Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Most cryptocurrencies stabilized connected Tuesday amid a slowdown successful volatility.

Sharp terms swings person been the norm this twelvemonth arsenic macroeconomic and geopolitical uncertainty kept traders connected edge. A operation of war, rising involvement rates, ostentation and slower economical maturation person caused investors to trim their vulnerability to risk, peculiarly during the archetypal fractional of the month.

For example, terms enactment implicit the past 2 weeks has resembled pullbacks that occurred successful the archetypal fractional of February and March. That could constituent to a little betterment signifier successful cryptos and stocks, barring immoderate unforeseen circumstances.

Just launched! Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

Most alternate cryptocurrencies (altcoins) outperformed bitcoin connected Tuesday, suggesting a greater appetite for hazard among traders. Shiba Inu's SHIB token roseate by 12% implicit the past 24 hours, compared with a 2% diminution successful BTC. NEAR, the autochthonal token of the Near protocol, was up by 3%, portion Convex Finance's CVX token was down by 6% implicit the past 24 hours.

Stocks were mostly level connected Tuesday arsenic the U.S. 10-year Treasury output declined. Gold, a accepted harmless haven, traded higher, which could constituent to underlying uncertainty successful the market.

In different news, the monthly U.S. Consumer Price Index came successful somewhat higher than expected connected Tuesday, astatine 8.5%, a caller four-decade high. But immoderate analysts and economists are present predicting the study mightiness people the peak of the existent inflation cycle.

●Bitcoin (BTC): $39341, −1.63%

●Ether (ETH): $2975, −1.05%

●S&P 500 regular close: $4397, −0.34%

●Gold: $1972 per troy ounce, +1.42%

●Ten-year Treasury output regular close: 2.73%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

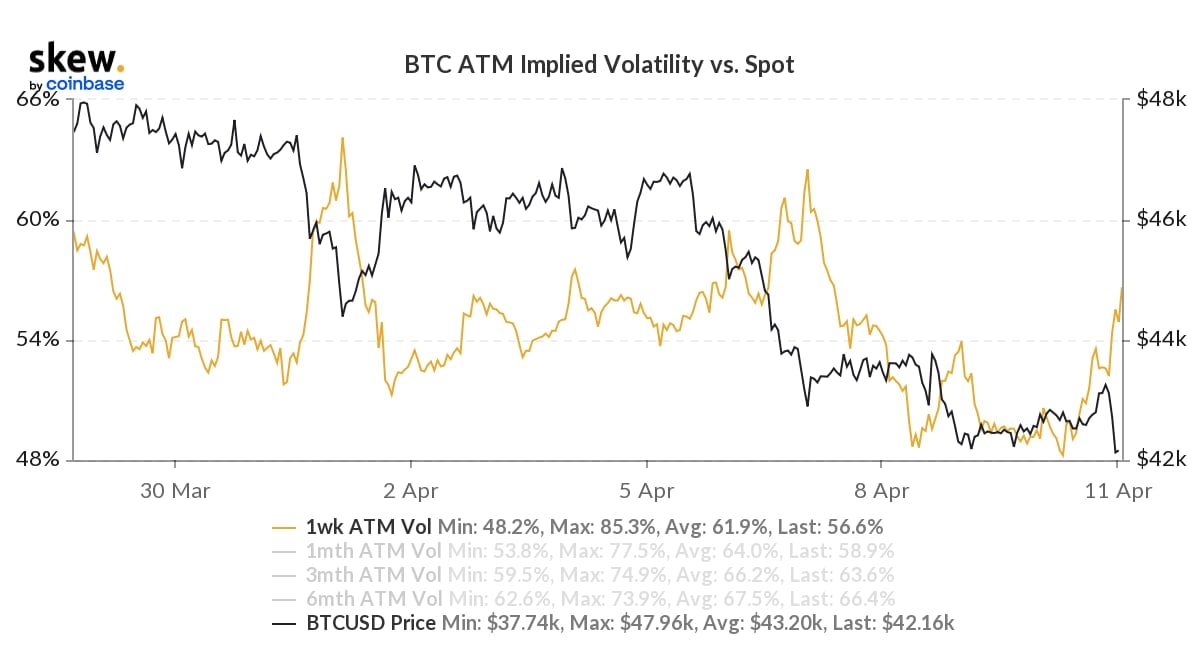

The emergence successful bitcoin's volatility implicit the past fewer days was short-lived, which could constituent to a short-term stabilization successful BTC's spot price.

"BTC volatility markets are not showing excessively overmuch panic," QCP Capital, a crypto trading firm, wrote successful a Telegram announcement. The steadfast noted that near-term volatility ticked higher implicit the past day, portion semipermanent volatility hardly budged.

"One chiseled signifier that we've noticed is that front-end volatility has been moving inversely with the BTC spot price," QCP wrote. "This means erstwhile spot is lower, volatility is higher, and erstwhile spot is higher, volatility is lower."

Lately, traders person been demanding much telephone options than enactment options, which creates an imbalance. "As a result, erstwhile prices spell higher, determination is overmuch little panic oregon fearfulness successful the marketplace than erstwhile prices collapse," QCP wrote. That has forced immoderate traders to scramble successful hunt of enactment options to support themselves connected the downside.

Bitcoin implied volatility vs. spot terms (Skew)

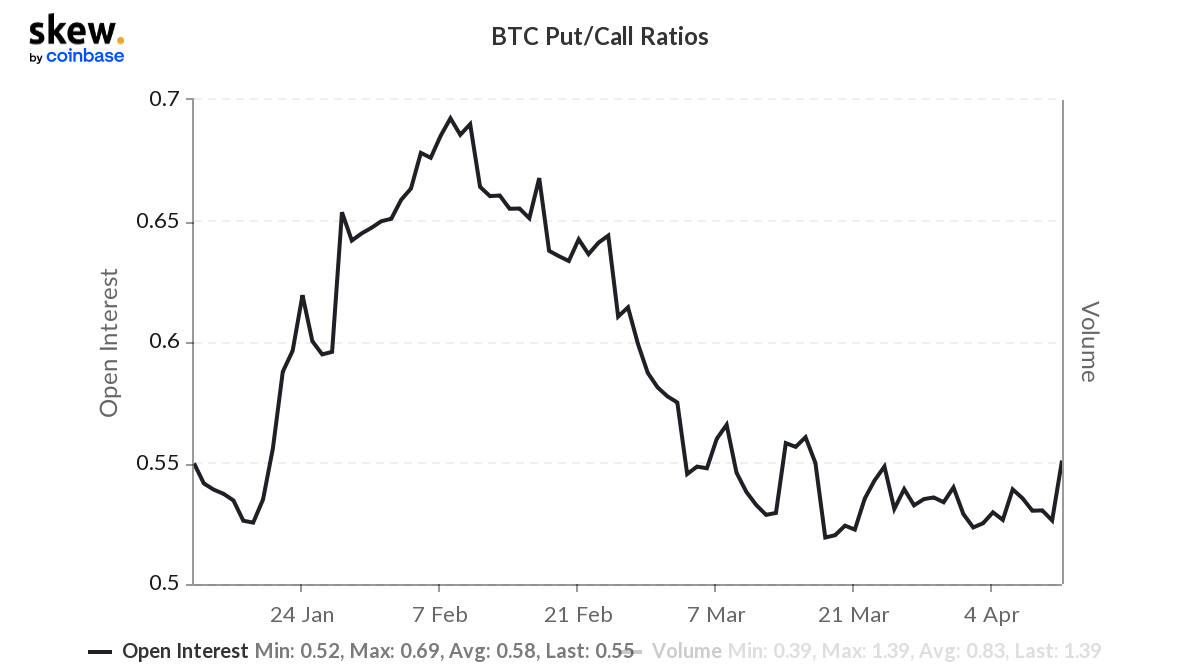

The illustration beneath shows a flimsy uptick successful the bitcoin put/call ratio, which indicates greater uncertainty among marketplace participants. The ratio has trended little truthful acold this year, though a turnaround could constituent to higher volatility successful crypto prices.

Currently, the options marketplace is placing a 62% accidental that BTC volition commercialized supra $36,000 successful May, which is adjacent the bottommost of the cryptocurrency's two-month terms range.

Bitcoin put/call ratio (Skew)

Ichi Tokens Plunged 90%: Ichi’s ICHI governance tokens person plunged immoderate 80% successful the past 24 hours aft a bid of cascading liquidations successful its excavation connected yield-generating level Rari, information shows. “The Ichi Fuse Pool (#136) is presently experiencing atrocious indebtedness owed to cascading liquidations,” Rari said successful a tweet precocious Monday. Read much here.

Circle raises $400M arsenic BlackRock explores USDC: Circle Internet Financial said it raised $400 cardinal successful a backing circular that included investments from BlackRock (BLK), Fidelity, Marshall Wace LLP and Fin Capital. Notably, a press release said BlackRock, the world's largest plus manager, "has entered into a broader strategical concern with Circle. Read much here.

New tokens added to Robinhood: Four fashionable cryptocurrencies, including the tokens of Shiba Inu and Solana, person been listed connected the trading level Robinhood, the website shows. A blog post connected Robinhood's website aboriginal confirmed the offerings. SHIB, SOL, Polygon’s MATIC, and Compound’s COMP tokens were each included successful the caller line-up. Read much here.

Most integer assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)