Bitcoin roseate supra $43,000 connected Wednesday, suggesting that a betterment from a 2 month-long downtrend is underway.

Alternative cryptocurrencies (altcoins) specified arsenic FTM, XLM and the fashionable dog-themed shiba inu (SHIB) token led the mode higher, each up much than 10% implicit the past 24 hours. The rally successful altcoins, which typically outperform bitcoin successful a rising market, reflects a greater appetite for hazard among traders.

Still, determination are signs that the rally successful highly speculative altcoins is owed for a pullback. "In the furniture 1 scene, some FTM and NEAR spot an open interest-to-market capitalization ratio substantially supra the large-cap tokens," Arcane Research wrote successful a report.

"FTM’s unfastened involvement maturation has been accompanied by beardown terms enactment and substantially affirmative backing – astatine existent levels, the FTM commercialized seems comparatively crowded," Arcane wrote.

Meanwhile, enactment traders look to beryllium little bearish connected bitcoin. The one-week put-call skew, which measures the outgo of puts – oregon bearish bets – comparative to calls, has fallen from 17% to astir 0% since precocious Monday, according to information provided by the crypto derivatives probe steadfast Skew.

Bitcoin (BTC): $43,905.25, +2.6%

Ether (ETH): $3381.68, +4.4%

10-year Treasury output regular close: $1.735

Some analysts support a semipermanent bullish outlook for BTC, suggesting the existent sell-off is simply a specified dip successful broader upcycle. For example, StackFunds, a Singapore-based crypto concern firm, has a terms people of $120,000 BTC this year.

Still, investors volition inactive person to brace themselves for volatility. "We are expecting crypto markets to beryllium highly disjointed the adjacent fewer months, inducing choppiness that overflow from equities, arsenic investors navigate a caller epoch of inflation," Lennard Neo, caput of probe astatine Stack Funds, wrote successful a report.

Is bitcoin entering a betterment phase?

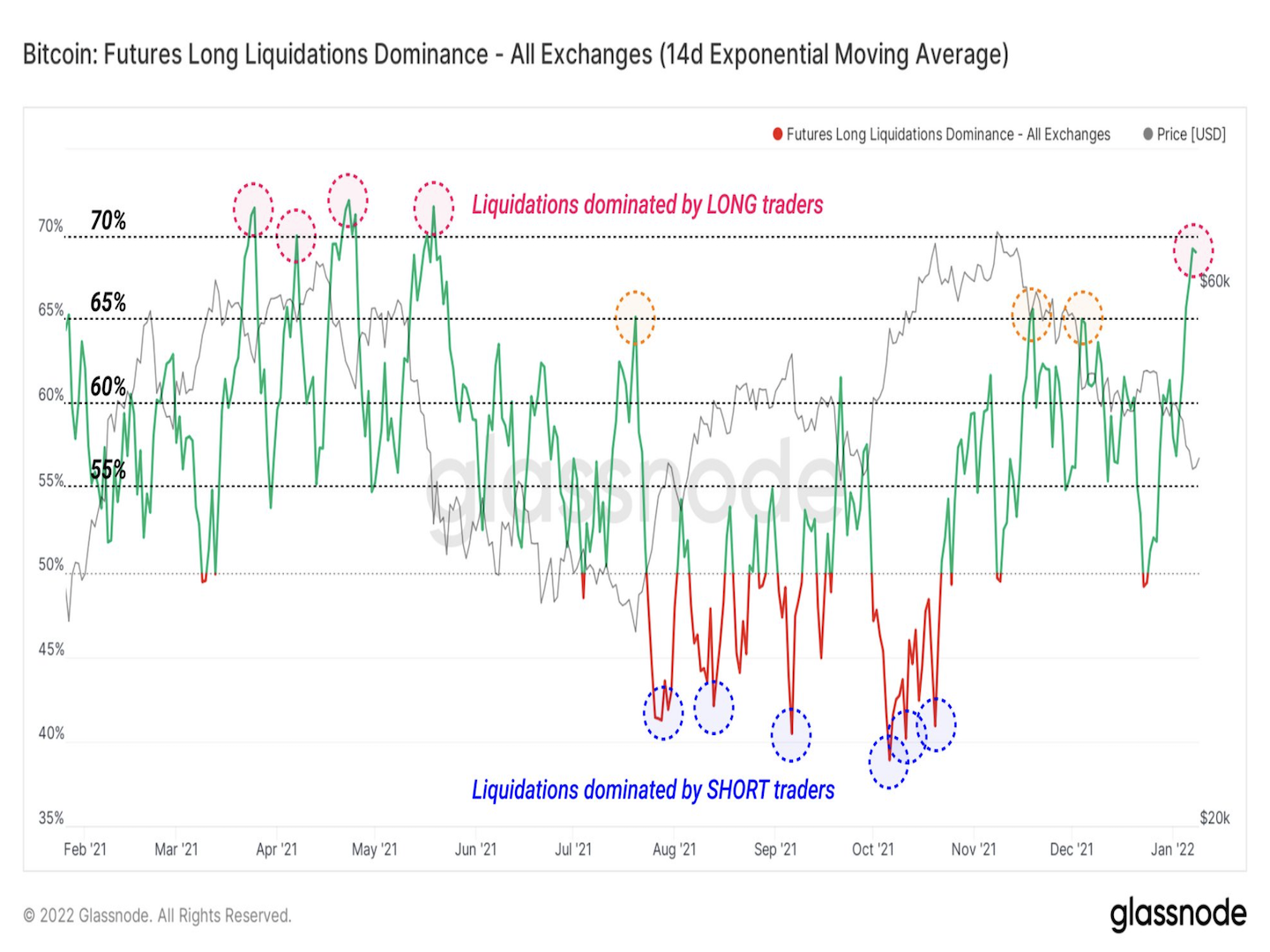

"A byproduct of accordant downtrends successful terms are the liquidation of assured agelong traders trying to drawback a falling knife," crypto information steadfast Glassnode wrote successful a blog post. That could mean BTC is approaching a short-term bottom, particularly fixed the caller downtrend successful terms and the consequent emergence successful liquidations.

Liquidations hap erstwhile an speech forcefully closes a trader’s leveraged presumption arsenic a information mechanics owed to a partial oregon full nonaccomplishment of the trader’s archetypal margin. That happens chiefly successful futures trading.

The illustration beneath suggests short traders, oregon those positioned for a terms drop, could soon look liquidations if BTC enters a betterment phase, akin to what occurred past July.

Bitcoin long/short liquidations (Glassnode)

Near and different FOAN tokens are reaching all-time high: While each large cryptocurrencies saw prices spike higher connected Wednesday, a fewer fashionable tokens stood out. Fantom (FTM), harmony (ONE), cosmos (ATOM) and adjacent (NEAR) surged arsenic precocious arsenic 21%. Traders successful crypto circles colloquially notation to a handbasket of those tokens arsenic “FOAN,” a acceptable of tokens associated with layer 1 blockchains primed for decentralized concern (DeFi) enactment with their inexpensive and accelerated networks. Fundamentals for the FOAN handbasket shows committedness for traders, Shaurya Malwa and Lyllah Ledesma reported. Read much here.

Ethereum reaches a staking milestone: The apical 4 staking entities connected the Ethereum 2.0 Beacon Chain present cumulatively relationship for 47.5% of full deposits, with Lido making a important jump. Over time, decentralized staking providers similar Lido and RocketPool person intimately aligned with the wellness of Ethereum, allowing the protocols to take a assortment of node operators that tally antithetic clients and diversify attraction risk, according to CoinDesk’s Edward Oosterbaan. Read much here.

Solana becoming Visa of the digital-asset world: The Solana blockchain could go the “Visa of the integer plus ecosystem” arsenic it focuses connected scalability, debased transaction fees and easiness of use. It could drawback marketplace stock from the Ethereum blockchain implicit time, Bank of America said successful a probe note. Solana is optimized for user usage cases specified arsenic micropayments and gaming. Read much here.

Most integer assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)