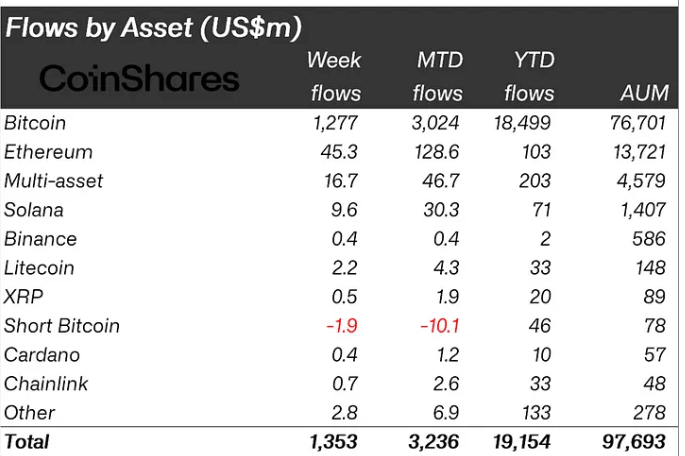

Crypto concern products saw their 3rd consecutive week of inflows past week, reaching $1.35 billion. This has pushed the full inflows for July to surpass $3 billion, according to CoinShares’ latest play report.

Notably, ETP trading volumes besides roseate importantly past week, expanding by 45% week-on-week to $12.9 billion. However, this important measurement lone accounts for 22% of the wide crypto marketplace volume.

Positive sentiments

Bitcoin-related products led the inflows, contributing 95% of the full with $1.27 billion. The flows were dominated by BlackRock’s IBIT and Fidelity’s FBTC, whose BTC ETFs saw astir $1 cardinal successful inflows past week.

Conversely, short-bitcoin ETPs saw outflows of $1.9 million, bringing full outflows since March to $44 million, representing 56% of assets nether absorption (AuM).

James Butterfill, caput of probe astatine CoinShares, explained that this inclination indicates the enduring affirmative capitalist sentiment since Bitcoin completed its halving lawsuit successful April.

Crypto Asset Inflows (Source: CoinShares)

Crypto Asset Inflows (Source: CoinShares)Ethereum-related products besides saw affirmative movement, with $45 cardinal successful inflows past week. This brought its year-to-date (YTD) inflows to $103 million, overtaking Solana.

The emergence successful Ethereum inflows is linked to the anticipated motorboat of its spot exchange-traded funds (ETFs). Last week, the Chicago Board Options Exchange (Cboe) announced that 5 products—21Shares’ CETH, Fidelity’s FETH, Franklin Templeton’s EZET, Invesco’s QETH, and VanEck’s ETHV—will commencement trading connected July 23, pending regulatory approval.

Solana saw $9.6 cardinal successful inflows past week but lags down Ethereum with $71 cardinal YTD. Litecoin was the lone different altcoin with implicit $1 cardinal successful inflows, signaling $2.2 cardinal past week. Chainlink, Cardano, and Binance collectively saw $1.5 cardinal successful inflows.

Butterfill added that blockchain equities faced outflows of $8.5 cardinal past week contempt astir ETFs outperforming satellite equity indices.

Regionally, the US and Switzerland had important inflows of $1.3 cardinal and $66 million, respectively. In contrast, Brazil and Hong Kong experienced insignificant outflows of $5.2 cardinal and $1.9 million, respectively.

The station July crypto inflows surpass $3 cardinal milestone, driven by Bitcoin ETF demand appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)