Seven days aft the caller Bitcoin ETFs launched, I analyzed however they could enactment unit connected Bitcoin’s proviso dynamics successful an nonfiction called “If BlackRock continues 6k BTC regular buys, we get a proviso crunch wrong 18 months; here’s why.’ On the time of publication, Jan. 18, Bitcoin closed astatine $41,248 aft falling from a precocious of $49,000 connected Jan. 11. Since then, the flagship integer plus has soared 37% to interruption $57,000.

While Bitcoin had fallen consistently aft the ETF launched, CryptoSlate noted the persistent BTC inflows, which, astatine the time, averaged astir 6,266 BTC per time for BlackRock alone. The investigation identified that were specified inflows continue, the liquid proviso of Bitcoin could beryllium absorbed this year, with the speech balances oregon precise liquid supplies targetable by mid-2025.

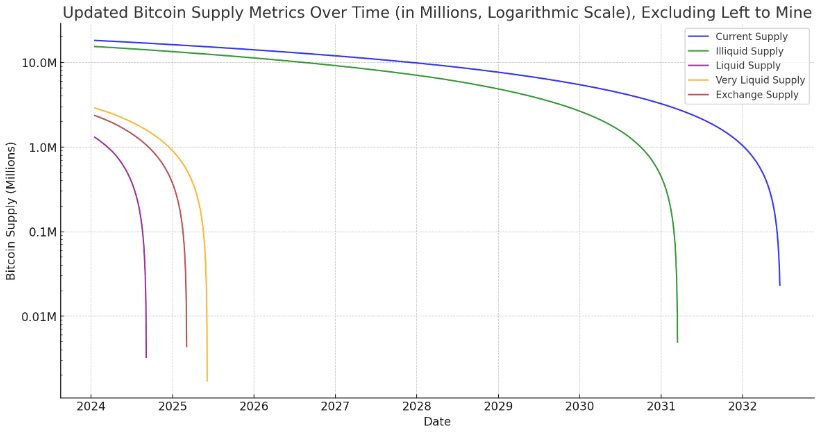

Hypothetical Bitcoin proviso absorbed by BlackRock

Hypothetical Bitcoin proviso absorbed by BlackRockAs noted astatine the time, the investigation was purely hypothetical and did not see the outflows from Grayscale GBTC. Additionally, it lone looked astatine BlackRock, the largest fund’s inflows, to simplify the information astatine that point. The workout aimed to stress the potential for a proviso squeeze and the deficiency of liquid Bitcoin to facilitate persistent ETF unit connected the supply. On Jan. 18, BlackRock had 25,067 BTC nether management, valued astatine $1 billion.

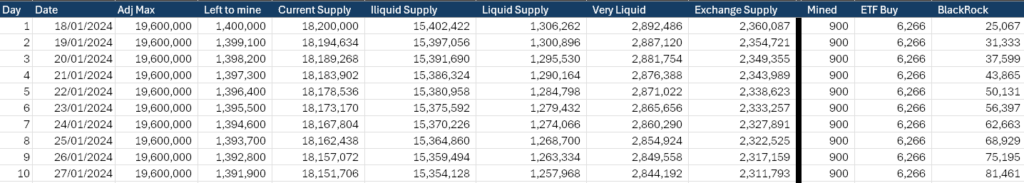

BlackRock Bitcoin inflow rate

BlackRock Bitcoin inflow rateInterestingly, portion the inflows into BlackRock did not support the 6,266 BTC regular mean pressure, inflows into the Newborn Nine person surpassed this level. BlackRock presently has 130,231 BTC nether management, whereas the money would person 275,707 BTC if it continued astatine 6,266 BTC daily. However, connected Jan. 18, 6,266 BTC was valued astatine $258 million, which would present correspond an inflow of $357 million, fixed the melodramatic terms surge.

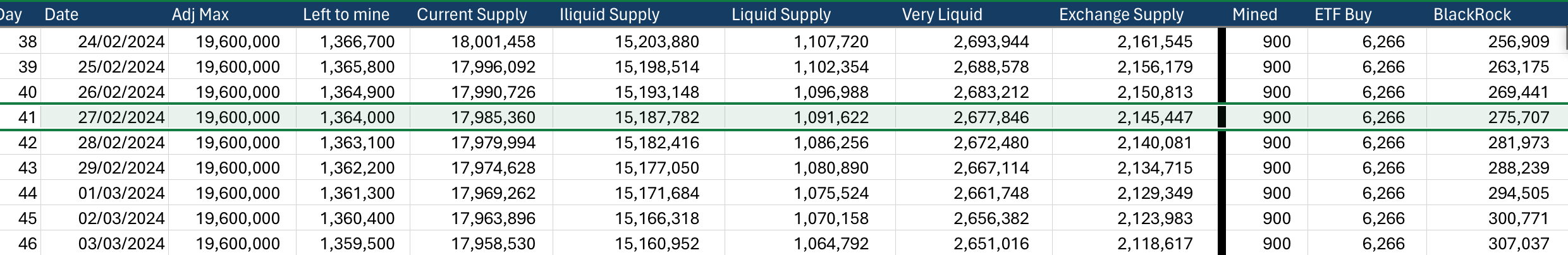

Bitcoin ETF projections astatine 6k per day

Bitcoin ETF projections astatine 6k per dayIt’s important to retrieve that the spot Bitcoin ETFs are purchased with dollars and denominated successful dollars successful a brokerage account. Thus, portion inflows into the ETF person been accordant successful dollar terms, they person been reduced successful presumption of Bitcoin purchases.

Across the Newborn Nine, 303,002 BTC is present held nether absorption per K33 Research. Looking astatine the CryptoSlate array utilized for the Jan. 18 article, this aligns with inflows projected for BlackRock by March 2, 2024.

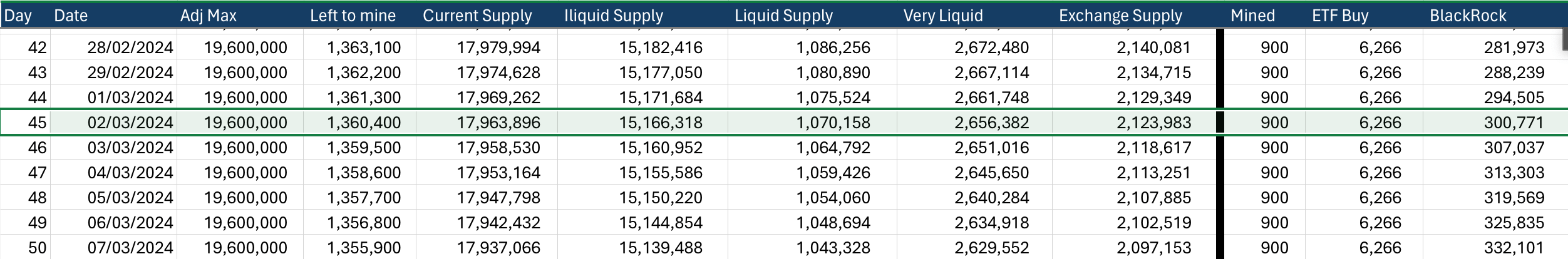

300k BTC BlackRock ETF inflow projections

300k BTC BlackRock ETF inflow projectionsUsing this data, should the Newborn Nine proceed to absorb Grayscale’s declining outflows and acquisition further Bitcoin from the broader marketplace astatine this pace, 1 cardinal BTC could beryllium nether absorption by June. Further, this complaint would swallow the BTC equivalent of the full existent liquid proviso of Bitcoin (roughly 1.3 cardinal BTC) by September.

On Feb. 8, I discussed the imaginable for the ‘Mother of each Supply Squeezes‘ for Bitcoin, which is akin to the GameStop saga but adjacent much effective. The terms has surged 29% since that nonfiction went unrecorded successful conscionable 19 days, an mean of 0.65% per day. Bitcoin ETFs person continued to buy, and Grayscale’s outflows are slowing.

The requirements for a proviso compression look to beryllium present; the lone question I spot is, astatine what level does the request go affected by the price? Do Bitcoin ETF purchasers proceed to bargain if Bitcoin is astatine $100,000? Well, astatine that price, BlackRock’s IBIT would beryllium astir $60 per share. That doesn’t dependable rather arsenic costly to new investors now, does it?

The station Is this the Bitcoin proviso compression playing retired arsenic predicted? appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)