- Nasdaq has refiled BlackRock’s exertion for a Spot Bitcoin exchange-traded money (ETF).

- The ETF exertion was antecedently rejected by the SEC for not providing capable details astir the crypto product.

- The Chicago Board Options Exchange besides refiled Fidelity’s rejected Bitcoin ETF exertion earlier today.

- BlackRock’s latest exertion stated that Coinbase would supply marketplace surveillance arsenic good arsenic BTC custody services.

Nasdaq has refiled Wall Street elephantine BlackRock Inc.’s exertion for offering a spot Bitcoin exchange-traded money (ETF). The 2nd largest banal marketplace by marketplace capitalization submitted BlackRock’s BTC ETF exertion to the U.S. Securities and Exchange Commission (SEC). Nasdaq’s refiling was accompanied by that of the Chicago Board Options Exchange (CBOE), which refiled applications for aggregate operators, including Fidelity and ARK Invest.

Coinbase Shares Surge After Refiling of Multiple Bitcoin ETF Applications

According to a study by Bloomberg, the latest filing by Nasdaq included details that were sought by the SEC erstwhile it rejected the archetypal applications past week. The revised filing named Coinbase arsenic the crypto speech that would enactment with BlackRock connected marketplace surveillance. Bloomberg reported that a surveillance statement with an speech could play a important relation successful convincing the securities regulator, fixed that specified an statement would trim fraud and marketplace manipulation. Coinbase has besides been named arsenic the custodian for the BTC holdings associated with BlackRock’s ETF.

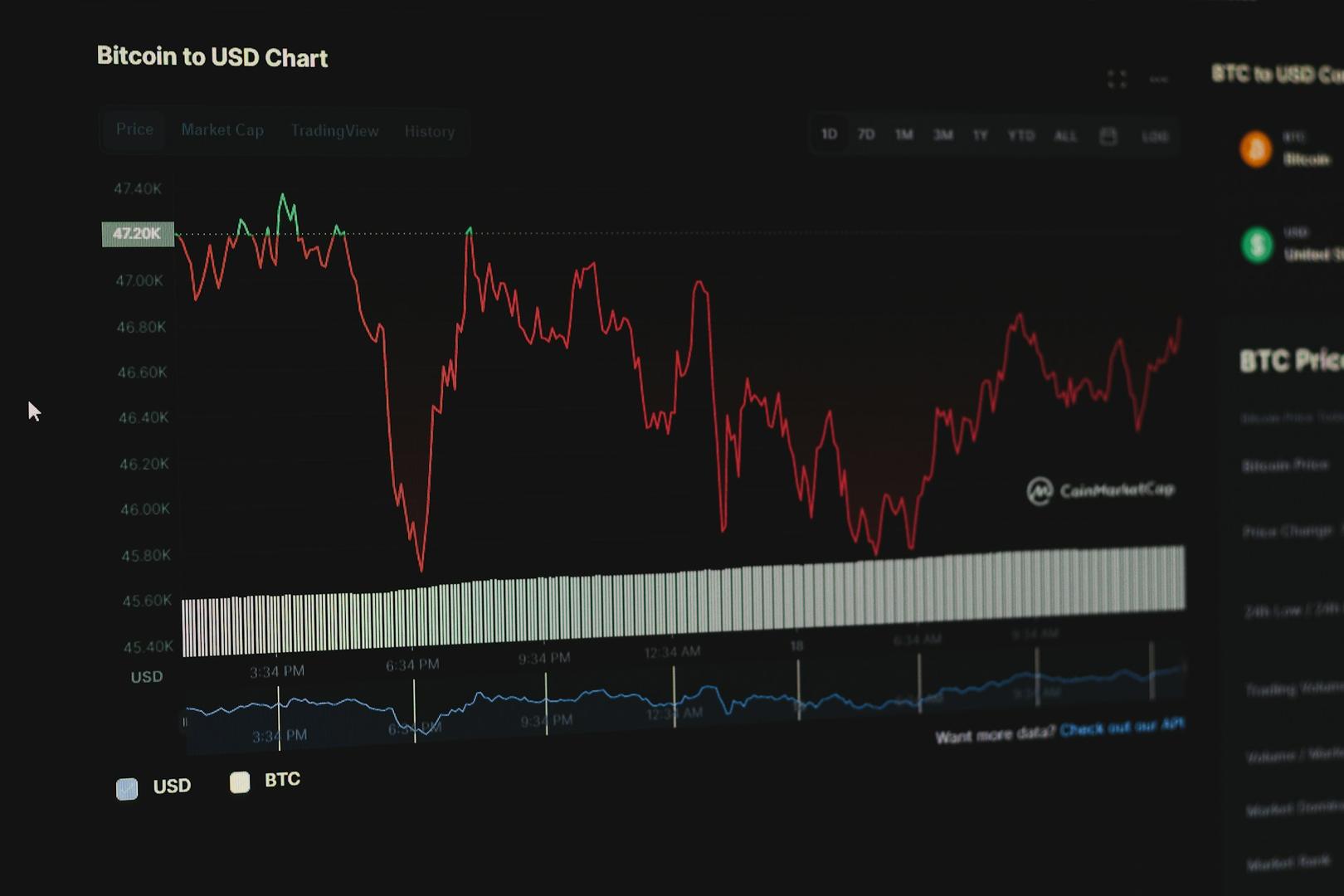

The latest developments sent Coinbase’s stock terms soaring. The banal has gained much than 11% since marketplace unfastened and is presently trading astatine $79.9. The refiling of aggregate BTC ETF applications led to optimistic sentiments among crypto investors, which prompted the flagship cryptocurrency to adhd arsenic overmuch arsenic 2.4% to its price. At the clip of writing, BTC was trading astatine $31,112.

Other companies which revised their applications and refiled with the United States SEC included Invesco, VanEck, 21Shares, and WisdomTree. The revised spot BTC ETF applications filed by the Chicago Board Options Exchange connected behalf of Fidelity, WisdomTree, and ARK Invest besides named Coinbase arsenic the crypto speech spouse for marketplace surveillance. All of the anterior applications were rejected by the SEC for failing to sanction the spouse successful the surveillance-sharing agreements,

2 years ago

2 years ago

English (US)

English (US)