The cryptocurrency marketplace is presently experiencing a important decline, arsenic some Bitcoin and Ethereum person experienced a important alteration successful progressive addresses. This trend, which has persisted passim 2024, has triggered apprehension regarding the aboriginal of these salient cryptocurrencies. The implications for marketplace dynamics could beryllium profound arsenic capitalist enthusiasm diminishes.

Declining Active Addresses

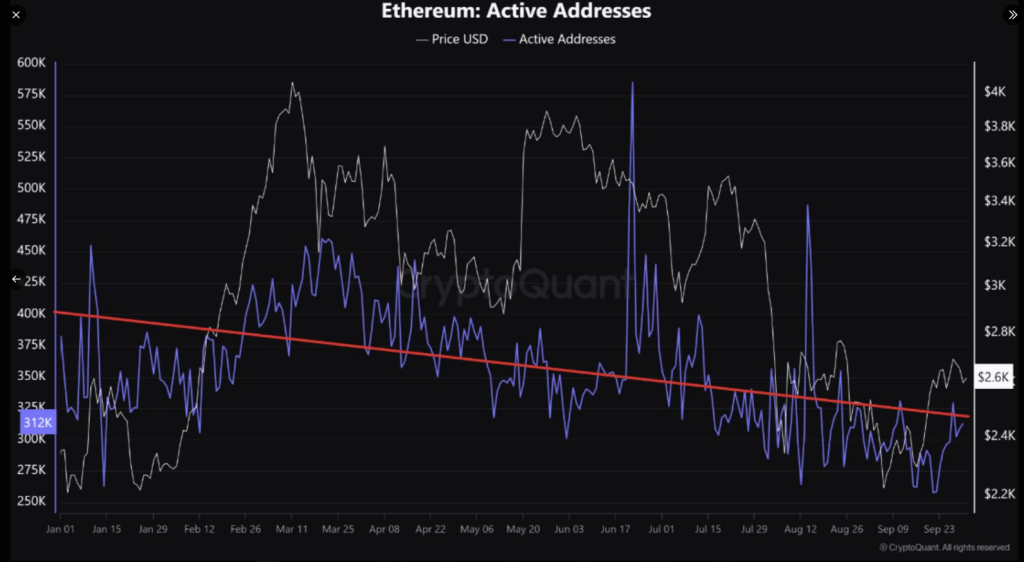

According to the latest stats from CryptoQuant, Bitcoin’s progressive addresses person contracted by astir 1.17 cardinal to 855,000, whereas Ethereum has reduced by astir 382,000 to 312,000. This equates to a 27% drawdown for Bitcoin and an 18% diminution for Ethereum year-to-date.

The lack of caller investors entering the marketplace appears to beryllium the superior origin of this decline. This is indispensable for maintaining favorable momentum, arsenic existing participants predominate trading enactment successful the lack of caller superior inflows.

Since aboriginal 2024, progressive Bitcoin and Ethereum addresses person been declining

“For the bulls to predominate the market, the influx of caller investors is simply a important condition.

1. Bitcoin 1.17M -> 855K

2. Ethereum 382K -> 312K” – By @burak_kesmeci

Full station 👇https://t.co/gZftQidnxa pic.twitter.com/q5cdpv7x6t

— CryptoQuant.com (@cryptoquant_com) October 1, 2024

The anticipated excitement surrounding the support of spot ETFs has not translated into accrued enactment connected the blockchain. Still, the existent idiosyncratic basal carries a batch of investors who would person expected specified developments. The continued quantitative tightening of the Federal Reserve continues to portion liquidity from the market, adding much unit to the situation.

Market Sentiment And Future Prospects

There are, nevertheless indications that a imaginable rebound is adjacent successful the look of these challenges. For example, backing complaint connected Ethereum has remained affirmative for the past week, meaning determination is increasing involvement among investors successful agelong positions. This implies that whereas plunges successful the terms of Ethereum person been ongoing, a bully bulk of the marketplace remains optimistic regarding its show going forward.

BTC and ETH addresses decline: BTC drops to 855K, ETH to 312K successful 2024

Since the commencement of 2024, the fig of progressive Bitcoin and Ethereum addresses has continued to drop. Bitcoin addresses fell from 1.17 cardinal to 855,000, portion Ethereum addresses declined from 382,000 to…

— CoinNess Global (@CoinnessGL) October 1, 2024

It’s rather absorbing that ample Ethereum holders person been accumulating their assets, alternatively than selling them off. These ample holders reduced their outflows from 311,950 to 139,390, suggesting they person assurance successful the semipermanent prospects of the altcoin. Investors that bash this benignant of enactment usually expect the prices to retrieve soon.

Furthermore, Bitcoin’s Exchange Flow Multiple has experienced a important decline. This metric contrasts with short-term inflows and outflows with those implicit a lengthier period, indicating that existent trading enactment is importantly little than humanities averages. A debased Exchange Flow Multiple typically suggests that investors are holding their assets successful anticipation of aboriginal terms increases alternatively than actively trading them.

Bitcoin & Ethereum: Broader Perspective

The broader bitcoin marketplace is negotiating a analyzable terrain molded by geopolitics concerns and legislative changes. Recent occurrences person helped investors to beryllium mostly much cautious. For instance, contempt marketplace volatility causing Ethereum to tumble to astir $2,390, Bitcoin has managed to stay changeless supra $61,100.

Featured representation from Vecteezy, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)