Ichi’s ICHI governance tokens person plunged immoderate 90% successful the past 24 hours aft a bid of cascading liquidations successful its excavation connected yield-generating level Rari, information show.

“The Ichi Fuse Pool (#136) is presently experiencing atrocious indebtedness owed to cascading liquidations,” Rari said successful a tweet precocious Monday. “This is simply a permissionless excavation that is owned and operated by Ichi Foundation.”

The slump occurred arsenic Rari's Fuse protocol automatically sold holdings successful Pool 136 to enactment the pool's value. However, debased liquidity for the token connected decentralized exchanges (DEX) meant the terms abruptly plunged, and the excavation was drained. At the clip of writing, the liquidity sits astatine $0 arsenic the full excavation was wiped retired arsenic crypto prices declined yesterday.

Understanding Rari and Ichi

Rari allows users to proviso and get immoderate plus successful its Fuse pools to gain yields connected their idle capital. Users tin acceptable up their ain pools with a handbasket of Ethereum-based assets. Other users tin deposit funds into those pools to gain yields. The yields are generated arsenic rewards for trading enactment connected those liquidity pools.

Ichi allows crypto communities to mint stablecoins by backing each created token with $1 successful value. For example, the oneBTC token created connected Ichi was initially backed by adjacent amounts of USD Coin, a stablecoin pegged to U.S. dollars, and wrapped bitcoin (WBTC), with the WBTC stock expanding arsenic the underlying bitcoin treasury grew successful size.

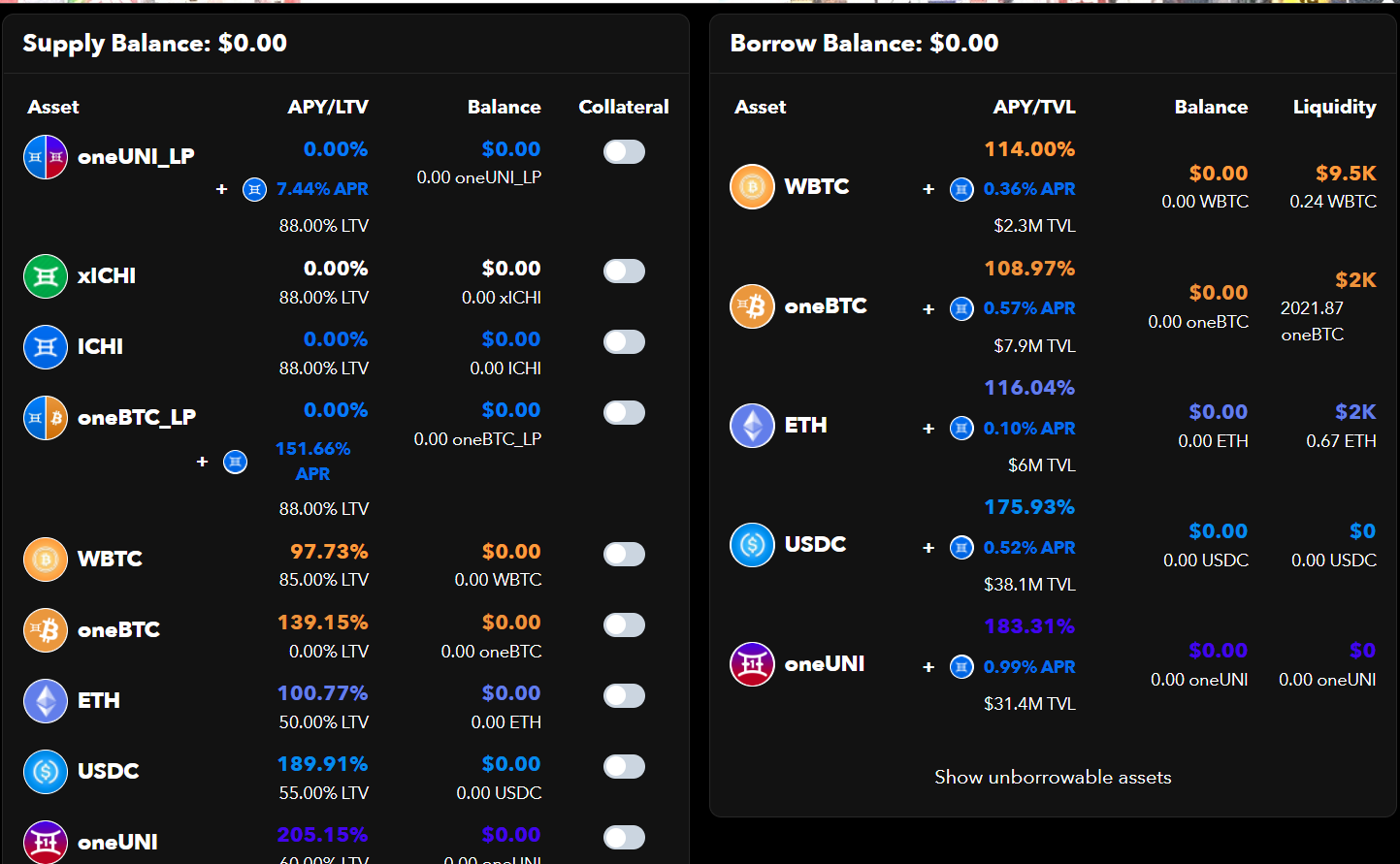

Pool 136 connected Rari consisted of specified Ichi-issued assets. Data amusement immoderate $124 cardinal – dispersed implicit WBTC, oneBTC, ICHI and six different assets – was locked connected the Fuse protocol.

Pool 136 connected Fuse Protocol. (Rari Capital)

Ichi, which acceptable up Pool 136, acceptable a collateral origin of 85% connected ICHI and allowed hundreds of millions of dollars to beryllium utilized arsenic collateral. The collateral origin refers to the maximum magnitude of wealth that tin beryllium borrowed against supplied assets. That meant users supplying 100 ICHI arsenic collateral could get astatine astir 85 ICHI worthy of different assets astatine immoderate fixed time.

"Liquidity was structured truthful the bulk of it sat conscionable nether marketplace price, allowing the excavation to sorb sells with minimal impact," explained Aswath Balakrishnan, vice president of probe astatine Delphi Digital, successful a Telegram message. "There wasn't capable liquidity to sorb each the ICHI liquidations, causing the terms to cascade."

Rari developers pointed retired the precocious collateral origin and deficiency of caps connected proviso contributed to the slide.

“A collateral origin of 85% is highly high,” Rari developer Jack Longarzo wrote successful a tweet. “Additionally, the squad didn't usage proviso caps and allowed an infinite magnitude of $ICHI to beryllium utilized arsenic collateral. This allowed $ICHI holders to get extensively against uncapped collateral.”

“if you spot collateral successful a excavation importantly successful excess of what tin beryllium liquidated this is simply a reddish flag. Cascading liquidations tin origin the terms to diminution quickly, adust up the liquidity, and permission the excavation with atrocious debt,” helium added.

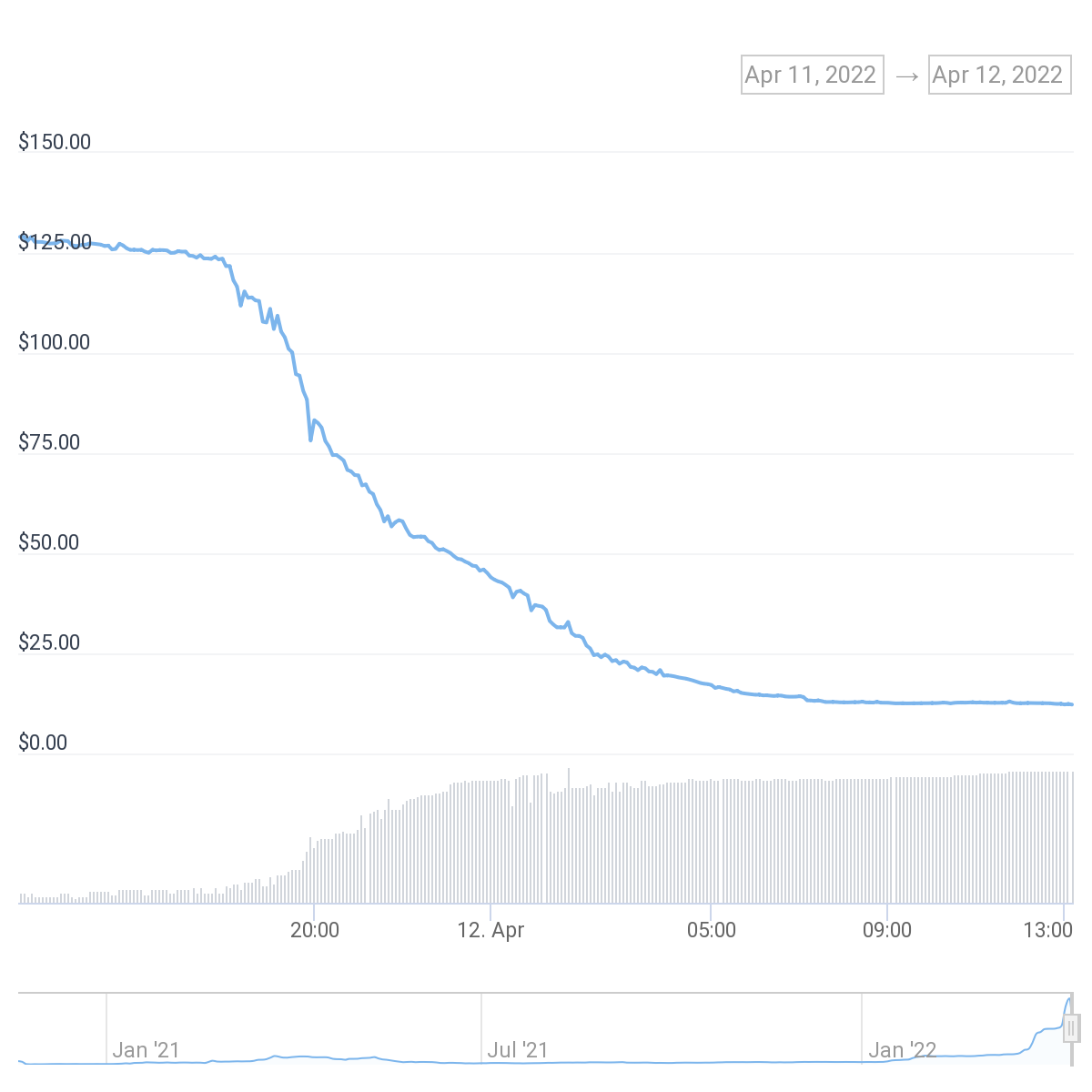

ICHI traded astatine implicit $120 connected Monday successful aboriginal European hours. Data from CoinGecko amusement excavation liquidations started astir 12:30 UTC connected Monday and continued until 2:30 UTC connected Tuesday.

Prices dropped each the mode to $12.50 and person since stabilized. Market capitalization reached $53 cardinal astatine penning clip from yesterday’s $579 million.

ICHI tokens person plunged 90% successful the past 24 hours. (CoinGecko)

Longarzo said Ichi developers could person taken respective steps to cushion risks, specified arsenic expanding the liquidity successful the marketplace for ICHI erstwhile the driblet began and putting a proviso headdress successful spot erstwhile the excavation was created.

Ultimately, it was up to Ichi’s developers to guarantee risks related to Pool 136 were contained.

“Fuse is simply a permissionless protocol. Pool operators are liable for pursuing champion practices to debar situations similar this one,” Longarzo said.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Valid Points, our play newsletter breaking down Ethereum’s improvement and its interaction connected crypto markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)