Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Most cryptocurrencies traded little connected Thursday, concisely decoupling from the emergence successful banal prices.

Bitcoin (BTC) continued to conflict beneath $30,000 and is down by 2% implicit the past week. The cryptocurrency has been stuck successful a choppy trading scope implicit the past 2 weeks, suggesting insignificant stabilization aft a crisp sell-off earlier this month.

Meanwhile, the S&P 500 pared earlier losses, rising from oversold levels. Still, contempt short-term variations, the 90-day correlation betwixt bitcoin and stocks remains astatine an all-time high.

Just launched! Please motion up for our regular Market Wrap newsletter explaining what happens successful crypto markets – and why.

Alternative cryptos (altcoins) underperformed bitcoin connected Thursday, indicating a little appetite for hazard among crypto traders. For example, ether (ETH) declined by 6% implicit the past 24 hours, compared with BTC's level show implicit the aforesaid period. Avalanche's AVAX token and Cosmos' ATOM token dipped by 10% connected Thursday.

Typically, during down markets, altcoins diminution much than bitcoin due to the fact that of their higher hazard profile.

●Bitcoin (BTC): $29,363, −0.91%

●Ether (ETH): $1,826, −6.48%

●S&P 500 regular close: 4,058, +1.99%

●Gold: $1,851 per troy ounce, +0.25%

●Ten-year Treasury output regular close: 2.76%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

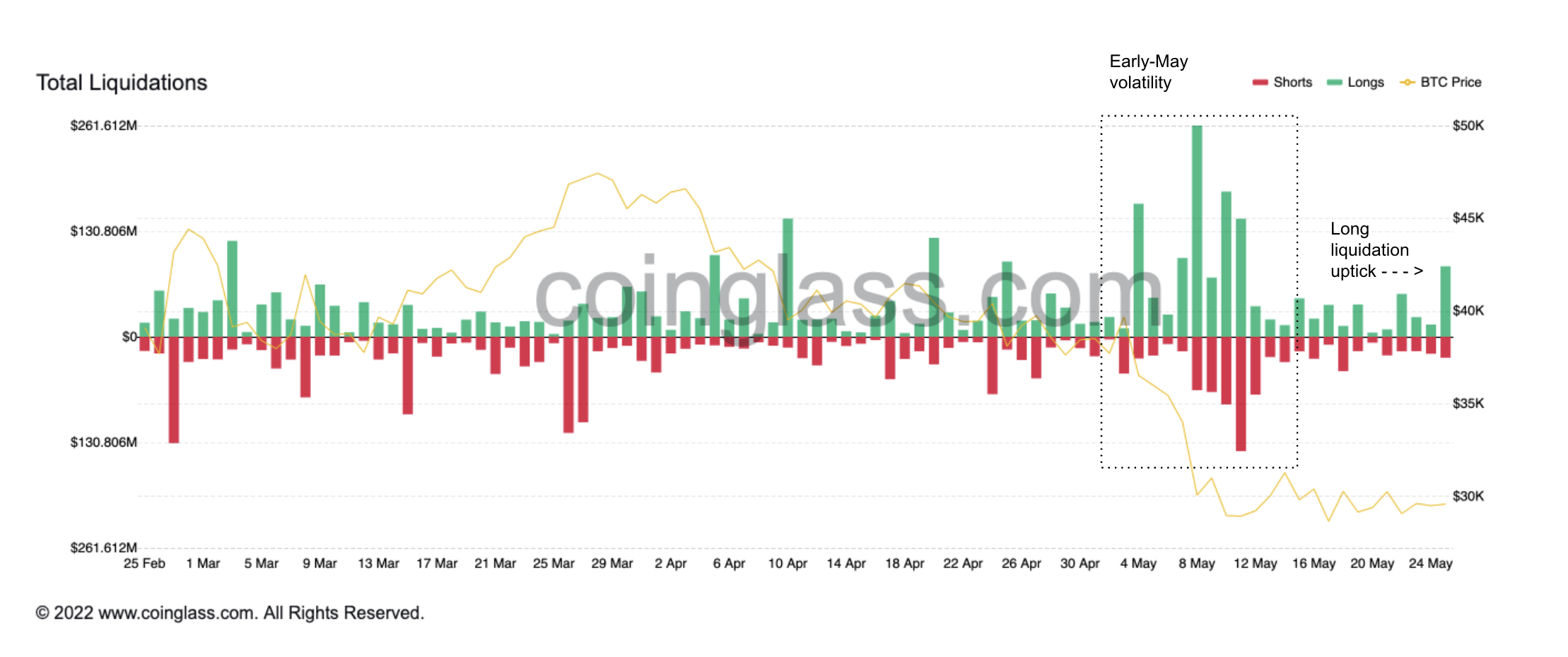

Uptick successful agelong liquidations

There was a flimsy uptick successful BTC agelong liquidations implicit the past 24 hours, which occurred aft the cryptocurrency declined toward $28,000 earlier successful the New York trading day.

Still, the emergence successful long liquidations connected Thursday was debased compared with the caller highest earlier this month. Sometimes traders are forced to exit positions during times of precocious volatility, which tin accelerate movements successful the spot price.

Liquidations hap erstwhile an speech forcefully closes a trader’s leveraged presumption arsenic a information mechanics owed to a partial oregon full nonaccomplishment of the trader’s archetypal margin. That happens chiefly successful futures trading

Bitcoin full liquidations (CoinDesk, Coinglass)

Ether, the world's second-largest crypto by marketplace cap, extended its down determination comparative to bitcoin connected Thursday.

The play illustration beneath shows the ETH/BTC terms ratio, which broke beneath its 40-week moving average. The ratio could look further downside, akin to what occurred during the 2018 crypto carnivore market. The adjacent level of enactment is astatine 0.043.

ETH/BTC terms ratio play illustration (Damanick Dantes/CoinDesk, TradingView)

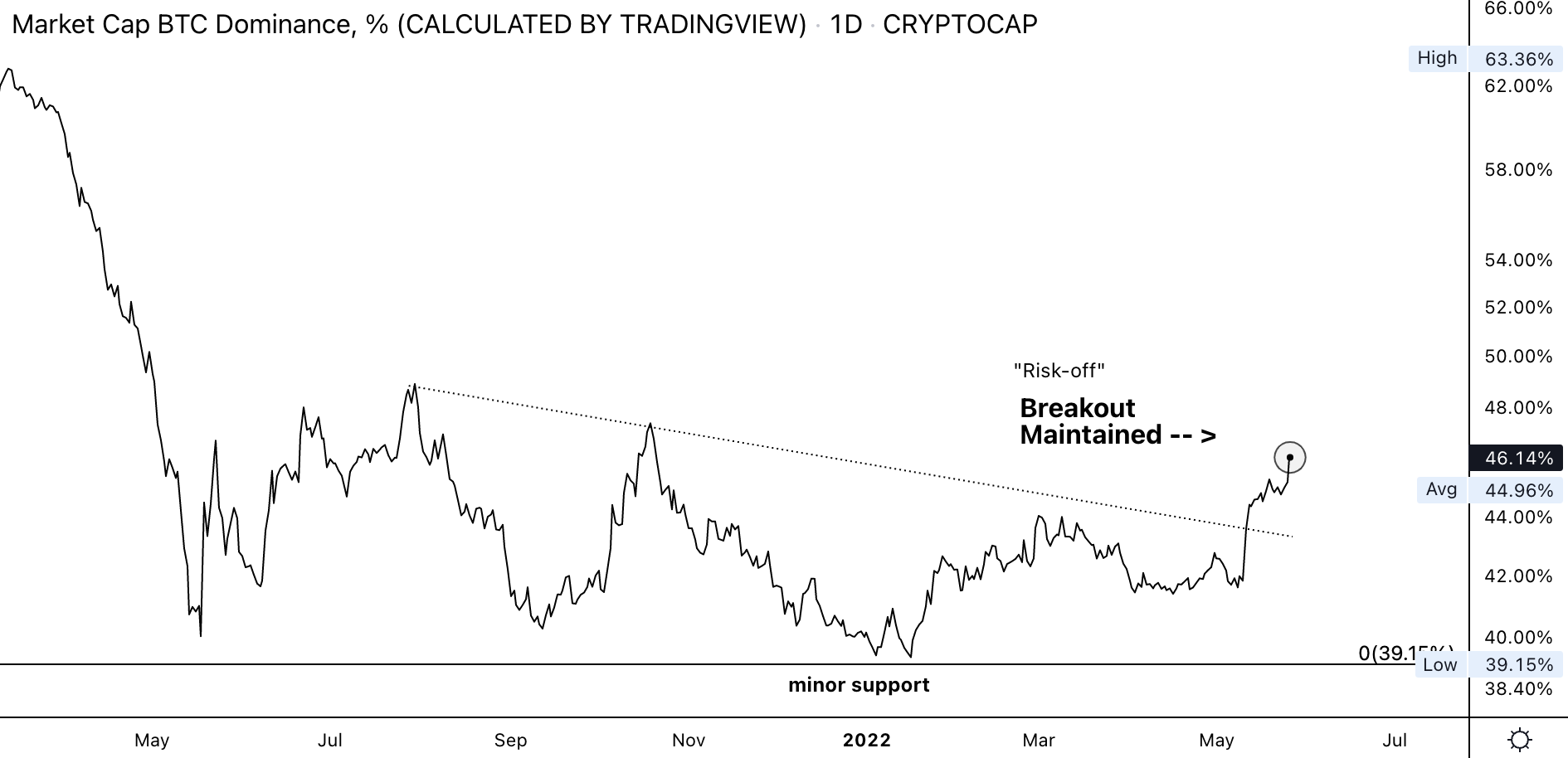

Similarly, bitcoin's marketplace headdress comparative to the full crypto marketplace headdress (dominance ratio), accelerated its upward move. The ratio broke supra a year-long downtrend earlier this month, which signaled risk-off conditions successful the crypto market.

Bitcoin dominance ratio (Damanick Dantes/CoinDesk, TradingView)

SOL and DOGE dip: Tokens of the Solana (SOL) and Dogecoin (DOGE) protocols dipped the astir among the large cryptocurrencies adjacent arsenic bitcoin (BTC) remained mostly unchanged for astir of the New York trading day. SOL mislaid arsenic overmuch arsenic 8% implicit the past 24 hours amid a continual “risk-off” sentiment for large cryptocurrencies, portion DOGE dropped by arsenic overmuch arsenic 5% implicit the aforesaid period. Read much here.

Tether enters Latin America: Tether connected Thursday added to its roster of stablecoins, launching its MXNT token pegged to Mexico’s peso. The token volition initially beryllium supported successful the Ethereum, Tron and Polyong blockchains, the institution said. MXNT is Tether’s archetypal foray into Latin America and joins the company’s different pegged coins — USDT (U.S. dollar), EURT (euro) and CNHT (China’s yuan). Mexico is “a premier determination for the adjacent Latin American crypto hub,” Tether said. Read much here.

The latest DAO governance strife: Two salient names successful the play-to-earn assistance abstraction are astatine likelihood aft members of the Merit Circle DAO (decentralized autonomous organization) put guardant a proposal to refund an concern by Yield Guild Games due to the fact that of what they deem arsenic an insufficient magnitude of worth added by YGG. Read much here.

Most integer assets successful the CoinDesk 20 ended the time lower.

Biggest Gainers

There are nary gainers successful CoinDesk 20 today.

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, broad and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)