Miners correspond the instauration of the Bitcoin market. Their behaviour is 1 of the champion indicators of marketplace wellness and tin beryllium utilized arsenic a gauge for marketplace sentiment.

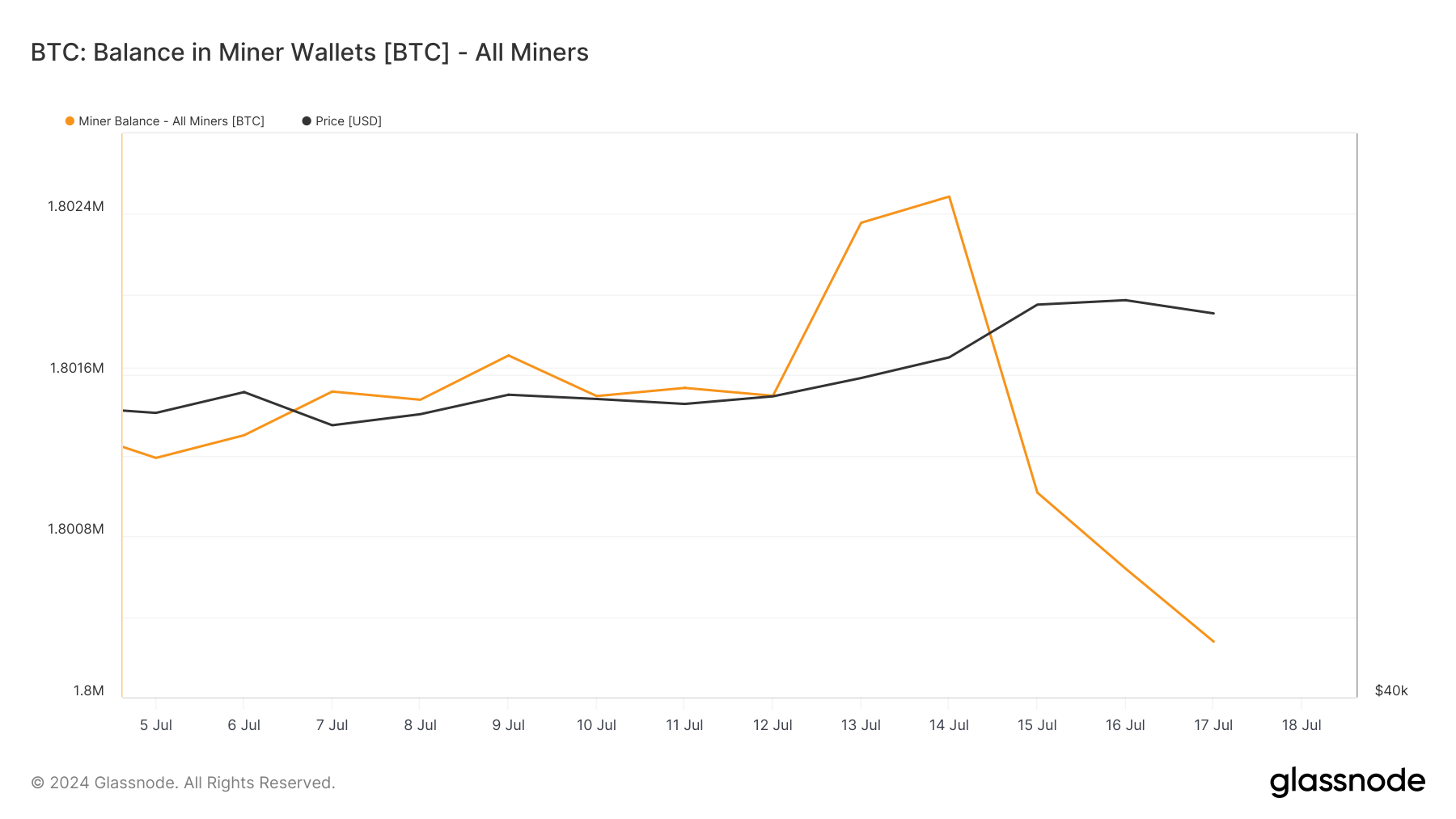

Miner balances bespeak the full magnitude of BTC held by miners. They service arsenic 1 of the starring indicators of selling unit since they are predominant sellers owed to the request to screen operational costs.

However, miners are besides successful a contention to enactment arsenic profitable arsenic possible, truthful they usually bash not merchantability oregon administer their holdings if Bitcoin’s terms is excessively low. When miners clasp onto their BTC, it tin beryllium a motion of assurance successful aboriginal terms increases. Conversely, erstwhile miners sell, it indicates they’re taking profits portion prices are precocious capable oregon that they mightiness expect a terms decline.

In the past week, miner balances decreased by astir 1,260 BTC. This simplification continues the semipermanent inclination of reducing miner balances, which person been dropping since October 2023. Current miner balances person reached levels not seen since April 2019. And portion the alteration we’ve seen implicit the past week isn’t alarming, it reflects a broader signifier of miners gradually reducing their holdings.

Total proviso held successful miner addresses from July 5 to July 17, 2024 (Source: Glassnode)

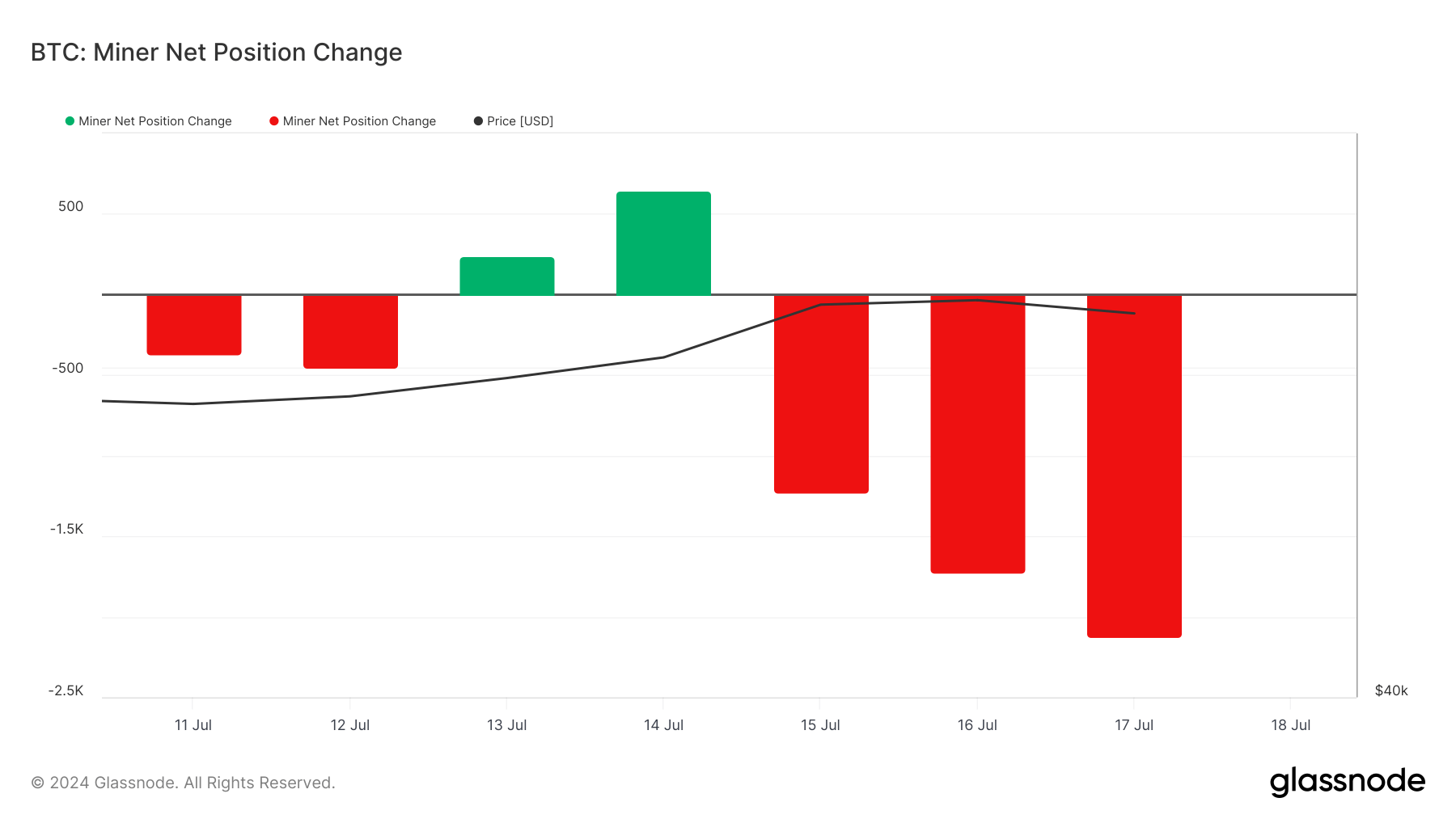

Total proviso held successful miner addresses from July 5 to July 17, 2024 (Source: Glassnode)Looking astatine the miner nett presumption change, we spot fluctuations implicit the past week. Breaking the three-month-long inclination of nett outflows, July 13 and July 14 saw nett inflows of 241 BTC and 645 BTC, respectively, showing impermanent accumulation.

This was followed by important nett outflows that lasted until July 17, erstwhile miners sold 2,126 BTC. The crisp summation successful selling these days correlates with a notable emergence successful Bitcoin’s price, peaking astatine $65,172 connected July 16 earlier somewhat dropping to $64,120 the adjacent day.

30-day alteration of the proviso held successful miner addresses from July 11 to July 17 (Source: Glassnode)

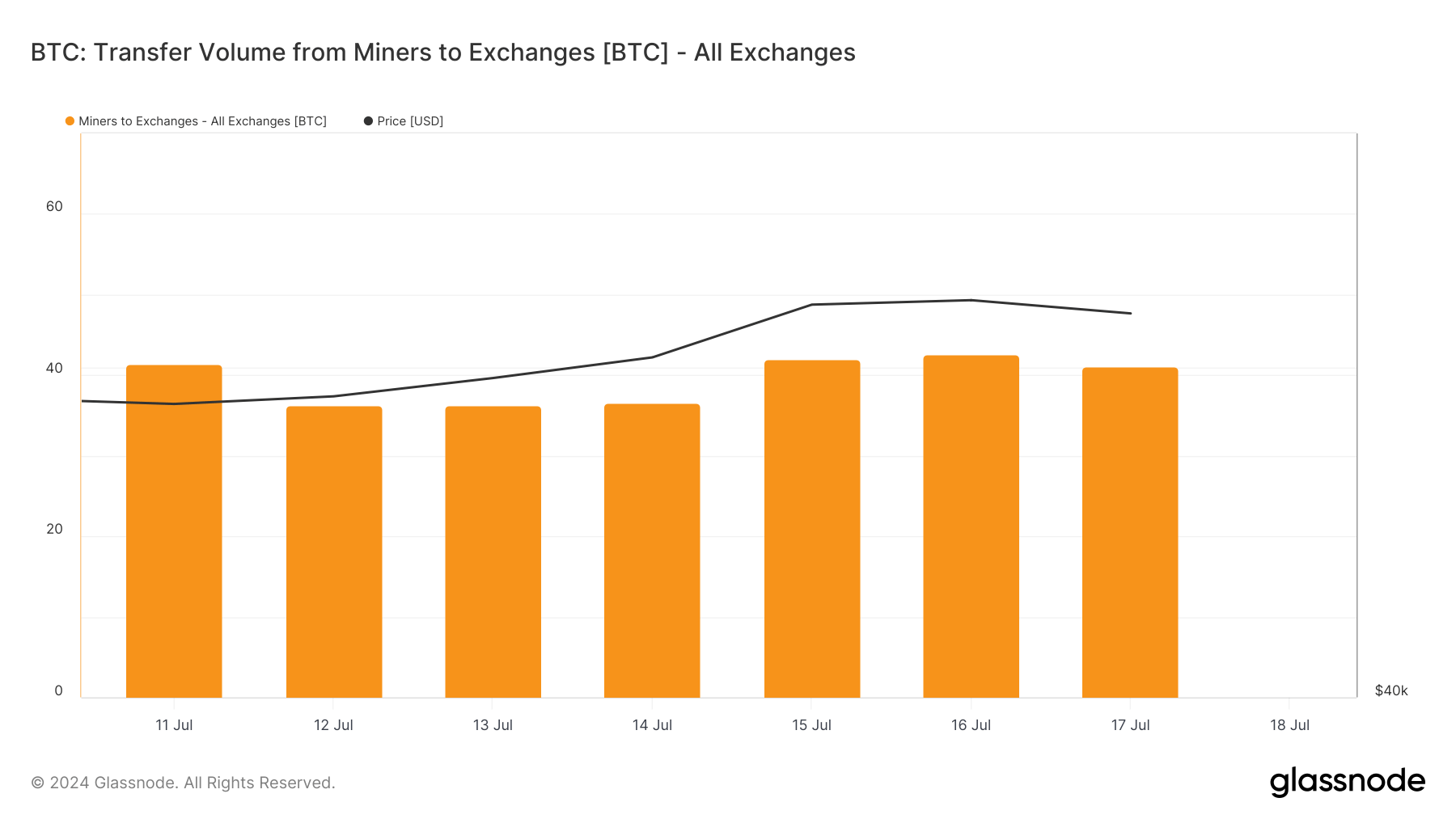

30-day alteration of the proviso held successful miner addresses from July 11 to July 17 (Source: Glassnode)The transportation measurement from miners to exchanges remained comparatively stable, ranging from 36 BTC to 42 BTC daily. This stableness suggests that miners are not importantly expanding their nonstop income to exchanges, adjacent arsenic their wide outflows increase.

The highest transportation measurement to exchanges successful the past 3 months was 262 BTC connected June 13, indicating that caller volumes are wrong mean ranges. A alteration successful miner balances alongside comparatively debased transfers to exchanges suggests miners mightiness beryllium selling their Bitcoin done over-the-counter (OTC) transactions alternatively than connected nationalist exchanges.

Total transportation measurement from miners to exchanges from July 11 to July 17, 2024 (Source: Glassnode)

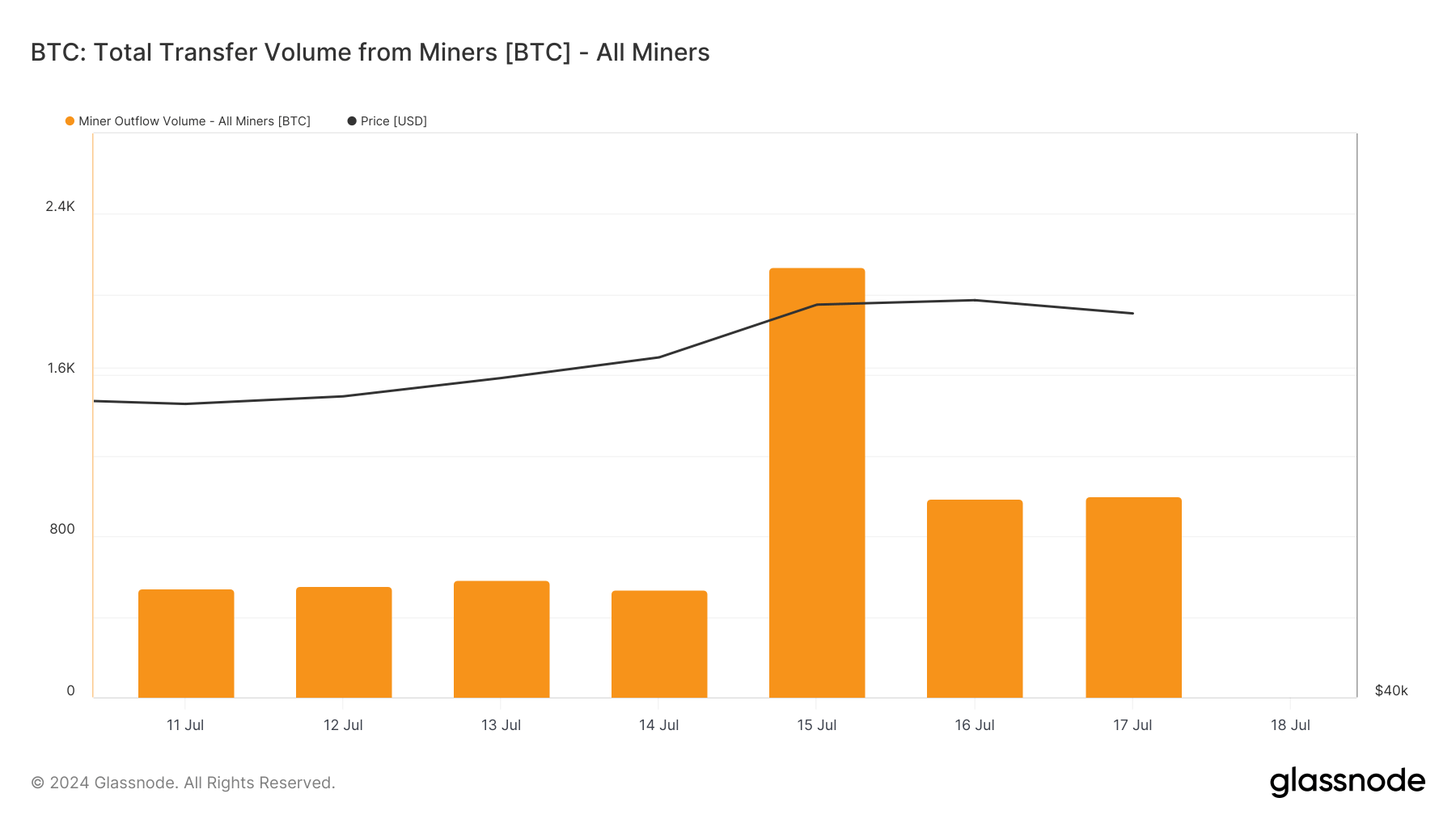

Total transportation measurement from miners to exchanges from July 11 to July 17, 2024 (Source: Glassnode)Transfer volumes from miners amusement much variability, with a important spike connected July 15 astatine 2,136.10 BTC, the 2nd highest successful the past 30 days. This spike aligns with a crisp terms increase, showing miners took vantage of higher prices to determination important amounts of BTC. The outflows of 985.60 BTC connected July 16 and 1,001.63 BTC connected July 17 further corroborate this trend.

Total magnitude of coins transferred from miner addresses from July 11 to July 17, 2024 (Source: Glassnode)

Total magnitude of coins transferred from miner addresses from July 11 to July 17, 2024 (Source: Glassnode)The information suggests that miners are reducing their wide holdings to maximize their returns during terms increases. This strategical selling contributes to marketplace liquidity and tin power short-term terms fluctuations.

The station Miners trim holdings amid rising prices appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)