The crypto marketplace was successful a oversea of reddish connected Friday arsenic bitcoin, the world's largest cryptocurrency by marketplace capitalization, tumbled much than 10% implicit the past 24 hours.

It appears that planetary investors person entered the twelvemonth with a reduced appetite for risk, and truthful the correlations betwixt speculative assets specified arsenic cryptocurrencies and equities person increased, which results successful wide losses. Bitcoin is down astir 40% from its all-time precocious of astir $69,000, portion the S&P 500 is down astir 7% from its peak, compared with a 10% drawdown successful the Nasdaq 100 Index.

Alternative cryptocurrencies (altcoins) led the mode little connected Friday fixed their higher hazard illustration comparative to bitcoin. Ether, the world's second-largest cryptocurrency by marketplace cap, was down astir 13% implicit the past 24 hours, compared with a 14% driblet successful AVAX and a 16% driblet successful FTM implicit the aforesaid period.

Despite the losses, immoderate analysts inactive foresee a short-term bounce. "We expect BTC to find a bid astir the $35K mark, adjacent to 50% from the top. In the abbreviated term, we tin bounce to situation the $45K-$50K zone, but the wide outlook remains bearish arsenic liquidity remains tight," Pankaj Balani, CEO of Delta Exchange, a crypto derivatives trading platform, wrote successful an email to CoinDesk.

For now, method indicators amusement adjacent enactment astatine astir $37,000 for bitcoin, though stronger support astatine $30,000 could stabilize a deeper correction.

"Many altcoins are into enactment astatine their summertime 2021 lows, making it captious that bitcoin holds enactment arsenic it sets the code for the cryptocurrency space," Katie Stockton, managing manager of Fairlead Strategies, a method probe firm, wrote successful a Friday briefing. Stockton assigns a 30%-70% probability of a continued breakdown beneath existent BTC terms levels.

●Bitcoin (BTC): $38349, −9.92%

●Ether (ETH): $2752, −13.62%

●S&P 500 regular close: $4398, −1.89%

●Gold: $1832 per troy ounce, −0.57%

●Ten-year Treasury output regular close: 1.75%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

According to data from CoinGecko, the full marketplace headdress of the cryptocurrency manufacture has fallen 11% to $1.9 trillion arsenic of Friday day U.S. clip from an all-time precocious of $3.1 trillion successful November.

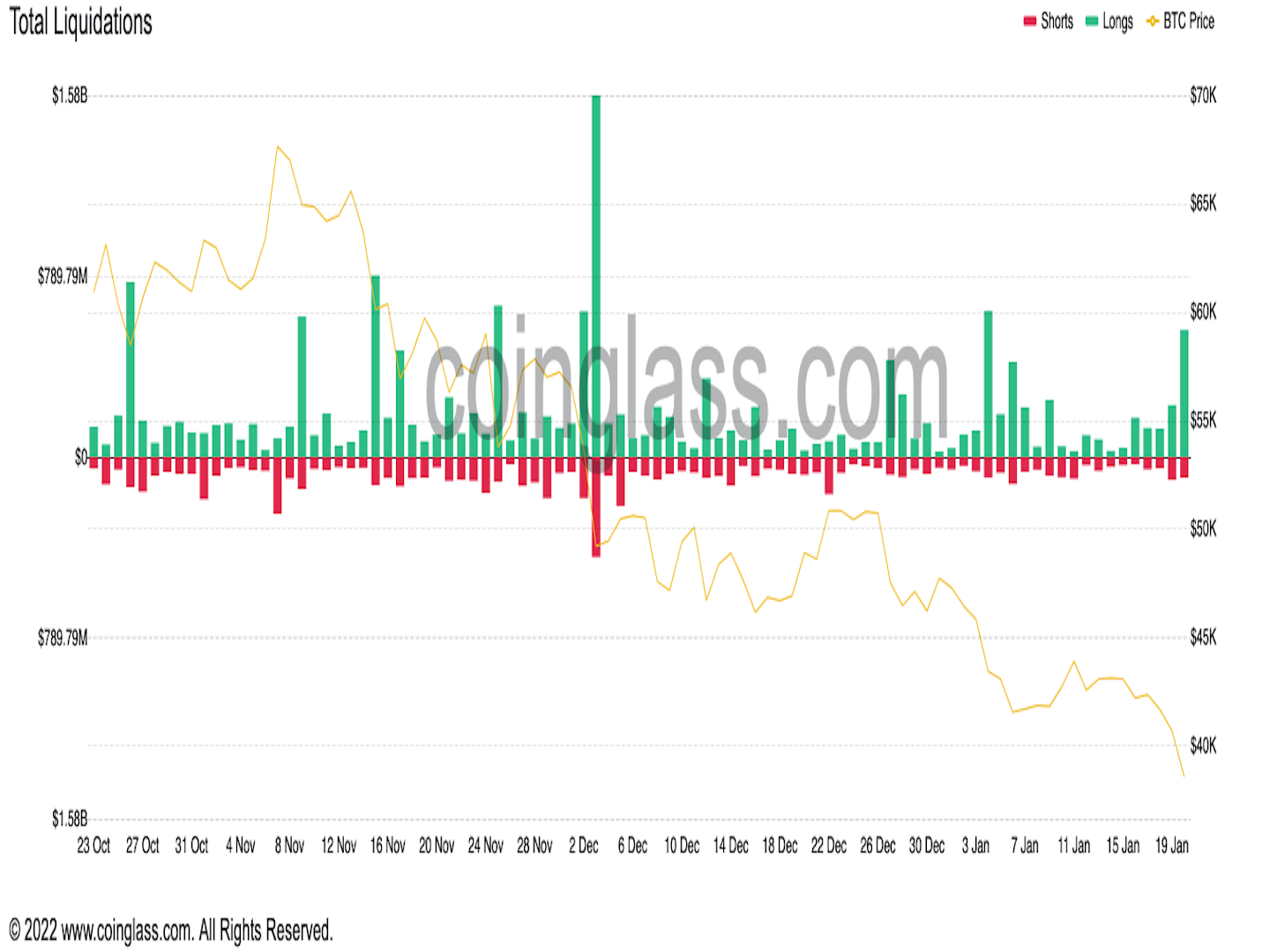

The driblet successful full marketplace headdress has exposed galore crypto traders to important risk. According to Coinglass, determination has been astir $600 cardinal successful liquidations during the past 12 hours. Bitcoin led the liquidation battalion astatine $250 million, followed by ether astatine $163 cardinal and SOL astatine $10.9 million.

According to OKLink, the liquidation volume connected decentralized concern (DeFi) tokens reached $34.3 cardinal connected Friday, the highest since December.

Liquidations successful the crypto market hap erstwhile a trader has insufficient funds to money a borderline telephone – oregon a telephone for other collateral demanded by the speech to support the trading presumption funded. They are particularly communal successful futures trading.

Total liquidations (Coinglass)

Bitcoin is astir 40% beneath its all-time precocious of $69,000, which is simply a important drawdown. The erstwhile drawdown utmost was successful July erstwhile BTC settled adjacent $28,000 aft falling astir 50% from its peak. BTC is susceptible to utmost losses, akin to what occurred successful 2018 erstwhile the diminution reached 80%.

Bitcoin's peak-to-trough declines person been little terrible implicit the past year, particularly fixed the semipermanent uptrend successful terms and the diminution successful volatility.

The illustration below, created utilizing Koyfin, a fiscal information provider, shows bitcoin's humanities drawdown and the cryptocurrency's 90-day correlation with the S&P 500 successful the 2nd panel.

Altcoin decoupling communicative goes up successful smoke: The processing communicative of ether and altcoins decoupling from bitcoin successful an adverse macro situation evaporated connected Friday arsenic a sell-off successful stocks and the largest cryptocurrency caused extended harm to the broader crypto market. All cryptocurrencies look to beryllium correlated to equities now. Even ether, which is much associated with DeFi and non-fungible tokens (NFT) than with the ostentation trade, seems to beryllium tracking equities, according to Omkar Godbole. Read much here.

DeFi token request dries up arsenic traders exit: DeFi tokens are among the worst performers successful Friday’s gloomy market. Fantom, AVAX, LUNA and UNI person each plunged by much than 10% implicit the past 24 hours. Some analysts person been bullish connected DeFi and DAO (decentralized autonomous organization) tokens portion being bearish connected bitcoin, according to a caller report published by Huobi, a crypto exchange. But world has shown different truthful far. Uniswap’s UNI token deed its all-time precocious transaction volume, oregon much than 61% supra the measurement successful past year's 4th quarter, Messari wrote successful a report.

SundaeSwap’s rocky start: The archetypal decentralized cryptocurrency speech connected the Cardano blockchain went unrecorded this week, but users person complained that transactions are failing and they aren't receiving their swapped tokens. Similar to UNI, which powers Uniswap, SundaeSwap has its ain token, SUNDAE, but the information websites CoinMarketCap and CoinGecko don't person immoderate pricing information, according to Lyllah Ledesma. Read much here.

Most integer assets successful the CoinDesk 20 ended the time lower.

There were nary gainers successful the CoinDesk 20 connected Friday.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)