The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Bitcoin Investment Vehicles

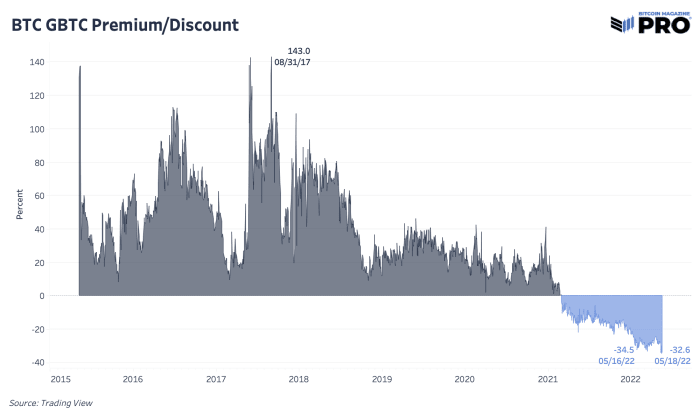

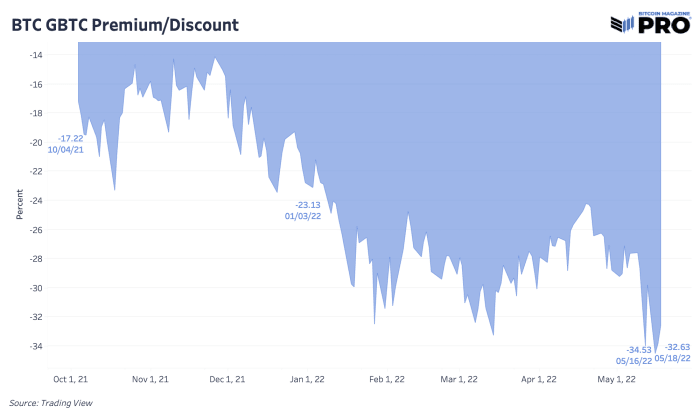

In our contented past month, GBTC Discount Shrinks, we highlighted the latest authorities of the Grayscale Bitcoin Trust, an overview of its spot ETF support process and expected 2023 timeline. At that time, we were seeing a reversal successful the GBTC discount trading astatine 23.15% up from its 30% low.

Since then, the discount has dropped further, reaching an all-time debased of 34.5% this week. Likely this steepening discount is simply a effect of much marketplace sell-offs successful hazard appetite and the market’s absorption to the LUNA UST marketplace blowup. Although the nonaccomplishment of LUNA tin beryllium thought of arsenic strengthening the lawsuit for Bitcoin semipermanent (the champion volition survive), this illustration volition surely beryllium utilized arsenic firepower for accrued authorities regulation, scrutiny and capitalist extortion efforts crossed the full industry.

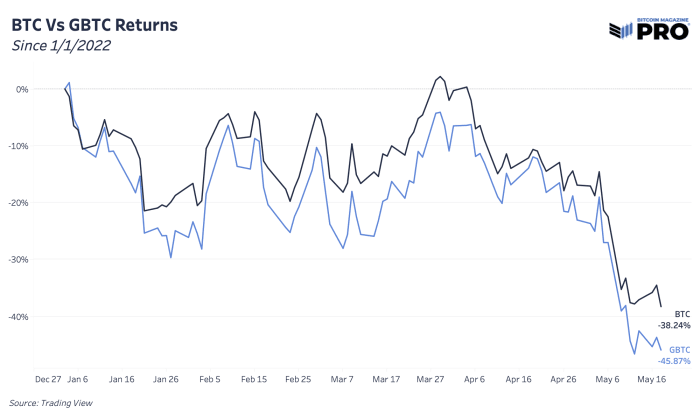

Regardless of the nonstop reasons for the little GBTC discount, the deficiency of a bitcoin spot ETF successful the United States continues to impact GBTC holders with show down an further 7.63% year-to-date comparative to bitcoin.

For funds and individuals looking to dip their toed into immoderate bitcoin exposure, GBTC looks to beryllium a fantastic purchase, equivalent to buying bitcoin astatine astir $21,000 with a 2% annualized absorption fee. While it is evident that shares of GBTC that commercialized successful secondary markets travel with nary of the self-sovereign properties of the autochthonal on-chain bitcoin, if/when the spot converts to an ETF, GBTC shares connection steep upside comparative to bitcoin.

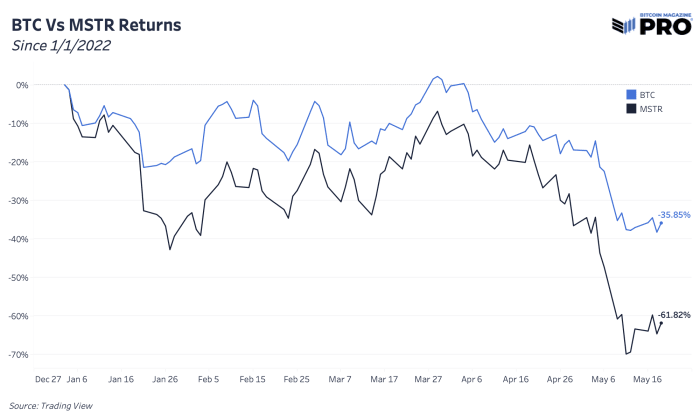

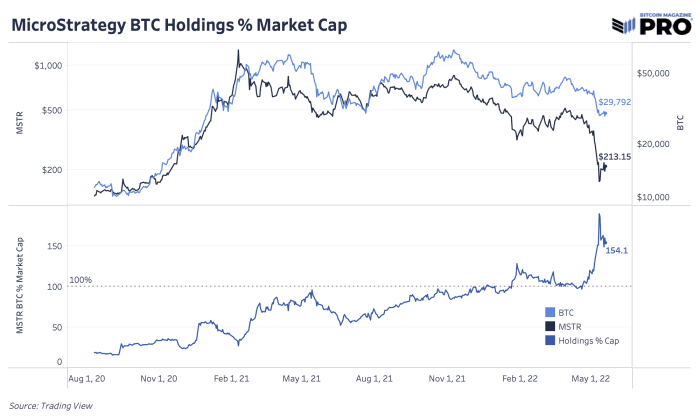

Lastly, we person 1 of the astir salient bitcoin vulnerability vehicles implicit the past 2 years, MicroStrategy. As per their net presumption earlier this month, the institution owns 129,218 bitcoin with an mean outgo ground of $30,700. As a effect of their leveraged indebtedness presumption to acquisition bitcoin and bitcoin’s 36% year-to-date drawdown, markets are repricing the level of hazard of holding MicroStrategy indebtedness and equity. MicroStrategy is down 61.82% year-to-date portion MicroStrategy’s worth of bitcoin holdings present makes up 154% of their full marketplace cap.

While buying MSTR contiguous does connote beardown aboriginal expected show successful the terms of bitcoin, if 1 is close with that assumption, shares of MSTR would beryllium 1 of the champion bets to marque implicit the medium/long term, fixed the company’s adjacent un-liquidatable leverage bitcoin position, and entree to nationalist superior markets on with escaped currency travel and a increasing nationalist brand.

3 years ago

3 years ago

English (US)

English (US)