Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

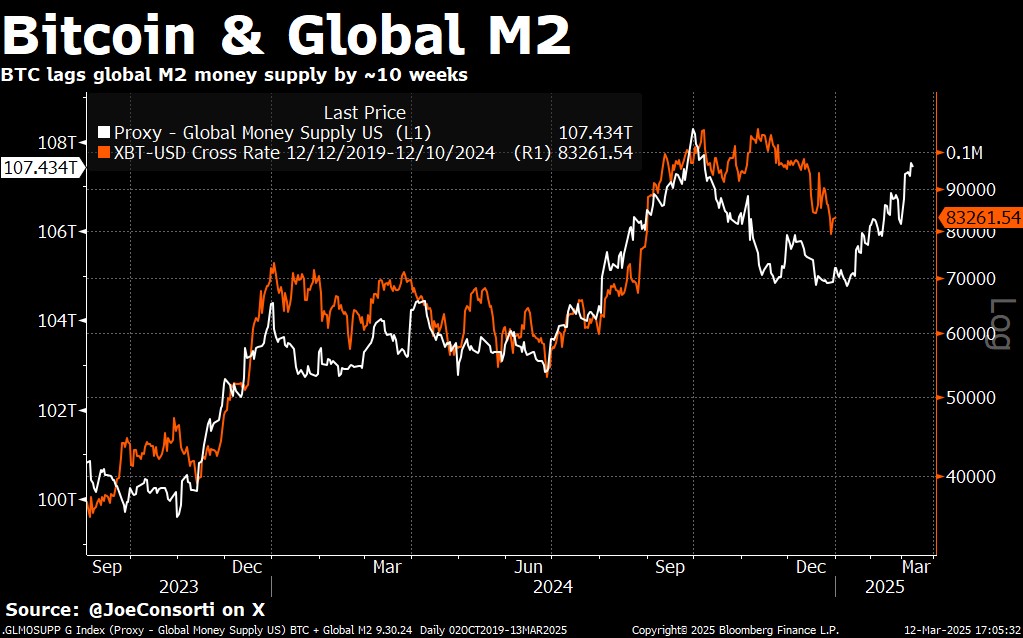

Bitcoin’s choky correlation with planetary M2 has returned to the spotlight, suggesting that broader monetary conditions stay a cardinal unit down the cryptocurrency’s marketplace trajectory. Recent terms enactment shows Bitcoin converging with M2’s downward drift—mirroring astir a 70-day lag. This cyclical question highlights Bitcoin’s ongoing responsiveness to fluctuations successful liquidity, adjacent arsenic different cardinal factors, similar the recently announced US Strategic Bitcoin Reserve (SBR), proceed to seizure headlines.

Global M2 Correlation And Bitcoin Market Inefficiency

In his latest probe note, expert Joe Consorti underscores that “Bitcoin’s directional correlation with planetary M2 has tightened again,” indicating that terms remains heavy swayed by wealth proviso trends. After a fewer months of divergence—fueled successful portion by a beardown US dollar—Bitcoin fell to $78,000, coming wrong $8,000 of M2’s projected path.

The planetary M2 index has softened, partially reflecting the dollar’s robust performance. Despite that drag, Bitcoin appears to beryllium pursuing the wide liquidity blueprint it has tracked passim this cycle, suggesting Bitcoin’s terms inactive hinges connected large macro forces similar cardinal slope expansions and contractions. “While this narration isn’t a nonstop cause-and-effect mechanism, it continues to supply a utile macro framework,” Consorti writes.

Bitcoin vs M2 | Source: X @JoeConsorti

Bitcoin vs M2 | Source: X @JoeConsortiHe added: “The takeaway? Bitcoin remains the eventual monetary plus successful a satellite wherever wealth supply, equilibrium expanse capacity, and recognition are perpetually expanding. As planetary wealth proviso expands, bitcoin tends to travel it, astatine slightest directionally. But this rhythm is seeing further variables that marque M2 a little reliable standalone indicator, specified arsenic the US dollar being historically strong, creating a resistance connected planetary M2 denominated successful USD, and much close measures of wealth proviso and liquidity coming onto the scene.”

Although macro conditions are exerting acquainted pressure, the market’s absorption to the SBR announcement has been perplexing. After the US President Donald Trump formally declared plans to accumulate Bitcoin done a “budget-neutral” mechanism, the terms tumbled 8.5% successful conscionable nether a week. Consorti described the sell-off arsenic “an irrational absorption highlighting large inefficiencies successful pricing Bitcoin’s geopolitical importance.”

Executive Order 14233 mandates Treasury and Commerce officials to turn America’s BTC holdings—currently astatine 198,109 BTC—without caller payer outgo oregon legislature oversight. This is simply a stark opposition to erstwhile government-level adoptions, specified as El Salvador’s ineligible tender move, which coincided with a surge successful Bitcoin’s price. Consorti attributes the disparity to short-term nett taking and a “sell-the-news” mentality, adding that “the magnitude of the selloff indicates a implicit nonaccomplishment to terms successful the semipermanent implications.”

Despite the SBR-related dip, Bitcoin’s method signals suggest a imaginable section bottommost forming. The cryptocurrency dipped to $77,000 earlier bouncing back, filling a low-volume spread successful the $76,000–$86,000 range. Buyers seized connected the retracement, creating 2 hammer candlesticks connected the play chart.

Hammer candlesticks typically constituent to a reversal, particularly erstwhile they look astatine cycle-defining enactment levels. According to Consorti, “Historical precedent suggests that Bitcoin forms these patterns astatine rhythm turning points… The past clip we saw this nonstop terms operation was during the process extremity of Bitcoin’s summertime 2024 consolidation, 2 months earlier it surged from $57,000 to $108,000.”

A notable inclination amid these terms fluctuations is Bitcoin’s rising dominance, adjacent during periods of marketplace contraction. ETH/BTC precocious sank to 0.0227—its lowest since May 2020—indicating intensifying skepticism toward altcoins. Meanwhile, organization request for Ethereum has likewise slumped, arsenic evidenced by a 56.8% driblet successful the plus nether absorption (AUM) ratio for Ethereum vs. Bitcoin.

“This rhythm belongs to Bitcoin, and each aboriginal cycles volition lone further cement this reality,” Consorti asserts. He suggests altcoins are warring an uphill conflict arsenic Bitcoin-centric narratives summation planetary traction.

At property time, BTC traded astatine $82,875.

BTC remains beneath cardinal resistance, 1-day illustration | Source: BTCUSDT connected TradingView.com

BTC remains beneath cardinal resistance, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

9 months ago

9 months ago

English (US)

English (US)