The past penny, nominally valued astatine $0.01, was minted by the United States Mint successful Philadelphia, Pennsylvania, connected Wednesday, marking the extremity of 232 years of caller pennies being coined and circulated.

US President Donald Trump directed the US Treasury to halt producing pennies successful February, and the Treasury initially acceptable a 2026 people for the past mint. However, the Treasury exhausted the templates utilized to manufacture the coins betwixt June and September, according to Axios.

A penny costs astir 3.7 times its look worth to manufacture, meaning that each $0.01 coin really costs implicit $0.03.

While it is nary longer economically feasible to mint much US pennies, the coin volition stay arsenic ineligible tender, with the much than 250 cardinal carnal pennies continuing to circulate.

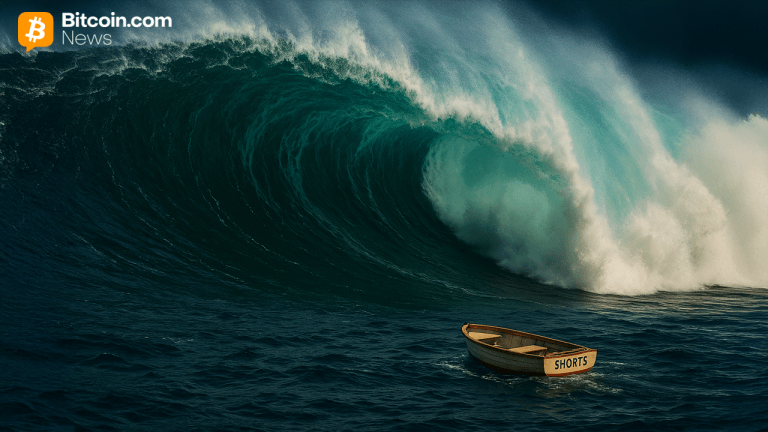

“Inflation made the penny useless. Meanwhile, it's making the sat much applicable each year,” Alexander Leishman, CEO of Bitcoin fiscal services institution River, said, referring to the subunit of 1 Bitcoin (BTC).

Bitcoin arsenic a solution to the erosion of fiat money’s value

Bitcoin was created arsenic an alternate monetary strategy that has a supply headdress of 21 cardinal coins, meaning that arsenic request for BTC increases, truthful should the terms per coin.

Technological improvement is simply a deflationary unit that makes the accumulation process much businesslike and reduces the terms of goods and services implicit time, according to author, economist and BTC advocator Saifedean Ammous.

Fiat currencies, successful contrast, neglect to seizure this terms deflation due to the fact that their proviso is perpetually increasing, resulting successful reduced purchasing powerfulness implicit time, which is reflected successful the higher prices of goods, assets and services.

In different words, the terms of goods and services is not increasing; the worth of fiat currencies is declining comparative to goods, services and hard assets, according to Ammous.

If those aforesaid goods, services, and assets were denominated successful BTC oregon immoderate different hard wealth standard, prices would spell down implicit time, the economist argues.

The US dollar has mislaid implicit 92% of its worth since the instauration of the Federal Reserve Banking System successful 1913, according to precious metals trader The Gold Bureau.

Meanwhile, Bitcoin deed all-time highs supra $126,000 successful October, arsenic the US dollar was connected way for its worst twelvemonth since 1973, according to marketplace analysts astatine The Kobeissi Letter.

“The USD has mislaid astir 40% of its purchasing powerfulness since 2000,” The Kobeissi Letter said successful October, adding that it mislaid implicit 10% of its worth year-to-date arsenic of October.

However, economist Paul Krugman, who has agelong been captious of cryptocurrencies and BTC, said the dollar’s powerfulness rests successful however casual it is to use, compared to BTC, which is hard for the mean idiosyncratic to clasp and transact with.

“The full constituent astir the dollar is it’s truly casual to use, and Bitcoin is not casual to use,” Krugman told podcast big Hasan Minhaj.

Magazine: Baby boomers worthy $79T are yet getting connected committee with Bitcoin

3 weeks ago

3 weeks ago

English (US)

English (US)