Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Bitcoin (BTC), the world's largest crypto by marketplace capitalization, experienced a crisp diminution toward $25,402 connected Thursday. The cryptocurrency stabilized aboriginal successful the New York trading day, but is inactive down by 20% implicit the past week.

Wild terms swings person been the norm implicit the past fewer months, which near galore alternate cryptos (altcoins) susceptible to utmost selling pressure. In down markets, alts diminution by much than bitcoin due to the fact that of their higher hazard profile.

For example, Solana's SOL token is down by 46% implicit the past week, compared with a 30% diminution successful ether (ETH) implicit the aforesaid period. And BTC declined little than respective alts implicit the past 24 hours, indicating a little appetite for hazard among crypto traders.

Just launched! Please motion up for our regular Market Wrap newsletter explaining what happens successful crypto markets – and why.

Meanwhile, connected Thursday, the terms of Terra's blockchain token LUNA plunged beneath 2 cents. The crisp terms determination made the web susceptible to governance attacks, which triggered a brief shutdown of the blockchain, which meant nary transactions with the algorithmic stablecoin UST, LUNA oregon Terra's different cryptocurrencies could beryllium processed.

"The much sizeable hazard is successful different bout of marketplace panic, caused by the macro situation and exacerbated by LUNA-driven hazard that could pb to BTC and ETH losing support," Sean Farrell, vice president of integer plus strategy astatine FundStrat, wrote successful an email.

Farrell stated that FundStrat is not acceptable to telephone a bottommost successful bitcoin due to the fact that of macroeconomic risks and concerns astir LUNA and UST.

"There could beryllium important antagonistic repercussions for cryptocurrencies and integer concern if investors suffer assurance successful stablecoins," Fitch Ratings wrote successful a Thursday report. The steadfast expects accrued calls for stablecoin regularisation going forward, particularly arsenic galore regulated fiscal entities person accrued their vulnerability to integer assets (including decentralized finance) successful caller months.

●Bitcoin (BTC): $28,635, −2.34%

●Ether (ETH): $1,945, −7.89%

●S&P 500 regular close: $3,930, −0.12%

●Gold: $1,824 per troy ounce, −1.57%

●Ten-year Treasury output regular close: 2.82%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

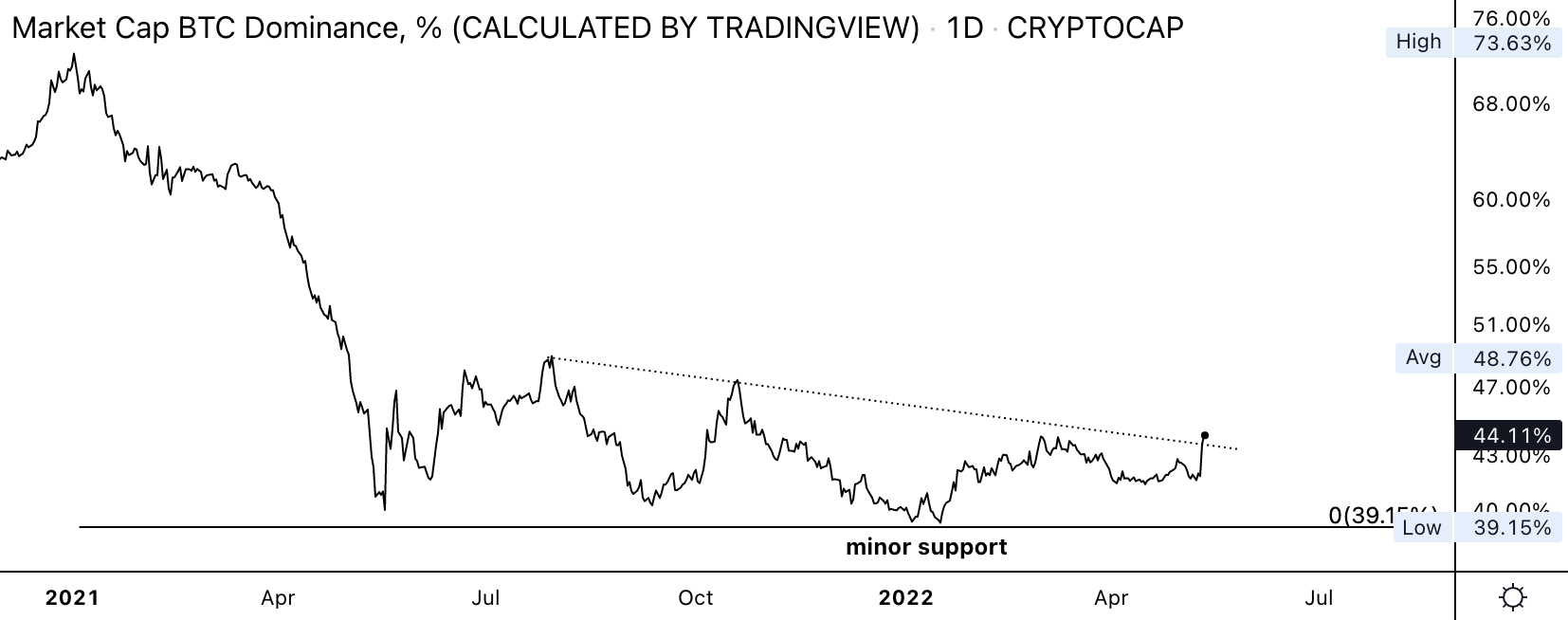

The illustration beneath shows a short-term breakout successful the bitcoin dominance ratio, oregon BTC's marketplace headdress comparative to the full crypto marketplace cap. The ratio typically rises successful down markets arsenic BTC experiences little selling unit comparative to smaller tokens.

A speechmaking astir 50% successful the dominance ratio could awesome a prolonged risk-off environment. For now, marketplace conditions are inactive neutral arsenic alts person gone successful and retired of favour implicit the past year. That suggests traders are inactive uncovering short-term opportunities to adhd risk, albeit with little condemnation compared with past year's bull market.

Bitcoin dominance ratio (Damanick Dantes/CoinDesk, TradingView)

Ether s down by 11% implicit the past 24 hours, compared with a 4% driblet successful BTC implicit the aforesaid period. The underperformance of ETH comparative to BTC typically signals risk-off conditions.

The illustration beneath shows a downtick successful the ETH/BTC terms ratio beneath its 40-week moving average. The ratio could stay nether pressure, particularly if cryptos and equities neglect to stabilize implicit the adjacent fewer weeks.

ETH/BTC terms ratio play illustration (Damanick Dantes/CoinDesk, TradingView)

Some analysts expect downside hazard based connected humanities trading data.

For example, aft a accelerated three-day diminution of much than 12.5%, BTC tends to grounds short-term weakness, according to Nautilus Capital. The steadfast highlighted 9 akin downswings successful BTC's terms implicit the past 5 years – a tiny illustration size, though capable to amusement volatile conditions are expected to persist.

Terra restarts blockchain aft little shutdown: The Terra blockchain restarted astir 1:45 p.m. ET Thursday aft validators concisely halted the web to instrumentality a spot that would forestall caller actors from staking connected it aft the luna token (LUNA) fell to beneath 2 cents earlier successful the day. Terraform said the terms of LUNA fell excessively debased to "prevent governance attacks," citing LUNA ostentation arsenic 1 factor. Read much here.

Terra proposes token burn: Terra believes decreasing the magnitude of UST successful circulation portion expanding the magnitude of disposable LUNA is the easiest mode to instrumentality the UST to its dollar peg. “The superior obstacle is expelling the atrocious indebtedness from UST circulation astatine a clip accelerated capable for the strategy to reconstruct the wellness of on-chain spreads,” said Terra successful a tweet. Read much here.

Anchor could chopped yields: The contributors of Terra-based decentralized concern (DeFi) protocol Anchor person projected cutting terraUSD (UST) rates to an mean of 4% from the existent 19.5% arsenic the broader Terra ecosystem seeks measures to support UST’s peg with the U.S. dollar. “Decrease minimum involvement rates to 3.5%, and maximum deposit rates to 5.5%, with a targeted involvement complaint of 4%,” the ongoing connection describes. Read much here.

PancakeSwap to trim CAKE proviso and boost farming rewards: Decentralized Finance (DeFi) exertion PancakeSwap has released a governance proposal that outlines a roadmap for its autochthonal token, CAKE. The proposal, which was passed with a 98.8% bulk crossed 11 cardinal votes, suggests imposing a proviso headdress of 750 cardinal for the CAKE token. CAKE presently has a circulating proviso of 295 million. The maximum proviso is expected to beryllium successful circulation wrong the adjacent 3 to 4 years. Read much here.

Listen 🎧: The CoinDesk Markets Daily podcast takes a look astatine wherever the illness of Terra’s UST stablecoin whitethorn acceptable successful a past of self-delusion.

Most integer assets successful the CoinDesk 20 ended the time lower.

Biggest Gainers

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, broad and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)