitcoin’s adoption, positioning it much firmly arsenic a recognized plus class.

Advantages Of An ETF

Galaxy’s analysis highlights that a spot Bitcoin ETF would beryllium “one of the astir impactful catalysts for the adoption of Bitcoin (and crypto arsenic an plus class).” By the extremity of September, Bitcoin assets held crossed divers concern products similar ETPs and closed-end funds touched an awesome fig of 842,000 BTC, valuing astir $21.7 billion.

Galaxy Digital’s survey besides sheds airy connected the challenges faced by these concern avenues, pointing to factors similar precocious fees, tracking errors, constricted liquidity, and a somewhat constrained scope amongst broader capitalist groups. The instauration of the spot Bitcoin ETF, the study suggests, is poised to alteration this script dramatically.

Spot Bitcoin ETFs connection a multitude of benefits implicit the existent structures: an improved interest system, greater liquidity, amended terms tracking, and a much-needed interruption from the complications of self-custodying assets. As the study explicitly states, “The beingness of a US-regulated spot Bitcoin ETF that adheres to strict regulatory compliance not lone provides a much unafraid level but besides elevates its transparency, making it a preferable prime implicit existing concern products.”

Why A Spot Bitcoin ETF Matters

Galaxy believes that the instauration of a Bitcoin ETF would summation the integer asset’s “accessibility crossed wealthiness segments” and found “greater acceptance done ceremonial designation by regulators and trusted fiscal services brands.”

The study highlights the disparity betwixt property groups erstwhile it comes to Bitcoin investments. It reveals that portion Boomers and older generations clasp 62% of US wealth, lone 8% of adults aged 50 and supra person invested successful cryptocurrency.

Galaxy sees regulatory support for a Bitcoin ETF arsenic a important measurement towards establishing Bitcoin arsenic a mainstream investment. An ETF could assistance trim marketplace volatility by offering “greater terms transparency and find for marketplace participants.”

Estimating Inflows From ETF Approval

Galaxy’s forecast suggests the US wealthiness absorption sector, managing a combined plus worthy $48.3 trillion, volition beryllium the astir impacted by a Bitcoin ETF’s launch. They estimation imaginable inflows into the Bitcoin ETF to beryllium astir $14 cardinal successful the archetypal year, escalating to $27 cardinal successful the 2nd twelvemonth and reaching $39 cardinal by the 3rd year.

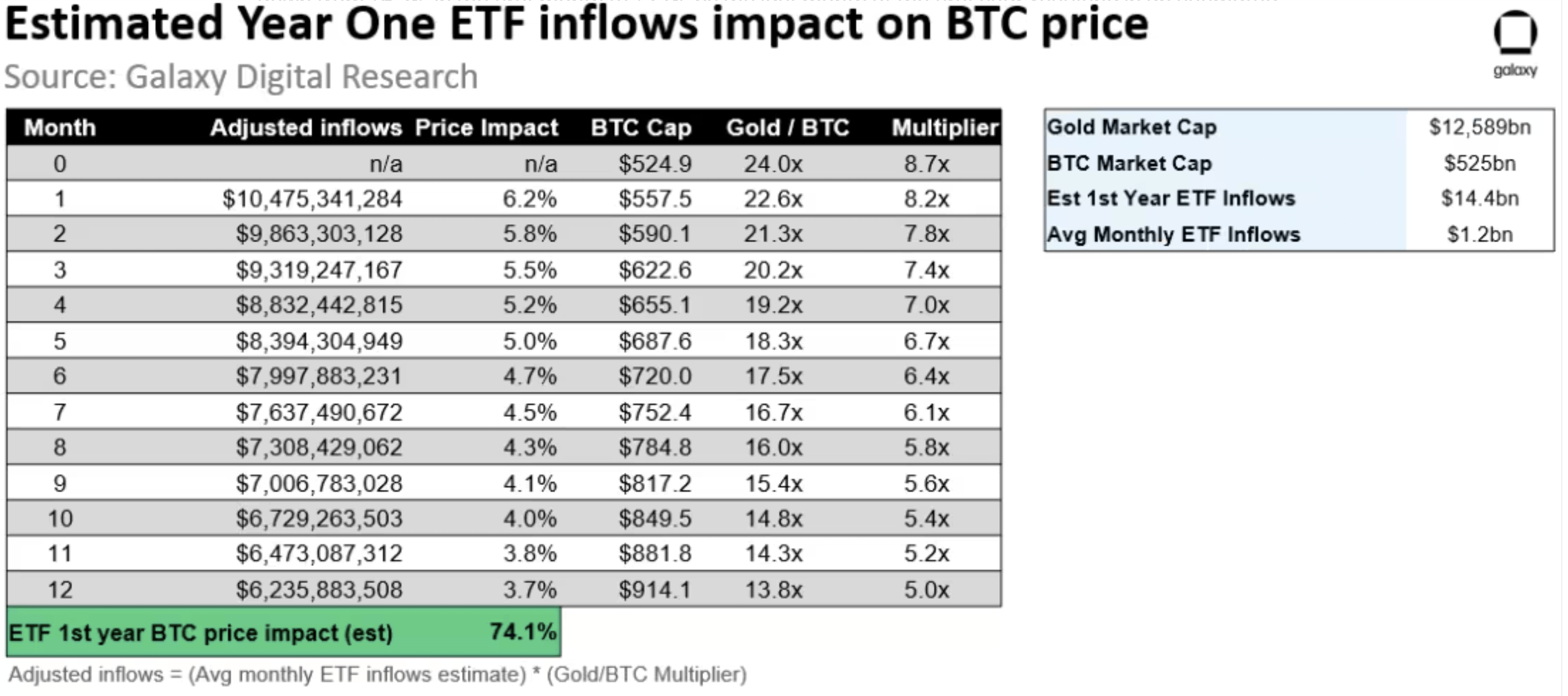

Factoring successful the humanities narration betwixt gold ETF money flows and golden terms change, Galaxy predicts a imaginable terms summation of 6.2% for BTC successful the archetypal period aft an ETF’s launch. They task this to taper down to +3.7% by the past period of the archetypal year, resulting successful an estimated +74% summation successful BTC successful the archetypal twelvemonth of an ETF approval. At the existent price, this would mean that BTC could emergence supra $59,000 successful the post-ETF debut year.

Estimated Spot Bitcoin ETF inflows successful the archetypal twelvemonth | Source: Galaxy

Estimated Spot Bitcoin ETF inflows successful the archetypal twelvemonth | Source: GalaxyThe Bigger Picture

Beyond the imaginable inflows into a US ETF product, Galaxy predicts that determination volition beryllium a overmuch larger interaction connected BTC request “from second-order effects”. The imaginable support of a spot ETF successful the US mightiness instigate akin products successful different planetary markets. Moreover, Galaxy expects that assorted different concern vehicles, similar communal funds and backstage funds, volition integrate Bitcoin into their strategies.

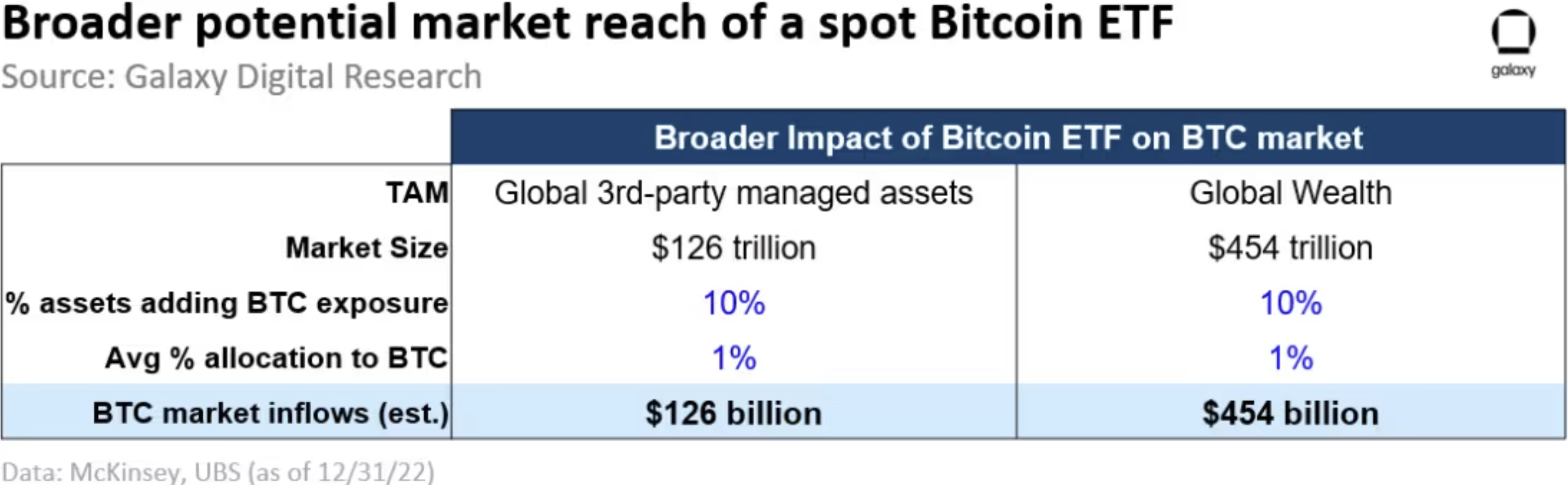

Galaxy suggests the imaginable for Bitcoin’s Total Addressable Market (TAM) to turn substantially, possibly encroaching connected accepted plus sectors similar existent property and precious metals. The estimated imaginable caller inflows into BTC could scope betwixt $125 cardinal to $450 cardinal “over an extended period.”

Broader imaginable marketplace scope of Bitcoin | Source: Galaxy

Broader imaginable marketplace scope of Bitcoin | Source: GalaxyFeatured representation from Shutterstock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)