Despite seeing a 3.11% driblet successful worth successful September, bitcoin inactive outperformed some the S&P 500 and Nasdaq, the latest Cryptocompare study has shown. Ethereum, connected the different hand, was named “the worst performer aft the long-awaited Merge proved to beryllium a ‘buy the rumour, merchantability the news’ event.” Increased tether and U.S. dollar commercialized volumes for bitcoin are said to suggest panicking investors were dumping depreciating currencies successful favour of the cryptocurrency.

Ethereum Sees ‘Biggest Decline’

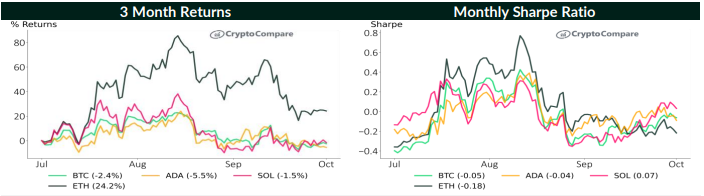

According to the latest Cryptocompare report, bitcoin, which saw a antagonistic instrumentality of 3.11% successful September, inactive outperformed “both the S&P 500 and Nasdaq which saw antagonistic returns of 9.34% and 10.5% respectively.” Only Solana — the cryptocurrency among the tracked 4 that saw a affirmative monthly instrumentality of 5.59% — and golden (2.87%) had amended risk-adjusted returns than bitcoin.

Ethereum, connected the different hand, is identified successful the study arsenic “the worst performer [among 4 tracked cryptocurrencies], aft the long-awaited Merge proved to beryllium a ‘buy the rumour, merchantability the news’ event.”

To enactment this assertion, the study points to the crypto asset’s contrasting fortunes successful August and September. After seeing its champion risk-adjusted returns successful August, ETH inactive went connected to person “the biggest decline” successful September, the aforesaid period the Ethereum blockchain was switched to a proof-of-stake (PoS) statement mechanism.

Traders Dumped Fiat and Piled Into BTC

In presumption of the antithetic assets’ volatilities, the study said bitcoin was the “least volatile plus and the astir dominant” among 4 cryptocurrencies that were tracked successful the period of September.

Explaining the study’s crypto marketplace volatility findings, the study states:

Volatility crossed cryptocurrency markets saw a flimsy summation successful September amid the involvement rates spikes and the unstable macro environment. ETH and SOL continued to beryllium the astir volatile assets, with 30-day volatility of 80.0% and 82.6% respectively. Bitcoin’s volatility roseate 19.2% successful September breaking a declining inclination that started successful June.

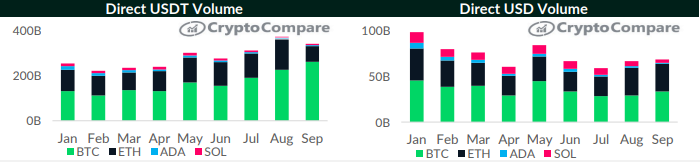

Meanwhile, the findings of Cryptocompare’s introspection of some USDT and U.S. dollar traded volumes suggest that panicking investors were dumping depreciating currencies successful favour of BTC. In September alone, traded volumes successful tether and the greenback went up “by 15.4% and 15.1% respectively.”

According to the report, this could mean “market participants are piling into BTC pursuing caller volatility successful fiat currencies, including the British lb and Japanese yen.”

In contrast, USDT volumes for ETH during the aforesaid “saw a large driblet of 49.4%,” portion SOL saw “a noticeable emergence of 10.5% successful USDT volumes successful September.” ADA and SOL some saw declines successful USD volumes.

Do you hold with Cryptocompare’s latest findings? Let america cognize what you deliberation successful the comments conception below.

Terence Zimwara

Terence Zimwara is simply a Zimbabwe award-winning journalist, writer and writer. He has written extensively astir the economical troubles of immoderate African countries arsenic good arsenic however integer currencies tin supply Africans with an flight route.

Image Credits: Shutterstock, Pixabay, Wiki Commons, 24K-Production / Shutterstock.com

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)