Most cryptocurrencies traded little connected Wednesday arsenic concerns astir ostentation and geopolitical tensions emanating from Russia's penetration of Ukraine kept immoderate buyers connected the sidelines.

U.S. Federal Reserve Chairman Jerome Powell said connected Wednesday the cardinal slope is connected way to start raising involvement rates this month. "So far, we've seen vigor prices determination up further and those increases volition determination done the system and propulsion up header inflation, and besides they're going to measurement connected spending," Powell said during his grounds earlier the U.S. House Financial Services Committee.

The Thomson Reuters Core Commodity Index is up 30% implicit the past six months, retracing astir 50% of its decade-long downturn. Further, the terms of WTI crude lipid has risen by 20% implicit the past week and reached a decennary precocious supra $100 per barrel. The surge successful commodity prices could constituent to slower economical maturation and greater marketplace volatility.

Meanwhile, Russia continued to equine rocket strikes connected Ukraine and to advance its troops connected Ukraine contempt ongoing negotiations. So far, talks betwixt Russian and Ukrainian officials person not led to a ceasefire.

In crypto markets, BTC spot trading measurement is starting to diminution from the Feb. 24 spike. The ratio of buy-to-sell measurement has been neutral.

Still, immoderate indicators person shown a greater capableness to walk among bitcoin traders, which could trigger an summation successful buying volume.

●Bitcoin (BTC): $43819, −0.32%

●Ether (ETH): $2949, −0.34%

●S&P 500 regular close: $4387, +1.86%

●Gold: $1929 per troy ounce, −0.71%

●Ten-year Treasury output regular close: 1.86%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Analysts are monitoring signs of imaginable buying powerfulness among crypto traders, which could pb to a emergence successful BTC's price.

In down markets, crypto traders typically summation their holdings of stablecoins comparative to bitcoin. Stablecoins are a proxy for accepted dollars successful crypto markets, and are often utilized arsenic a conveyance for entering and exiting bitcoin positions.

Theoretically, a diminution successful the stablecoin proviso comparative to the full bitcoin proviso could yet scope a turning point, assuming that traders are comfy with buying connected terms dips.

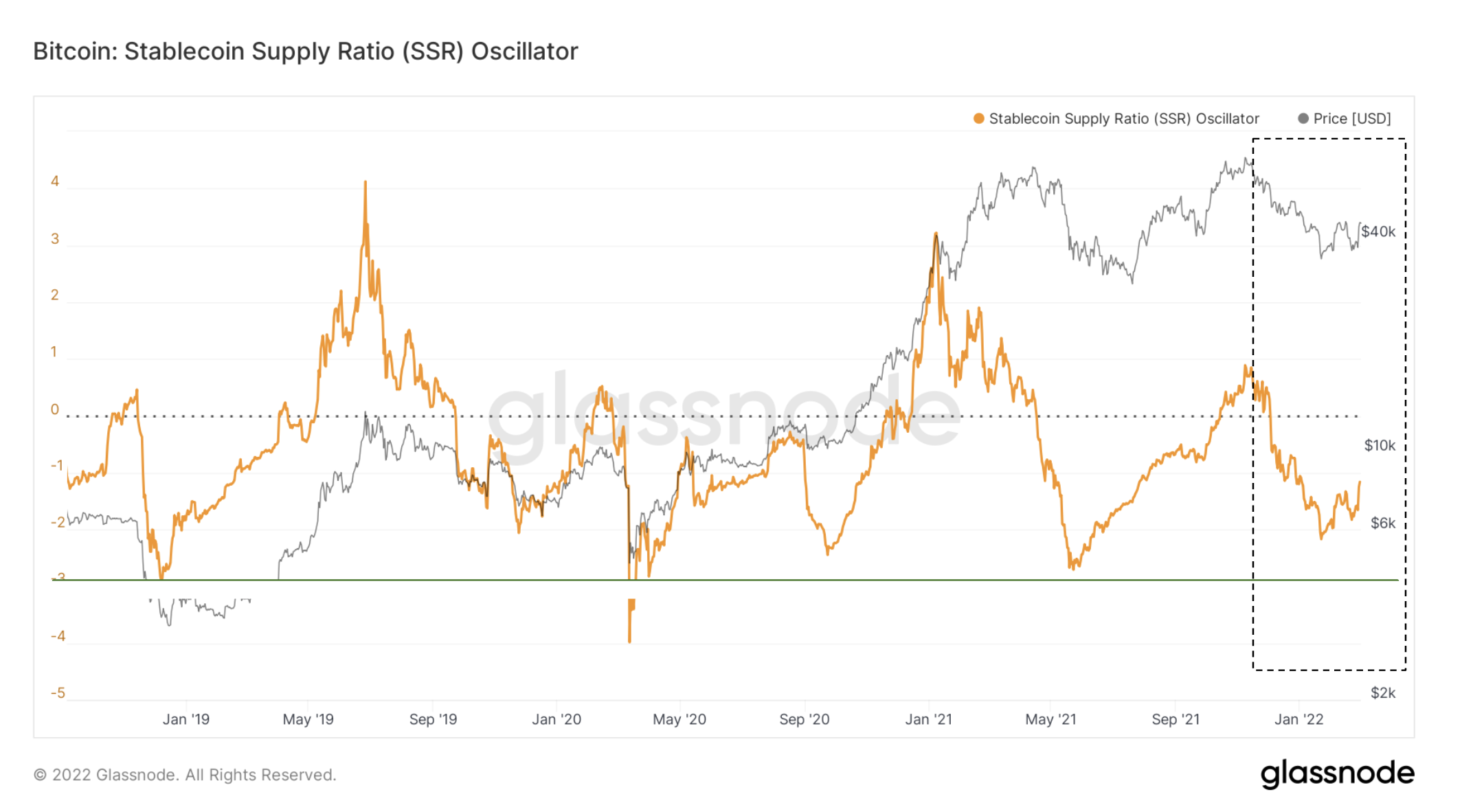

The illustration beneath shows the stablecoin proviso ratio (SSR). The ratio is adjusted to show erstwhile levels person reached an extreme, which typically coincides with peaks and troughs successful price. Currently, the SSR is not astatine an utmost debased but has risen with terms implicit the past week. That could constituent to "the accrued imaginable to propulsion the terms of bitcoin higher," according to Glassnode.

Still, it remains to beryllium seen whether SSR is simply a starring oregon lagging indicator, which means a trader's determination to clasp stablecoins oregon bitcoin could beryllium delicate to abrupt terms changes.

Bitcoin stablecoin proviso ratio (Glassnode)

Terra’s LUNA passes ether to go second-largest staked asset: A terms surge successful Terra’s LUNA token implicit the past week has made it the second-largest staked plus among each large cryptocurrencies successful full worth staked. LUNA surpassed ether (ETH), which has conscionable implicit $28 cardinal successful staked worth astatine the clip of writing. Cross-chain protocol Orion.money holds implicit $2 cardinal successful staked LUNA, the largest among each staking applications that enactment LUNA. Its 43,000 stakers make astir 7% successful yields, according to CoinDesk’s Shaurya Malwa. Read much here.

Ukraine expands crypto donations to judge dogecoin: Ukraine said it would present judge cryptocurrency donations successful dogecoin (DOGE) from supporters of the struggle with Russia – and tagged the billionaire and DOGE promoter Elon Musk successful the tweet announcement. Mykhailo Fedorov, Ukraine’s vice premier curate and curate of integer transformation, tweeted the quality connected Wednesday morning, on with the country’s authoritative DOGE wallet address successful an effort to solicit donations successful the dog-themed cryptocurrency, reported CoinDesk’s Tracy Wang. Read much here.

IMA fiscal plans to commencement selling NFT security successful decentraland: IMA Financial Group, a ample U.S. security broker and wealthiness absorption firm, is opening a probe and improvement installation successful Decentraland, the Ethereum-based virtual satellite wherever Wall Street megabank JPMorgan precocious launched. Denver-based IMA’s foray into the metaverse, dubbed “Web3Labs,” was driven by the accelerated maturation of the non-fungible token (NFT) market, said Justin Jacobs, elder vice president of selling astatine IMA Financial Group and designer of Web3Labs, reported CoinDesk’s Ian Allison. Read much here.

Digital assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)