Ethereum is undergoing a notable correction aft an explosive rally that saw its terms surge implicit 85% since precocious June. After reaching a section precocious adjacent $3,940, ETH has pulled backmost astir 13%, sparking statement among analysts astir whether this is simply a steadfast consolidation oregon a displacement successful marketplace momentum. While immoderate presumption the retracement arsenic a earthy intermission aft a accelerated uptrend, others caution that selling unit and macroeconomic uncertainty could trigger deeper downside moves.

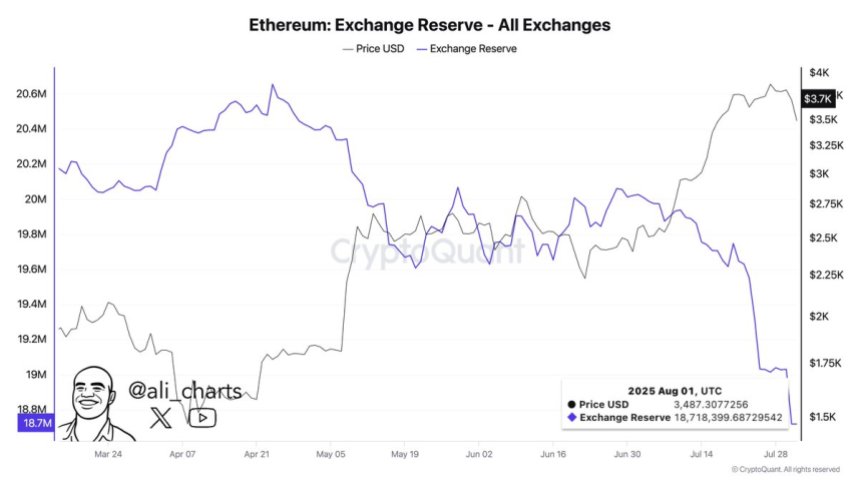

However, on-chain information from CryptoQuant paints a antithetic representation beneath the surface. Despite the caller terms drop, a monolithic magnitude of Ethereum has been consistently withdrawn from exchanges implicit the past fewer weeks. This inclination suggests assertive accumulation by investors moving their holdings into acold storage, reducing the liquid proviso connected trading platforms.

Such outflows are often interpreted arsenic a bullish signal, indicating that holders are positioning for semipermanent gains alternatively than preparing to sell. As Ethereum continues to pb successful areas similar DeFi, stablecoins, and Real-World Asset (RWA) tokenization, this structural demand could supply a beardown instauration for terms stableness and aboriginal rallies.

Ethereum Bullish Accumulation Trend Continues

Analyst Ali Martinez has revealed that implicit 1 cardinal Ethereum (ETH) person been withdrawn from exchanges successful the past 2 weeks, signaling a beardown accumulation inclination among investors. This monolithic outflow reduces the liquid proviso of ETH disposable for trading, which historically correlates with semipermanent bullish terms action. Despite Ethereum facing a 13% correction from its caller precocious of $3,940, the accordant withdrawal of coins suggests that investors are positioning for the adjacent limb up.

Ethereum Exchange Reserve | Source: Ali Martinez connected X

Ethereum Exchange Reserve | Source: Ali Martinez connected XThis accumulation inclination mirrors the capitalist behaviour seen successful Bitcoin implicit the past year. BTC experienced a akin signifier of speech outflows passim 2024, which laid the groundwork for its monolithic bull cycle. Analysts present judge that Ethereum could travel a comparable trajectory, arsenic the fundamentals supporting ETH stay robust, including its dominance successful DeFi, stablecoins, and Real-World Asset (RWA) tokenization.

While the marketplace sentiment remains broadly bullish, immoderate risks persist. Recent US occupation information released connected Friday sparked short-term panic, injecting volatility crossed crypto and accepted markets. However, galore analysts presumption Ethereum’s existent correction arsenic a steadfast retracement and an accidental to accumulate ETH astatine a discount earlier the marketplace resumes its upward trend.

ETH Testing Key Support After Sharp Correction

Ethereum (ETH) is presently trading astir $3,391 aft a crisp correction from its caller precocious of $3,940. The 12-hour illustration reveals that ETH has breached beneath its short-term enactment and is present investigating the 50-day SMA astatine $3,462, which could enactment arsenic a near-term enactment level. If bulls neglect to support this zone, the adjacent captious enactment is located astir $2,852, a cardinal level that antecedently acted arsenic beardown absorption successful precocious June.

ETH investigating cardinal request levels | Source: ETHUSDT illustration connected TradingView

ETH investigating cardinal request levels | Source: ETHUSDT illustration connected TradingViewVolume spikes during the breakdown suggest accrued selling pressure, which aligns with caller profit-taking activities by short-term holders. However, contempt this drop, Ethereum’s terms operation remains successful an wide uptrend, with higher highs and higher lows intact connected the broader timeframe.

The correction appears to beryllium a retest of erstwhile breakout levels, arsenic ETH had surged implicit 85% since precocious June. Maintaining the $3,350-$3,450 scope is important for bulls to regain power and effort different determination toward the $3,860 absorption zone. Failure to clasp could trigger a deeper correction towards the 100-day SMA astatine $2,972.

Featured representation from Dall-E, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)