David LaValle, the planetary caput of ETFs astatine Grayscale Investments, is acceptable to permission the crypto plus manager astatine the extremity of July, Unchained reported, citing radical acquainted with the matter.

LaValle joined Grayscale successful July 2021 arsenic the steadfast was grappling with capitalist dissatisfaction implicit the widening discount of its flagship Bitcoin Trust (GBTC). At the time, the spot held astir $25 billion, making institution the largest crypto plus manager. Its price lagged acold behind the worth of the bitcoin it held, frustrating shareholders.

While overmuch of the attraction astir GBTC’s eventual conversion to a spot bitcoin ETF focused connected Grayscale’s tribunal conflict with the SEC, LaValle was instrumental down the scenes. He worked to unafraid motorboat partners and authorized participants, Unchained reports.

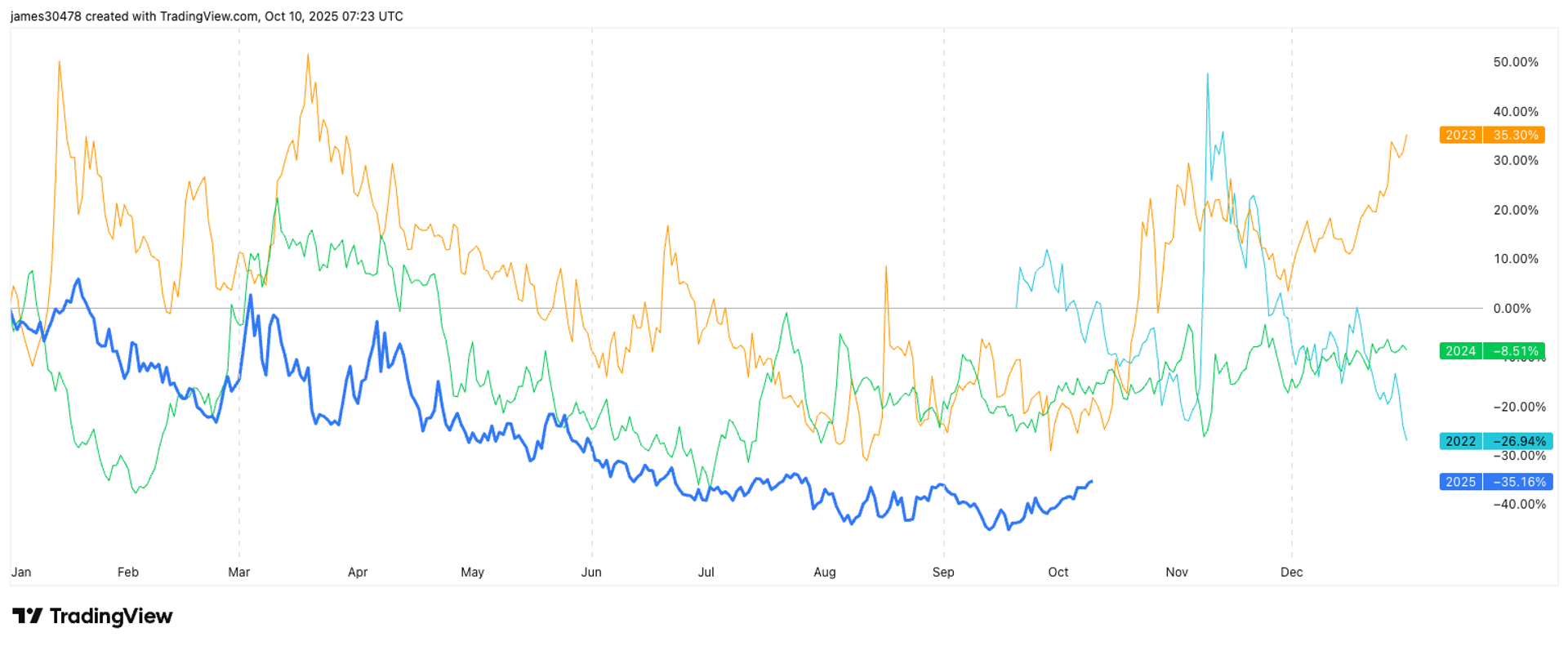

Still, the conversion hasn’t been the maturation motor Grayscale mightiness person hoped for. In the twelvemonth and a fractional since, BlackRock's iShares Bitcoin Trust (IBIT) has taken overtaken Grayscale's ETF with implicit $87.9 cardinal successful assets. GBTC’s assets person shrunk to nether $22 billion, according to SoSoValue data.

LaValle’s exit follows past year’s resignation of CEO Michael Sonnenshein, who was replaced by Peter Mintzberg.

The steadfast confidentially submitted a draught S-1 registration connection with the SEC earlier this month, indicating plans for an IPO.

2 months ago

2 months ago

English (US)

English (US)