Bitcoin, the world’s astir fashionable cryptocurrency, appears poised for a large move, but the absorption remains shrouded successful mystery. Analysts are divided connected whether a bullish breakout oregon an extended consolidation play lies ahead.

Reaching New Highs: Euphoric Bulls On The Horizon?

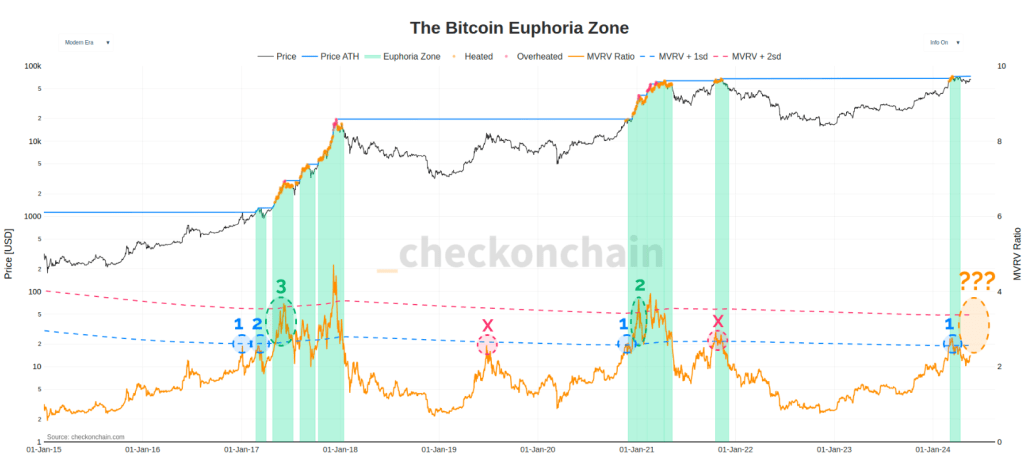

Renowned crypto expert Checkmate has ignited a spark of optimism with his “Euphoric Bull” theory. According to Checkmate, a surge to a caller all-time precocious could awesome a captious displacement successful marketplace sentiment. This benignant of bull signifier would correspond a important acceleration successful bullish momentum, perchance starring to a steeper terms increase.

Checkmate’s mentation hinges connected the Market Value to Realized Value (MVRV) ratio, a metric that compares the existent marketplace worth of Bitcoin to the full worth paid to get each Bitcoins successful circulation. Historically, erstwhile the MVRV ratio climbs supra 1 modular deviation of its average, it has often preceded a displacement to a “Euphoric Bull” phase.

#Bitcoin breaking to a caller ATH has historically represented a modulation constituent from the Enthusiastic Bull, into the Euphoric Bull.

It besides coincides with the MVRV ratio getting supra 1 modular deviation, but we seldom wide it connected the archetypal attempt.

Bull…Crab…Bull…

A… pic.twitter.com/4YyD179LRS

— _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) May 21, 2024

However, Checkmate warns that Bitcoin doesn’t ever travel the publication connected the archetypal try. The marketplace often exhibits cautious behavior, with Bitcoin perchance attempting to breach this cardinal MVRV level aggregate times earlier a decisive breakout.

Bitcoin’s caller consolidation play comes aft a surge that saw the alpha crypto scope a six-week precocious of $71,950. While a flimsy pullback has occurred, Bitcoin is inactive trading comfortably adjacent the $70,000 level, with a steadfast regular trading volume. This terms question suggests a imaginable intermission earlier the adjacent important move, making the existent infinitesimal a tense waiting crippled for some traders and investors.

Breakout Or Consolidation? A Bullish Dilemma

Crypto expert Rekt Capital has emerged arsenic a cardinal dependable successful the ongoing debate. Rekt Capital believes a play candle closing supra $71,500 could beryllium the catalyst for a important breakout. This milestone, if achieved, could trigger a surge successful bullish momentum, propelling Bitcoin towards a notable uptrend.

However, Rekt Capital besides acknowledges the anticipation of an extended consolidation phase. Historically, Bitcoin has exhibited a inclination to consolidate wrong its re-accumulation scope for respective weeks earlier experiencing a breakout. This extended consolidation, Rekt Capital argues, would bring Bitcoin person to aligning with humanities halving cycles, events that person historically preceded large bull runs.

Bitcoin Price Prediction

Meanwhile, different analysts are predicting a imaginable banner twelvemonth for the world’s starring cryptocurrency successful 2025. The high-end prediction of $168,459 represents a staggering imaginable increase, fueled by factors similar humanities terms trends and the upcoming Bitcoin halving cycle. Buoying this optimism are method indicators pointing towards a “Bullish” marketplace sentiment with a hefty dose of “Extreme Greed.”

Bitcoin terms forecast based connected method analysis. Source: CoinCodex

Bitcoin terms forecast based connected method analysis. Source: CoinCodexHowever, a dose of world is necessary. The wide scope betwixt the predicted precocious and debased ($69,971) underscores the inherent uncertainty successful these forecasts. Bitcoin’s notorious volatility, evident successful the caller 4.47% terms swings wrong conscionable 30 days, further complicates things. While this level of greed suggests capitalist confidence, it tin besides beryllium a informing motion of a imaginable marketplace correction connected the horizon.

Featured representation from Vecteezy, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)