Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Bitcoin (BTC) and different cryptos traded little connected Thursday, tracking declines successful stocks.

Concerns astir macroeconomic and geopolitical risks proceed to linger, which has kept immoderate buyers connected the sidelines. For example, during a quality league connected Wednesday, Russian President Vladimir Putin said that bid talks with Ukraine person reached a dormant end. Putin besides pledged that Russia’s “military cognition volition proceed until its afloat completion."

Just launched! Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

Geopolitical uncertainty is 1 crushed wherefore gold, a accepted safe-haven asset, and lipid person been well bid this year. Cryptos and stocks, however, person traded successful a choppy terms range, reflecting uncertainty among marketplace participants.

BTC struggled to clasp supra $40,000 connected Thursday portion ether (ETH) traded astir $3,000. Meanwhile, astir alternate cryptos (altcoins) underperformed BTC, suggesting a little appetite for hazard among crypto traders. WAVES and LUNA person declined by much than 20% implicit the past week, compared with a 7% nonaccomplishment successful BTC implicit the aforesaid period.

●Bitcoin (BTC): $39739, −3.14%

●Ether (ETH): $2992, −2.93%

●S&P 500 regular close: $4393, −1.21%

●Gold: $1975 per troy ounce, −0.29%

●Ten-year Treasury output regular close: 2.83%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Bitcoin dominance rangebound

The illustration beneath shows bitcoin's dominance ratio, oregon BTC's marketplace capitalization comparative to the full cryptocurrency marketplace cap. The ratio has been stuck successful a year-long range, akin to BTC's price, which reflects neutral sentiment among crypto traders.

Typically, a emergence successful the dominance ratio indicates a formation to safety, akin to what occurred during the 2018 crypto carnivore market. Further, BTC declines little than altcoins during times of marketplace stress. The other is existent during crypto rallies.

From a method perspective, the dominance ratio is consolidating aft a steep diminution past twelvemonth erstwhile altcoins specified arsenic ETH rallied up of BTC. This year, however, altcoins person fallen successful and retired of favour amid geopolitical and macro risk.

The dominance ratio is inactive supra its 2018 debased astatine 35%, which means alts could person further country to outperform implicit the abbreviated term, truthful agelong arsenic resistance astatine 47%-49% holds. Still, a breakout supra absorption would bespeak a risk-off environment.

Bitcoin dominance ratio support/resistance (Damanick Dantes/CoinDesk, TradingView)

Profit-taking among whales?

For now, ample bitcoin investors, oregon whales, person started to instrumentality profits connected terms rallies. That could bespeak immoderate anxiousness among the whales, who typically accumulate connected terms dips implicit the agelong term.

The illustration beneath shows that the fig of addresses with a equilibrium of much than 10,000 BTC has decreased substantially implicit the past week oregon so.

"In this period, astatine slightest 4 whales person sold their bitcoin – this whitethorn look insignificant, but each of these addresses has sold much than $400 cardinal worthy of bitcoin," Marcus Sotiriou, an expert astatine the U.K.-based integer plus broker GlobalBlock, wrote successful an email to CoinDesk.

"This is an important metric to look astatine due to the fact that whales typically person the powerfulness to power the absorption of the market," Sotiriou wrote.

Bitcoin addresses >10K (Glassnode)

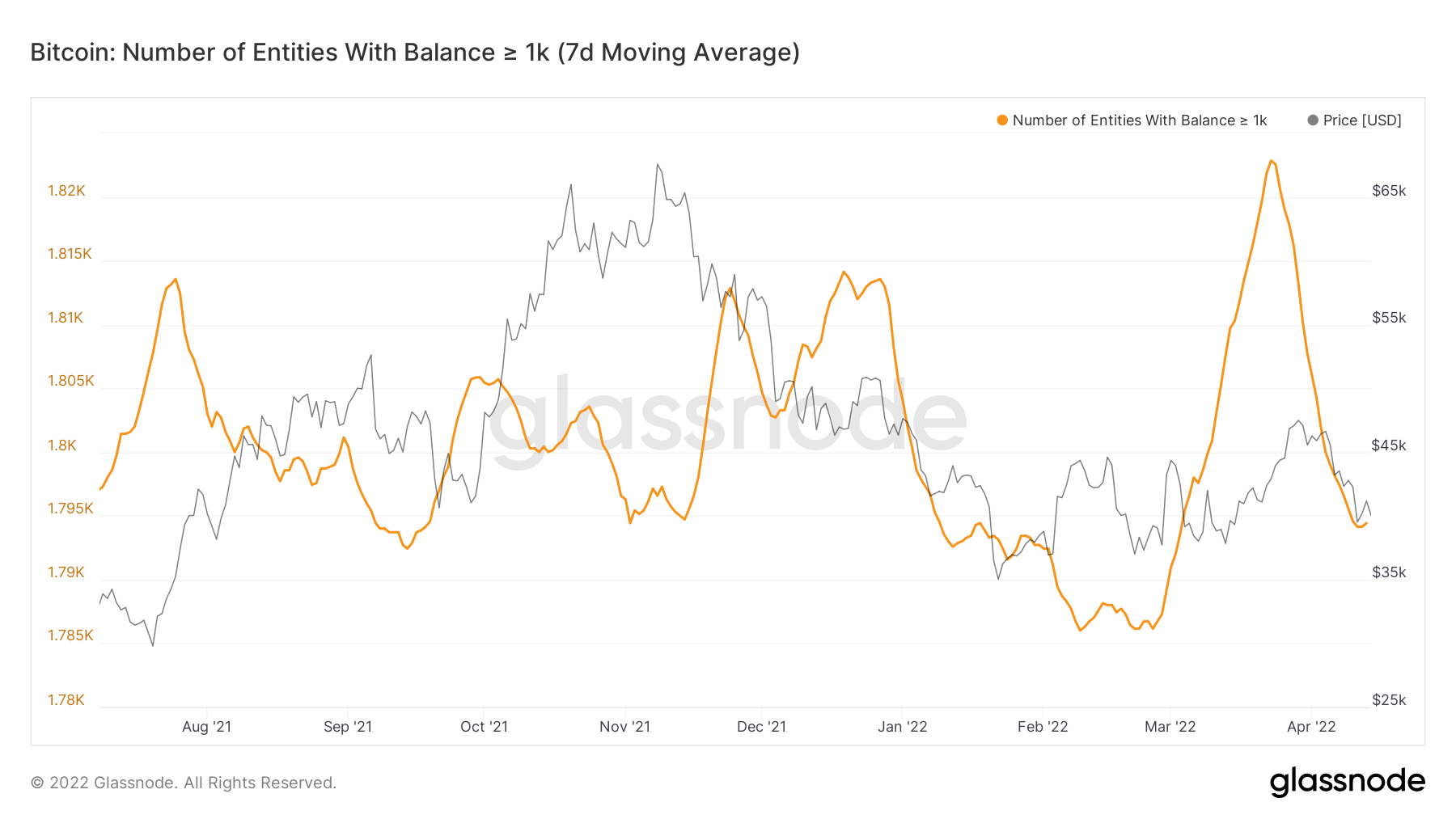

Smaller whales, oregon investors holding much than 1,000 BTC, person besides taken immoderate profits implicit the past month. The illustration beneath shows the seven-day moving mean of smaller whale balances, which appears to beryllium stabilizing.

Sotiriou is inactive optimistic for the crypto marketplace implicit the abbreviated word due to the fact that of utmost antagonistic sentiment among traders. Indeed, the bitcoin Fear & Greed Index reached "extreme fear" territory this week, which typically precedes terms jumps, albeit with a agelong pb clip that tin span respective months.

Bitcoin addresses >1K (Glassnode)

Terraform Labs gives $820M successful LUNA tokens to Luna Foundation Guard: Terraform Labs, the enactment down the UST algorithmic stablecoin (UST) and the LUNA token, gave 10 cardinal LUNA tokens worthy $820 cardinal to Luna Foundation Guard (LFG), the nonprofit that is gathering up bitcoin (BTC) reserves for UST, The Block reported. Read much here.

Cosmos gains interchain accounts arsenic upgrade kicks in: An upgrade to the Cosmos blockchain web known arsenic Hub Theta went unrecorded Wednesday, developers confirmed. The upgrade brings interchain accounts, a diagnostic long-awaited by the Cosmos community. Read much here.

Oregon Democrat pitches run NFTs successful crowded location primary: Matt West, the erstwhile decentralized concern (DeFi) developer-turned-aspiring lawmaker successful Oregon’s sixth legislature district, volition merchantability a postulation of Ethereum-based non-fungible tokens (NFT) to rise wealth for his campaign. The NFTs diagnostic cartoon beavers (Oregon’s authorities animal) drawn by movie poster creator Paul Zeaiter. Read much here.

Most integer assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)