Behind the scenes of astir large blockchains, shadowy super-coders and the bots they physique are utilizing the transparency of blockchains and the transaction interest marketplace to their advantage. By watching a database of each pending and unconfirmed transactions called the mempool, the bots are capable to wage higher transaction fees to gaffe successful their ain transaction successful an bid that is profitable, often astatine the disbursal of decentralized concern (DeFi) users.

This nonfiction primitively appeared successful Valid Points, CoinDesk’s play newsletter breaking down Ethereum 2.0 and its sweeping interaction connected crypto markets. Subscribe to Valid Points here.

According to the Ethereum Foundation, Maximal Extractable Value (MEV) is the catch-all operation for “the maximum worth that tin beryllium extracted from artifact accumulation successful excess of the modular artifact reward and state fees by including, excluding and changing the bid of transactions successful a block.” More specifically, arbitrage, liquidations, frontrunning and sandwich attacks are each forms of MEV successful its existent state.

MEV is not inherently atrocious and exists successful immoderate transaction interest market-driven concatenation with unfastened entree to the mempool. Decentralized exchanges and lending protocols adjacent trust connected MEV to arbitrage pools and liquidate undercollateralized loans successful a competitory and businesslike manner. The quality to bid transactions wrong a artifact besides casts a acheronian unreality implicit MEV due to the fact that searchers are capable to beforehand tally bargain orders conscionable to simultaneously merchantability connected the trader aft the bid goes through. Searchers whitethorn gain an other percent connected the transaction, but it is wholly astatine the disbursal of the trader who overpaid for the plus they received.

Concentrated liquidity and MEV

Flashbots, a improvement enactment focused connected mitigating the antagonistic externalities of MEV, co-hosted a Twitter Spaces with the Uniswap squad successful precocious January to speech astir “Just-In-Time” (JIT) Liquidity Provision, an progressively fashionable MEV strategy. Just arsenic it sounds, MEV “searchers” scour the mempool for ample pending speech swaps and supply liquidity to the associated excavation earlier the swap is confirmed. This allows the searcher to summation a ample chopped of the trading fees lone to subsequently propulsion that liquidity retired successful the aforesaid block.

This MEV maneuver has proven much profitable connected concentrated liquidity decentralized exchanges similar Uniswap v3. Version 3 allows liquidity providers to proviso superior wrong definite terms ranges, theoretically improving trading extent astir existent prices and expanding fees for progressive liquidity providers. MEV searchers deploy their LP wrong a choky terms scope of the trade, taking up a important magnitude of the trading fees and making the transaction worthwhile.

The strategy employs a non-atomic attack to MEV wherever searchers are exposed to delta risk, the accidental that an plus drops successful price. Therefore, the searcher indispensable person immoderate short-term outlook connected the marketplace due to the fact that their portfolio was rebalanced from the trade, and aboriginal terms volatility could rapidly instrumentality distant the profits made via trading fees.

Potential benefits and drawbacks of progressively blase MEV

The Uniswap squad foresaw the imaginable of JIT liquidity connected v3, but wanted to spot however the strategy affected traders and liquidity providers successful actuality. Should the maneuver travel to beryllium a nett antagonistic for the protocol’s users, Uniswap considered implementing superior punishments for liquidity providers that deposited and withdrew liquidity successful the aforesaid block. However, JIT liquidity has been mostly affirmative for traders who person seen accrued liquidity successful their trading range, minimizing slippage.

The merchandise pb astatine Flashbots, Robert Miller, posted an insightful thread connected JIT liquidity and an on-chain notation example. Miller highlighted the benefits JIT liquidity brings to traders and however it differs from sandwich attacks, adjacent portion it employs a akin strategy. Furthermore, LPs person been capable to stay profitable adjacent contempt JIT liquidity. Because the MEV searcher cannot utilize this strategy successful a azygous atomic transaction, it is not risk-free and whitethorn not acceptable the bots hazard profile.

A ample interest is that MEV volition proceed to payment the fewer astatine the disbursal of mundane DeFi users. Passive liquidity proviso volition proceed to go much hard if JIT liquidity strategies beryllium profitable, and trading connected DEXs volition beryllium little desirable if users are being frontrun and sandwich-attacked. We tally into immoderate of the aforesaid problems arsenic we spot successful accepted finance, with order travel selling and high-frequency trading.

However, astatine some the protocol and exertion level MEV tin and is being mitigated. Flashbots has brought the misunderstood assemblage to airy and is gathering products to combat the drawbacks felt by mundane users. For example, an off-chain marketplace wherever searchers tin vie for transaction bid ensures that on-chain state wars go little likely. Over the adjacent respective months we whitethorn get a clearer representation of who is affected by MEV and however users tin support themselves.

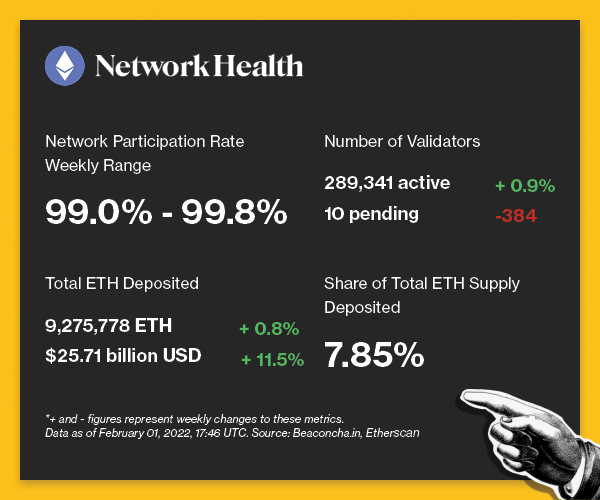

The pursuing is an overview of web enactment connected the Ethereum 2.0 Beacon Chain implicit the past week. For much accusation astir the metrics featured successful this section, cheque retired our 101 explainer connected Eth 2.0 metrics.

(Beaconcha.in, Etherscan)

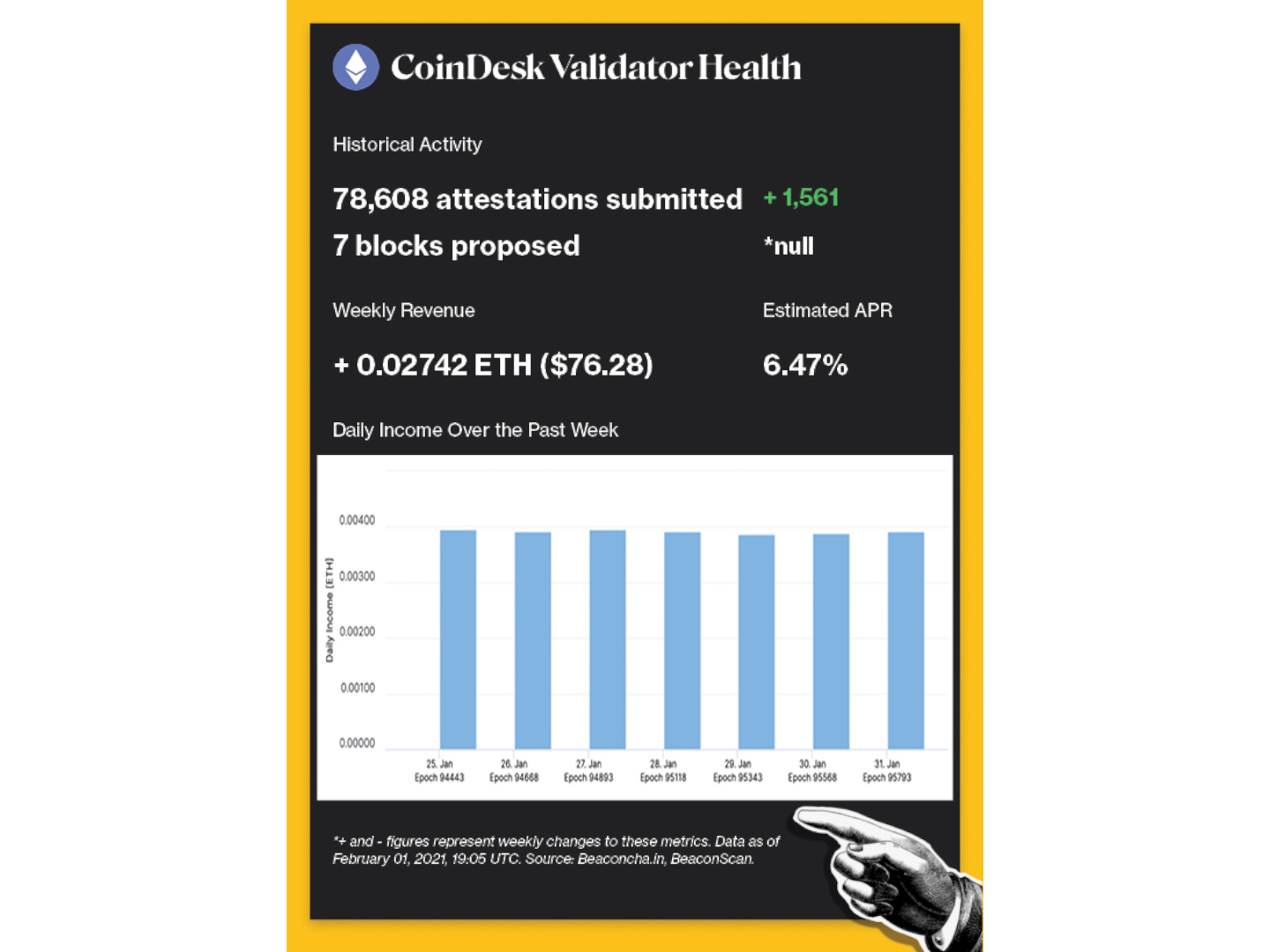

(Beaconcha.in, BeaconScan)

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking task volition beryllium donated to a foundation of the company’s choosing erstwhile transfers are enabled connected the network.

A Coinbase technologist has assured users the speech is moving connected a solution for staking work lawsuit concentration. BACKGROUND: The speech astir lawsuit diverseness continues to vigor up arsenic Prysm-style validators instrumentality an progressively ample chopped of artifact production. Community members look to clasp staking providers similar Coinbase and Kraken accountable for the wellness of the network. Large exchanges are successful power of astir 30% of validators and person heavy leaned connected the usage of Prysm, adding unnecessary hazard to the network.

The Ethereum Foundation released a breakdown of validator organisation thresholds successful airy of lawsuit diverseness issues. BACKGROUND: Ethereum’s multi-client quality allows the web and validators to support themselves against bundle failures. Ideally, nary lawsuit would beryllium tally connected implicit 33.3% of the network’s validators, assuring that a bug wrong immoderate of the respective clients could not disrupt finality. However, if a lawsuit makes up implicit 66.6% of the web similar Prsym, it has the imaginable to finalize bugs and origin avoidable concatenation splits down the road, financially punishing anyone utilizing the bulk client.

OpenSea ended January with implicit $4.9 cardinal successful NFT trading volume connected Ethereum for the month. BACKGROUND: Non-fungible token trading came backmost with a vengeance successful January, with OpenSea measurement 44% higher than the erstwhile most-active month. While we are lone 1 period into the caller year, OpenSea is connected gait to bring successful astir $1.5 cardinal successful gross during 2022. The fig is adjacent much awesome erstwhile accounting for the $900 cardinal successful measurement done connected precocious launched platform, Looksrare.

Blockscan introduced off-chain wallet-to-wallet communication connected Etherscan. BACKGROUND: Communication betwixt wallets has been precise hard and has required on-chain transactions successful the past. Blockscan allows wallet users to stay anonymous but besides to scope retired and respond to different wallets wrong the Etherscan website.

https://explore.flashbots.net/

Valid Points incorporates accusation and information astir CoinDesk’s ain Eth 2.0 validator successful play analysis. All profits made from this staking task volition beryllium donated to a foundation of our choosing erstwhile transfers are enabled connected the network. For a afloat overview of the project, cheque retired our announcement post.

You tin verify the enactment of the CoinDesk Eth 2.0 validator successful existent clip done our nationalist validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Shows, amusement newsletter promo.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)