Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Cryptocurrencies were mixed Friday, though selling unit from earlier successful the week appeared to beryllium gaining steam.

Bitcoin (BTC) traded little aft failing to interruption supra $44,000 during the New York trading day. Meanwhile, NEAR, the cryptocurrency powering furniture 1 blockchain Near, roseate by arsenic overmuch arsenic 20% implicit the past 24 hours. WAVES declined by 10% and XRP was down by 3% implicit the aforesaid period.

The dispersion successful crypto returns suggests uncertainty among traders aft a adjacent 7% dip successful BTC implicit the past week. Further, alternate cryptos (altcoins) person fallen successful and retired of favour arsenic capitalist sentiment shifts betwixt bullish and bearish.

Just launched! Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

Elsewhere, the S&P 500 was astir level connected Friday, portion accepted harmless havens specified arsenic golden and the U.S. dollar traded higher. The 10-year Treasury output reached a caller three-year precocious astatine 2.7% arsenic investors reduced their vulnerability to bonds amid rising ostentation and higher involvement rates.

●Bitcoin (BTC): $42775, −1.63%

●Ether (ETH): $3243, +0.49%

●S&P 500 regular close: $4489, −0.26%

●Gold: $1948 per troy ounce, +0.73%

●Ten-year Treasury output regular close: 2.71%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

The bitcoin futures marketplace has been comparatively quiet, which suggests that BTC's 30% emergence from its Jan. 24 debased astir $33,000 was driven by spot traders.

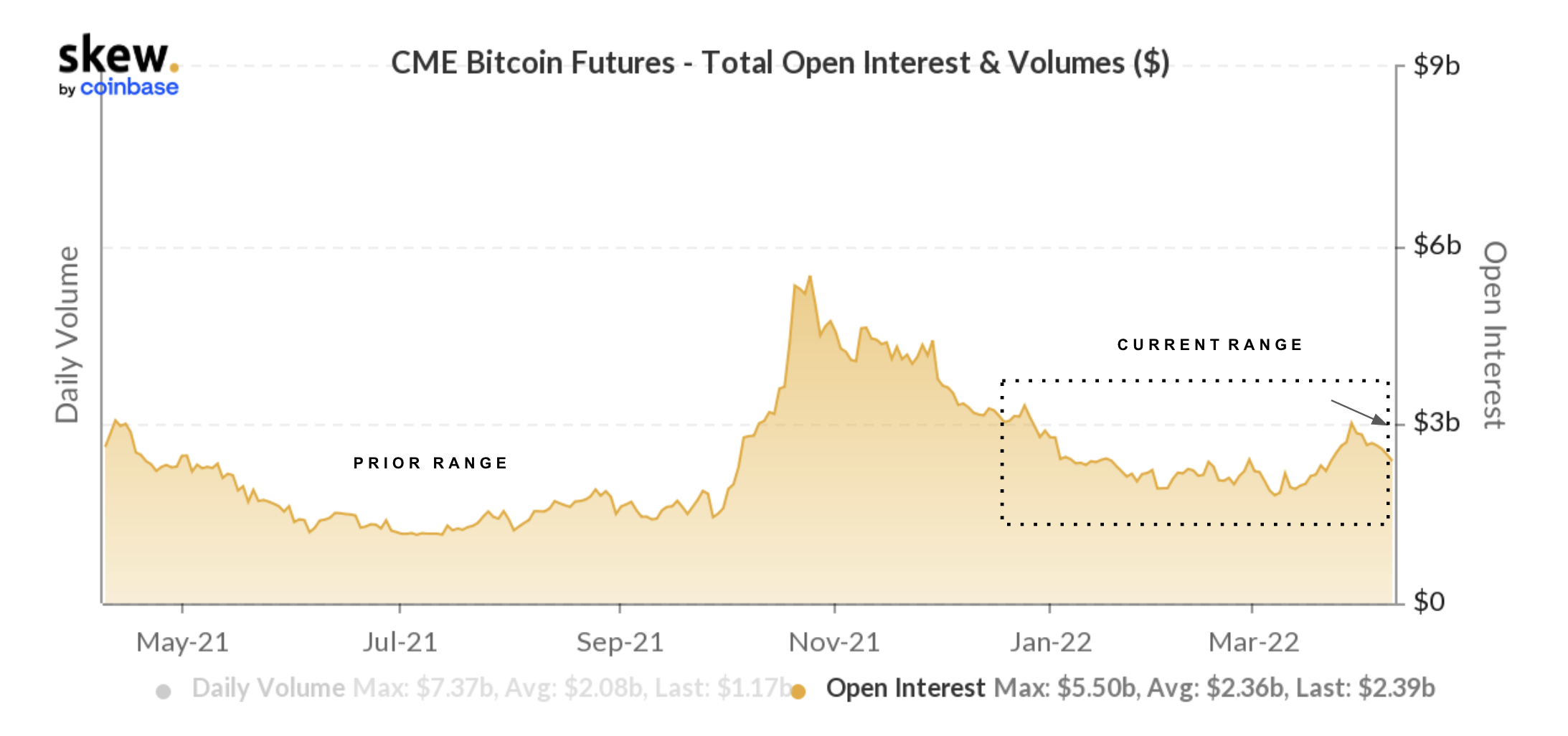

The illustration beneath shows bitcoin's full unfastened interest, oregon fig of outstanding derivative contracts connected the Chicago Mercantile Exchange (CME), which has ticked little implicit the past week. Participation successful the bitcoin futures marketplace has waned since highest levels successful November of past year, which preceded a 50% driblet successful BTC's price.

Still, the existent level of unfastened involvement is higher than its erstwhile scope betwixt May and September of 2021.

CME bitcoin futures unfastened involvement (skew)

Analysts besides pointed to a simplification successful leverage among bitcoin futures traders, which indicates little condemnation down the latest terms recovery.

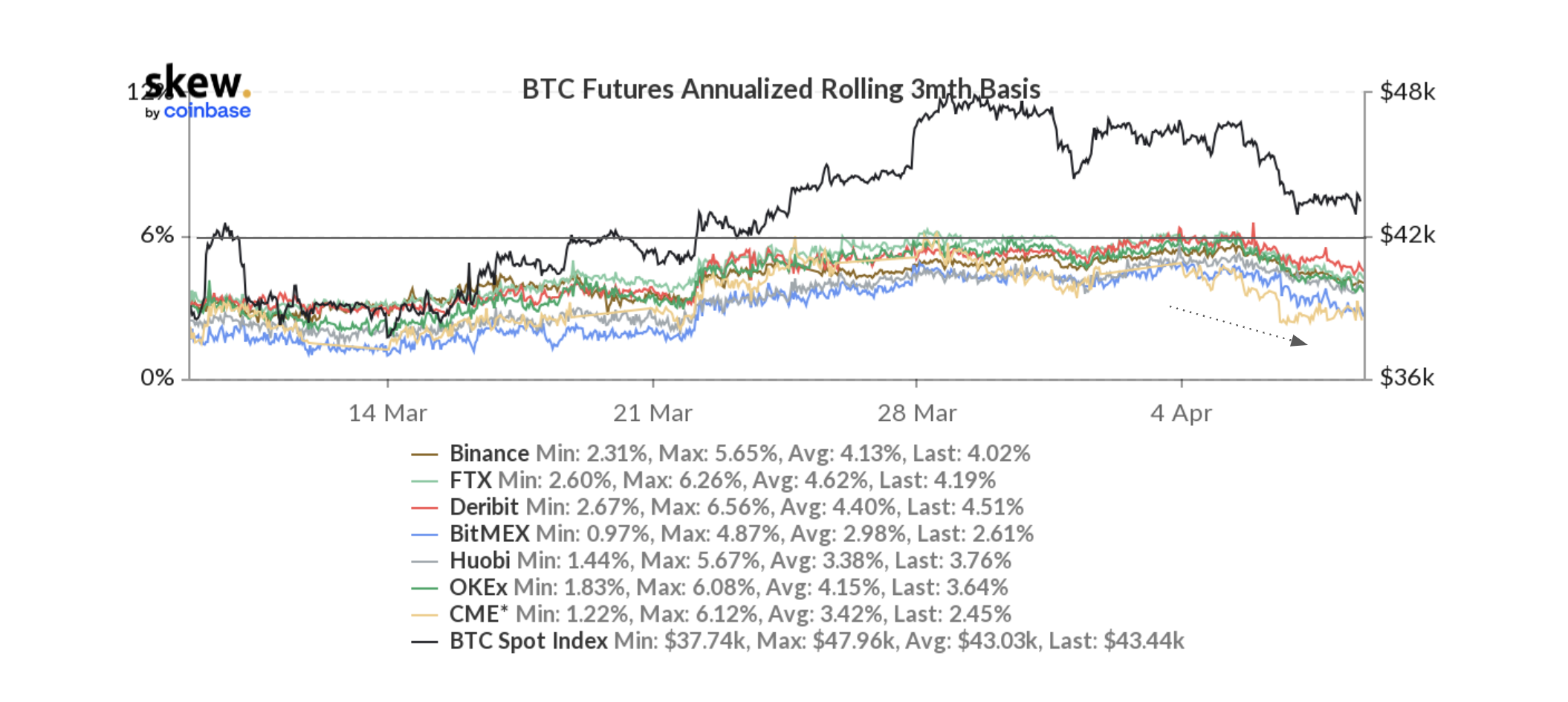

Further, BTC's annualized rolling three-month basis, oregon the comparative quality betwixt the terms of the aboriginal declaration and the spot price, has declined crossed large exchanges implicit the past 2 weeks. That indicates uncertainty among traders astir the aboriginal terms of bitcoin.

Bitcoin futures annualized three-month ground (skew)

Axie Infinity builder takes ‘full responsibility’ for $625M Ronin hack: “These are the players who trusted us, and we failed to unrecorded up to that trust,” Sky Mavis co-founder Aleksander Larsen said connected CoinDesk TV Friday. To forestall further exploits, Sky Mavis is adding much validators to Ronin. Axie Infinity's token AXS is down 20% implicit the past week. Read much here.

DeFi elephantine Yearn leads the mode connected ERC-4626 token modular adoption: Yearn Finance, a vault-based, decentralized output aggregation platform, has go the archetypal large protocol to publically enactment the adoption of ERC-4626, providing a level of legitimacy and encouragement for others successful the abstraction to commencement exploring the usage of ERC-4626. Yearn's token YFI is down 76% from its all-time precocious successful May of past year, compared with a 30% peak-to-trough diminution successful ETH. Read much here.

Top U.S. slope watchdog issues informing connected stablecoins: The wildly antithetic approaches the crypto manufacture has taken to designing and hosting stablecoins whitethorn beryllium bully for innovation but atrocious for applicable and harmless usage, argued Michael Hsu, the acting main of the Office of the Comptroller of the Currency. Read much here.

Most integer assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)