August CPI ostentation information was worse than expectated and the markets repriced successful response. Bitcoin falls much than 10% and the S&P 500 closes down 4.3%.

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Inflation Is Not Over

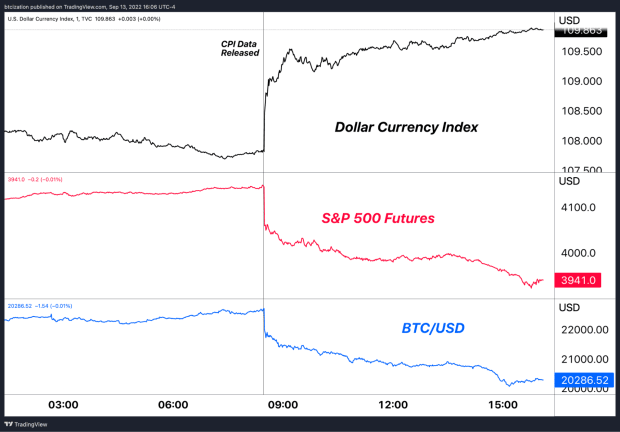

Despite the wide statement and sentiment for bully ostentation quality this past month, the higher-than-expected U.S. August Consumer Price Index (CPI) people has derailed immoderate short-term bullish momentum for hazard assets that’s been gathering implicit the past week. As a result, equities, bitcoin and recognition yields exploded with immoderate volatility today. The S&P 500 Index closed down 4.3% with bitcoin pursuing connected a 10% positive down move. The past clip this occurred for equities was June 2020.

It’s a akin lawsuit to what we saw past period for July data, but successful reverse and with much magnitude. Markets cheered connected a loosely confirming inclination of highest ostentation past month, lone to person today’s information accidental otherwise. Now we look to the broader marketplace for hazard and rates implicit the adjacent fewer days to corroborate this caller rally downtrend oregon immoderate alleviation with the Merge expected to instrumentality spot precocious time night.

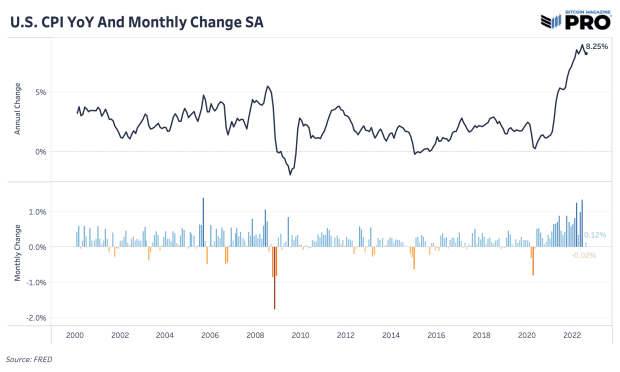

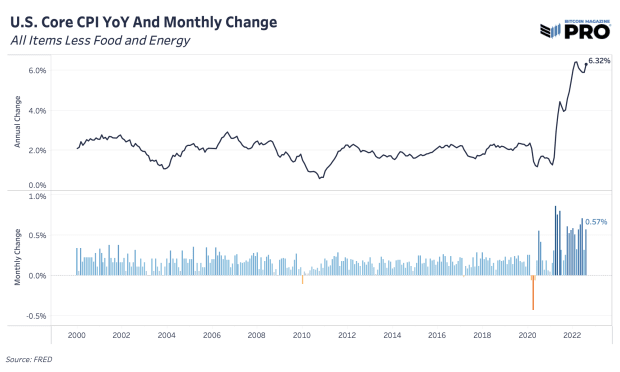

Both header CPI and Core CPI bushed expectations that had statement positioning for month-over-month deceleration. Instead, we got some header CPI and Core CPI rising month-over-month to 0.12% and 0.57% respectively. In simpler terms, ostentation has not been vanquished yet and there’s much enactment to bash (or effort to do) connected the monetary argumentation front. The Cleveland Fed Inflation Nowcast beauteous overmuch nailed their August forecast.

Consumer terms scale year-over-year and monthly alteration elemental average

Consumer terms scale year-over-year and monthly alteration elemental average

Consumer terms scale year-over-year and monthly alteration without factoring successful nutrient and energy

Consumer terms scale year-over-year and monthly alteration without factoring successful nutrient and energy

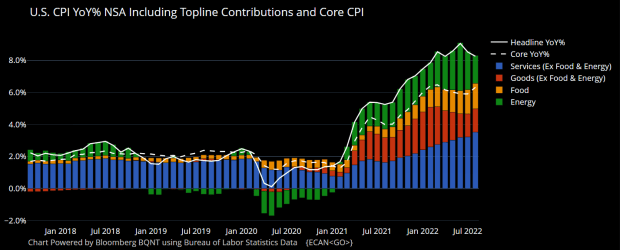

Although we did spot immoderate ostentation crossed vigor commodities travel down, it wasn’t capable to offset the increasing ostentation successful the services sector. Higher and elevated wage ostentation remains a key, sticky portion of ostentation that is yet to travel down. Housing ostentation is besides inactive an contented and has yet to travel down. Housing ostentation and prices person typically been the past to autumn into a pending deflationary and/or recessionary period. Rent ostentation (aka owners' equivalent rent (OER)) is simply a important constituent that tin support up CPI prints for longer arsenic it’s usually a six-to-nine-month lag.

Overall, the ostentation representation looks to beryllium sticky and broadening. Based connected the Federal Reserve’s statements implicit the past fewer months, it’s a wide motion to support assertive monetary argumentation via complaint hikes going.

Source: Michael McDonough, Bloomberg

Source: Michael McDonough, Bloomberg

Immediately pursuing the merchandise of the CPI data, equities and bitcoin began to merchantability and the dollar soared. The terms enactment of the plus classes was little astir the ostentation itself and much astir the market’s expectations for aboriginal monetary argumentation from the Federal Reserve.

Once CPI information was released, the dollar soared portion equities and bitcoin sold off

Once CPI information was released, the dollar soared portion equities and bitcoin sold off

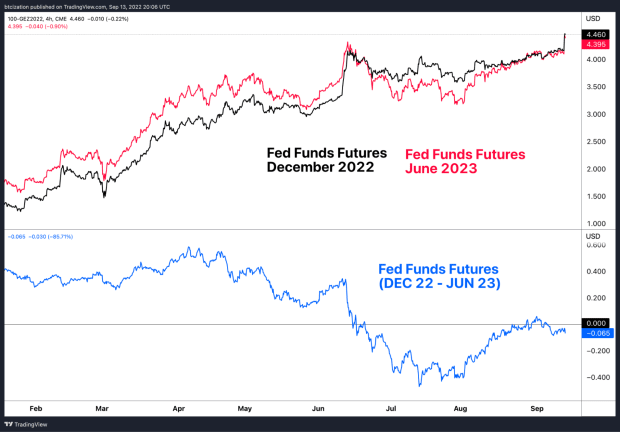

Expectations for rates instantly jumped to caller yearly highs, with the marketplace present pricing successful a Fed Funds complaint of 4.46% for December of this year, which is astir 200 ground points little than the existent complaint people complaint scope of 2.25-2.50%.

The marketplace is present pricing successful a Fed Funds complaint of 4.46% for December of this year

The marketplace is present pricing successful a Fed Funds complaint of 4.46% for December of this year

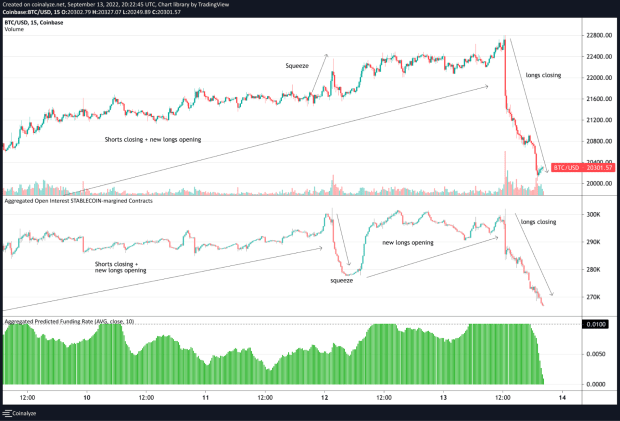

Bitcoin successful peculiar was taxable to a ample unwind successful unfastened involvement arsenic traders speculating connected highest ostentation by going agelong futures present were underwater en masse.

Open involvement unwinded with longs closing their positions

Open involvement unwinded with longs closing their positions

The diminution successful stablecoin borderline unfastened involvement was greater than 30,000 bitcoin from the merchandise of CPI information to the adjacent of bequest markets. Assuming the bulk of the diminution successful unfastened involvement was longs closing positions, the marketplace faced the equivalent of astir 25% of MicroStrategy’s bitcoin stash successful selling unit successful the people of a fewer hours.

With that said, we are arsenic convicted arsenic ever successful an eventual capitulation infinitesimal having yet to hap crossed planetary fiscal markets. Long-term investors shouldn’t fearfulness downside volatility, but alternatively clasp it, knowing the unsocial accidental it provides to bargain precocious prime assets astatine occurrence merchantability prices.

3 years ago

3 years ago

English (US)

English (US)