Most cryptocurrencies traded higher implicit the past 24 hours, albeit with ample terms swings aft the U.S. Federal Reserve raised involvement rates for the archetypal clip since 2018.

The Fed besides boosted its ostentation forecasts and signaled plans to rise involvement rates successful akin increments six much times this year. Low rates and cardinal slope stimulus person contributed to rallies crossed speculative assets, including cryptocurrencies.

Bitcoin (BTC) fell astir 3% instantly pursuing the Fed announcement, but rapidly pared losses toward the extremity of the New York trading day. Similar terms moves were seen successful the S&P 500, portion Treasury yields and the U.S. dollar pared earlier gains.

The cardinal slope besides announced that it volition trim its equilibrium expanse of enslaved holdings "at a coming meeting," not specifying whether it volition hap astatine the adjacent gathering successful May. Over time, analysts expect higher volatility and little marketplace returns arsenic a effect of tighter monetary policy.

Meanwhile, connected Wednesday, Ukrainian President Volodymyr Zelenskyy legalized crypto successful the country. The instrumentality determines the ineligible status, classification, ownership and regulators of virtual assets. Ukraine has received astatine slightest $100 million successful crypto donations implicit the past 3 weeks from radical who privation to enactment its defence and assistance money humanitarian efforts.

●Bitcoin (BTC): $40,771, +2.41%

●Ether (ETH): $2,741, +2.93%

●S&P 500 regular close: $4,358, +2.24%

●Gold: $1,927 per troy ounce, −0.07%

●Ten-year Treasury output regular close: 2.19%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

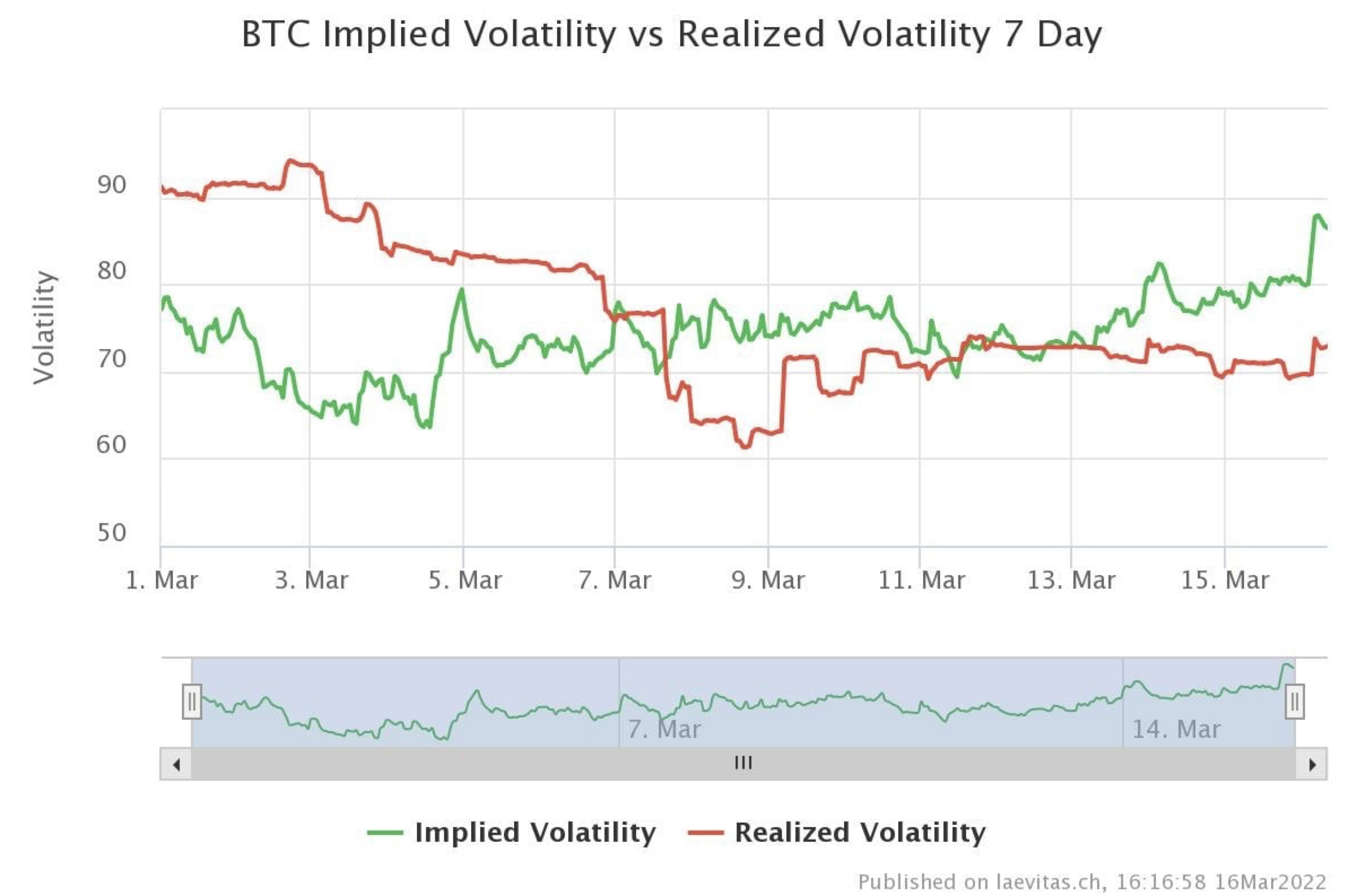

The illustration beneath shows elevated BTC implied volatility versus realized volatility, which means bitcoin traders person positioned themselves for an summation successful terms swings implicit the past week.

Lately, determination has been ample request for longer-dated options toward June-December, coupled with accrued enactment successful ETH enactment options, according to QCP Capital, a Singapore-based crypto trading firm. QCP expects BTC's volatility curve to steepen aft the Fed determination arsenic traders discount short-term terms price swings.

The options marketplace has placed a 52% probability that BTC volition commercialized supra $38,000 successful April, according to Skew data.

Bitcoin implied versus realized volatility (QCP Capital)

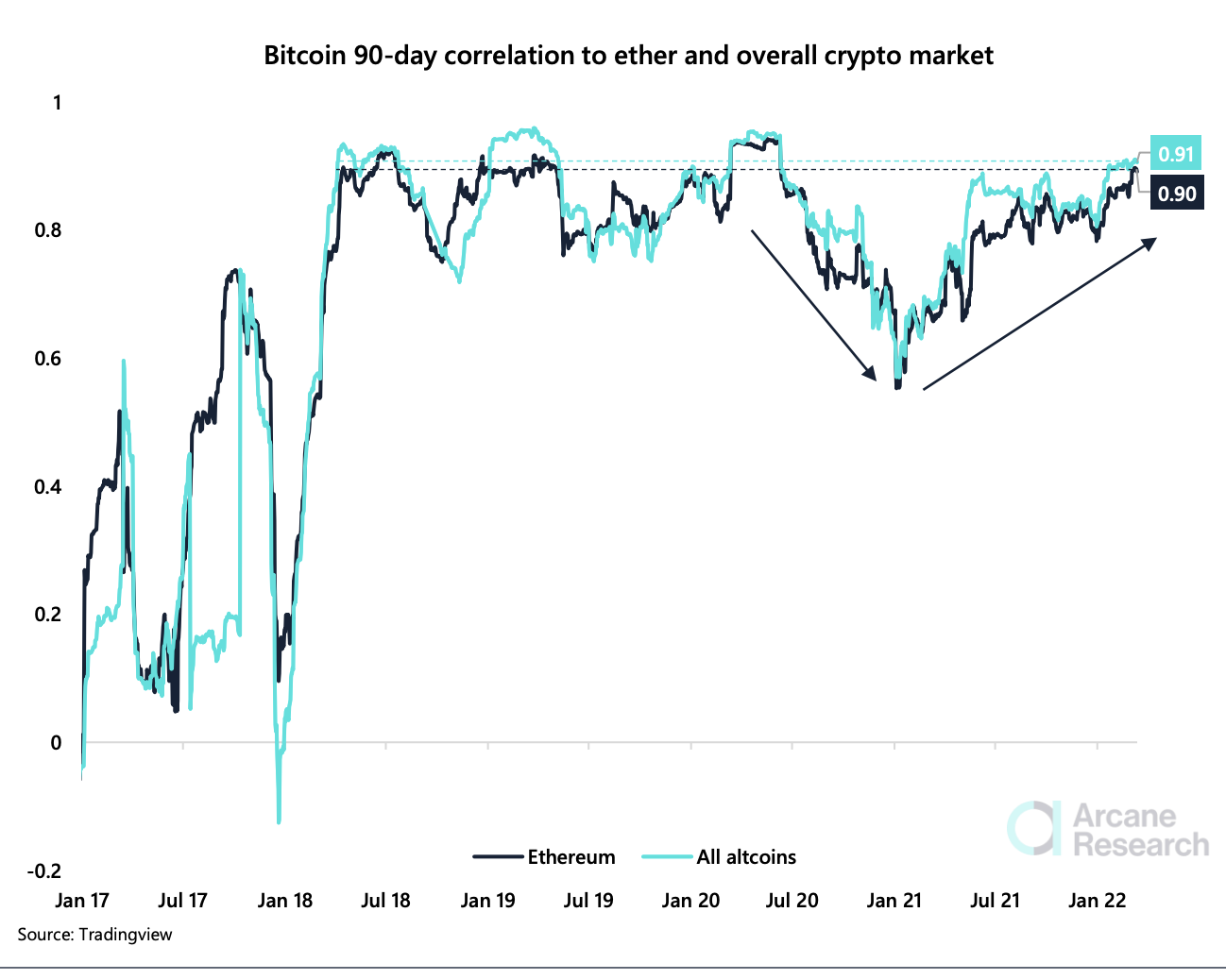

Bitcoin's 90-day correlation with the wide crypto marketplace is adjacent all-time highs, which makes it hard for investors who privation to diversify crossed tokens.

Generally, altcoins outperform during bull markets due to the fact that they person a greater hazard illustration comparative to bitcoin. And during down markets, bitcoin outperforms arsenic investors trim their vulnerability to risk. So, erstwhile correlations are high, determination is little accidental to trim volatility successful a crypto portfolio, which is wherefore immoderate traders person remained connected the sidelines.

Rising correlations "paint a representation of an wide risk-averse sentiment successful the market," Arcane Research wrote successful a caller report. "In the summertime of 2020, the correlation was headed downwards, caused by bitcoin's spot compared to altcoins. The correlation bottomed successful Jan. 2021, earlier it grew arsenic altcoins began moving much inline with bitcoin."

Since cryptos person moved successful the aforesaid absorption implicit the past year, determination is little tendency among traders to rotate into altcoins, according to Arcane Research. That could heighten bitcoin's outperformance comparative to altcoins.

Bitcoin correlation to ETH and altcoins (Arcane Research)

GRT station rally: GRT, the superior token connected the Graph ecosystem, is up 23% implicit the past week owed to the continuing subgraph migration from Ethereum to the Graph's mainnet. The Graph besides announced past Friday plans to grant grants to assistance the migration until the extremity of March. Also, the Graph Day, the protocol’s yearly convention, volition beryllium held connected June 2, fostering treatment astir Web 3 innovation.

Fantom’s FTM terms jump: The announcement of upcoming protocol updates triggered FTM, the superior token connected the Fantom Network, to emergence arsenic overmuch arsenic 10% implicit the past 24 hours. Fantom is simply a layer 1 blockchain level that powers decentralized concern (DeFi) applications. The instauration down Fantom plans to heighten its web with little representation consumption, improved retention capabilities and caller information features. Read much here.

DeFi level Aave launches mentation 3 with cross-chain swaps: The Aave Companies announced Wednesday the motorboat of Aave v3 crossed six antithetic blockchains. Headlining the caller features are cross-chain “portals,” isolated markets that volition let the protocol to amended vie with permissionless counterparts and a “high efficiency” mode enabling precocious loan-to-value borrowing connected prime assets, according to CoinDesk's Andrew Thurman. Read much here.

Digital assets successful the CoinDesk 20 ended the time higher.

There are nary losers successful CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)