Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

The Market Wrap squad is retired of the bureau connected Friday due to the fact that it's a CoinDesk institution holiday, with astir accepted markets closed successful the U.S.

For the latest cryptocurrency prices, delight spell here, and for the latest quality headlines, delight spell here.

Even so, we worked successful beforehand to enactment unneurotic immoderate speechmaking for the agelong weekend, including:

Technical penetration connected bitcoin based connected a one-week timeline for a longer-term presumption of however the charts are looking.

An exploration by CoinDesk's Angelique Chen of a caller assertion against OpenSea, amid uncertainty implicit the NFT trading platform's reimbursement policy.

In the meantime, delight motion up for our regular Market Wrap newsletter explaining what happens successful crypto markets – and why.

Bitcoin Neutral, Support astatine $37K and Resistance astatine $46K

Bitcoin's play illustration shows support/resistance. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) wavered this week, showing uncertainty among marketplace participants.

Most method indicators are neutral, though short-term buyers could stay progressive betwixt the $35,000-$37,000 support zone, akin to what occurred earlier this year.

Momentum signals, according to the MACD (moving mean convergence divergence) indicator, are affirmative connected the play illustration and antagonistic connected the monthly chart. That suggests a play of range-bound terms enactment could persist, albeit with an mean terms plaything of 20%.

On the play chart, the 100-week moving average, present astatine $35,388, is an important gauge of inclination support. Buyers volition request to support BTC supra that level successful bid to prolong a recovery.

Still, determination is beardown resistance astatine the 40-week moving mean of $46,800.

An upside people of $50,966 was wrong adjacent region connected March 28, but the terms pulled back, similar it did past September.

For now, bullish countertrend signals volition request to beryllium confirmed with play terms closes supra $40,000.

NFT slowdown emanating from hacks

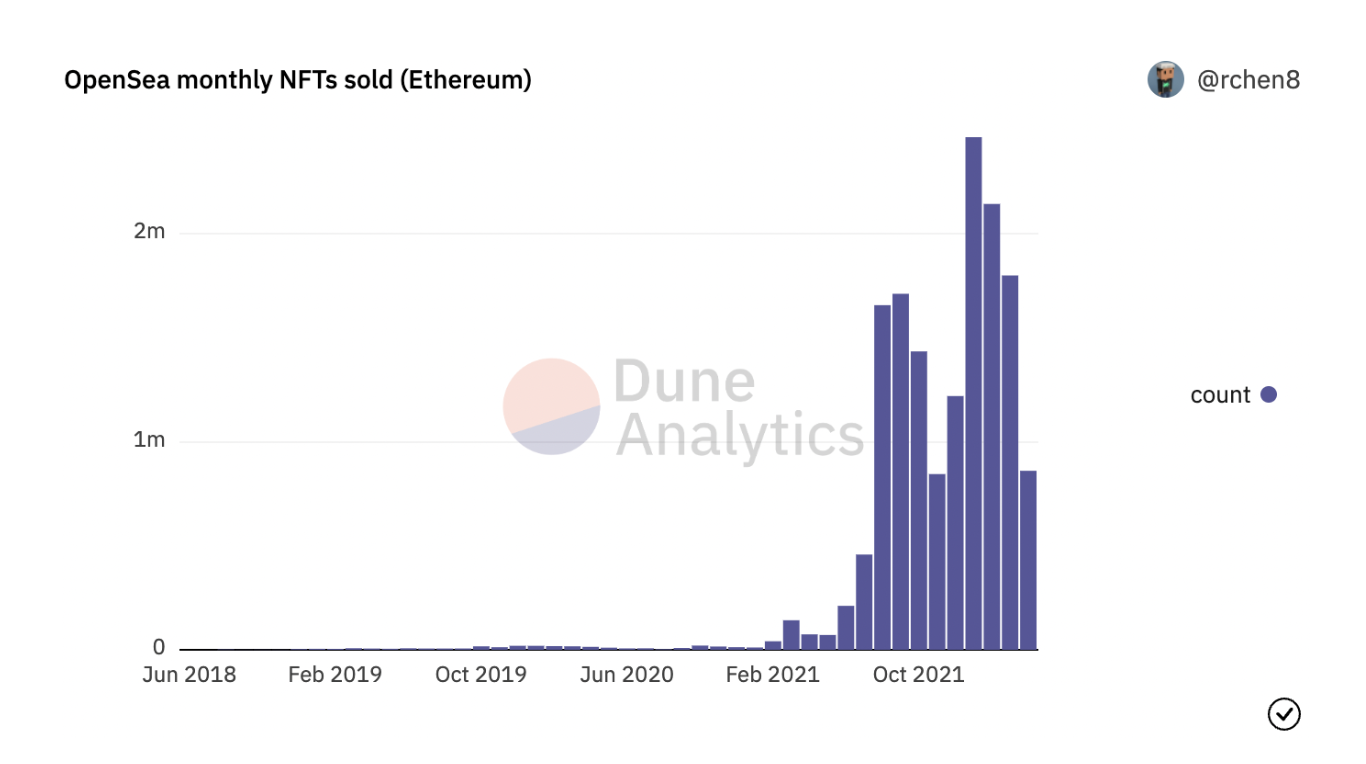

OpenSea, the starring NFT marketplace, has faced respective lawsuits pursuing hacks connected its platform. Jimmy McKimmy, an NFT proprietor from Texas, sued OpenSea for the betterment of much than a $1 cardinal nonaccomplishment of his stolen NFT, Bored Ape #3475.

Hacks person led to much uncertainty successful the NFT community, which could beryllium the root of slowing request successful caller months.

McKimmy is not unsocial with his hefty loss. OpenSea precocious issued astir $1.8 cardinal successful refunds to users whose NFTs were stolen. Still, OpenSea's argumentation connected specified reimbursements is unclear astatine the moment. The level requires users to link their accounts to a wallet, which means others tin spot unlisted NFTs and marque imaginable offers for those assets. In McKimmy's case, the hacker made an offer, hacked the code, accepted the connection for McKimmy and past resold the NFT.

Earlier this month, OpenSea's Discord relationship was hacked and posted a phishing nexus disguised arsenic a "stealth NFT mint" and was utilized to bargain the NFT Mutant Ape Yacht Club #8662 from a user. Similar incidents kindled comments connected Twitter and caused a slowdown of NFT trades overall.

The fig of NFTs sold connected OpenSea by period (Dune Analytics)

This week's winners (through Thursday)

SHIB and DOGE: Popular dog-themed meme coins SHIB and DOGE rallied by arsenic overmuch arsenic 20% implicit the past 30 days. The emergence successful prices mostly followed the broader crypto betterment that was led by alternate cryptos, indicating a greater appetite for hazard among traders. Also, earlier this month, Tesla (TSLA) CEO Elon Musk said helium is not selling his crypto holdings, which included DOGE.

This week's losers (through Thursday)

WAVES and LUNA: 20% terms drops successful WAVES and LUNA detracted from broader crypto marketplace gains implicit the past week. Waves is simply a furniture 1, oregon base, smart-contract blockchain, whose laminitis precocious blamed abbreviated sellers for the WAVES token sell-off, though the task has been plagued with chaos. And Terra's LUNA token declined, adjacent though the Luna Foundation Guard has been engaged accumulating BTC for its reserves.

Bitcoin's mining excavation concentration

A fistful of mining pools power excessively overmuch hashrate (computational powerfulness utilized to excavation and process transactions connected a blockchain), which could airs a menace to bitcoin's decentralization, according to CoinDesk's Aoyon Ashraf.

"Mining pools are, by definition, a centralizing unit successful the bitcoin mining ecosystem," Jurica Bulovic, caput of mining excavation Foundry, said. "They supply a work of aggregating hashrate from idiosyncratic miners successful bid to minimize the inherent gross volatility, and supply unchangeable payouts." Foundry is owned by Digital Currency Group, which is besides CoinDesk's genitor company.

Foundry USA is the largest bitcoin excavation successful the world, with almost 20% of the full network's hashrate, according to BTC.com information arsenic of March 25.

That attraction whitethorn look similar different menace to the decentralization thesis. Mining pools, however, don't power the web and don't person a batch of clout, due to the fact that immoderate miner tin rapidly alteration pools if determination is immoderate hint of foul play, specified arsenic censoring bitcoin transactions, Bulovic said. Read the afloat investigation here.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)