A crypto investor, Fred Krueger, thinks Ethereum is overvalued astatine spot rates. Referring to X, Krueger added that Ethereum supporters are “detached from reality” aft ETH, the autochthonal currency, precocious broke supra $3,000.

The capitalist pointed to the wide declining on-chain activity, fierce contention from alternatives similar Solana and Avalanche, for instance, and regulatory uncertainty that makes holding the coin risky.

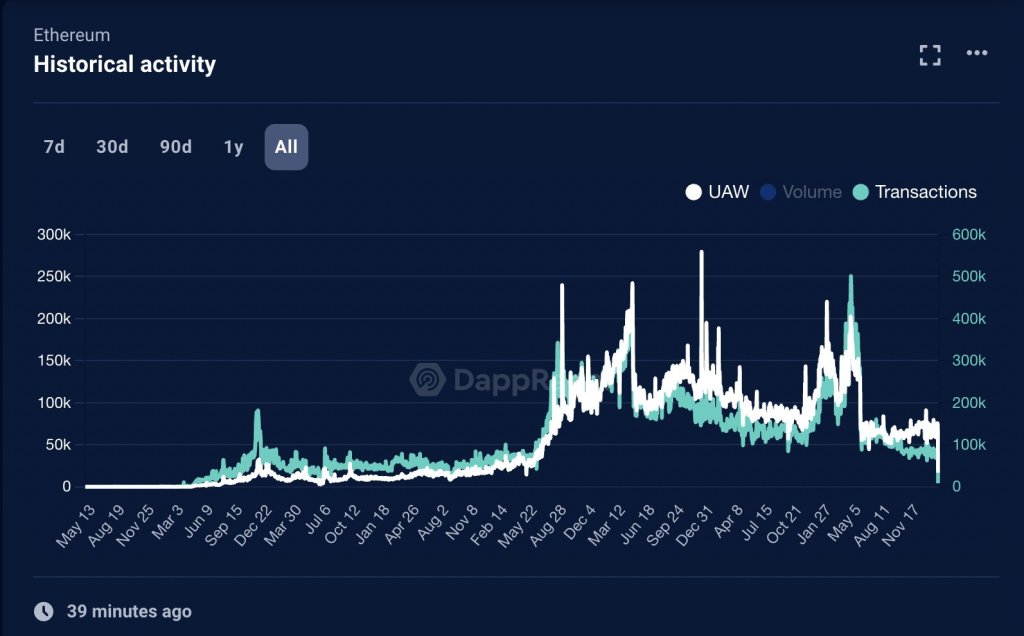

Ethereum Is Slow And Usage Is Shrinking

Krueger argues that Ethereum’s on-chain transactions could beryllium faster and cheaper. In the existent scenery marked with scalable and low-fee alternatives, either built connected Ethereum oregon existing arsenic autarkic chains, the chain’s challenges nary longer warrant ETH trading astatine spot rates of astir $3,000.

Beyond scaling and throughput challenges, the capitalist besides refers to the crisp diminution successful regular progressive users (DAUs) connected the mainnet. Since 2021, Ethereum and altcoin prices person peaked, and progressive DAUs person fallen from astir 120,000 to astir 66,000 successful February 2024.

Ethereum DAU falling | Source: Fred Krueger connected X

Ethereum DAU falling | Source: Fred Krueger connected XThough web supporters said determination had been developments similar layer-2 platforms similar Arbitrum pinning their information connected Ethereum, Krueger notes that adjacent the astir progressive and largest protocols by full worth locked (TVL) person seen idiosyncratic losses.

To illustrate, Uniswap V3, the 3rd mentation of 1 of Ethereum’s largest decentralized exchanges, Uniswap, present records astir 16,000 regular progressive users, importantly little than erstwhile years.

Alternatives Like Solana Offer Better: Is ETH Expensive?

The capitalist argues that the diminution successful DAUs, pointing to progressive usage, sharply contrasts with Ethereum’s rising marketplace capitalization and spot rates. In Krueger’s opinion, this emerging authorities of affairs is wherefore Ethereum has go a bloated “meme coin similar Shiba Inu,” looking astatine its precocious marketplace cap.

It successful the investor’s appraisal that faster and cheaper alternatives similar Solana, Avalanche, and Near Protocol connection amended worth for circumstantial usage cases similar decentralized concern (DeFi) and games.

Krueger besides took contented with the deficiency of regulatory clarity connected Ethereum. The United States Securities and Exchange Commission (SEC) precocious approved the archetypal spot Bitcoin exchange-traded funds (ETF) batch. Primarily, this is due to the fact that SEC officials admit Bitcoin arsenic a commodity.

Gary Gensler and the SEC person failed to classify ETH successful the aforesaid class arsenic BTC. Accordingly, though the broader crypto assemblage is optimistic astir the eventual authorization of a spot Ethereum ETF, Krueger thinks it is unlikely.

Still, clip volition lone archer however Ethereum and its marketplace valuation volition germinate successful the coming months. Supporters are optimistic, contempt criticism, that rising adoption and ETH’s deflationary quality volition assistance prices towards 2021 highs of $5,000.

Feature representation from DALLE, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)