Acknowledgment: Derek Pennings came up with “The Entry Indicator.” I helped him with putting the thought process successful writing. You tin find him connected Twitter @PenningsDerek.

Not Again

It happened. Again. Price dropped much than 50% from its all-time high. During times similar these, radical wonderment whether the bottommost is successful oregon not. Nobody wants to merchantability the bottom. And cipher likes to bargain a dip that keeps connected dipping either.

There are a batch of indicators. Some of which we telephone “on-chain” indicators and immoderate are method terms indicators. For example, the comparative spot scale (RSI) connected the regular clip frame. When it hits 20 oregon lower, past it’s truly something. Or what astir Fibonacci levels? All large indicators to get immoderate consciousness of terms action. But does it marque it a large introduction indicator? It whitethorn beryllium useful, but it’s ever comparative to the erstwhile terms action, which isn’t a cardinal threshold. It’s technical.

Realized Price

So, which indicator has a cardinal threshold? We similar to ticker the realized terms closely. In an earlier written article, we explicate however we look astatine the bitcoin (market) terms with the realized terms arsenic an anchor. When the terms of bitcoin goes beneath the realized price, it means that, connected average, bitcoin HODLers are astatine a loss. Early investors whitethorn inactive beryllium successful profit, but astir investors are astatine a loss.

On January 31, 2022, the realized terms was astir $23,900. In the past of bitcoin, it seldom happens that the marketplace terms reaches this level oregon adjacent goes beneath it. But adjacent erstwhile it happens, it doesn’t precisely people the bottom. Yes, it’s a darn bully spot to stack immoderate other sats, but volition the terms halt from dropping astatine this level? On January 14, 2015, it astir surely did not. With a realized terms of $310.91 and a marketplace terms of $172.21, it went a batch lower. Maybe this was due to the fact that the 2nd highest of the 2013 bull marketplace was an outlier, and the realized terms was beforehand moving the “normal tech adoption curve.” We mightiness elaborate connected that proposal successful a antithetic article, but for now, let’s absorption connected an introduction spot.

Adjusted Realized Price

There were times that the bitcoin terms went done a ample correction and the terms recovered again earlier touching oregon getting adjacent the realized price. Since 2020, ample investors are stepping successful and are changing the rules of the game. Michael Saylor likes to adhd bitcoin to his equilibrium expanse erstwhile the terms drops and President Bukele is besides smashing the bargain fastener connected his telephone erstwhile terms dips. So, it mightiness instrumentality years for the bitcoin terms to scope the realized terms again. It whitethorn ne'er hap again, ever. Are you consenting to hold for that?

So, what if we set the realized terms for mislaid coins. Coins that haven’t been moved for implicit 7 years, whitethorn ne'er determination again. The adjusted realized terms is astir $30,649 (depends connected however you cipher it). This mightiness dependable much realistic. We already saw a wick to $33,000. But adjacent this adjusted realized terms isn’t ever a cleanable introduction indicator.

Framework For An Entry Indicator

But what makes an introduction indicator a bully introduction indicator? Let’s deliberation astir it. There are a mates of factors that you privation to relationship for. The first is the infinitesimal successful time. Because the complaint of bitcoin that inflates the full circulating proviso halves each 4 years, you mightiness see buying if a halving is adjacent oregon you mightiness hold longer if a halving conscionable happened 18 months agone and the adjacent 1 is inactive 30 months away.

The second is the quality betwixt the expected valuation of bitcoin during that definite halving play and the existent marketplace price. If the existent terms is mode little than the expected price, you mightiness see buying, and if the terms is astatine par oregon higher, you mightiness privation to hold for a little price.

The third is the existent authorities of the market. Are short-term holders freaking retired again and panic selling? Are semipermanent holders keeping their religion oregon are diamond hands adjacent turning into insubstantial hands?

Stock-To-Flow Deflection

Almost everyone successful the Bitcoin abstraction heard astir the stock-to-flow (S2F) model. It values bitcoin by its scarcity. The deflection is the existent terms divided by the valuation of the stock-to-flow model. Stock-to-flow became a precise arguable model. It astir apt is (way) excessively bullish successful the agelong run, due to the fact that it doesn’t person diminishing returns built in, yet determination is empirical grounds that determination are diminishing returns successful bitcoin.

But the exemplary could inactive beryllium precise useful. What it does is worth the terms of bitcoin during a circumstantial halving (expectation). And it is utile to separate which play you find yourself successful betwixt halvings (time). Even if the expected worth of S2F volition beryllium proven to beryllium excessively high, it inactive tin beryllium utilized successful an introduction indicator. Why? Because we are creating a ratio and if the S2F terms is excessively high, the “green zone” of the ratio volition beryllium little than if S2F was (entirely) correct.

Percent Of Supply In Profit

With the S2F deflection having some the expected valuation and clip covered, we inactive person to woody with behaviour and sentiment to find a large introduction point. To get a feeling astir what the sentiment is during a correction, it’s utile to ticker however galore radical are nether h2o with their bitcoin purchase. This is imaginable with the metric of percent of proviso successful profit, due to the fact that if 70% of the proviso is successful profit, 30% isn’t.

Since the bitcoin terms has lone gone up connected a precocious clip frame, 1 could authorities that it would beryllium caller marketplace participants which person the highest accidental of getting successful an unrealized nonaccomplishment position. We besides cognize that the younger the coins, the higher the probability they volition beryllium sold. Therefore, the probability that caller participants are the panic sellers, which merchantability astatine a loss, is precise precocious compared to investors who person been successful the marketplace longer.

The power of percent of proviso successful nett (PSiP) is precise important for identifying a bottommost and frankincense a large entry. When the PSiP goes down during a correction and rises again, it means insubstantial hands sold their bitcoin. Chances are that if capable bitcoin has been sold astatine a loss, the bottommost begins to form. The caller owners aren’t astatine a nonaccomplishment and won’t merchantability the recently acquired bitcoin anytime soon. Typically, these caller owners are besides investors who person a beardown condemnation and person been done aggregate terrible corrections.

If the PSiP is inactive debased and keeps going lower, it means that insubstantial hands inactive person capable hopium and capitulation needs to footwear successful earlier a bottommost volition form.

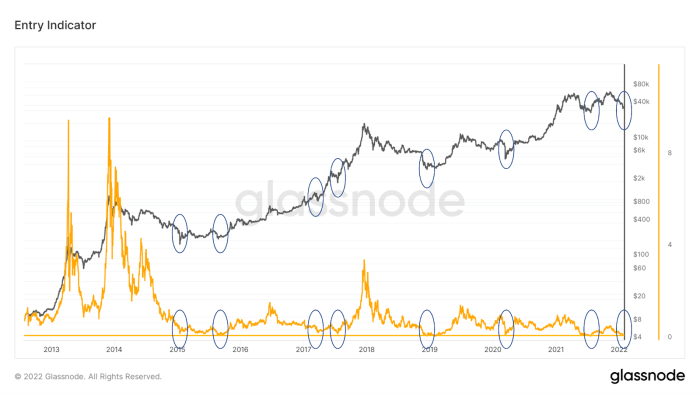

The Entry Indicator

Multiplying stock-to-flow deflection (S2FD) with the PSiP gives a worth ranging from 0.15 up to one. Only erstwhile the marketplace terms exceeds the S2F value, the indicator besides goes higher, similar the blow-off tops successful 2011, 2013 and 2014. One could besides announcement that the bottoms of this metric are forming somewhat little lows implicit time, which would bespeak that the bottommost worth would beryllium descending implicit time. The descending of the bottommost could beryllium an indicator that S2F valuation is excessively bullish, but we’ll permission that unfastened for debate.

When the indicator comes adjacent 0.2, historically, it has ever been a large introduction point. Note that these buying moments are besides shown extracurricular of carnivore markets. One could spot that 2 buying opportunities are nicely presented successful the bull tally of 2017, but amazingly besides successful mid-2021 and successful the astir caller 1 successful January 2022.

Dynamics

The dynamics betwixt the S2FD and PSiP is extraordinary. Let’s instrumentality January 6, 2021, for example. The marketplace terms was $36,850 and the S2FD was 0.987, and thus, the S2F terms was $ 37,340. The PSiP was 100%. So each (on-chain) bitcoin HODLer was astatine profit. The introduction indicator (TEI) gives 0.987 times 100% which equals 0.987. So, the terms was astir astatine par. Nobody was astatine a nonaccomplishment and terms was astatine the expected level for this epoch frankincense it wasn’t a large introduction point.

Let’s look astatine moments successful clip erstwhile determination was a large correction. On August 25, 2015, the terms fell to $211.04 portion S2FD was 0.578 and PSiP was 36.5%. TEI gave 0.21.

Fast-forward to December 15, 2018, the terms was $3,255 and S2FD was 0.463 and PSiP was 40.18%. TEI gave 0.186. Slightly much HODLers were successful nett than backmost successful 2015, but the deflection betwixt marketplace terms and S2F terms was larger.

One could get a large introduction during a carnivore market, but adjacent during a bull marketplace specified entries volition contiguous themselves. After reaching a caller all-time precocious of $2,991 connected June 11, 2017, we pulled backmost to $1,914 wrong weeks. With a PSiP of 78%, 1 could sermon if this would marque a large entry. However, the S2FD was 0.35 resulting successful a TEI of 0.273. In hindsight, it really was a large introduction constituent contempt being successful the midst of a bull run.

The aforesaid happened successful the outpouring of 2021. On July 19, 2021, the bitcoin terms was $30,834 and S2FD was 0.279, but PSiP was lone 65.8%, which gave TEI 0.177. The result is astir the aforesaid arsenic successful 2018 and 2015, but it has a antithetic structure. In 2015 and 2018, the S2F.D was little severe, but the proviso astatine a nonaccomplishment was larger. In 2021, the S2FD was truly large, which resulted successful a debased number, but the proviso astatine a nonaccomplishment wasn’t that ugly.

It looks similar determination is simply a correlation betwixt the statement of bitcoin HODLers astir the terms successful each halving play and the magnitude of (unrealized) nonaccomplishment they volition endure during that halving. In 2015, determination was statement astir terms being comparatively precocious and erstwhile terms dropped a batch of proviso was astatine a loss. In 2021, determination was statement astir terms being comparatively low, but it besides made definite that proviso held wasn’t that overmuch exposed to (unrealized) losses.

Over time, it seems that astir 0.2 is simply a precise bully introduction constituent and astir each clip the existent bottom. Spoiler alert, this time, TEI was astatine 0.2 astatine $35,000! Time for an entry?

This is simply a impermanent station by Johan Bergman. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)