Google (or DDG) “inflation” and you’ll find articles with headlines from fundamentally each media outlet saying thing like: “US Inflation Jumps to Fresh 4-Decade High of 8.5% successful March.” That’s a large number. When ostentation fearfulness enters the conversation, investors spell “risk-off,” and they heap into ostentation hedges and store-of-value assets similar golden and … similar bitcoin?

Well then, wherefore didn’t bitcoin’s terms rocket up aft the ostentation people came retired past week? Is bitcoin a atrocious ostentation hedge? Is it ever going to beryllium a store of value? For each its promise, Bitcoin’s dependable wealth properties should predispose it toward being a utile ostentation hedge and store of value. That has fallen flat. So what gives? How aspirational is the “bitcoin arsenic a store-of-value” narrative? Are bitcoin investors screwed? Why is bitcoin acting similar a tech stock?

That (and possibly more) below…

You’re speechmaking Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor. Sign up here to get it successful your inbox each Sunday.

Prevailing economical mentation is built upon 3 pillars: output, wealth and expectations. The radical and groups that tally economies privation to summation economical output and fortify their sovereign wealth against different currencies portion managing expectations for the aboriginal to debar economical downturns. There’s not capable country successful a file to dive into the gory details of each of these concepts, but let’s zoom successful connected money, expectations and the entity liable for those 2 successful the U.S., the Federal Reserve, and necktie it into caller ostentation woes (and Bitcoin!).

The Fed has been fixed work for monetary argumentation successful the U.S. and aims to guarantee “maximum employment, unchangeable prices and mean semipermanent involvement rates.” The Fed has 3 levers it tin propulsion to execute its goal: 1) unfastened marketplace operations (i.e. “print money”), 2) the discount complaint (i.e. “interest rates”) and 3) reserve requirements (i.e. “vault deposit rules”). Printing wealth (by buying bonds and “stuff”) and changing involvement rates (by changing the complaint it charges banks to lend wealth overnight) are the main mechanisms we’ve seen the Fed employment successful caller memory.

And, wow, does the Fed person its hands afloat close now.

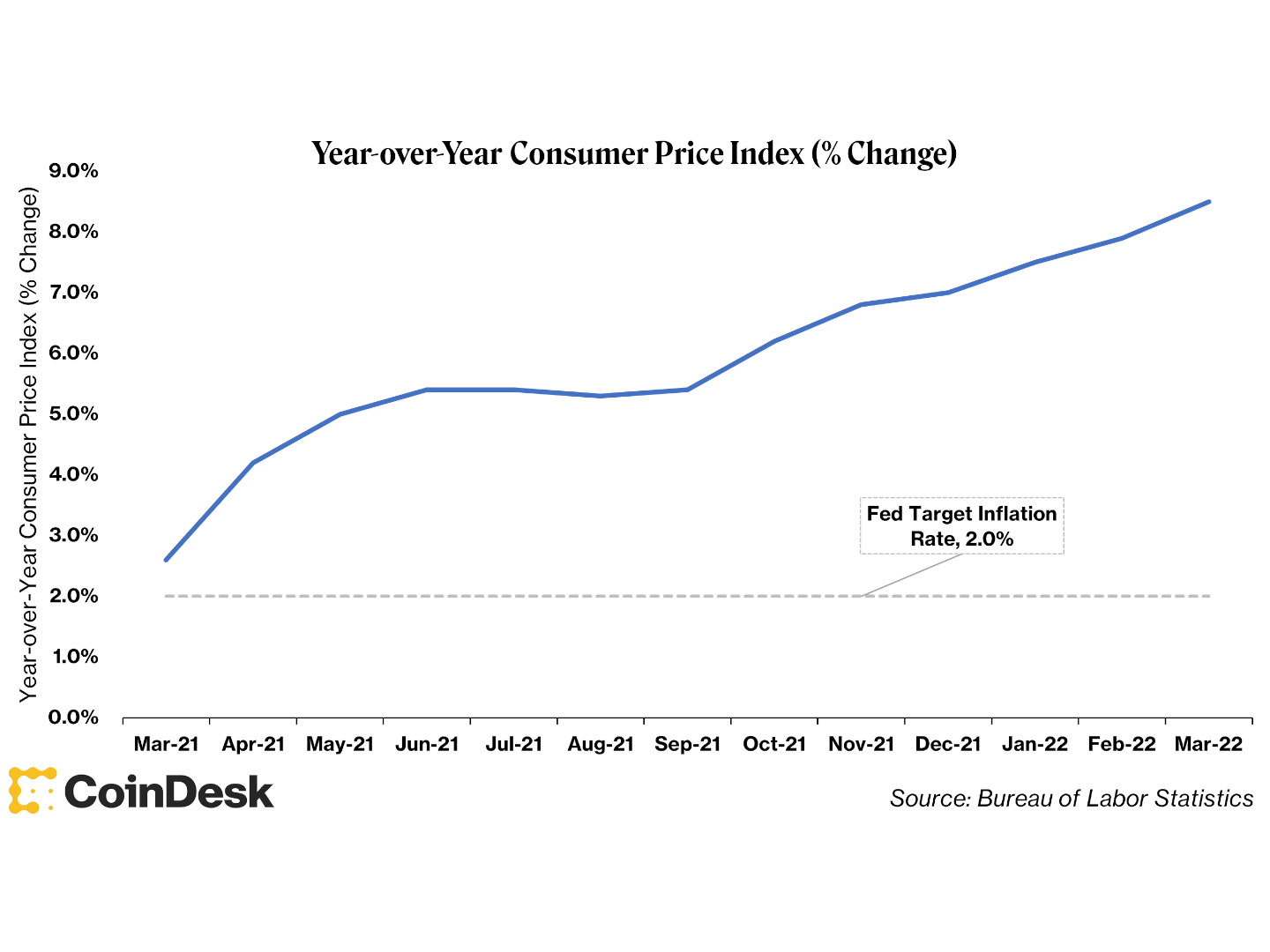

“Stable prices'' is simply a extremity for the Fed, and that has historically meant an arbitrary 2% target for ostentation each year, meaning the Fed wants things to outgo 2% much each year. Well, past week the user terms index, a means to measurement inflation, jumped to a four-decade precocious of 8.5% year-over-year successful March. Basically, past year’s $10 burrito is present $10.85. That is not a bully thing. On apical of that, year-over-year CPI metrics person exceeded 2% each period since March 2021. Inflation is clearly not transitory.

I’m not going to speech astir however unprecedented wealth printing and near-zero involvement rates mightiness person led america here. Instead, I’m going to speech astir what investors are doing to support their portfolios.

In times of precocious ostentation and economical uncertainty, investors spell risk-off, and there’s a “flight to quality.” In practice, erstwhile sentiment flips risk-off, investors merchantability their risky tech stocks and bargain thing similar bonds, oregon if they truly fearfulness inflation, thing dependable similar gold.

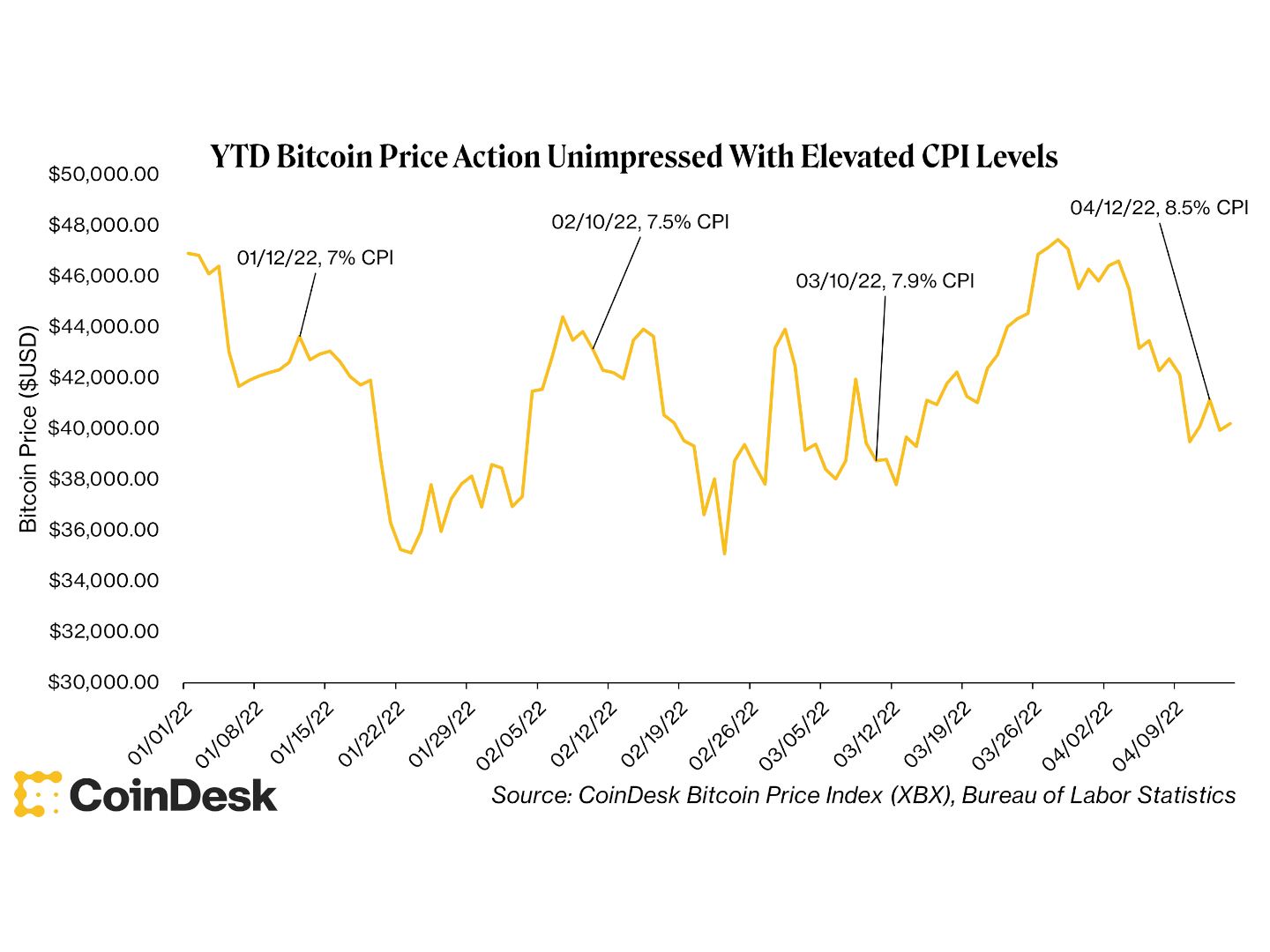

And you cognize what’s amended than gold? Gold 2.0 of course. Bitcoin (or the Reserve Asset 3.0). We person precocious inflation, and truthful everyone piled into bitcoin and its terms changeable up, right? Not quite…

(12-Month Percentage Change, Consumer Price Index / Bureau of Labor Statistics)

What gives? This is dependable money, right? This is simply a store of worth with a known existent proviso and emissions schedule, right? Isn’t bitcoin provably scarce? I thought the emissions docket of bitcoin didn’t alteration arsenic request for the plus increased?

That’s each true: Bitcoin has a known monetary argumentation with a hard headdress and a predetermined minting schedule; anyone with a full node (a basal machine with immoderate software) tin archer you however galore bitcoins are successful circulation and if the terms of bitcoin went to $1 cardinal tomorrow, the coins wouldn’t beryllium mined immoderate faster than they are today.

But there’s 1 happening missing.

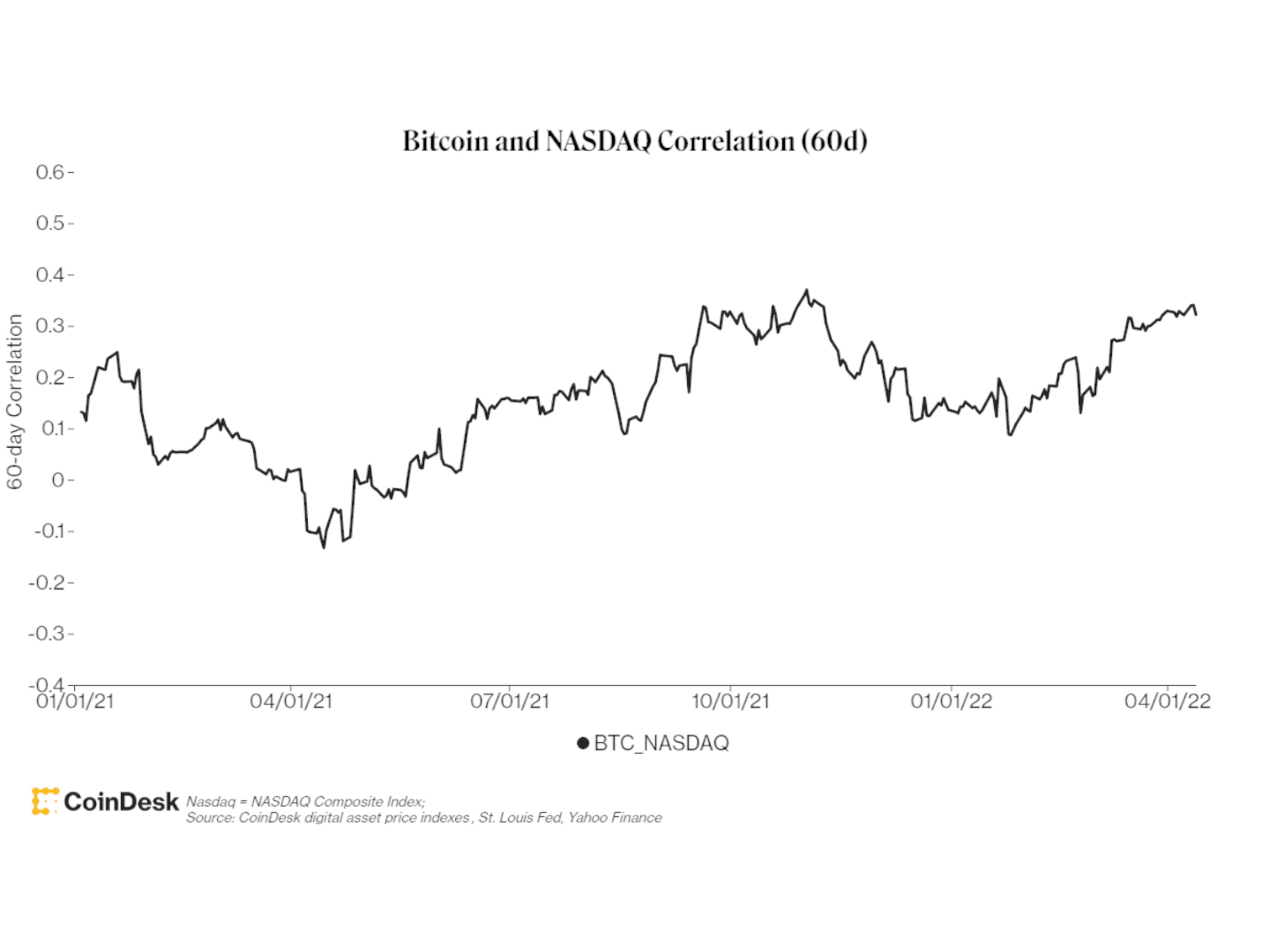

(60-Day Bitcoin correlation to NASDAQ / CoinDesk Research)

(CoinDesk Bitcoin Price Index, Bureau of Labor Statistics)

On a 60-day lookback, bitcoin’s terms has been somewhat correlated (> 0.20 correlation coefficient) with the exertion stocks successful the Nasdaq for astir 50% of trading days successful 2022. I deliberation the crushed for that is rather simple. While bitcoin’s hard wealth properties marque it a risk-off plus for its supporters, investors spot a risk-on plus due to the fact that of its volatility and technology-like asymmetric terms upside. When investors privation to chopped risk, they merchantability stocks alongside bitcoin. So bitcoin isn’t a risk-off oregon risk-on plus yet. Instead, I deliberation it’s amended to telephone it “risk everything.”

As such, it is astir apt much close to notation to bitcoin arsenic an aspirational store of value. Yes, a borderless, permissionless, uncensorable, dependable monetary system-of-value transportation with a predictable monetary argumentation is theoretically a large store of value, but until that communicative penetrates much than 100 cardinal people, the different 7.8 cardinal radical won’t presumption that strategy arsenic a store of value, and that communicative volition prevail. For now.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)