While Ethereum hasn’t been rather accordant with its bullish trajectory successful the past weeks, its circulating proviso has done the opposite. According to data from Ultrasoundmoney, ETH’s circulating proviso has skyrocketed to implicit 120.72 cardinal ETH arsenic of today.

Although this summation successful proviso is not straightforwardly negative for ETH, it inactive marks a notable displacement successful the network’s dynamics, fuelled mostly by adopting Ethereum’s proof-of-stake (PoS) model.

Supply Increase, How And Why?

The surge successful Ethereum’s full proviso to 120.72 cardinal ETH, arsenic shown successful the information from Ultrasound.money, reflects the network’s expanding enactment implicit the past month.

In this play alone, Ethereum saw the issuance of 77,102 ETH, portion 19,402 ETH were removed from circulation done a burning mechanics introduced successful the network’s caller London Hard Fork.

The nett summation of astir 57,653 ETH highlights a gentle uptick successful the yearly proviso maturation complaint from 0.58% to 0.69% implicit the past 7 days.

Ethereum proviso alteration successful the past 7 days. | Source: Ultrasoundmoney

Ethereum proviso alteration successful the past 7 days. | Source: UltrasoundmoneyNotably, with Ethereum’s modulation from the proof-of-work (PoW) to PoS model, the web has not lone achieved a large displacement successful information but has besides accrued the rewards for participation.

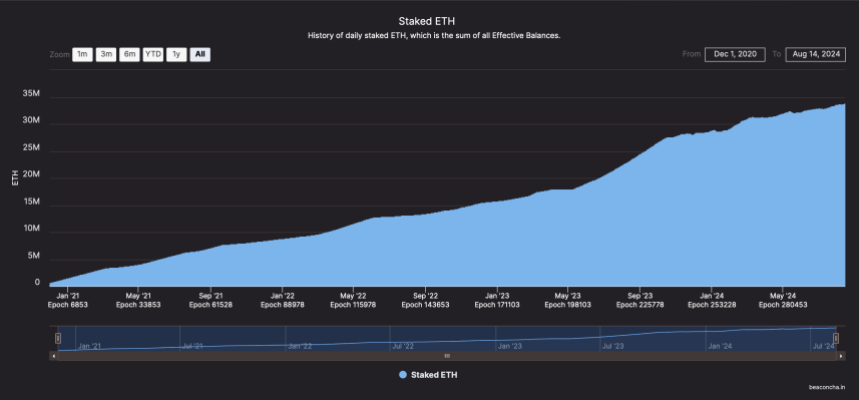

Concerning the apt reasons down the summation successful supply, astir 33.9 cardinal ETH are presently staked successful the network, generating substantial rewards successful recently issued ETH.

Total ETH staked. | Source: Beaconcha.in

Total ETH staked. | Source: Beaconcha.inThis large-scale staking appears to beryllium contributing importantly to the summation successful Ethereum’s full supply. Additionally, the staking process has been further amplified by the inclination of restaking, wherever participants reinvest their staking rewards into the network.

This restaking rhythm creates a compounding effect connected the issuance of caller ETH, boosting the proviso adjacent arsenic the web moves to a “seemingly” inflationary trajectory aft the archetypal deflationary expectations acceptable by the ETH pain mechanism.

Ethereum Market Performance

So far, Ethereum appears to beryllium seeing a gradual price increase, from $2,500 past Thursday to presently trading astatine $2,652 astatine the clip of writing, marking a 9.3% summation successful the past 7 days.

This surge successful worth coincides with ETH’s market headdress valuation, which saw a spike of astir $20 cardinal implicit the aforesaid period. Despite this rise, ETH’s regular trading measurement has seen the opposite.

Particularly, implicit the past week, this metric has plunged from implicit $21 cardinal to presently sitting astatine $12.8 billion. Regardless of this, galore analysts successful the crypto abstraction stay bullish connected Ethereum.

Earlier today, a renowned expert known arsenic the titan of crypto connected X has acceptable a $3,000 people for ETH. According to the analyst, ETH looks acceptable for a large rally arsenic a “CME futures GAP” towards the upside remains unfilled.

#Altcoins #Ethereum $3,000 Target 🎯#ETH looks poised for a move, with a CME futures GAP supra inactive waiting to get filled. pic.twitter.com/6lC2d6lgQ6

— Titan of Crypto (@Washigorira) August 15, 2024

Featured representation created with DALL-E, Chart from TradingView

1 year ago

1 year ago

English (US)

English (US)