It has been a choppy trading week for cryptocurrencies, which kept immoderate buyers connected the sidelines. Stocks were besides nether unit arsenic tensions betwixt Russia and Ukraine escalated.

On Friday, a occurrence broke retired astatine Ukraine’s Zaporizhzhia nuclear powerfulness plant, and conditions astir the installation stay unstable. The incidental kept planetary investors connected edge, contributing to further gains successful lipid prices and accepted harmless haven assets specified arsenic golden and the U.S. dollar.

Technical indicators are mostly neutral for bitcoin, though a important nonaccomplishment of upside momentum connected semipermanent charts points to continued selling pressure. Still, the cryptocurrency could stabilize astir the $37,000-$40,000 enactment portion implicit the abbreviated term.

"I americium cautiously optimistic," Timothy Brackett, a method expert astatine The Markets Compass, said during an interrogation connected CoinDesk TV's "First Mover" amusement this week. Brackett pointed to signs of improving short-term momentum and cardinal enactment levels that person kept the bull marketplace intact implicit the agelong term.

Meanwhile, different analysts suggest volatility could summation this month, which could trigger further terms swings.

●Bitcoin (BTC): $39,418, −5.96%

●Ether (ETH): $2,610, −6.74%

●S&P 500 regular close: $4,329, −0.79%

●Gold: $1,971 per troy ounce, +1.90%

●Ten-year Treasury output regular close: 1.72%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

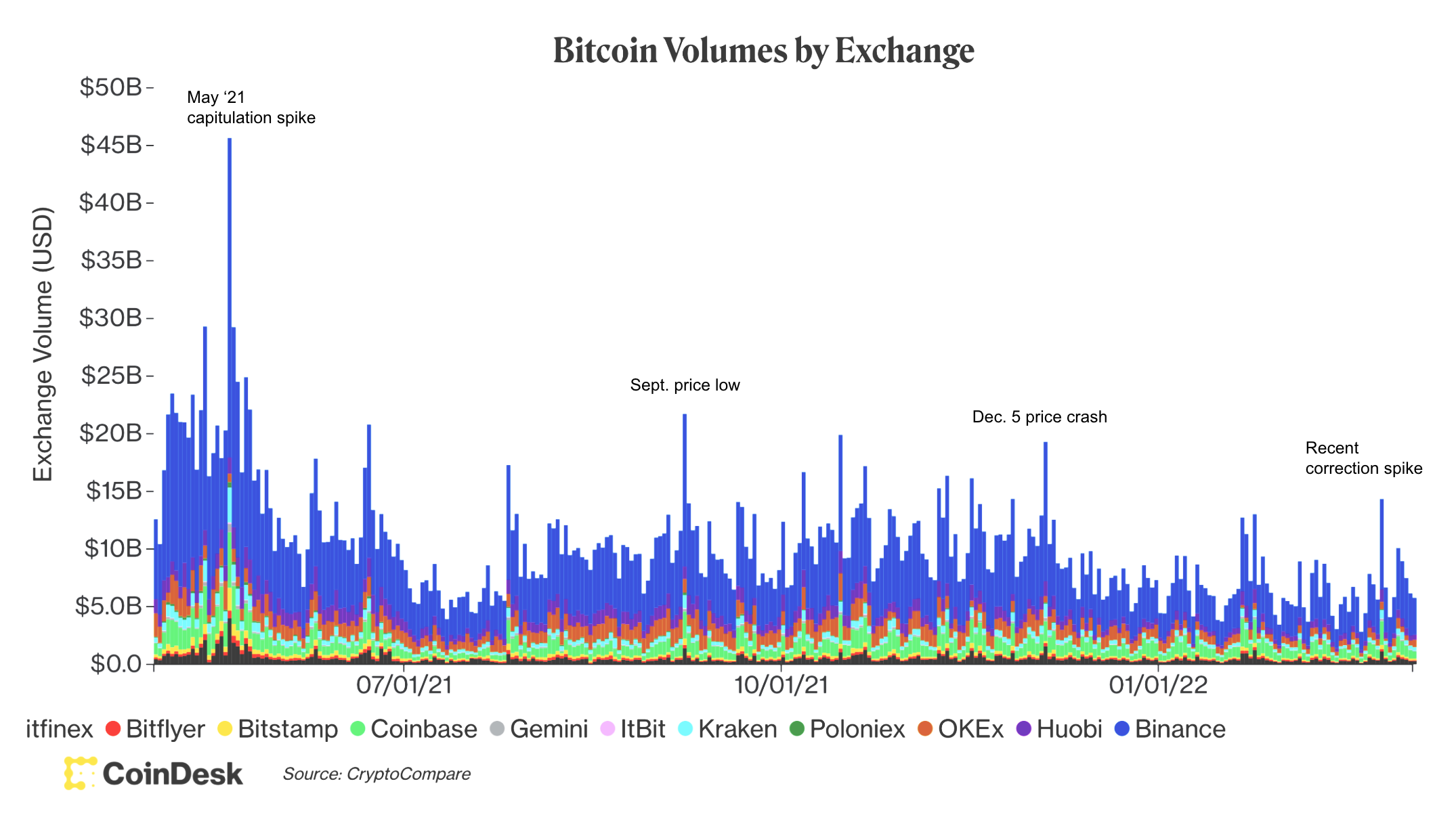

The illustration beneath shows a diminution successful bitcoin's trading measurement crossed spot exchanges, according to CoinDesk data.

Typically, ample measurement spikes during sell-offs coincide with terms lows. Over the past fewer months, measurement spikes person been insignificant comparative to the May 2021 extreme. Further, agelong liquidations and open interest successful the bitcoin futures marketplace stay steady, indicating small absorption among marketplace participants to caller terms moves.

Bitcoin volumes by speech (CoinDesk, CryptoCompare)

Potential volatility spike

"Despite the immense magnitude of uncertainty successful the market, enactment volatility is comparatively inexpensive twelvemonth implicit year," Gregoire Magadini, co-founder of Genesis Volatility said during an interrogation with CoinDesk.

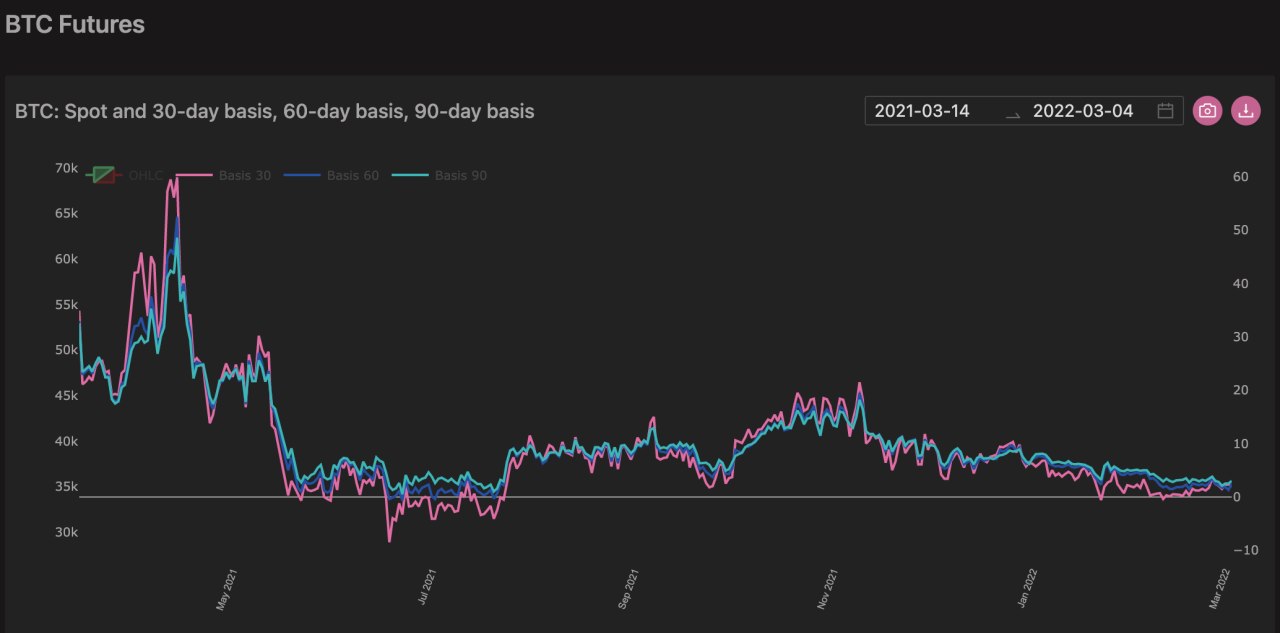

"BTC volatility is known to spike connected terms drops. May 2021 is simply a cleanable example. I deliberation the imaginable for an upside volatility spike is being underestimated by the market," Magadini said. He besides expects the futures basis to rally from 3% to 15% successful the coming months, particularly if spot prices determination higher.

"We added to our longer-term options position, selling the volatility spike post-invasion," QCP Capital, a crypto trading firm, wrote successful a Telegram chat, referring to Russia's penetration of Ukraine. The steadfast has been tactically accumulating a agelong volatility position, "expecting outsized volatility" going into the U.S. Federal Reserve gathering March 16-17.

Bitcoin futures ground (Genesis Volatility)

Algorand upgrade: The Algorand blockchain released a large method upgrade designed to enactment cross-chain interoperability and let developers to easy physique analyzable decentralized applications (dapps) based connected its network. The upgrade introduces astute contract-to-contract calling, which allows applications to efficiently interact with different astute contract-based products. Algorand's ALGO token is down 4% implicit the past week, compared with a 3% summation successful BTC implicit the aforesaid period. Read much here.

CVS enters the metaverse: The drugstore concatenation plans to connection virtual medicine drugs, wellness products and different merchandise authenticated by NFTs. CVS (CVS) lays assertion to “downloadable virtual goods, namely, a assortment of user goods, medicine drugs, health, wellness, quality and idiosyncratic attraction products and wide merchandise for usage online and successful online virtual worlds." Metaverse tokens including Decentraland's MANA and The Sandbox's SAND are down arsenic overmuch arsenic 6% implicit the past week. Read much here.

ANC powers on: Anchor, the decentralized wealth market, remained successful the spotlight aft its ANC token gained 22% implicit the past 24 hours. Henrik Andersson, co-founder of Australia-based crypto-asset concern steadfast Apollo Capital, said that ANC's rally is owed to a operation of ANC offering a precocious yearly percent output (APY) and talks of caller tokenomics.

Digital assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)