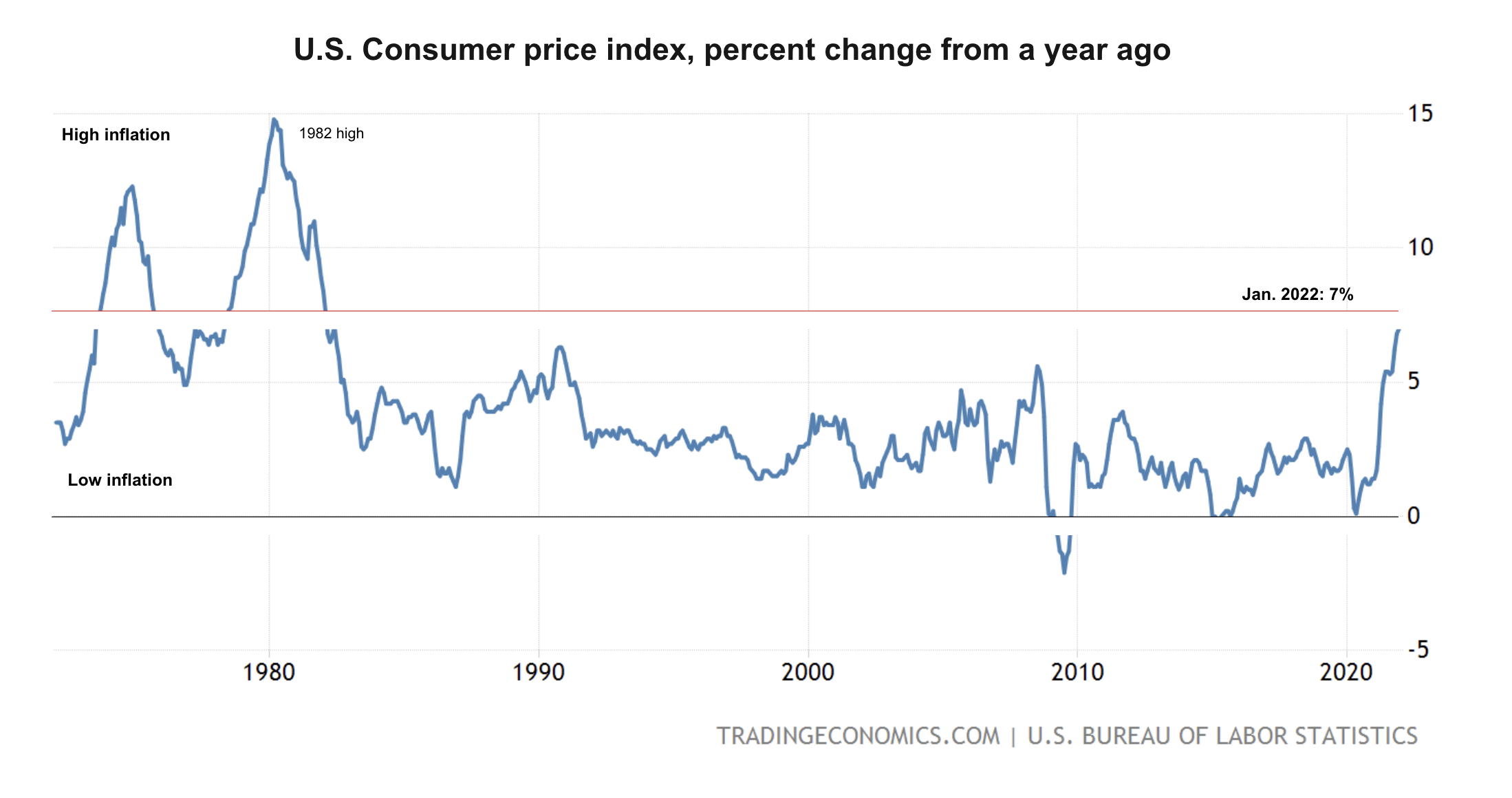

Bitcoin (BTC) recovered from a astir 5% driblet connected Thursday aft the January U.S. ostentation report showed a 7.5% summation successful prices, a four-decade high.

The summation successful ostentation was the fastest since February 1982 and exceeded economists' predictions of a 7.3% rise. The U.S. Federal Reserve is expected to raise involvement rates adjacent month, which could easiness ostentation implicit time. Tighter monetary argumentation could besides measurement connected speculative markets specified arsenic equities and cryptocurrencies.

Stocks besides fell connected Thursday, with the S&P 500 down arsenic overmuch arsenic 2% implicit the past 24 hours, portion Treasury yields roseate supra 2%.

In crypto markets, bitcoin outperformed astir alternate cryptocurrencies (altcoins). Typically, during down markets, investors overweight bitcoin due to the fact that of its little hazard illustration comparative to altcoins. BTC was astir level implicit the past 24 hours, versus a 4% driblet successful ETH and a 6% driblet successful SOL.

●Bitcoin (BTC): $44122, −1.25%

●Ether (ETH): $3114, −4.36%

●S&P 500 regular close: $4504, −1.81%

●Gold: $1828 per troy ounce, −0.40%

●Ten-year Treasury output regular close: 2.03%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Some analysts expect selling unit to yet wane, portion others expect slowing economical maturation and tighter monetary argumentation volition support buyers connected the sidelines.

"The elemental mentation from our extremity is that determination is large trading measurement astir economical information releases," Sean Farrell, caput of integer plus strategy astatine Fundstrat Global Advisors, wrote successful a Thursday brief. "It’s imaginable that the carnage we witnessed the past respective weeks already priced successful a 50 ground constituent complaint hike."

Fundstrat remains bullish connected crypto, and it has advised clients to bargain connected dips done the archetypal fractional of this twelvemonth contempt choppy terms enactment and macroeconomic uncertainty.

Meanwhile, MRB Partners, an concern strategy firm, wrote successful a enactment this week that stocks and bonds "will conflict to digest the little accommodative displacement successful planetary monetary argumentation implicit the adjacent six to 12 months."

"There is further upside for authorities enslaved yields successful the adjacent year, though a intermission apt looms successful the adjacent term," MRB wrote.

U.S. CPI illustration (CoinDesk, TradingEconomics)

Cartesi to grow its blockchain crippled ecosystem with Aetheras: Cartesi, which is trying to make a furniture 2 Linux infrastructure, is teaming up with Aetheras successful the anticipation that aboriginal blockchain games tin beryllium created with its blockchain operating system. According to Cartesi, Aetheras' bundle volition alteration gamers to bask much flexibility to research antithetic games astatine the aforesaid clip without the interest of losing their in-game assets. Read much here.

Streamr Network approaches a cardinal milestone of decentralization: Streamr, a real-time information network, volition go the open, permissionless and decentralized Brubeck Network connected Feb. 24. Developers tin present physique connected the Brubeck Network, oregon migrate their existing apps guardant successful anticipation of the authoritative launch. Read much here.

FLOW tokens surge connected mobile crippled Beijing 2022: The terms of Flow’s FLOW token has risen 12% since Tuesday arsenic nWayPlayNFT, a subsidiary of the Hong Kong-based crippled bundle institution and task superior steadfast Animoca Brands, launched an officially licensed play-to-earn mobile crippled called Beijing 2022. Read much here.

Digital assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)