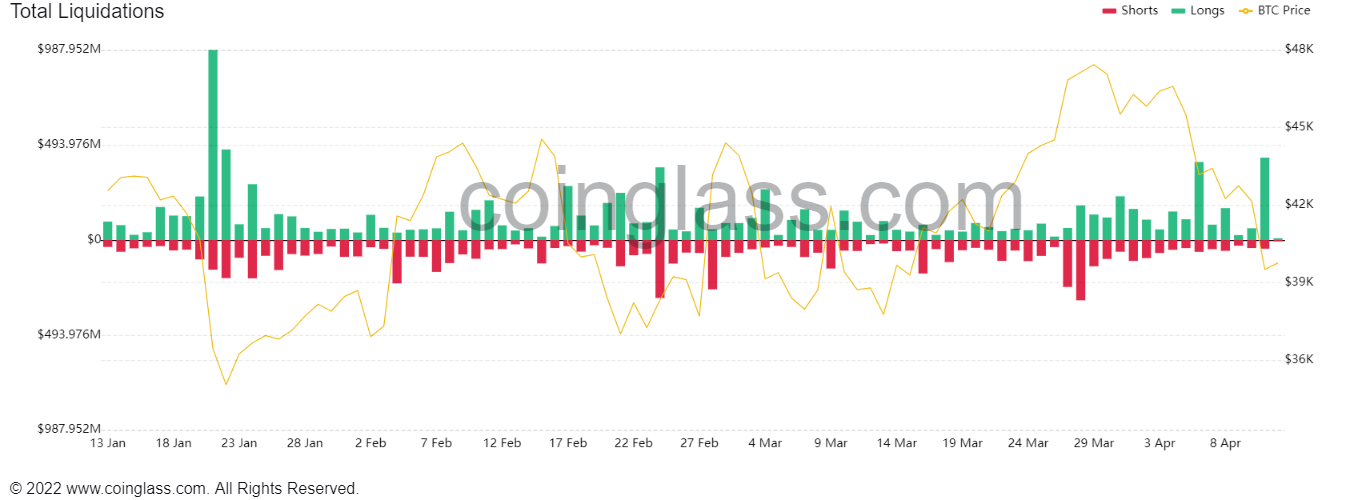

Futures traders betting connected the continued betterment of crypto prices were caught successful the crosshairs aft bitcoin (BTC) dropped to nether $40,000 successful the past 24 hours. Traders racked up implicit $430 cardinal successful losses to liquidations, according to information from Coinglass.

Liquidations hap erstwhile an speech closes a trader’s leveraged presumption arsenic a information mechanics owed to a partial oregon full nonaccomplishment of the trader’s archetypal margin. This happens chiefly successful futures trading, which lone tracks plus prices arsenic opposed to spot trading, wherever traders ain the existent assets.

Longs, oregon positions of traders betting connected upward prices, took the biggest deed and accounted for astir 90%, oregon $386 million, of each losses successful the past 24 hours. Shorts saw a comparatively little $44 cardinal successful losses.

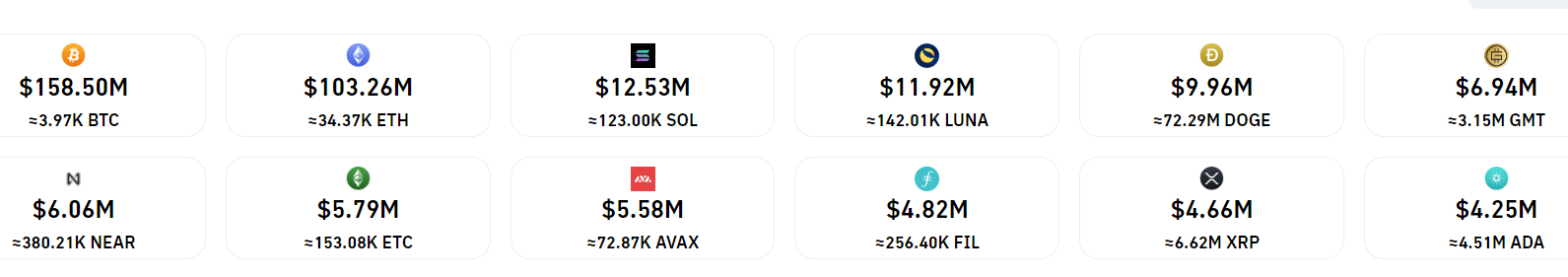

Bitcoin, ether futures saw the astir losses. (TradingView)

Traders of bitcoin futures mislaid $156 cardinal alone, followed by ether (ETH) futures astatine $102.85 million, and SOL futures, which way Solana’s autochthonal tokens, astatine $12.41 million. Futures Dogecoin’s DOGE and Stepn’s GMT notched up a combined $16 cardinal successful losses aft a tally past week.

Crypto speech OKX notched up $149 cardinal successful liquidations, the largest among each crypto exchanges. Nearly 96%, oregon $143 million, were those stemming from agelong positions. Bitmex saw the highest liquidated value, however, with a azygous $10 cardinal bitcoin presumption getting closed connected the exchange.

The losses came arsenic bitcoin mislaid 5.2% successful the past 24 hours, information from CoinGecko shows. Ether declined by a akin percentage, portion Solana’s SOL and Polkadot’s DOL tokens slid immoderate 8%.

Monday's losses were among the highest this year. (TradingView)

The driblet successful crypto markets came arsenic recession fears mounted successful the U.S. connected Monday pursuing hawkish comments by the U.S. Federal Reserve (Fed) comments past week, which has since contributed to a descent successful planetary markets.

Stocks and lipid besides slid connected Monday. The Dow closed astatine 1.19% lower, the S&P 500 dropped 1.69%, portion technology-heavy Nasdaq slid adjacent further astatine 2.18%. Asian markets inched little connected Tuesday, with Japan’s Nikkei 225 falling 1.89% and declines of 0.80% successful Singapore and India’s Sensex, respectively.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)