Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Bitcoin (BTC) continued its descent connected Monday, concisely dipping beneath $40,000 and tracking losses successful planetary equities.

Investors look to beryllium reducing their vulnerability to speculative assets, including stocks and cryptos, amid concerns astir ostentation and slower economical growth. Further, the 10-year Treasury output roseate to a caller three-year precocious connected Monday astatine 2.78%, which reduces the present value of expensively priced tech stocks.

Just launched! Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

Gold, a accepted harmless haven, traded higher connected Monday, portion the Chicago Board Options Exchange's CBOE Volatility Index (VIX), a measurement of the banal market's anticipation of volatility based connected S&P 500 scale options, roseate supra 20, akin to what occurred successful aboriginal February. That indicates uncertainty among investors.

In crypto markets, astir alternate cryptocurrencies (altcoins) underperformed bitcoin connected Monday. Ether (ETH) was down 8% implicit the past 24 hours, compared with a 16% driblet successful THORChain's RUNE token, and a 6% diminution successful BTC implicit the aforesaid period.

For now, method indicators suggest little support astatine $37,500 and $40,000 could stabilize BTC's down move.

●Bitcoin (BTC): $40065, −7.48%

●Ether (ETH): $3011, −8.67%

●S&P 500 regular close: $4413, −1.69%

●Gold: $1957 per troy ounce, +0.79%

●Ten-year Treasury output regular close: 2.78%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

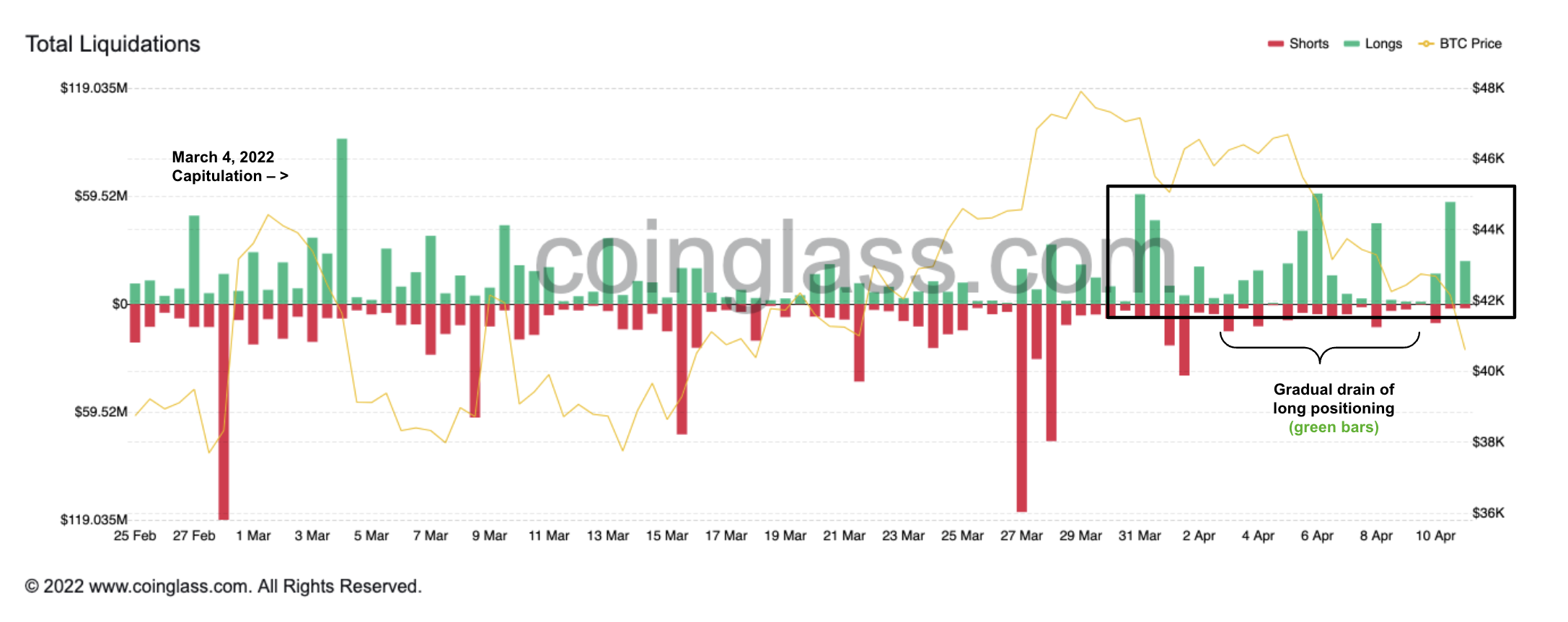

Bitcoin's pullback beneath $43,000 triggered a question of agelong liquidations implicit the weekend.

Liquidations hap erstwhile an speech forcefully closes a trader’s leveraged presumption arsenic a information mechanics owed to a partial oregon full nonaccomplishment of the trader’s archetypal margin. In this case, traders who were agelong bitcoin are forced retired of their positions arsenic terms drops, which tin accelerate declines successful the spot market.

Still, agelong liquidations implicit the past fewer weeks person not reached an extreme, particularly compared with aboriginal March. That could constituent to further selling unit until BTC experiences a much decisive down determination with precocious trading volume, which typically indicates capitulation among abbreviated traders.

Bitcoin full liquidations (CoinDesk, Coinglass)

Trading measurement crossed bitcoin spot exchanges remains low, according to CoinDesk data. Further, determination was nary uptick successful measurement implicit the play contempt BTC's 7% terms dip.

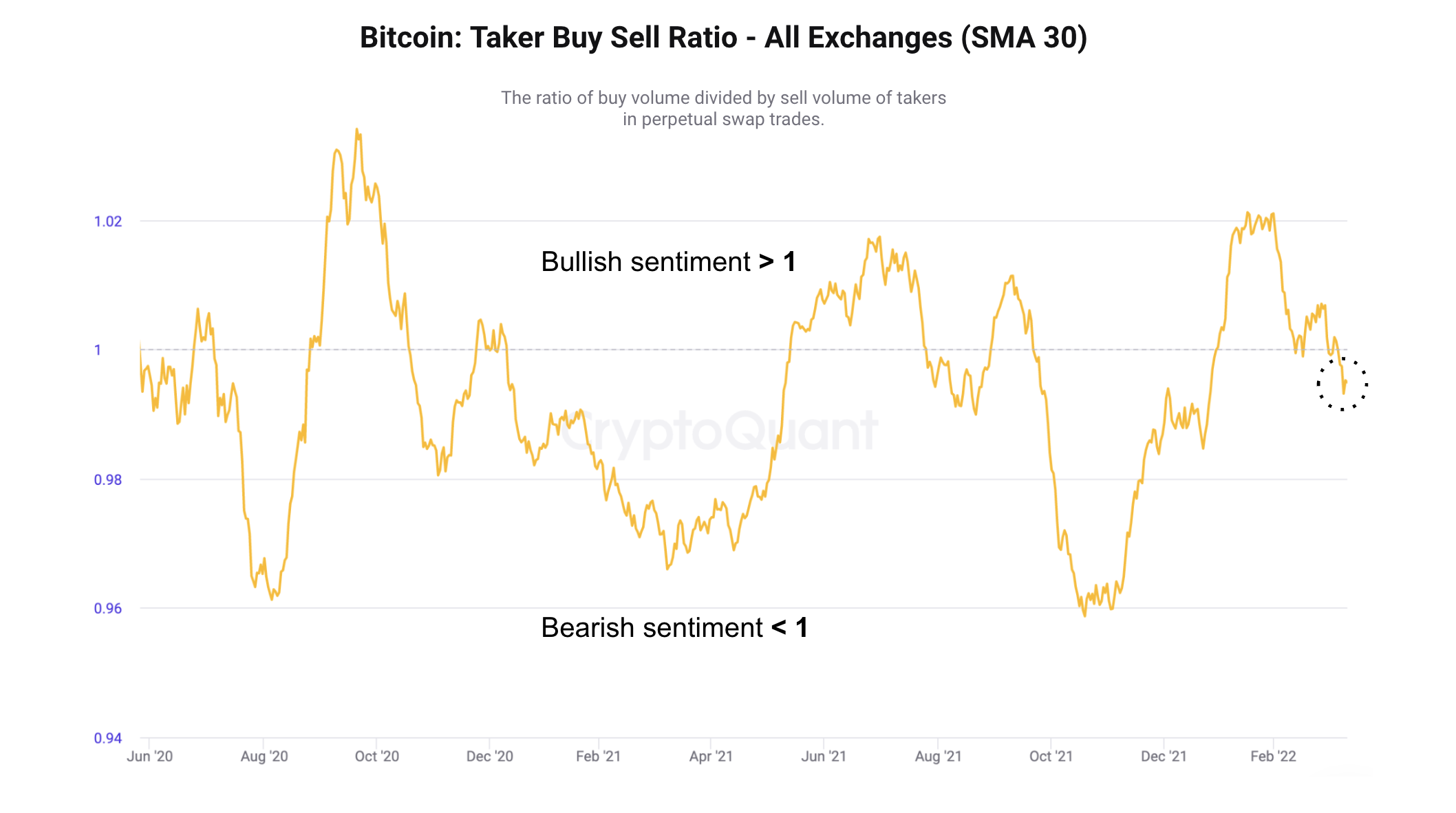

The illustration beneath shows the ratio of buy measurement versus merchantability volume successful bitcoin's perpetual swaps marketplace (30-day moving average), which is simply a benignant of crypto derivative trading product. The ratio dipped beneath one, suggesting ascendant bearish sentiment among bitcoin traders.

Bitcoin buy/sell measurement (CoinDesk, CryptoQuant)

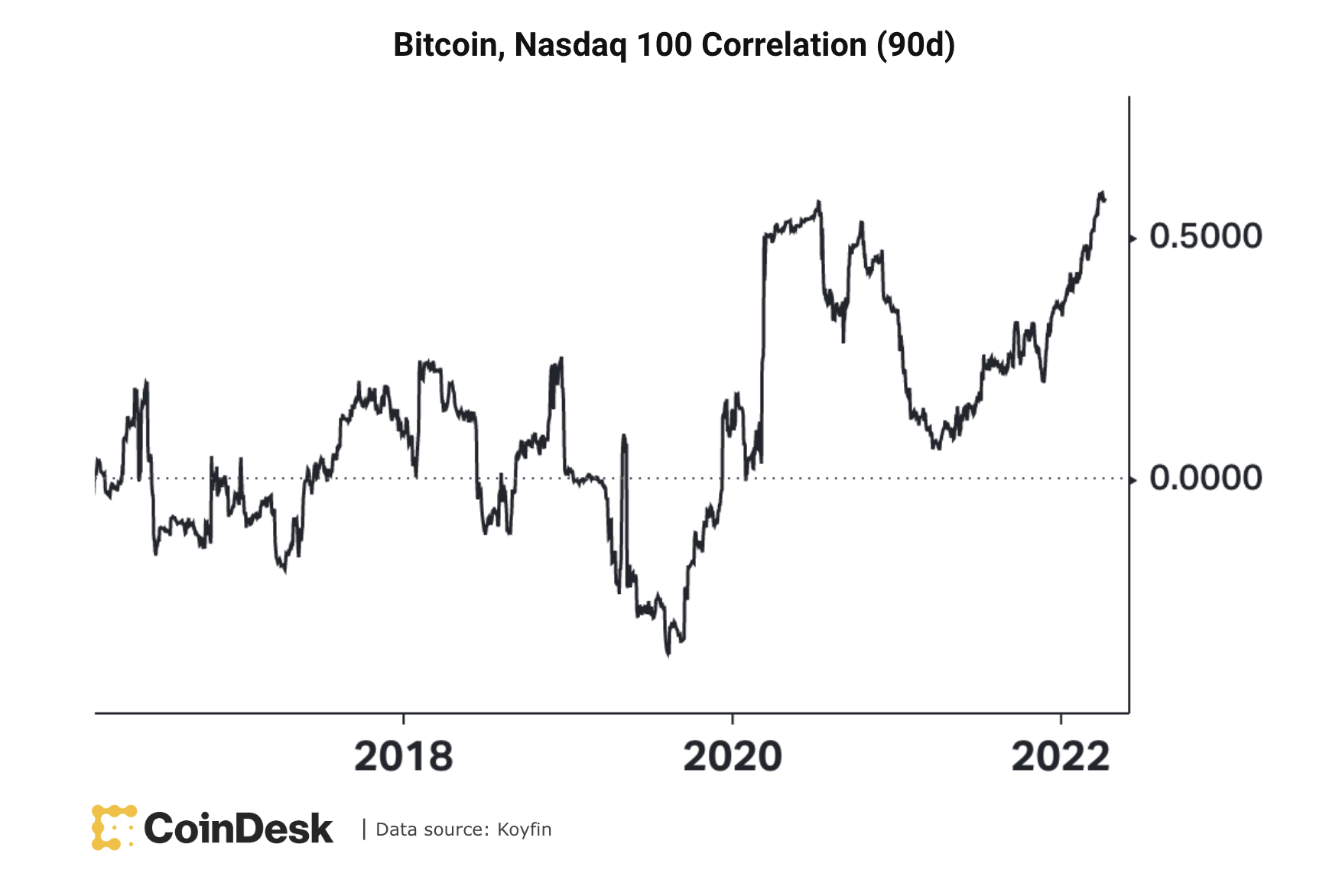

Despite crypto-specific events, specified arsenic The Luna Foundation Guard's (LFG) accumulation of 40,000 BTC, bitcoin has mostly tracked moves successful stocks implicit the past year.

The illustration beneath shows a caller precocious successful the 90-day correlation betwixt bitcoin and the tech-heavy Nasdaq 100 index. While the correlation is inactive comparatively low, it has remained elevated since the pandemic-induced sell-off crossed speculative assets successful 2020.

In a Monday newsletter, FundStrat, a planetary advisory firm, wrote that macro uncertainty could outweigh LFG's reserve purchases. "Following erstwhile LFG purchases, we witnessed a emergence successful realized marketplace headdress arsenic different [traders] followed LFG's lead," the steadfast wrote. "However, realized marketplace headdress has remained level since this latest purchase, indicating marginally little appetite for buying this weekend's dip."

It appears that investors person tightened their risk budget, which is emblematic during times of marketplace turbulence. After all, planetary volatility has been compressed passim the past 15 years of unprecedented monetary stimulus.

Bitcoin, Nasdaq correlation (CoinDesk, Koyfin)

Ethereum's archetypal Mainnet shadiness fork goes unrecorded arsenic determination to PoS continues: Ethereum's archetypal mainnet shadiness fork went unrecorded today, arsenic the developers of the world's second-largest cryptocurrency by marketplace headdress proceed transitioning the backing web to a proof-of-stake (PoS) model. The shadiness fork is simply a mode to "stress trial our assumptions astir syncing and authorities growth," tweeted Parithosh Jayanthi, an Ethereum Foundation developer, connected April 10. Read much here.

Terra’s LUNA leads slide: LUNA fell by arsenic overmuch arsenic 8% adjacent arsenic Luna Foundation Guard (LFG) added $173 cardinal successful bitcoin to its wallet implicit the weekend, bringing its full holdings to 40,000 bitcoin, as reported. The LFG is simply a recently formed nonprofit that aims to support the Terra ecosystem by gathering a $10 cardinal reserve successful bitcoin for backing the UST, a stablecoin issued by Terra, 1 of LFG’s main backers. Read much here.

Huobi, Kucoin, others pb $250M Toncoin ecosystem fund: The task arms of cryptocurrency exchanges Huobi and Kucoin are among the backers of a caller $250 cardinal ecosystem money to enactment projects built connected Toncoin, the reincarnation of failed blockchain task TON. Read much here.

Most integer assets successful the CoinDesk 20 ended the time lower.

There are nary gainers successful CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)