Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Most cryptocurrencies precocious connected Wednesday, shaking disconnected immoderate of the bearish sentiment implicit the past fewer days.

Bitcoin (BTC), the world's largest cryptocurrency by marketplace cap, returned to supra $40,000, portion alternate cryptos outperformed. For example, THORChain's RUNE token rallied by 12% implicit the past 24 hours, compared with a 4% emergence successful BTC implicit the aforesaid period. AAVE, GRT and AVAX were each up by much than 8% connected Wednesday.

Just launched! Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

Stocks besides traded higher connected Wednesday portion the 10-year Treasury output pared earlier gains. Still, gold, a accepted harmless haven asset, ticked higher, indicating immoderate uncertainty among investors.

In crypto, immoderate buyers person remained connected the sidelines contempt caller terms bounces. "Investor spending behaviour appears to beryllium switching from dominance of nonaccomplishment realization, towards a humble magnitude of nett taking – 58% of bitcoin transaction measurement is presently realizing a profit," Glassnode, a crypto information firm, wrote successful a blog post.

●Bitcoin (BTC): $41104, +4.47%

●Ether (ETH): $3090, +3.82%

●S&P 500 regular close: $4447, +1.12%

●Gold: $1981 per troy ounce, +0.45%

●Ten-year Treasury output regular close: 2.69%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

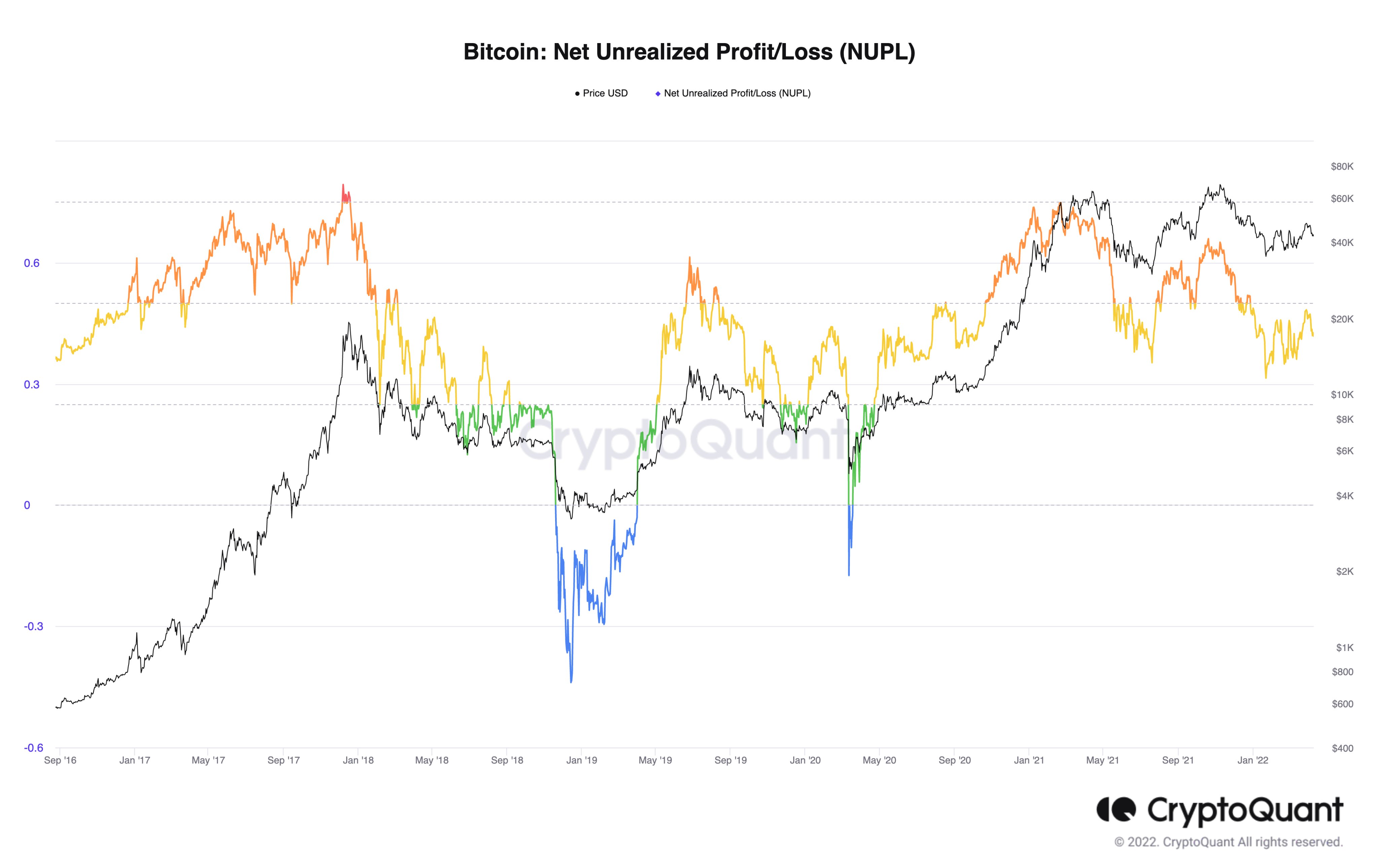

The illustration beneath shows bitcoin's nett unrealized profit/loss indicator (NUPL), which is utilized by immoderate analysts to spot inflection points successful BTC's price.

In theory, the marketplace tends to attack a terms debased erstwhile a bulk of BTC traders' positions are successful a nonaccomplishment (token terms has decreased beneath outgo basis). The other is existent erstwhile BTC trades acold supra the mean traders' outgo basis.

Currently, the NUPL indicator is neutral, akin to mid-2018 and mid-2020. The past large rhythm precocious was seen astir the January and November 2021 terms peaks, which preceded the latest 50% sell-off successful BTC's price. A terms low, however, has not been triggered, which antecedently occurred connected precocious measurement down moves acold beneath the mean traders' outgo ground astir $30,000-$40,000 BTC.

For now, upside could beryllium constricted contempt short-term terms jumps.

Bitcoin nett unrealized profit/loss (CryptoQuant)

Ethereum merge nary longer expected successful June: After a fewer weeks of speculation, Ethereum halfway developer Tim Beiko confirmed successful a tweet Tuesday that the long-awaited Ethereum Merge volition travel aboriginal than expected. Instead of June, Beiko said that the network's modulation to proof-of-stake is much apt to travel “in the fewer months after.” In a tweet helium said: “It won't beryllium June, but apt successful the fewer months after. No steadfast day yet, but we're decidedly successful the last section of [proof-of-work] connected Ethereum,” according to CoinDesk’s Sam Kessler. Read much here.

Terra's anchor protocol to motorboat connected Polkadot DeFi hub Acala: Terra’s fashionable decentralized concern (DeFi) protocol Anchor is coming to Polkadot’s Acala network. The concern comes arsenic Polkadot looks to turn its DeFi adoption and Anchor expands into caller blockchains. According to a property release, Acala and Karura, a Polkadot parachain, volition grow Anchor’s collateral options for the UST stablecoin with liquid DOT (LDOT) and liquid KSM (LKSM), according to CoinDesk’s Tracy Wang. Read much here.

Tether’s USDT stablecoin enters Polkadot ecosystem with Kusama launch: Tether (USDT), the largest of the dollar-pegged stablecoins with a marketplace capitalization of over $80 billion, is launching connected Kusama, a strategy of parallel blockchains that serves arsenic Polkadot’s “canary network.” Stablecoins are a blistery taxable close now, with recent quality of BlackRock (BLK), the world’s largest plus manager, taking an involvement successful USDC, Tether’s closest rival successful presumption of circulating supply, according to CoinDesk’s Ian Allison. Read much here.

Chinese Banking Associations Target NFTs: As the marketplace heats up, the tokens are progressively nether the microscope successful China.

Most integer assets successful the CoinDesk 20 ended the time higher.

Top Gainers

Top Losers

There are nary losers successful CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)