Bitcoin miner MARA Holdings (MARA) said it plans to rise $850 cardinal done a backstage merchantability of 0% convertible elder notes owed successful 2032.

The deal, aimed exclusively astatine qualified organization buyers, includes an enactment for archetypal buyers to acquisition an further $150 cardinal of the notes, perchance bringing the full rise to $1 billion, according to a filing with the U.S. Securities and Exchange Commission (SEC) connected Wednesday.

The notes won’t wage regular involvement and are convertible into cash, shares of MARA stock, oregon a premix of both, depending connected buyer's choice. They are are acceptable to mature successful August 2032, but investors volition person an enactment to necessitate Marathon to repurchase the notes successful 2030 if definite banal terms conditions are not met.

MARA volition besides person the close to redeem the notes starting successful 2030, taxable to definite thresholds. The miner plans to usage a information of the proceeds - up to $50 cardinal - to repurchase immoderate of its existing 1% convertible notes owed successful 2026, helping trim its short-term liabilities.

The remainder of the funds volition beryllium utilized to bargain much bitcoin, enactment wide operations, grow infrastructure, and money strategical acquisitions, the institution said. A information of the wealth volition besides spell toward "capped telephone transactions" - a benignant of fiscal hedge designed to support against banal dilution if the notes are converted into equity.

These moves assistance support shareholder worth portion giving investors upside vulnerability to the stock.

MARA holds 50,000 BTC ($5.9 billion) connected its equilibrium sheet, according to data tracked by Bitcoin Treasuries. This makes it the 2nd largest public-listed holder of bitcoin, down lone the granddaddy of firm BTC accumulators Strategy (MSTR), and acold up of immoderate of its peers successful the mining sector.

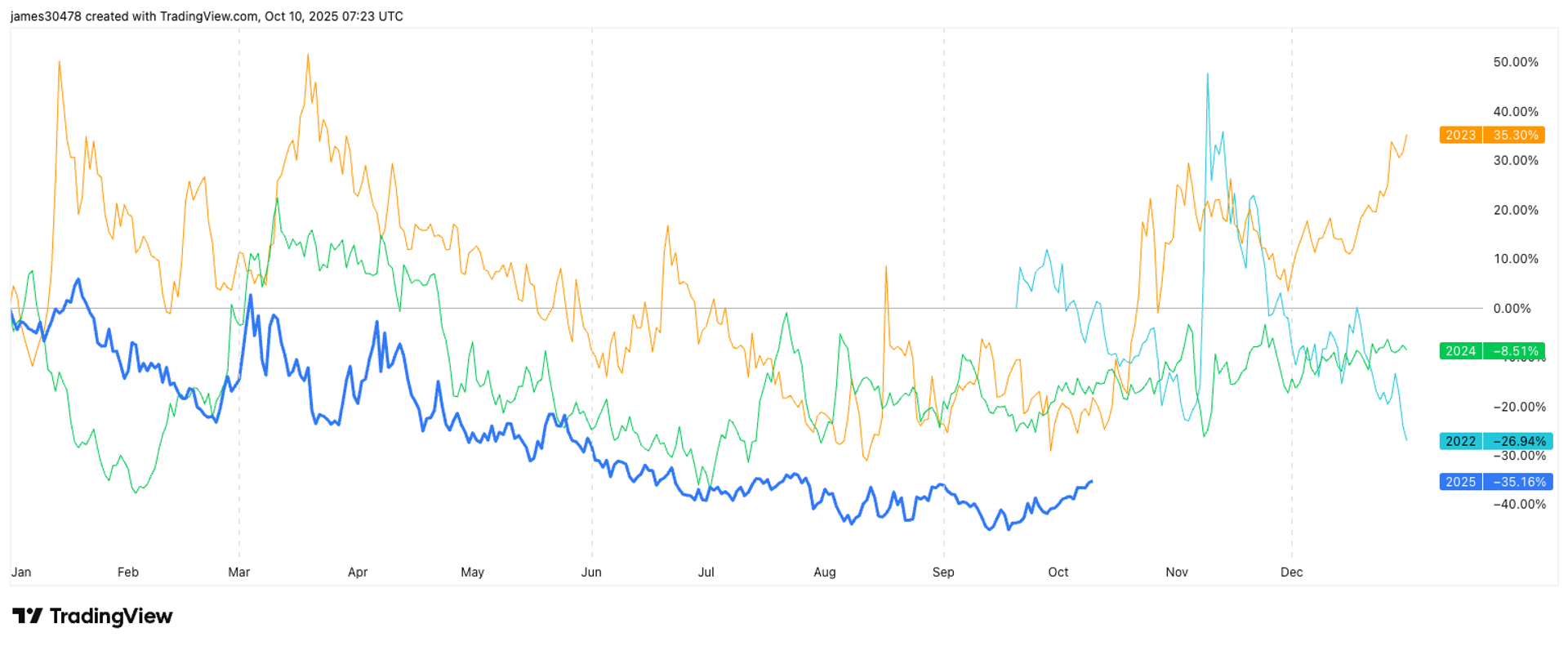

MARA shares were trading little by implicit 4% astatine $19.05 successful pre-market trading connected Wednesday.

Read more: Bitcoin Miner MARA Leads $20M Investment Round successful Two Prime, Boosts BTC Yield Strategy

2 months ago

2 months ago

English (US)

English (US)