Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Bitcoin (BTC) concisely roseate supra $30,000 connected Tuesday, extending its weeklong trading scope higher.

Most cryptocurrencies look to beryllium stabilizing alongside stocks, which indicates a intermission successful bearish sentiment among traders. Some method indicators applied to BTC and the S&P 500 stay successful oversold territory, though semipermanent charts suggest constricted upside from here.

Some alternate cryptos (altcoins) rallied connected Tuesday, albeit wrong a six-month downtrend. For example, Solana's SOL token roseate by arsenic overmuch arsenic 2% implicit the past 24 hours, compared with a 3% emergence successful BTC implicit the aforesaid period. Still, SOL is down by 50% implicit the past month, compared with a 35% driblet successful ether (ETH) and a 27% diminution successful BTC.

Just launched! Please motion up for our regular Market Wrap newsletter explaining what happens successful crypto markets – and why.

On the regulatory front, Alessio Evangelista, subordinate manager for enforcement astatine the U.S. Treasury Department's Financial Crimes Enforcement Network, spoke astatine a Thursday league wherever helium directed the crypto manufacture to proactively blacklist “problematic” wallets. Also, concern ministers from the Group of Seven (G-7) ample developed economies are preparing to telephone for faster planetary crypto regulations, according to Reuters.

In accepted markets, stocks were mixed, portion gold, a accepted harmless haven asset, ticked higher. Meanwhile, the U.S. dollar turned little aft reaching its highest level successful 4 years past week.

●Bitcoin (BTC): $29,998, +2.56%

●Ether (ETH): $1,995, +1.20%

●S&P 500 regular close: $3,901, −0.58%

●Gold: $1,842 per troy ounce, +1.42%

●Ten-year Treasury output regular close: 2.85%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Bitcoin's comparative strength

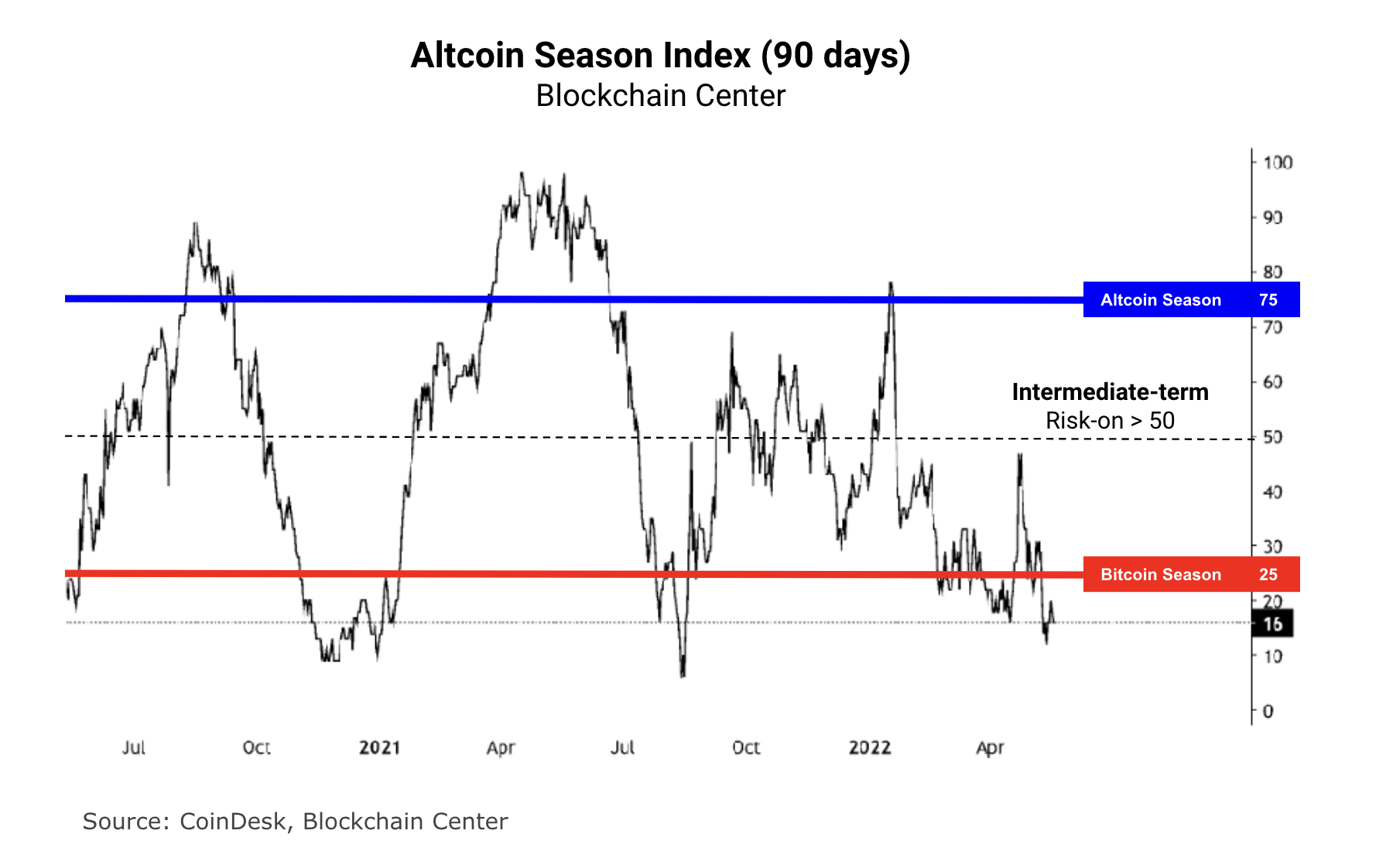

Bitcoin has been outperforming different cryptos implicit the past fewer months, which indicates a little appetite for hazard among traders.

Typically, bitcoin declines little than altcoins successful a down marketplace due to the fact that of its little hazard illustration comparative to smaller tokens. The other is existent successful a rising market.

Only 15% of the apical 50 altcoins person performed amended than bitcoin implicit the past 90 days, according to the Blockchain Center. That indicates an aversion to risk.

Over time, however, a sustained rally successful altcoins could awesome a risk-on environment, akin to what occurred successful January and August of past year.

Altcoin's play scale (CoinDesk, Blockchain Center)

The illustration beneath shows the bitcoin dominance ratio, oregon BTC's marketplace headdress comparative to the full crypto marketplace cap. The ratio broke supra a short-term downtrend past week and continues to tick higher. A sustained speechmaking supra 50% would awesome a risk-off situation akin to what occurred successful 2018.

Bitcoin's dominance ratio (Damanick Dantes/CoinDesk, TradingView)

Hashed Wallet takes a $3.5B deed aft Terra's LUNA collapse: Delphi Digital says LUNA tokens accounted for 13% of its assets nether absorption astatine their peak, portion Hashed, an early-stage task firm, appears to person mislaid implicit $3.5 billion. It's the latest fallout from the nonaccomplishment of assurance successful Terra's UST stablecoin. Further, local media successful South Korea study that much than 200,000 investors successful the state clasp Terra-related tokens. South Korea’s newly elected president, Yoon Suk-yeol, is pro-crypto and has promised a regulatory model for the plus class. Read much here.

Tether chopped commercialized insubstantial reserve by 17%: The simplification occurred successful the archetypal quarter, according to its latest attestation report. The simplification successful commercialized insubstantial has continued with a further 20% chopped since April 1, which volition beryllium reflected successful the second-quarter report, Tether announced Thursday. On June 30, 2021, commercialized insubstantial and certificates of deposit totaled $30.8 billion, oregon 49% of Tether's assets astatine that time. Read much here.

Magic Eden tops OpenSea successful regular trading volume: The Solana non-fungible token (NFT) marketplace is opening to find its stride, with regular transactions connected the ecosystem’s starring marketplace, Magic Eden, present topping OpenSea, its Ethereum blockchain counterpart. According to play information from DappRadar, Magic Eden has seen astir 275,000 regular transactions, which includes purchases, bids and listings, compared with OpenSea’s 50,000, according to play information from DappRadar. Read much here.

Most integer assets successful the CoinDesk 20 ended the time higher.

Biggest Gainers

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, broad and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

UPDATE (May 18 20:45 UTC): Adds accusation connected the U.S. banal markets and their declines.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)