BlackHoleDAO is simply a decentralized plus absorption protocol based connected DAO governance. “BlackHole DAO Protocol (BHDP)” is simply a marque caller standardized exemplary constructed based connected DeFi 3.0. The BHDP pain mechanism, by drafting connected the banal divided and banal merge successful the accepted banal market, resolves the imbalance betwixt precocious ostentation and deflation successful the market. It besides rolls retired the DAOs credit-based indebtedness service.

1.0 BHDP Components

1.1 BHDP Design Highlights

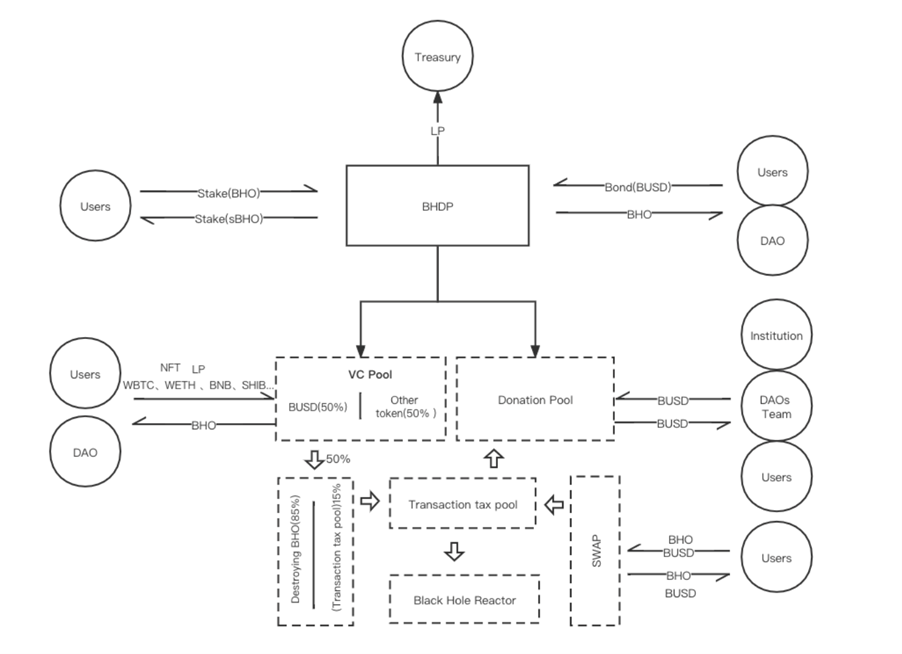

From the supra picture, BHDP (BlackHole DAO Protocol) is supported by a Treasury, with astute contracts to link VC Pool and Donation Pool. VC Pool supports multi-asset certificate investments, portion of which is utilized to pain BHO successful the liquidity excavation and the remainder for recognition loans aft the DAOs concern succeeds.

3 BHDP Ways of Deflation:

- It is simply a communal mode to pain straight 60% BHO of the transaction tax

- 50% of VC Pool is besides utilized to pain BHO successful the liquidity pool,

- The BHDP utmost deflation mechanics volition beryllium triggered erstwhile the utmost ostentation happens:

When the banal (BHO) successful the marketplace reaches a definite magnitude with a 0 enactment rate, the deflation mechanics volition beryllium triggered. The involvement connected Stake volition gradually alteration by a proportion.

X-[X/(Y*H)]=Z

x: magnitude erstwhile the pain mechanics is triggered

y: pain rate

h: Time (days)

z: magnitude remained erstwhile the enactment complaint is greater than 0

2.0 Wise Use of Olympus Stake and Bond

2.1 Evolved Stake and Bond

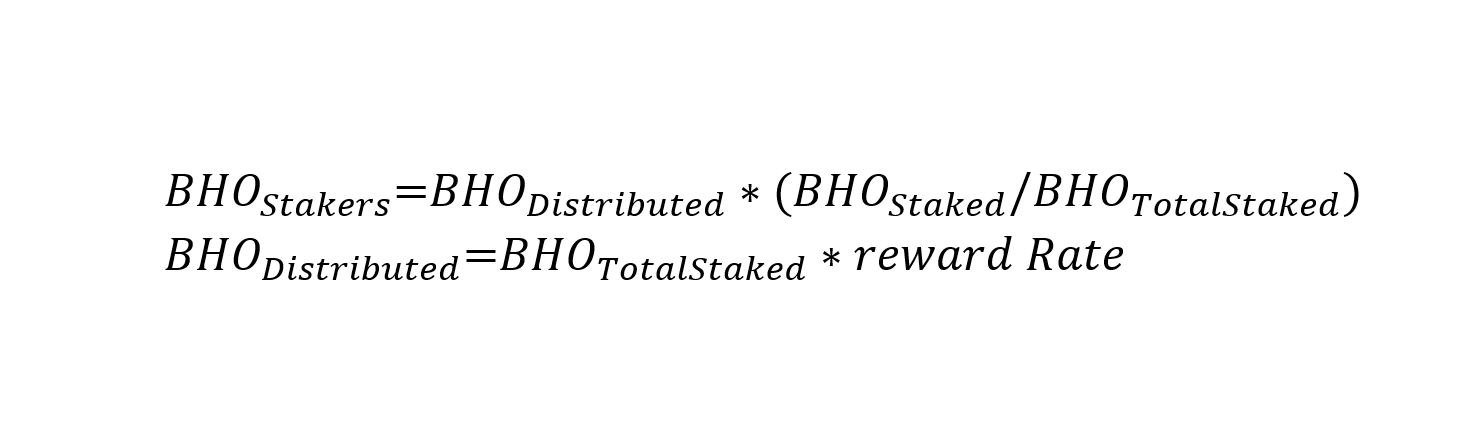

BlackHole DAO Stake regulates minting dynamically by the proportionality of the full staking amount. In different words, erstwhile the marketplace is successful inflation, the staking involvement volition decrease, portion successful deflation, it volition increase. However, it volition ne'er transcend the full staking amount. The vantage of dynamic regularisation is, this escaped marketplace transaction prevents the corporate behaviour to fly aft making a profit.

Staking reward is calculated as:

Improvements:

Improvements:

- Olympusdao tin mint tokens each the time, portion BlackHole DAO dynamically regulates the proportionality of minted tokens according to the ostentation rate. In a comparatively precocious ostentation rate, the proportionality of BHO minted by Bond volition decrease. Upon a 0 enactment rate, Bond volition halt minting.

- It provides a discount to bargain Tokens done Olympusdao, portion to bargain Tokens done BlackHole DAO is the aforesaid arsenic the marketplace price, but saves 15% of transaction tax.

For some choices, the astir invaluable constituent is that erstwhile the marketplace circulation worth is adjacent to the treasury value, Bond is nary longer the erstwhile precocious premium minting, but stopped minting, indicating that earlier the marketplace is successful inflation, the proportionality of minting successful the transmission volition gradually alteration until the minting is stopped, preventing further plus shrinkage during inflation.

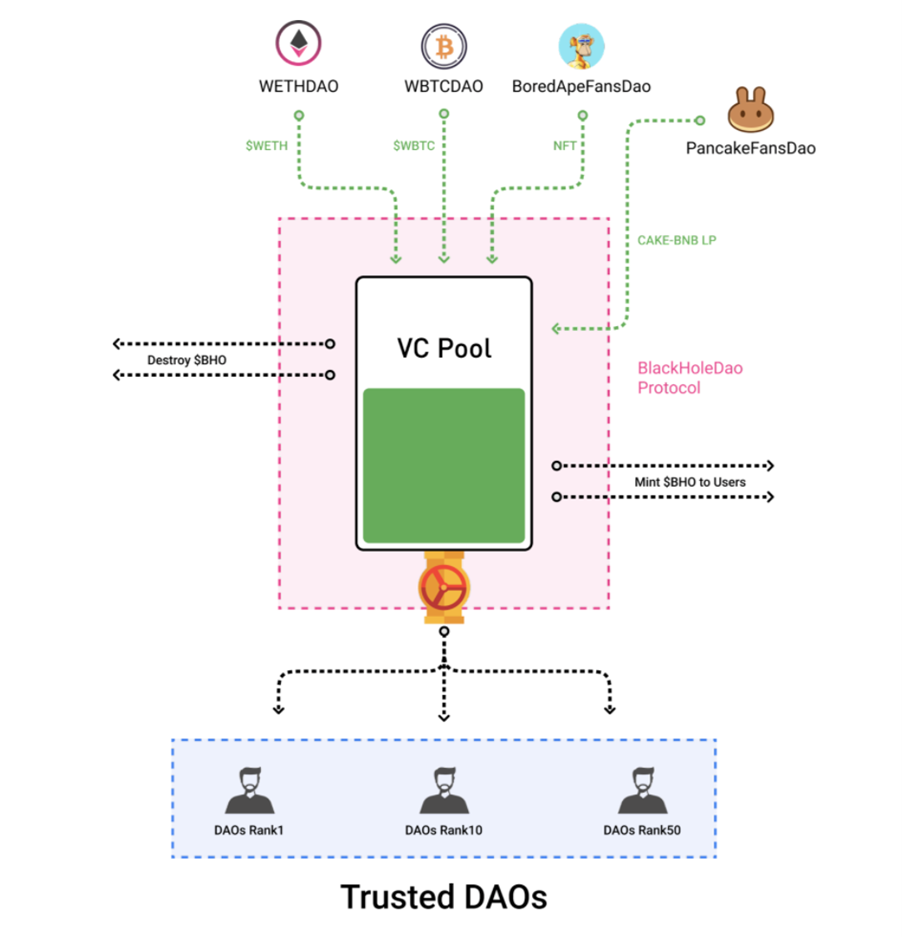

2.2 VC Pool with All Vouchers

According to the authoritative document, it is defined arsenic a “VC excavation with vouchers”. The papers describes: [Any task Token that enters VC Pool volition acquisition rigorous reappraisal and screening to forestall the malicious behaviour from causing the nonaccomplishment of the agelong process effect connected imaginable assets, resulting successful deflation and ostentation of stocks (BHO) and nonaccomplishment to play a locking relation successful the Token task entering into VC Pool.

We tin spot that VC Pool is the plus absorption business.With the last banal reflected successful the intrinsic worth of VC Pool.

VC Pool accepts specified invaluable vouchers arsenic stablecoins, NFTs and liquidity LPs. These invaluable vouchers, upon up to a definite magnitude successful VC Pool, volition radical LP and supply liquidity and LP indebtedness services to the 3rd party. All the claimed net volition participate the VC Pool to enactment circulation worth of the banal (BHO). Besides, 1 imaginable worth of VC Pool is to service arsenic the recognition pool. Bound with the DAOs community, it uses the DAOs assemblage protocol to accumulate the recognition and contented unsecured recognition loans according to the accumulated credit.

Meanwhile, VC Pool plays a regulatory relation successful BHDP

- In deflation, the proportionality of the banal (BHO) minted done VC excavation volition increase

- In inflation, the proportionality of the banal (BHO) minted done VC excavation volition decrease

- For BHO minted done VC excavation and entering VC Pool, 50% assets volition beryllium utilized to pain BHO successful the liquidity pool. The different 50% volition beryllium kept successful the excavation for DAOs assemblage recognition loan.

3.0 Reverse Investment to Cater for Different Customers

3.0 Reverse Investment to Cater for Different Customers

Investment Institutions

The concern starts astatine 10,000 BUSD, capable to person net from transaction taxation (BUSD+BHO)10% until the concern doubles.

DAOs Community

The concern starts astatine 1,000 BUSD, capable to person net from transaction taxation (BUSD+BHO)3% until the concern doubles. The earning volition halt astatine the extremity of the instrumentality period.

Individuals

The concern starts astatine 100 BUSD, capable to person net from transaction taxation (BUSD+BHO)2% until the concern doubles. The earning volition halt astatine the extremity of the instrumentality period.

4.0 Black Hole Reactor

The quality of the Black Hole Reactor looks similar the prize excavation acceptable by the task astatine antithetic stages. To conscionable a definite condition, the prize excavation volition beryllium opened. The funds are chiefly from 60% of the tax. erstwhile the marketplace circulation reaches 10 cardinal BHO and the reactor magnitude reaches 100 cardinal BUSD, the reactor volition beryllium opened. It’s definite that the magnitude varies depending connected the signifier of the reactor, and the magnitude of the reactor successful the 2nd signifier possibly 1 cardinal BUSD.

For peculiar reasons, determination are exceptions for opening the reactor

- The reactor volition beryllium opened erstwhile the marketplace circulation triggers the Blackhole Protocol mechanics with a last deflation to 10 cardinal BHO and the reactor magnitude reaches 100 cardinal BUSD

- Regardless of the result, the Black Hole Reactor volition beryllium opened aft 3 years.

- During the minting process, upon up to 100 cardinal BUSD, it volition unfastened the Black Hole Reactor and halt minting.

More detailed article:https://blackholedao.substack.com/p/interpretation-of-new-defi-30-blackholedao?s=w

3 years ago

3 years ago

English (US)

English (US)