Russia · Ukraine› Bitcoin › Analysis

The anticipation of bid successful Ukraine brought immoderate short-lived assurance into stocks and futures. Bitcoin, however, resisted a crisp correction.

Cover art/illustration via CryptoSlate

Most markets saw a important summation this greeting fueled by an FT report that said Russia and Ukraine were drafting up a neutrality program to extremity the war.

However, a large correction ensued successful a substance of hours arsenic the Ukrainian authorities disputed the study saying the “peace plan” was really the requesting presumption from the Russian broadside and not a bilateral agreement.

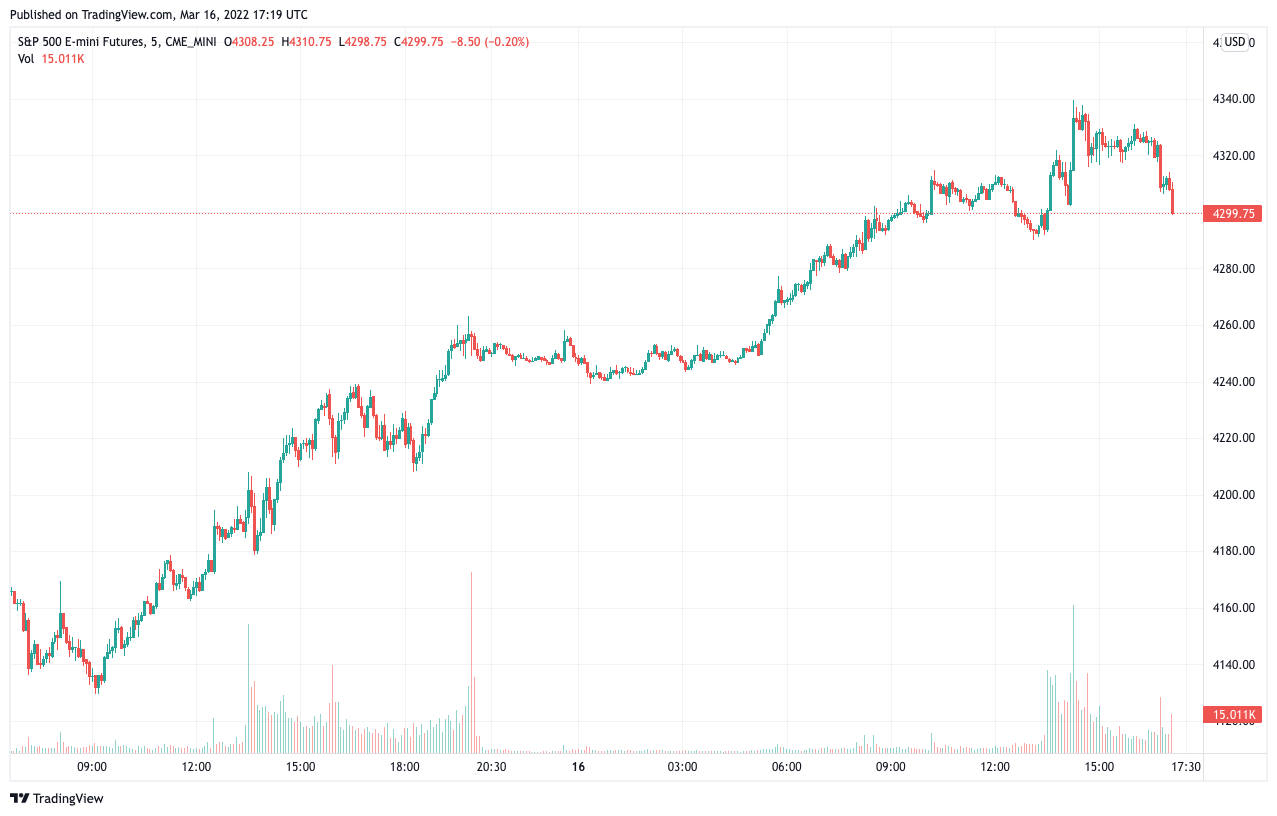

Stocks and futures unreserved connected misleading quality astir bid talks successful Ukraine

Earlier connected Wednesday, the Financial Times reported that Russia and Ukraine person made “significant progress” connected a tentative 15-point bid plan. According to the report, the program includes a ceasefire and Russian withdrawal from Ukraine if Kyiv declared neutrality and accepted limits connected its equipped forces.

Originating from sources that were progressive successful the talks, the study caused a disturbance successful planetary markets, starring to a sharp jump some successful spot and derivative markets. Cryptocurrencies weren’t immune to the quality either—Bitcoin’s terms saw an assertive upward momentum that brought it to $41,000 aft respective days of gathering beardown absorption astatine that point.

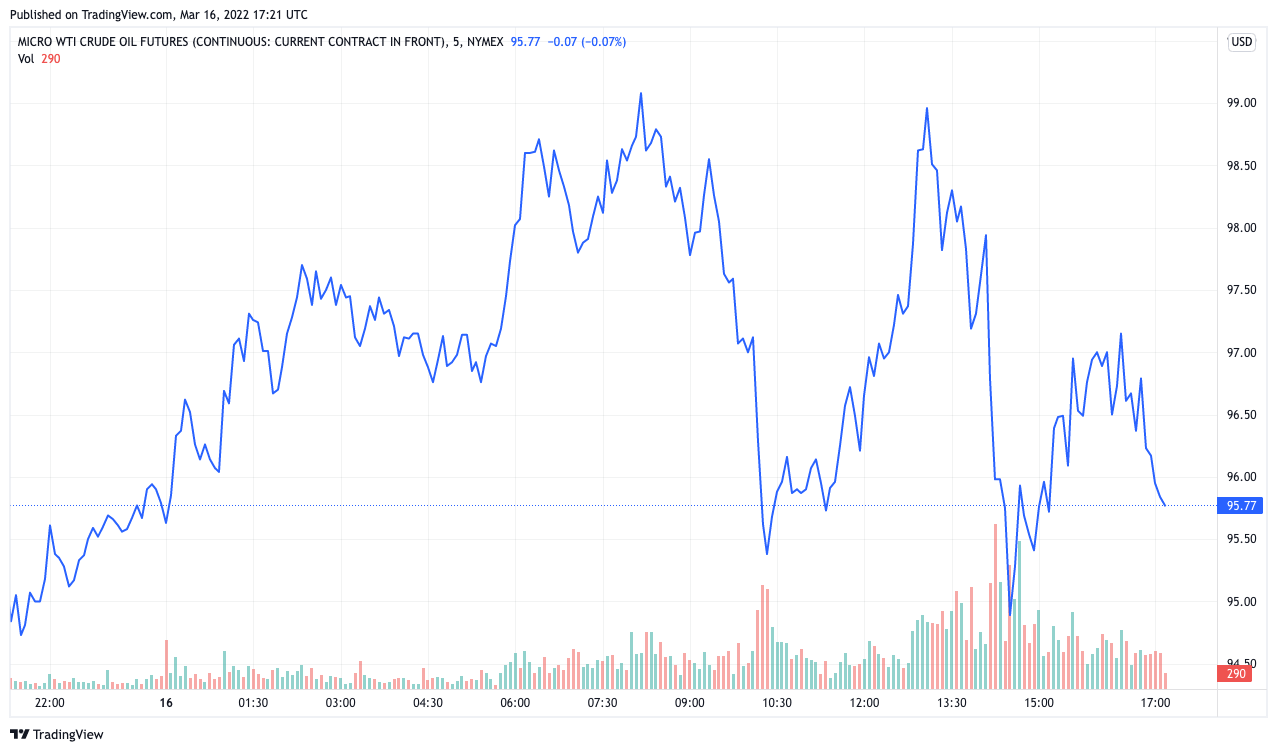

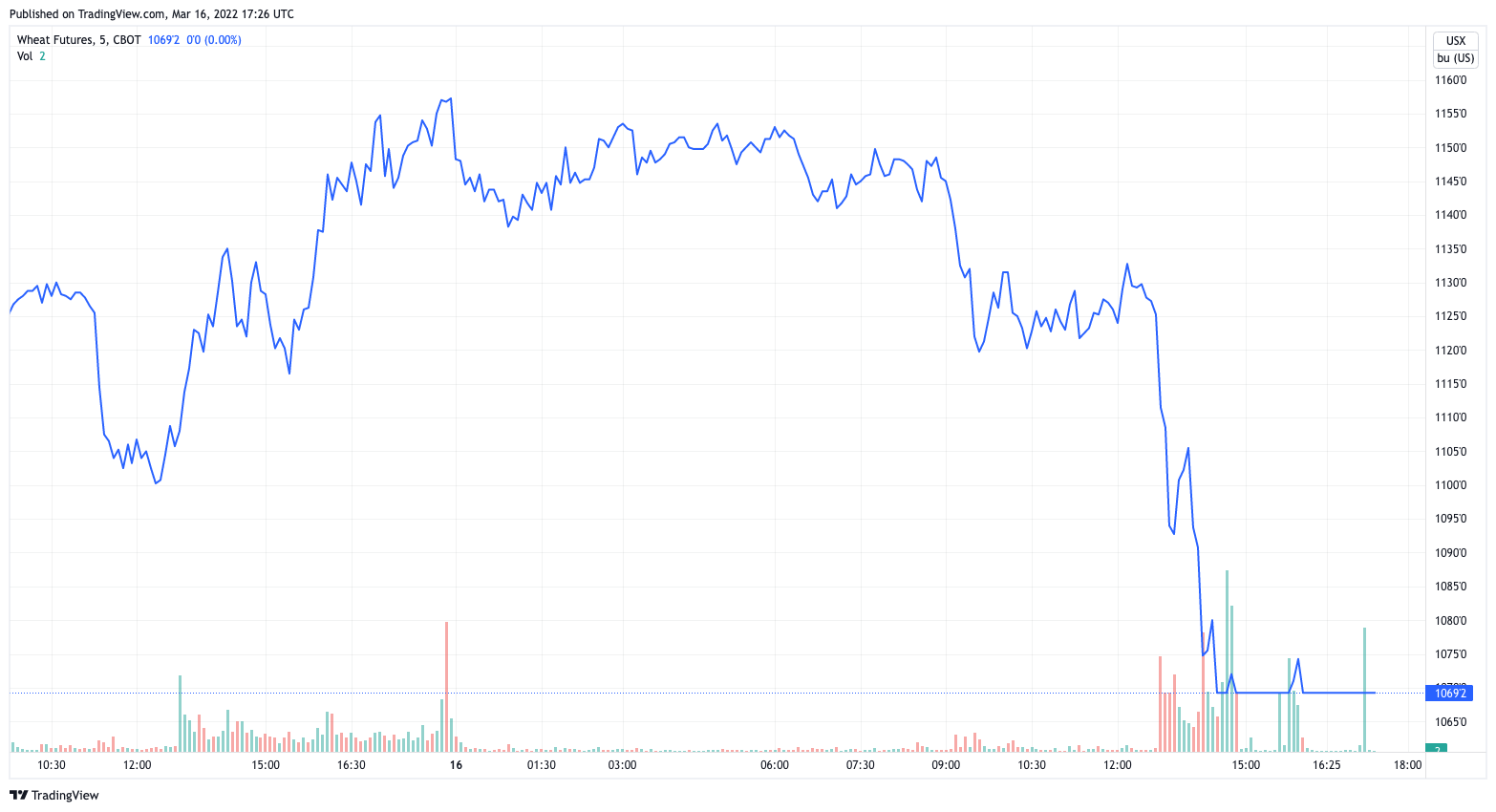

Crude lipid and wheat, which reached their decade-highs arsenic a effect of the warfare successful Ukraine, saw crisp drops arsenic traders rushed to offload their presumption anticipating the normalization of organisation channels for some markets.

Dmitry Peskov, Vladimir Putin’s property secretary, told reporters contiguous that neutrality for Ukraine based connected the presumption of Austria oregon Sweden was a possibility. Russia’s overseas curate Sergey Lavrov said that “absolutely circumstantial wordings” were “close to being agreed” successful the negotiations, bringing rather a spot of assurance to the markets that were hurting since Russia invaded Ukraine past month.

Chart showing the emergence and consequent driblet successful S&P 500 futures arsenic the concern successful Ukraine developed earlier contiguous (Source: Trading View)

Chart showing the emergence and consequent driblet successful S&P 500 futures arsenic the concern successful Ukraine developed earlier contiguous (Source: Trading View)However, the upward momentum we saw successful astir markets was short-lived.

Just hours aft the Financial Times reported connected the bid speech progress, Ukraine disputed the report, causing a crisp correction successful S&P 500 futures, crude oil, and wheat futures.

Chart showing crude lipid prices pursuing quality astir Ukrainian bid talks (Source: TradingView)

Chart showing crude lipid prices pursuing quality astir Ukrainian bid talks (Source: TradingView) Chart showing the driblet successful wheat futures pursuing quality astir Ukraine (Source: TradingView)

Chart showing the driblet successful wheat futures pursuing quality astir Ukraine (Source: TradingView)Mihailo Podolyak, an advisor to Ukraine’s president Volodymyr Zelenskyy, said that the Financial Times study was one-sided and that the “15-point bid plan” consists lone of Russian requests. Ukraine has its ain positions which weren’t included successful the plan, helium said, adding that the lone happening the state tin corroborate is that is looking for a ceasefire, the withdrawal of Russian troops, and information guarantees from a fig of, countries. Among the 15 points outlined by Russia were requests for Ukraine to garbage rank successful NATO and refrain from hosting overseas subject bases connected its territory.

Briefly. FT published a draft, which represents the requesting presumption of the Russian side. Nothing more. The 🇺🇦 broadside has its ain positions. The lone happening we corroborate astatine this signifier is simply a ceasefire, withdrawal of Russian troops and information guarantees from a fig of countries

— Михайло Подоляк (@Podolyak_M) March 16, 2022

Bitcoin excessively wasn’t immune to the quality astir a imaginable ceasefire successful Ukraine. However, it saw a overmuch little assertive terms spike, conscionable passing implicit $41,000 earlier today. And portion its tenure astatine $41,000 was arsenic short-lived arsenic the spike we saw successful the banal market, its driblet wasn’t arsenic drastic. At property time, the crypto marketplace saw a beardown buying unit that pushed Bitcoin to $40,000, showing a beardown and accelerated recovery.

Chart showing Bitcoin’s terms connected Wednesday, March 16th (Source: CryptoSlate TradingView)

Chart showing Bitcoin’s terms connected Wednesday, March 16th (Source: CryptoSlate TradingView)Get your regular recap of Bitcoin, DeFi, NFT and Web3 quality from CryptoSlate

It's escaped and you tin unsubscribe anytime.

Get an Edge connected the Crypto Market 👇

Become a subordinate of CryptoSlate Edge and entree our exclusive Discord community, much exclusive contented and analysis.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)