Decentralized concern (DeFi) firms IntoTheBlock and Trident Digital person merged to signifier Sentora, joining forces to bring organization investors onchain.

The caller company, helmed by Anthony DeMartino, co-founder of Trident and erstwhile caput of hazard strategies astatine Coinbase (COIN), is besides connected way to adjacent a $25 cardinal founding circular with New Form Capital starring the investment. Ripple, Tribe Capital, UDHC, Joint Effects besides participated successful the fundraising round, with further backing from strategical ecosystem investors including Curved Ventures, Flare and Bankai Ventures. While astir investors person already closed the investment, 2 firms volition adjacent the process by June, the institution told CoinDesk.

The merger comes astatine a clip erstwhile DeFi is maturing from its "wild west" beginnings into a blockchain-based fiscal system with offerings progressively catered towards blase investors.

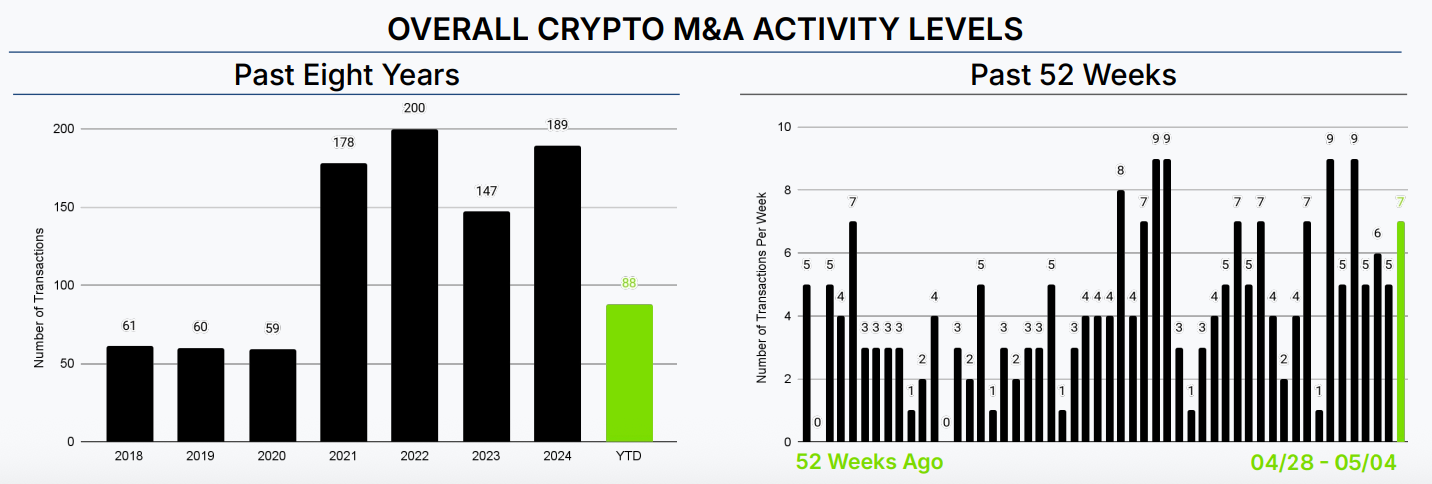

It besides underscores the ongoing inclination of consolidation wrong the crypto industry. There were 88 mergers and acquisitions successful the archetypal 4 months of 2025, according to Architect Partners, putting this twelvemonth connected way to surpass the grounds years of 2022 and 2024.

Sentora combines IntoTheBlock’s way grounds successful DeFi analytics—spanning implicit $3 cardinal successful organization deployments—with Trident’s acquisition structuring liquidity programs and fiscal products.

The level aims to supply a one-stop store for organization investors, offering output strategies, compliance, hazard absorption and entree to structured products each nether 1 hood.

"The imaginativeness is to physique each the halfway primitives that are needed for immoderate instauration whether it's a crypto institution, DAO foundation, accepted concern capitalist oregon idiosyncratic household office, to interact with DeFi successful a mode that feels intelligent, that feels safe, that feels secure," Jesus Rodriguez, co-founder of IntoTheBlock and present CTO of Sentora, said successful an interrogation with CoinDesk.

A cardinal roadblock that has hindered plus managers entering DeFi astatine standard is that the abstraction is getting progressively analyzable and fragmented crossed caller chains and protocols, DeMartino explained.

"It shouldn't beryllium this hard," helium said. "You shouldn't person to larn astir a caller concatenation and larn astir a full clump of antithetic protocols and recognize bridging and antithetic wallets each clip you privation to spell to a caller chain."

What tin assistance span this spread and pull adjacent accepted concern firms on-chain, according to DeMartino, is to abstract distant from interacting with idiosyncratic protocols with a azygous level that handles each the hazard absorption and liquidity, portion keeping transparency astir the underlying plumbing.

"DeFi rails are the aboriginal of finance, but it's inactive a precise tiny market," helium said. DefiLlama data shows that determination are little than $130 cardinal of assets connected DeFi protocols, dwarfed by the the aggregate trillions of assets nether absorption astatine the likes of BlackRock and Fidelity Investments.

"We're gathering the rails for the adjacent 130 trillion of assets to travel onchain," helium said.

Read more: Beyond Incentives: How to Build Durable DeFi

5 months ago

5 months ago

English (US)

English (US)