- Michael Saylor confirmed contiguous that Microstrategy purchased an further 301 Bitcoins astatine an mean terms of $19,851 per Bitcoin.

- According to Saylor, Microstrategy present holds $130,000 Bitcoins acquired astatine an mean of $30,639 per Bitcoin.

MicroStrategy’s erstwhile CEO Micheal Saylor revealed contiguous via his authoritative Twitter account that MicroStrategy purchased different $6 Million Bitcoin taking the full company’s BTC holdings to $3.98 cardinal astatine an mean terms of $30,639 per Bitcoin. Saylor precocious stepped down arsenic MicroStrategy CEO, taking the relation of enforcement chairman. His reasoning down his determination is that helium volition beryllium capable to supply oversight of the company’s bitcoin acquisition strategy.

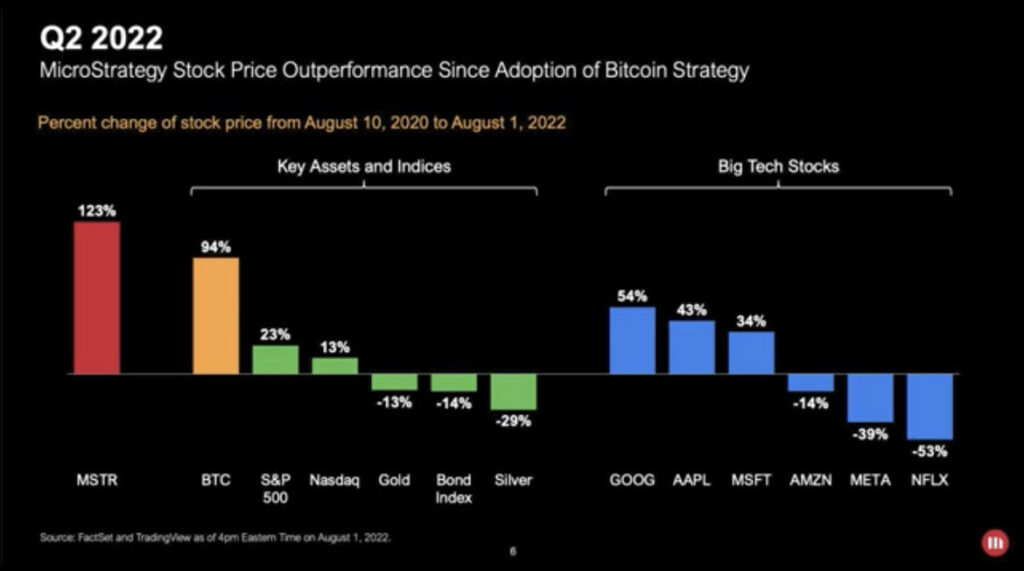

Michael Saylor antecedently stated that since MicroStrategy adopted the Bitcoin Standard, the institution heavy outperformed the S&P 500, Nasdaq, Gold, Bond Index, and immoderate Big Tech Stocks.

Could This Finally Be The Bitcoin Bottom?

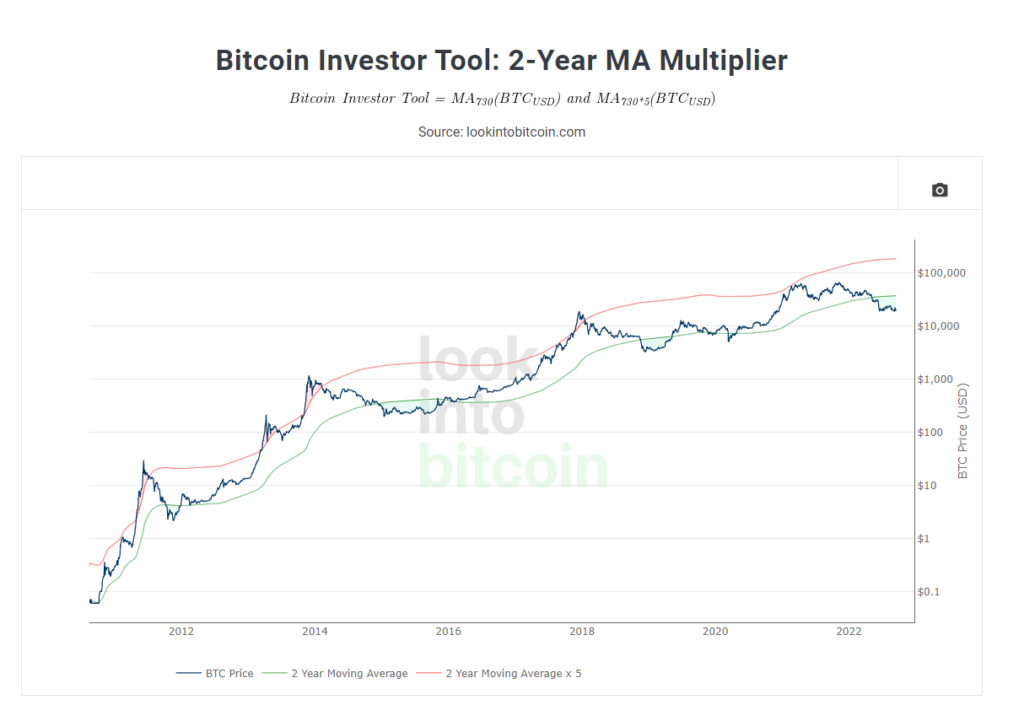

As antecedently stated, galore semipermanent holder charts are instigating the Bitcoin bottommost mightiness beryllium successful specified arsenic the Bitcoin Investor Tool: 2-Year MA Multiplier.

The illustration shows periods erstwhile buying and selling Bitcoin would person produced outsized returns.

Source: Lookintobitcoin

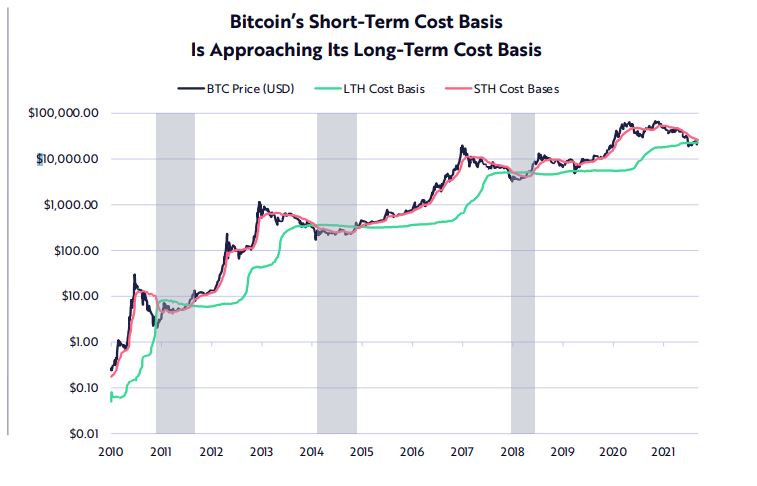

Source: LookintobitcoinArk Invest’s Bitcoin Monthly Report besides shows that agelong and short-term outgo bases look to cross, which would historically suggest a cyclical bottom.

Source: Ark Investment Management LLC

Source: Ark Investment Management LLCAccording to the report, the proviso held by semipermanent holders is connected gait to scope all-time highs, suggesting that the probability of selling and spending successful the aboriginal diminishes dramatically.

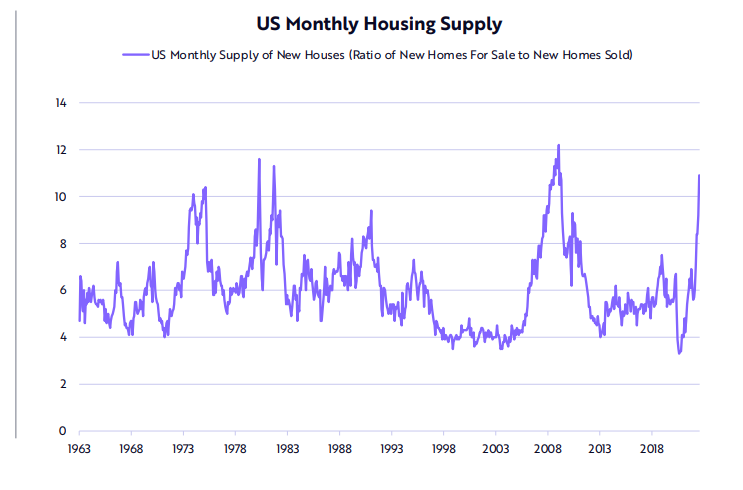

However, connected a macroeconomic scale, signs of recession are surfacing arsenic the FED tries to curb inflation. The CPI scale has reached highs not seen since the 1980s, and location inventories person spiked dramatically comparative to Home Sales, indicating we could beryllium successful a recession.

Source: Ark Investment Management LLC

Source: Ark Investment Management LLC

3 years ago

3 years ago

English (US)

English (US)