Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Bitcoin (BTC) was astir level connected Monday, portion immoderate alternate cryptos (altcoins) underperformed, indicating a little appetite for hazard among traders.

LUNA, Terra's governance token, declined by 18% implicit the past 24 hours, compared with a 6% driblet successful GALA and a 5% diminution successful AVAX and DOT implicit the aforesaid period. Typically, alts diminution much than bitcoin successful down markets due to the fact that of their higher hazard profile.

Still, the uptick successful trading measurement during past week's sell-off coupled with fading volatility could constituent to a little upswing successful crypto prices.

Just launched! Please motion up for our regular Market Wrap newsletter explaining what happens successful crypto markets – and why.

Technical indicators suggests a anemic terms betterment for bitcoin, which requires different play adjacent supra $30,000 to promote buying activity. Still, the betterment could slice astatine astir $33,000-$35,000 due to the fact that of antagonistic momentum signals connected the charts.

Meanwhile, Terraform Labs CEO Do Kwon released a “revival plan” to prevention the Terra web aft past week’s meltdown. Kwon projected forking Terra into a caller concatenation without terraUSD (UST). The program could spell into effect if token holders o.k. it. Read much here.

During past week's UST de-peg, "other large stablecoins specified arsenic USDC, BUSD and DAI experienced a 1% to 2% premium arsenic investors moved toward assets they perceived were little astatine hazard of contagion," Glassnode wrote successful a blog post. That suggests, for now, that risks surrounding UST person been contained.

●Bitcoin (BTC): $29,727, −1.98%

●Ether (ETH): $2,017, −3.39%

●S&P 500 regular close: $4,010, −0.36%

●Gold: $1,823 per troy ounce, +0.88%

●Ten-year Treasury output regular close: 2.88%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Uptick successful trading activity

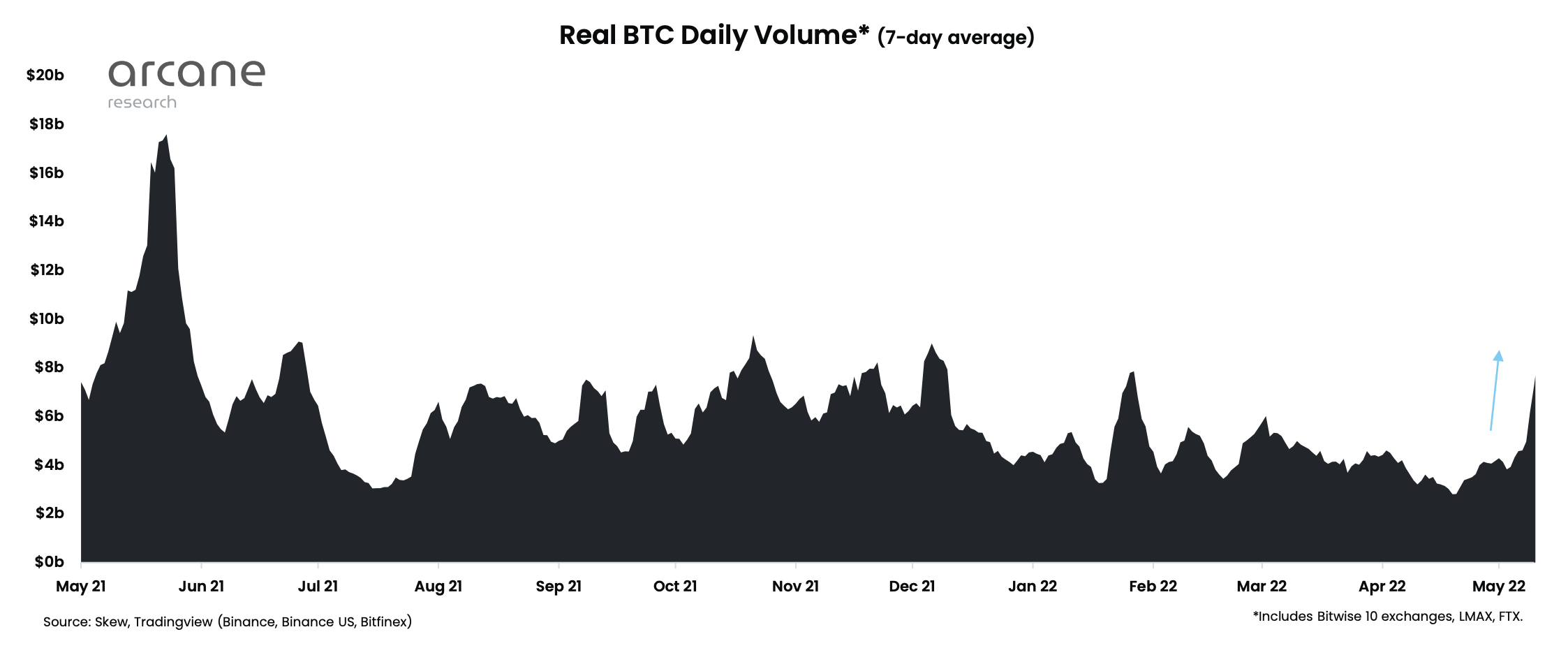

Bitcoin's mean trading measurement past week roseate toward its highest level since January. That happened during a clip of utmost bearish sentiment.

Trading measurement declined implicit the past weekend, but remains elevated – astir doubly arsenic precocious the mean measurement levels recorded successful April, according to Arcane Research.

Still, successful the futures market, bitcoin's unfastened interest, oregon the full fig of derivatives contracts outstanding connected the Chicago Mercantile Exchange, continues to diminution from its caller highest connected March 28. That suggests the caller sell-off emanated from trading enactment successful the spot marketplace alternatively than from leveraged traders successful the futures market, though liquidations person accelerated the downward terms moves.

Bitcoin's trading measurement (Arcane Research)

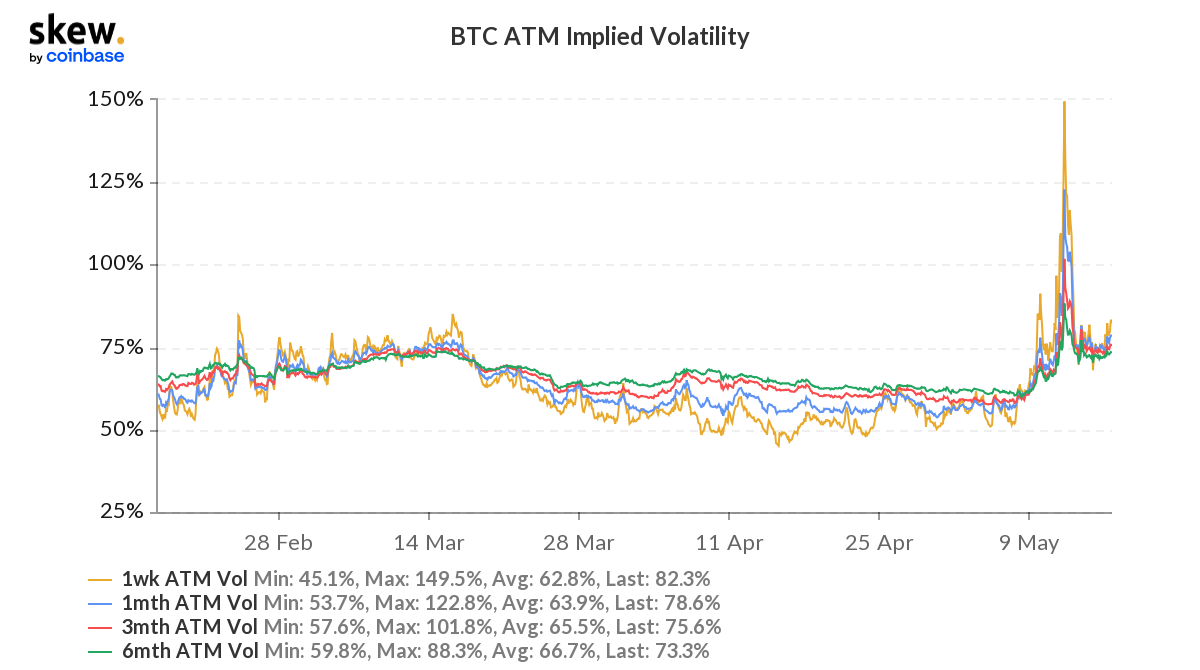

Bitcoin's implied volatility besides remains elevated pursuing past week's sell-off. Further, intraday volatility reached its highest level since May of past year, according to Arcane Research.

"The cardinal contributor to surging intraday volatility tends to beryllium monolithic destabilizing effects successful derivatives with leveraged positions unwinding, causing knock-off effects successful each associated markets," Arcane wrote.

Typically, volatility spikes are short-lived, particularly if terms declines stabilize. Some traders stay cautious due to the fact that of the anemic betterment successful crypto and equity prices pursuing past week's sell-off.

QCP Capital, a Singapore-based crypto trading firm, stated that it intends to support agelong volatility positions unfastened successful anticipation of choppy markets, according to a caller Telegram announcement. The steadfast is watching for quality connected the fallout from the Terra stablecoin debacle, which could beryllium a root of further volatility successful the future.

Still, others are looking for opportunities to slice the spike successful volatility. "In the abbreviated term, spot prices person apt bottomed retired portion enactment volatility apt peaked," Greg Magadini, CEO of Genesis Volatility, wrote successful a blog post connected Sunday.

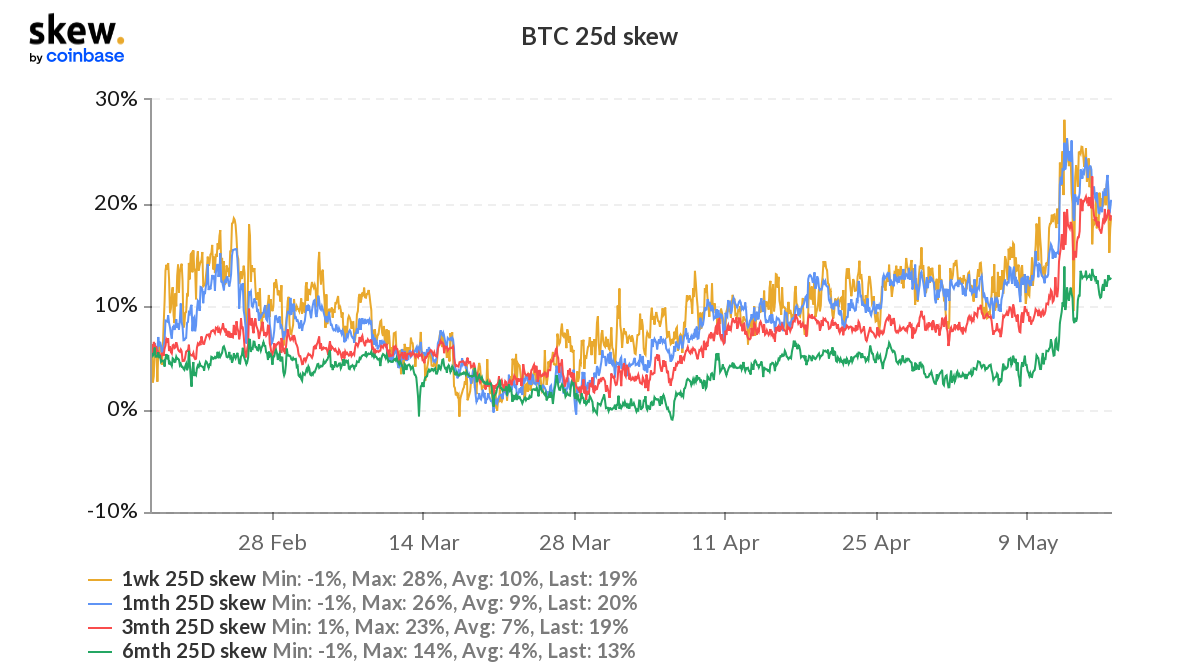

"Should prices find stableness and bounce violently higher, fading the skew is simply a premier volatility trade," Magadini wrote, referring to the anticipated diminution successful the comparative volatility of enactment options versus telephone options.

Bitcoin's implied volatility (Skew)

Bitcoin's 25-delta skew (Skew)

Morgan Stanley warns astir NFTs: The slope said non-fungible tokens (NFTs) whitethorn beryllium the adjacent portion of crypto requiring re-evaluation aft DeFi (decentralized finance) tokens and stablecoins saw liquidations, “as it is becoming clearer that each the elevated prices were traded connected speculation, with constricted existent idiosyncratic demand.” Read much here

UST reserves evaporates: Luna Foundation Guard, the nonprofit that was expected to prevention Terra’s stablecoin UST successful a crisis, broke its multiday soundlessness and confirmed that its reserve that was erstwhile $3 cardinal mostly held successful bitcoin has dwindled to $100 million. As UST fell into a decease spiral, LFG said that it sold the reserve to reconstruct UST’s peg and denied allegations that it bailed retired insiders with it. Earlier, blockchain analytics steadfast Elliptic tracked the wealth to large exchanges Gemini and Binance. Read much here

Investors fly stablecoins: As the marketplace tries to tummy crypto’s Lehman Brothers infinitesimal aft UST’s implosion, astir stablecoins saw dense outflows arsenic investors mislaid confidence. Tether (USDT) has mislaid $8 cardinal successful marketplace headdress successful May, and the proviso of dai (DAI) dropped 20% and frax (FRAX) astir halved, according to CoinMarketCap data. Meanwhile, the Fantom blockchain’s algorithmic stablecoin, Deus Finance's dei, mislaid its peg during the day. Read much here

Listen 🎧: The CoinDesk Markets Daily podcast squad is backmost to sermon what a caller measure connected crypto mining mightiness means for New York’s economy.

Most integer assets successful the CoinDesk 20 ended the time lower.

Biggest Gainers

Biggest Losers

`

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, broad and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)