Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Bitcoin (BTC) and different cryptos traded higher connected Tuesday arsenic bearish sentiment implicit the past week appears to beryllium fading.

Most alternate cryptocurrencies (altcoins) outperformed bitcoin, suggesting a greater appetite for hazard among traders. For example, THORChain's RUNE token rallied by 11% implicit the past 24 hours, compared with a 2% emergence successful BTC implicit the aforesaid period. Meanwhile, decentralized concern (DeFi) tokens specified arsenic AAVE and EOS roseate much than 7% connected Tuesday.

Just launched! Please motion up for our regular Market Wrap newsletter explaining what happens successful crypto markets – and why.

Sentiment is besides starting to amended among crypto traders, evidenced by a flimsy uptick successful the bitcoin Fear & Greed Index connected Tuesday. Still, immoderate buyers stay connected the sidelines arsenic BTC trades successful a choky scope betwixt $32,000 and $46,000.

Stocks were besides higher connected Tuesday arsenic the 10-year Treasury output roseate toward 2.9%, a level not seen since precocious 2018. Gold, a accepted harmless haven asset, traded little implicit the past 24 hours, indicating a flimsy risk-on code successful planetary markets.

●Bitcoin (BTC): $41322, +1.25%

●Ether (ETH): $3098, +2.75%

●S&P 500 regular close: $4462, +1.61%

●Gold: $1950 per troy ounce, −1.67%

●Ten-year Treasury output regular close: 2.91%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

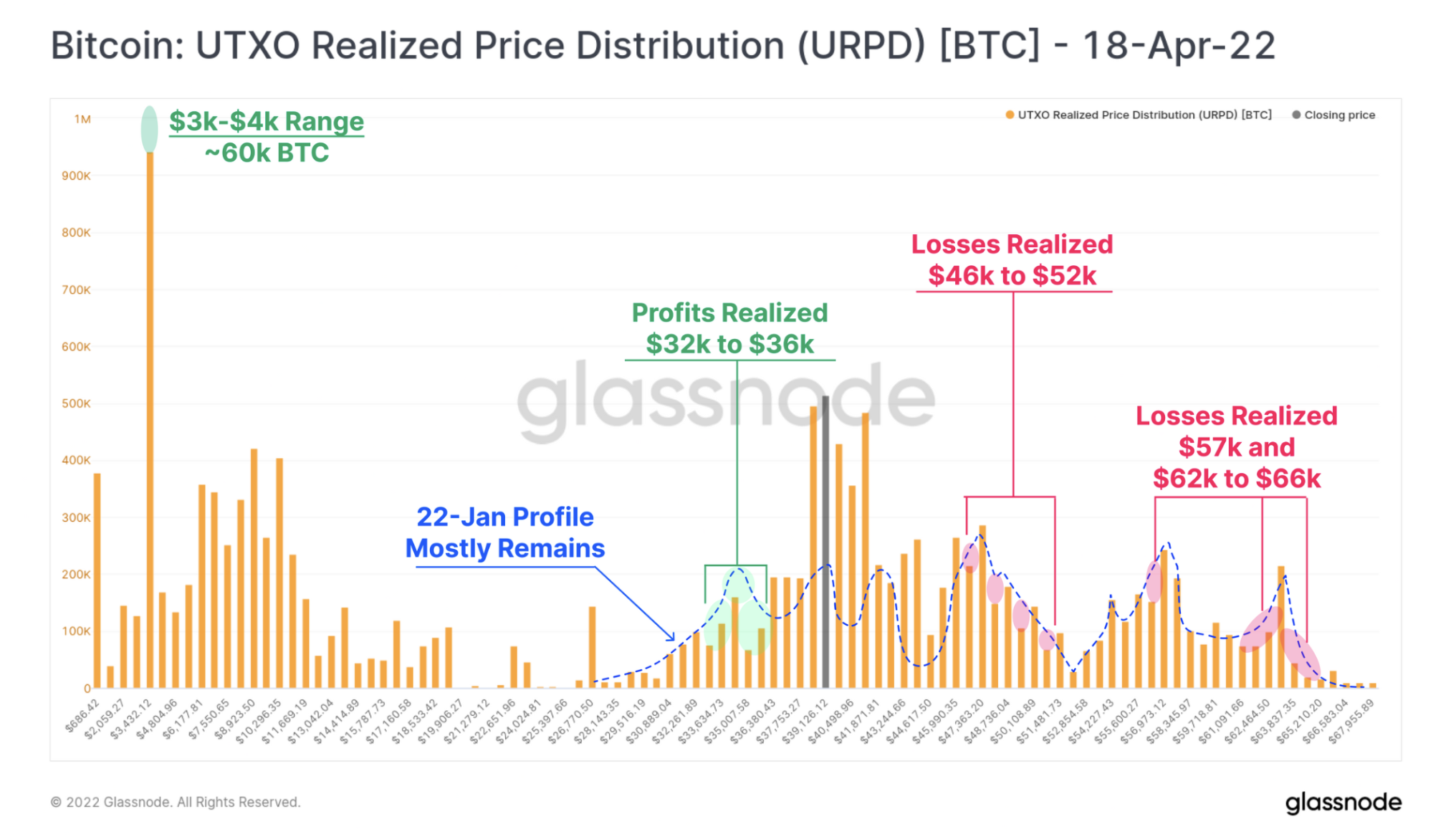

A ample magnitude of bitcoin proviso has been accumulated betwixt the $38,000 and $45,000 terms range, according to blockchain information compiled by Glassnode. Typically, terms "value" zones, areas with a ample magnitude of trading activity, precede beardown breakouts oregon breakdowns successful price.

"Despite an further 2 months of sideways consolidation, a ample proportionality of the marketplace appears unwilling to walk and merchantability their coins, adjacent if their coins are held astatine a loss," Glassnode wrote successful a blog post. That suggests price-insensitive traders clasp overmuch of bitcoin's proviso supra the $40,000 terms level.

So far, semipermanent terms momentum has deteriorated, truthful it remains to beryllium seen if traders volition proceed to find charismatic buying points betwixt $35,000 and $42,000. From a method perspective, a breakout oregon breakdown of the existent terms scope is needed to corroborate a displacement successful trend.

Bitcoin terms organisation (Glassnode)

The illustration beneath shows a volume profile of bitcoin's year-long terms range. Currently, the midpoint indicates short-term enactment astatine $38,590. High-volume nodes astir $32,000 and $50,000 specify the astir caller terms range, which typically coincides with prolonged periods of accumulation oregon distribution.

The caller diminution successful bargain measurement comparative to merchantability volume, however, could bespeak a deficiency of condemnation among bitcoin buyers. If a breakdown of the existent scope occurs, secondary support is seen astatine $27,000 and $23,500.

https://www.investopedia.com/terms/s/support.asp

Terra’s LUNA surges 11% arsenic UST becomes third-largest stablecoin: Terra’s LUNA outperformed the wider crypto market, rising by arsenic overmuch arsenic 11% implicit the past 24 hours. The determination comes aft a astir 37% driblet successful the archetypal 2 weeks of April pursuing beingness highs of $120 earlier this month. The spike comes arsenic Terra's algorithmic stablecoin UST toppled Binance USD (BUSD) to go the third-largest stablecoin by circulation, during the aboriginal hours of Monday. Read much here.

BNB concatenation burns implicit $770M worthy of BNB tokens: BNB Chain volition pain implicit 1.8 cardinal binance coins (BNB) successful its archetypal pain this quarter, data from trackers shows. The pain was executed connected BNB Chain astatine 08:23:05 UTC connected Tuesday. Read much here.

Ethereum Foundation holds $1.3B successful ether, $300M successful non-crypto investments: The Ethereum Foundation held much than $1.6 cardinal successful treasury assets astatine the extremity of March, the non-profit said Monday. Almost $1.29 cardinal was held successful ether (ETH), the world’s second-largest cryptocurrency by marketplace capitalization. That represented implicit 0.297% of the full ether proviso arsenic of March 31. Some $11 cardinal was held successful different cryptocurrencies. Read much here.

Listen: With bitcoin’s bounce stalling and a look astatine the communal ancestor betwixt bitcoin and today’s inflation, CoinDesk’s Markets Daily is backmost with the latest quality roundup.

Most integer assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)